AARP/UnitedHealthcare Medicare Advantage Review

AARP/UnitedHealthcare has cheap Medicare Advantage coverage, but average plans.

Compare Medicare Plans in Your Area

AARP/UnitedHealthcare is usually a good choice for Medicare Advantage plans. The company has cheap rates, a wide range of plan options and many extra benefits.

However, it's important to research plans in your area before you buy because the quality of plans differs depending on where you live.

Pros and cons

Pros

Many plan options available

Good network of doctors nationwide

Cheap rates and many $0 plans

Benefits like dental and vision coverage

Cons

Average coverage quality

Difficult to see medical specialists

Is UnitedHealthcare good?

AARP/UnitedHealthcare is a good option for Medicare Advantage plans because of its cheap rates and quality plans.

Consider UnitedHealthcare if you want a plan with extra benefits like dental care and vision coverage. The company also has a large network of doctors, which makes it easier to find one who takes your insurance. However, the company makes it difficult for many customers to get specialty care and some prescription drugs.

It's important to remember that coverage and price differ by plan type. An HMO (health maintenance organization) or HMO-POS (point of service) from UnitedHealthcare is usually a good choice. But, UnitedHealthcare's PPO (preferred provider organization) plans have lower ratings and middle-of-the-road monthly rates.

UnitedHealthcare is the largest Medicare Advantage company in the U.S. It sold 29% of all plans in 2024, and the company operates in 49 states.

Because of its large size, plan options, price and the quality of plans vary depending on where you live.

Cost of AARP/UnitedHealthcare Medicare Advantage

At $24 per month on average, AARP/UnitedHealthcare Medicare Advantage plans with prescription drug coverage cost less than the national average of $28 per month.

Keep in mind, most people have access to at least one $0 Medicare Advantage plan. These plans have no monthly cost aside from your $174.70 Medicare Part B rate. You're required to pay this regardless of whether you have Original Medicare or Medicare Advantage.

While UnitedHealthcare has cheap average rates, it's not the most affordable Medicare Advantage company overall. Competitors like Molina and Wellcare have cheaper rates on average and a higher percentage of $0 plans.

Compare Medicare Plans in Your Area

A free Medicare Advantage plan may sound like a good deal. However, it's important to carefully review your plan details before buying. For example, a more expensive plan may offer better benefits or more freedom in choosing your doctor.

