Homeowners Insurance

Rural Counties Have More Firefighters per Home but Their Residents Pay More for Insurance Because They’re Farther From Fire Stations

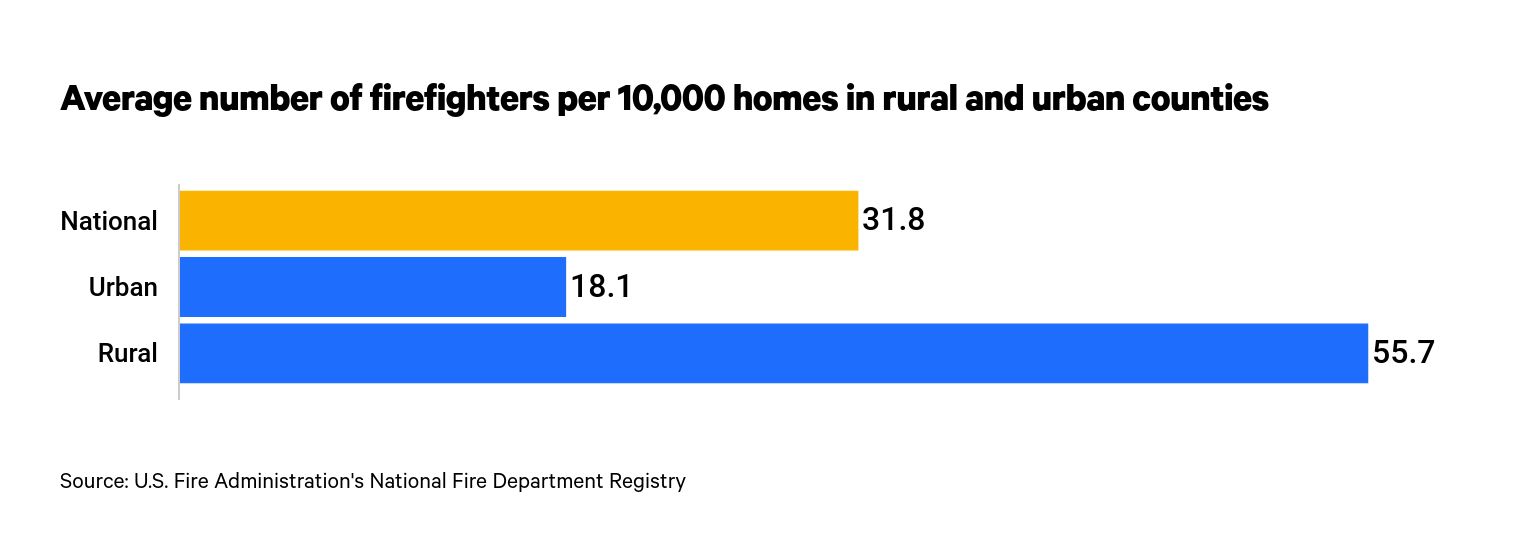

ValuePenguin researchers analyzed data from the U.S. Fire Administration's National Fire Department Registry and the U.S. Census Bureau to measure firefighting capabilities among the most urban and rural counties. The most urban counties have an average of 18.1 firefighters per 10,000 housing units, even if these departments cover smaller areas.

Rural counties face thinned-out resources, despite having 207% more firefighters relative to housing units than their urban counterparts. In the 25% most rural counties in the U.S., there are just 4.3 firefighters per 100 square miles. One consequence of this is higher home insurance rates — as much as a 43% increase for homes 25 miles or more from a fire station.

Key findings

- Urban counties are more likely to have fewer firefighters per housing unit while having higher numbers of stations relative to land area. There are 18.1 firefighters, on average, per 10,000 housing units in the most densely populated counties and more than eight times the amount of fire stations per land area than rural regions.

- Rural counties often have a high number of firefighters per housing unit, but resources are sparse compared to land area. There are 4.3 firefighters, on average, per 100 square miles in the top quarter of rural counties, despite having 207% more firefighters per 10,000 housing units than urban counties.

