Auto Insurance

Don't Miss Out on Electric Car Tax Benefit Deadlines

Electric cars only represent a small share of overall car sales in the United States — 1.2% of all sales in 2017. But as the technology becomes more cost-effective and consumer tastes shift, the market for electric vehicles (EVs) is growing, with sales per year more than tripling since 2013. Cost has been a key factor in convincing consumers to make the switch from gas to electric. We looked at how prices for some of the most popular and affordable EVs will change over the next year.

Contents

How much electric cars cost now — and in the future

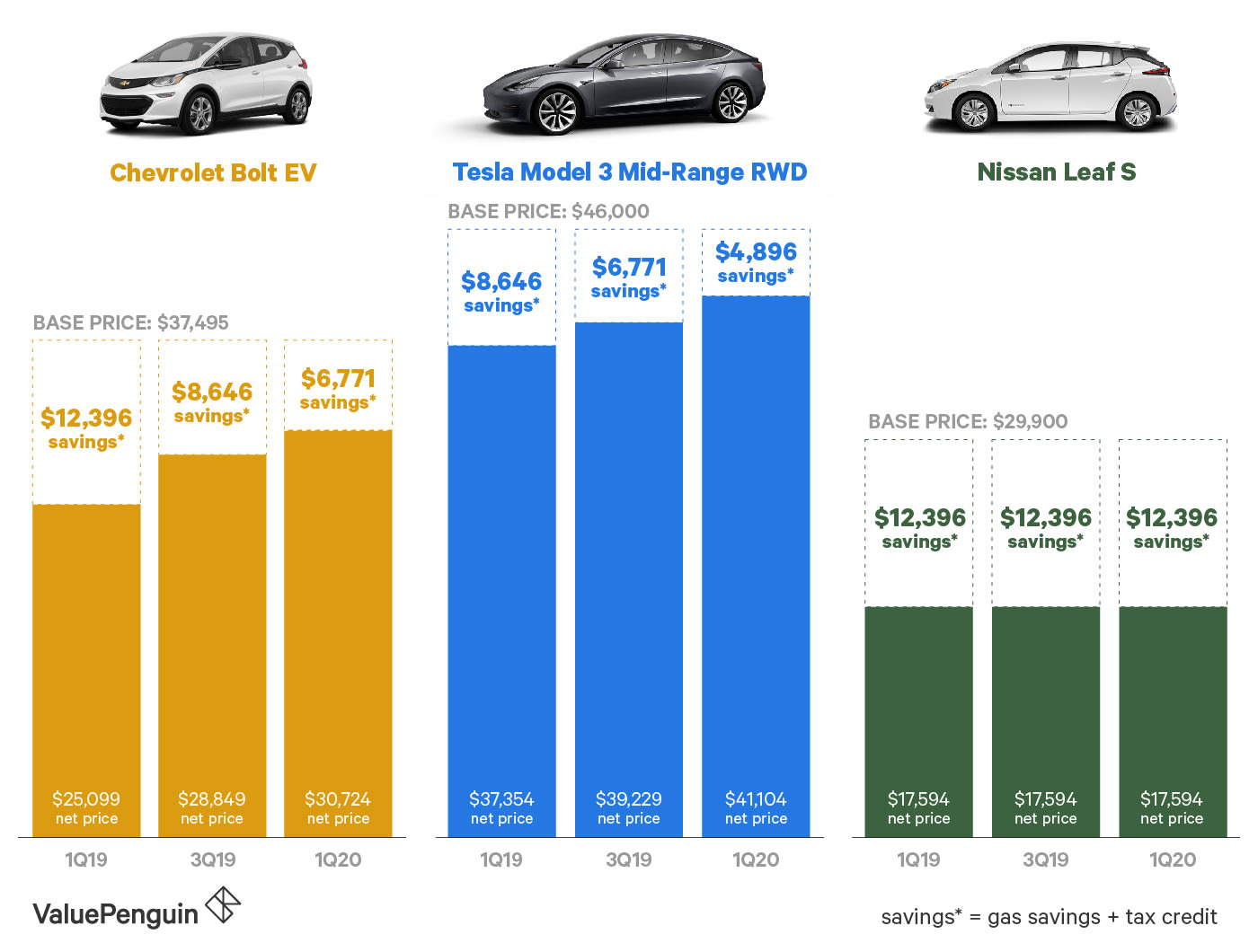

For EVs for which tax credits have begun to expire, or are expiring early this year — specifically those made by Tesla and General Motors, such as the Tesla Model 3 and Chevrolet Bolt — it will be cheaper to purchase the car sooner rather than later. For buyers of cars made by Tesla, tax credits have already begun to decrease and will completely expire in 2020. Cars made by General Motors and its subsidiaries are right behind them: GM tax credits will begin decreasing in the second quarter of 2019 and completely expire a year later, as they recently hit sales limits that trigger the sunset of the credits.

Customers of carmakers with fewer EV sales, such as Nissan or Ford, still remain far from sales limits and can continue to take advantage of the benefit for well over a year. Federal tax credits are the key contributor to lower prices because they allow buyers of electric cars to remove as much as $7,500 from their tax liabilities.

Projected electric car costs from the first quarter of 2019 to 2020

Several other factors affect the final price of owning an electric vehicle besides this tax credit, but these factors are less time-dependent and are more likely to be consistent over the next one to two years. They include the following.

-

Energy savings: Powering vehicles with electricity tends to be cheaper than powering them with gas, so every mile driven in an electric car will garner savings compared to a mile driven in a gas-powered car. Above, we've included the savings you would obtain driving an EV over a gas-powered car assuming that gas prices stay at their current levels over the next half-decade. Projected savings are almost $5,000 over six years — good, but not nearly the windfall of the one-time $7,500 tax credit.