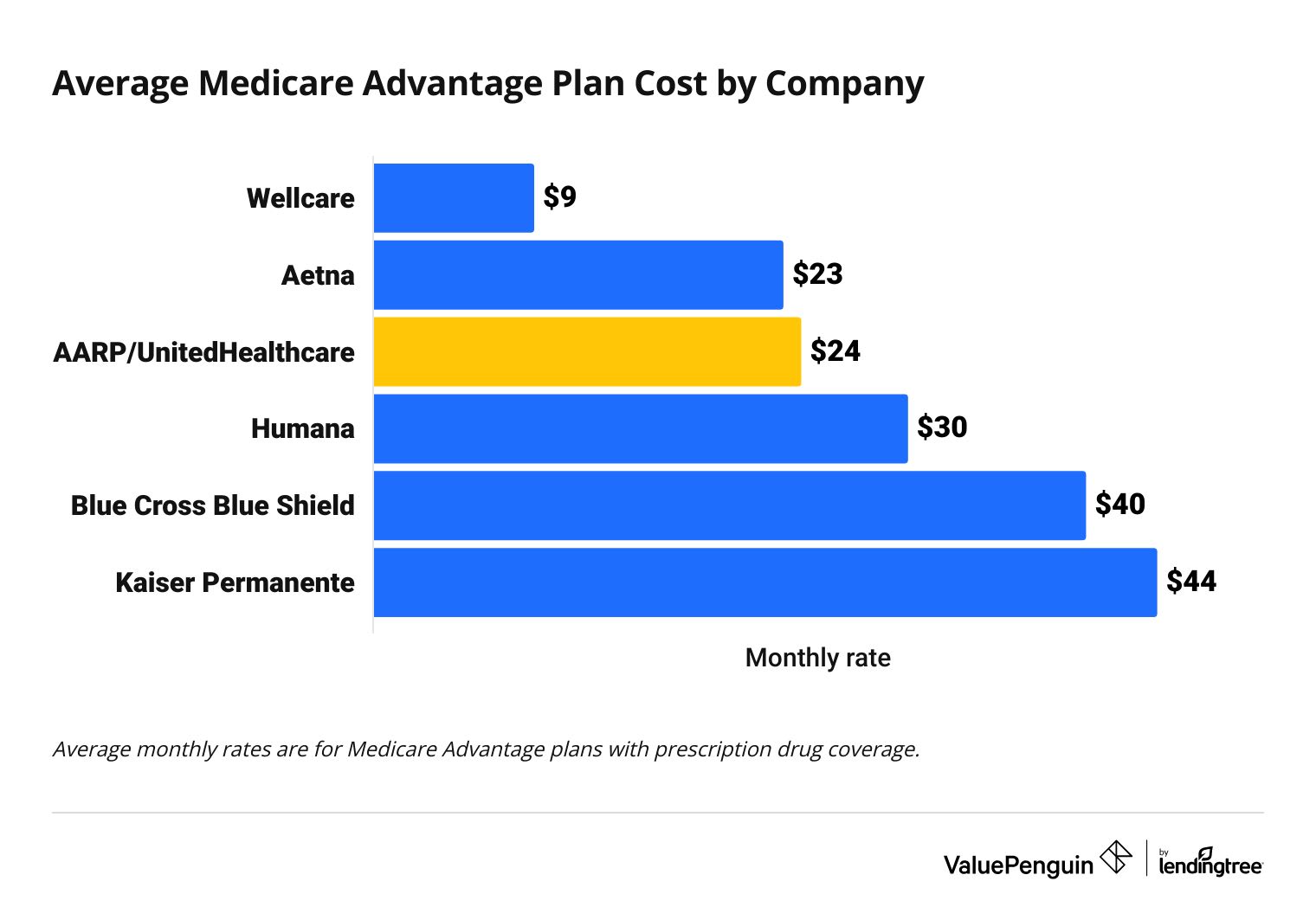

Medicare Advantage plan cost by company

Company | Average monthly cost |

|---|---|

| Wellcare | $9 |

| Aetna | $23 |

| AARP/UnitedHealthcare | $24 |

| Humana | $30 |

Blue Cross Blue Shield | $40 |

Medicare Advantage cost by plan type

UnitedHealthcare has cheap rates, but only for certain plan types.

UnitedHealthcare sells several different types of Medicare Advantage plans.

- HMO plans restrict you to a network of doctors unless you need emergency care. You have to pick a primary care doctor and get a referral before you see a specialist . HMO plans typically cost less than other plan types.

- PPO plans let you get care outside of your network of doctors. You don't need a primary care doctor, and you can see a specialist without getting a referral.

- HMO-POS plans let you see doctors outside of your network. However, you still need a primary care doctor, and you may need a referral to see a specialist.

UnitedHealthcare Medicare has cheap HMO-POS plans, at $15 per month on average. That's $5 per month cheaper than the national average.

However, PPO plans usually aren't a great deal. That's because UnitedHealthcare PPO plans cost $27 per month on average. That's about the same as the national average.

Compare Medicare Plans in Your Area

UnitedHealthcare only sells HMO Medicare Advantage plans in Florida and Texas.

Medicare Advantage monthly costs

Plan type | AARP/UHC plans | All Medicare Advantage |

|---|---|---|

| HMO | $0 | $16 |

| HMO-POS | $15 | $20 |

| PPO | $27 | $28 |

| Regional PPO | $74 | $91 |

PFFS plans aren't a good choice because they're usually expensive and can limit your choice of doctors. For these plans, UnitedHealthcare has high prices, low ratings and limited availability.

Number of plan options

On average, you'll have the choice of seven different UnitedHealthcare Medicare Advantage plans with prescription drug coverage, depending on where you live. Some areas have significantly more or fewer available plan choices.

Most UnitedHealthcare Medicare Advantage plan options are PPO plans or HMO-POS. These plan types give you more freedom when it comes to choosing your doctor. However, they often cost more than HMO plans which restrict you to a network of doctors.

An HMO-POS plan gives you more flexibility than a regular HMO plan. With an HMO-POS plan, you can see doctors outside of your network. However, both HMO and HMO-POS plans require that you choose a primary care doctor.

In addition, your doctor may need permission from your insurance company before performing certain procedures, called prior authorization, with both types of plans.

UnitedHealthcare Medicare Advantage brands

UnitedHealthcare sells plans through four different brand names: AARP, Erickson Advantage, Rocky Mountain Health Plans and UnitedHealthcare.

AARP Medicare Advantage plans are the most commonly offered option — they're even more common than UnitedHealthcare-branded plans. You do not need to be an AARP member to enroll in an AARP/UHC Medicare Advantage plan.

UnitedHealthcare Medicare Advantage plan benefits

UnitedHealthcare Medicare Advantage plans typically have good coverage, including coverage for prescription drugs and extra benefits like dental coverage and fitness benefits.

Coverage for prescriptions

Roughly four out of five UnitedHealthcare Medicare Advantage plans have prescription drug coverage.

If you choose a Medicare Advantage plan without prescription drug coverage, it's a good idea to buy a separate Part D policy.

Overall, AARP/UnitedHealthcare Medicare Advantage plans have average prescription drug benefits. In general, customers find it difficult to get necessary prescription drugs. However, the company's drug plan has gotten better over the past year.