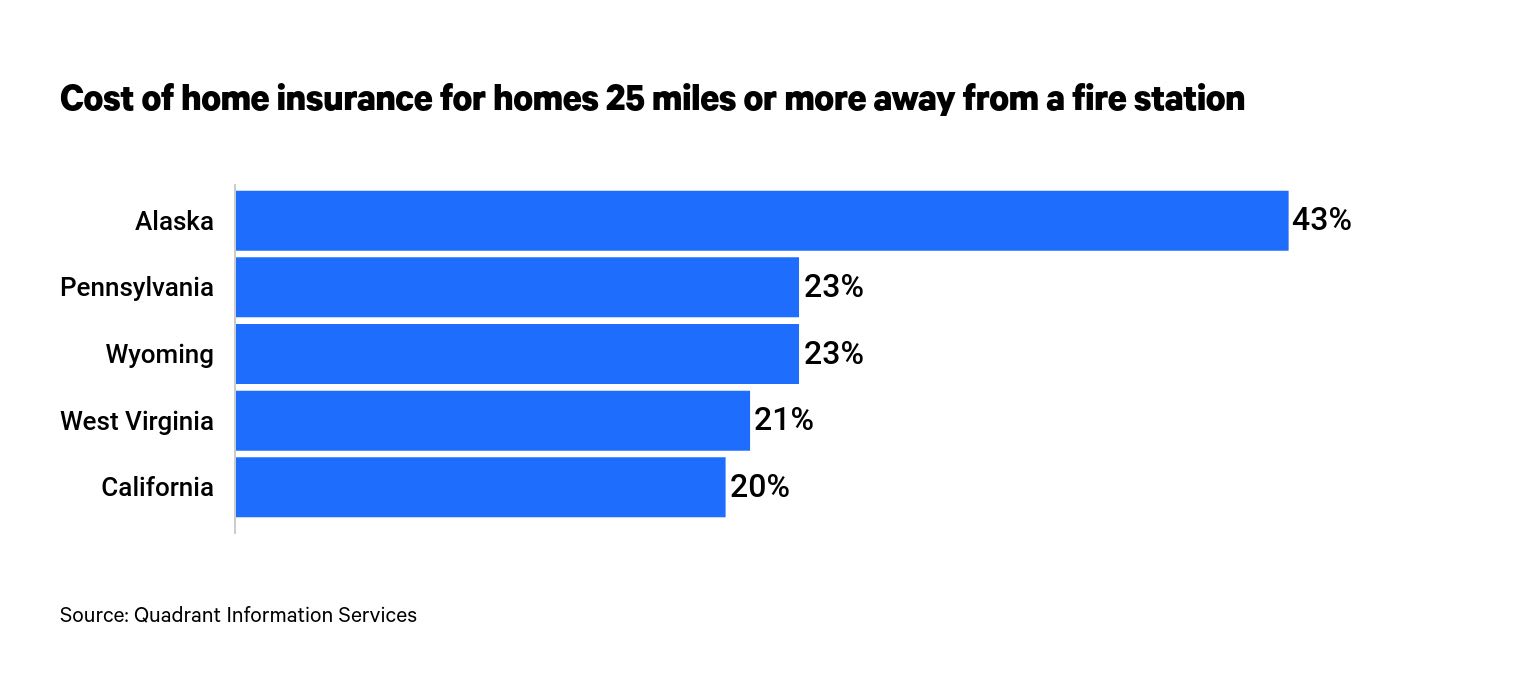

- The cost of home insurance increases for homeowners farther from fire stations. On average across the 50 states, the cost of coverage goes up by 9% for homes that are 25 miles or more away from the nearest fire station, compared to homes that are less than a mile from emergency services.

- In nearly half of states, costs rise 10% higher for properties that are 25 miles or more from fire stations. These higher rates most strongly impact homeowners in Alaska, Pennsylvania, Wyoming, West Virginia and California.

Living in the most heavily or sparsely populated areas can come with emergency services access problems

On average in counties across the U.S., there are 1.3 fire stations per 100 square miles, housing 28 firefighters. Ultimately, this results in a ratio of 31.8 firefighters for every 10,000 housing units. However, these numbers swing heavily depending on the population density of a given area.

The top 25% most populated counties in the U.S. have at least 12,774 housing units per 100 square miles. In these areas, there are 18.1 firefighters, on average, per 10,000 houses. This figure is nearly half of the national average of 31.8 per 10,000 housing units. A catastrophic fire-related emergency that affects multiple city blocks at once may overwhelm local response forces.

At the same time, there's a good chance urban dwellers live reasonably close to a fire station. There are 3.2 fire stations per 100 square miles in the most populated counties. Responsible for these 100 miles are 81.5 firefighters, on average. These figures contextualize the increase in coverage that nonrural homeowners or renters have access to relative to their counterparts. In these cases, there are 191% more firefighters and 141% more stations per 100 square miles than average.

On paper, rural residents have one clear advantage over city dwellers regarding their access to firefighting personnel. The counties with the fewest housing units per 100 square miles have 75% more firefighters per home than average and 207% more than their urban counterparts. But access is a real problem for these communities.

Data shows that the counties with a higher number of spread-out housing units have 95% fewer firefighters per 100 square miles than those who live in the most densely populated counties. And in these diffusely populated counties, there are only 0.38 fire stations for every 100 square miles. That's 71% less than average and 88% less than the most heavily populated counties.

Living just 5 miles from a fire station can result in an 8% increase in the average cost of homeowners insurance

Aside from possibly not having readily available emergency fire services, residents in rural communities could pay higher premiums for their home insurance. In fact, the preparedness of a community to fight fires determines its Insurance Services Office (ISO) score, which is used to set insurance rates. ValuePenguin discovered that — in most states — homes that are 25 miles or farther from a fire station experience home insurance costs that are 9% higher than average.

There are 10 states where insurers don't set higher rates for customers who live farther from a fire station.

Homeowners in Alaska face the largest rate increases for living farther from a fire station. Homeowners in the state who live 25 miles or more from a fire station see rates that are 43% higher than the rates of someone who lives less than a mile from one. In Alaska, according to ValuePenguin's analysis, there are 0.15 fire stations per 100 square miles, on average. Consequently, it's likely that a large share of the state's spread-out population could see a higher cost of home insurance than average.

California, a state commonly associated with dangerous wildfires, is among the places where homeowners see the largest surcharge due to their distance from fire stations. Compared to someone living within a mile of a station, Californians who live 25 miles or more from one see a 20% markup, on average. Despite the fire risk, there are 0.91 stations, on average, per 100 square miles — 31% less than the national average — according to data from the National Fire Department Registry.

Rank | State | Increase |

|---|---|---|

| 1 | Alaska | 43% |

| 2 | Pennsylvania | 23% |

| 3 | Wyoming | 23% |

| 4 | West Virginia | 21% |

| 5 | California | 20% |

| 6 | Nevada | 18% |

| 7 | Illinois | 17% |

| 8 | Minnesota | 17% |

| 9 | Utah | 17% |

| 10 | Indiana | 16% |

| 11 | New Mexico | 16% |

| 12 | Washington | 16% |

Table shows average increase in the cost of home insurance for policyholders living at least 25 miles from the nearest fire station.

It's not just residents who live 25 miles or farther from fire stations who are penalized. Residents who live even five miles from the closest station can be subjected to higher home insurance costs in nearly half of states. West Virginians pay the highest premiums (8% higher than average) for living between five and 10 miles from the closest station. Homeowners in Pennsylvania also pay higher premiums (6%).

From 2003 to 2019, there were 6.4 million fires in residential buildings — here's what homeowners can do to lower their risks and insurance premiums