UnitedHealthcare has an average drug deductible of $412 per year. Keep in mind that your drug deductible is separate from your regular health insurance plan deductible.

Fortunately, you don't need to meet your drug deductible before coverage starts for many generic drugs.

Extra benefits

All Medicare Advantage plans are required to have the same coverage as Original Medicare. This includes Medicare Part A (hospital stays) and Medicare Part B (doctor visits). In addition, Medicare Advantage plans can offer extra benefits, such as dental, vision and prescription drugs.

- Dental care: AARP/UnitedHealthcare has some of the best Medicare Advantage plans for dental coverage. Plans usually include basic dental benefits such as routine cleanings and X-rays. Some plans include more comprehensive coverage for fillings, root canals, crowns, dentures and implants.

- Vision care: Many plans have vision benefits that include coverage for free routine eye exams and lenses, glasses frames or contacts.

- Hearing: Plans usually cover a free hearing exam. There is often some coverage for hearing aids including a three-year manufacturer's warranty.

- Health care at home: UnitedHealthcare's HouseCalls program lets you get a free annual check-up at your house. This benefit may not be available in all areas.

- Fitness: Plans include benefits through a program called Renew Active. Depending on your plan, you might get a gym membership, access to online fitness videos and membership in a Fitbit Community.

- Healthy living rewards: Some plans give you cash back for activities like completing your annual checkup.

- Mental sharpness: The AARP Staying Sharp program gives you access to games and brain exercises that help keep your mind sharp as you get older.

- Allowance toward groceries: If you dual qualify for Medicare and Medicaid, your plan may have an allowance you can use to pay for groceries, such as fruit, vegetables, meat, dairy, water, first aid supplies, vitamins and more.

AARP/UHC and approval for certain types of care

Many AARP/UnitedHealthcare Medicare Advantage programs require that doctors get approval from UHC before performing certain procedures. This process, called prior authorization, can cause frustrating delays when you want or need care.

For example, if you need a lab test, your doctor may need approval from UnitedHealthcare before starting the test. This can delay things and also add extra paperwork if the request is denied.

How do AARP/UnitedHealthcare Medicare Advantage plans work?

Medicare Advantage plans, also called Medicare Part C plans, bundle your Medicare coverage into one plan. That means AARP/UnitedHealthcare plans cover doctor visits, hospital care and usually prescription medications.

When you get health care, the medical office will file a claim with your Medicare Advantage plan just like it would with any other health insurance plan. AARP/UnitedHealthcare will pay based on your coverage. You may have to pay some of your bill, especially if you haven't met your deductible yet.

Customer reviews and complaints

Customers typically rate AARP/UnitedHealthcare Medicare Advantage plans as about average.

The company has an rating of 3.8 out of 5 stars from the Centers for Medicare & Medicaid Services (CMS). That's about the same as the national Medicare Advantage plan average and similar to other large companies, such as Humana and Blue Cross Blue Shield.

UnitedHealthcare scored above average for customer satisfaction, according to a 2024 J.D. Power survey that looked at top Medicare Advantage companies. However, there were big differences at the state level. UnitedHealthcare came first for several states including North Carolina, Illinois, Georgia and Florida. But, the company was ranked last in Ohio.

AARP/UnitedHealthcare Medicare Advantage availability

AARP/UnitedHealthcare Medicare Advantage plans are available in 49 states and Washington DC. Zero-dollar plans are sold in every state but Vermont and South Dakota.

Keep in mind that Medicare Advantage options depend on what county you live in. For example, in California, UnitedHealthcare plans are only offered in about half the state.

Frequently asked questions

Is a Medicare Advantage plan from UnitedHealthcare good?

Yes, AARP/UnitedHealthcare has good Medicare Advantage plans. The company has cheap rates and fairly average plan ratings from the Centers for Medicare and Medicaid. However, its widely available HMO-POS plans stand out for having a good 4 out of 5-star rating.

What is the cost of the AARP Medicare Advantage plan?

UnitedHealthcare Medicare Advantage plans cost $24 per month on average. However, the amount you pay for coverage each month differs by plan, and most people have access to at least one $0 Medicare Advantage plan.

Is AARP Medicare Advantage the same as UnitedHealthcare Medicare Advantage?

Yes, AARP does not sell Medicare Advantage plans directly. Instead, AARP works with UnitedHealthcare Medicare Advantage plans as part of a marketing agreement.

Sources and methodology

Medicare plan costs and star ratings came from Centers for Medicare & Medicaid Services public use files (PUFs). Average costs are based on nationwide data for Medicare Advantage plans that include prescription drug coverage and are sold under any of UnitedHealthcare's brand names. Calculations exclude employer-sponsored plans and Special Needs Plans. Other rating data came from J.D. Power.

Our review considers all of UnitedHealthcare's Medicare Advantage plans, regardless of the advertised brand. For example, even when the plan name says AARP, the insurance is through UnitedHealthcare.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.