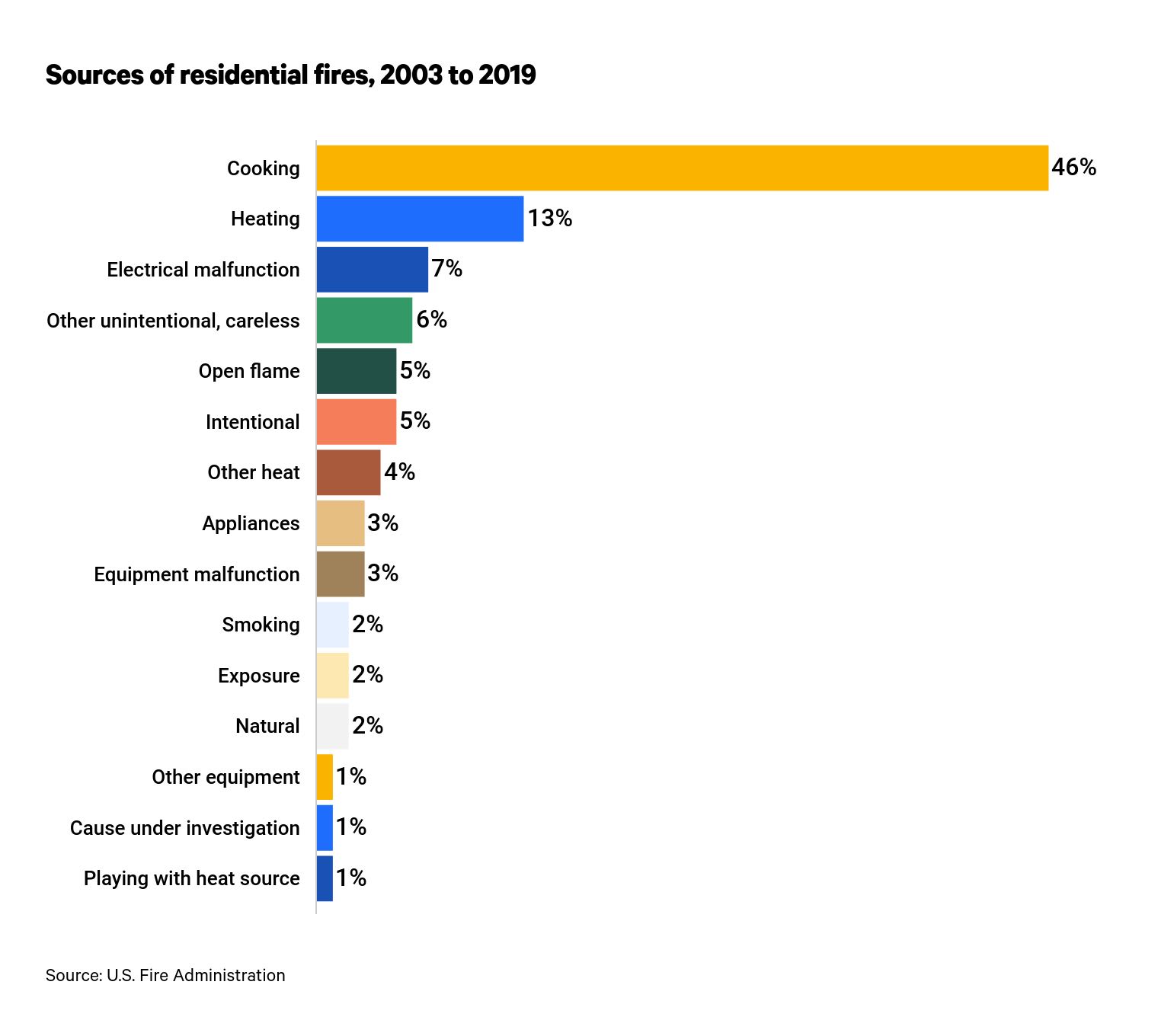

Fires in residential buildings caused $138 billion in damage from 2003 to 2019, according to data from the U.S. Fire Administration and Federal Emergency Management Agency. The most consistent sources of these fires were cooking and heating — staples of residential living. Insurers, aware of these trends, consider these ever-present risks when setting their rates.

While home insurance does cover fires in most forms, the amount policyholders pay for coverage depends on a range of factors that could influence the damage a fire would do if one broke out. These factors include the distance from fire response services, the materials a home is built from and the presence of fire-detection and mitigation systems, including fire alarms, smoke detectors and sprinklers.

Homeowners that face high costs for home insurance resulting from fire risk should consider installing fire mitigation devices in their homes. Insurers often offer discounts for homeowners who have outfitted their properties with sprinklers, fire alarms and other devices that would slow the spread of fire and lessen the damage that a fire causes.

Methodology

ValuePenguin gathered figures for the number of firefighters and fire stations from the U.S. Fire Administration's National Fire Department Registry. These figures reflect 92% of the total number of fire departments in the country. We also collected land area and housing unit data from the U.S. Census Bureau to contextualize the number of firefighters and stations in documented counties.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, as your quotes may be different.