- Auto insurance: The cost of auto insurance can be substantial for those buying a new vehicle. Although auto insurance rates for EVs are unlikely to change substantially in the next year and don't differ substantially from a gas-powered vehicle of the same price, it's an important consideration in calculating the total price of owning an electric car.

- Manufacturing costs: The costs of manufacturing electric vehicles will almost certainly come down in the coming years as the technology matures. However, given the uncertainty of how much costs will change over the next year, they have not been included in this calculation and we have kept base prices consistent.

- Maintenance costs: Maintenance costs for EVs have been found to be lower than those of gas vehicles, potentially garnering thousands of dollars in savings per year.

If gas prices remain at levels consistent with recent history, the Chevy Bolt and Tesla Model 3 will be 22% and 10% more expensive, respectively, at the beginning of 2020 compared to now. With Nissan highly unlikely to reach the production threshold for the expiration of tax credits within the next year, the Leaf will continue to receive the full $7,500 credit, maintaining its price level if we don't include potentially lower manufacturing costs.

Tax credits are the overwhelming factor driving our price analysis, showing their importance for price competitiveness. Even in a hypothetical scenario, discussed below, in which there is an upward shock in gas prices to levels seen in 2012, the increased EV price competitiveness compared to gas-powered cars would not come close to matching the savings of a full $7,500 tax credit.

How expiring tax credits will affect electric car costs

Given the size of the reimbursement, federal tax credits have provided a major incentive for certain consumers to make the switch to electric cars. Many of the most popular electric car models are eligible for the full $7,500 tax credit, and buyers can find out exactly which qualify on the website for the Office of Energy Efficiency and Renewable Energy. Effectively, buyers of almost every major electric car model to date have been able to take $7,500 off the base price of their vehicle purchase after they file their tax returns the following year.

EV model | Base price | Effective price after tax credit | Comparably priced gas-powered car |

|---|---|---|---|

| Chevrolet Bolt LT | $37,495 | $29,995 | Chevrolet Impala ($28,020) |

| Tesla Model 3 (midrange) | $46,000 | $42,250 | BMW 320i xDrive Sedan ($36,900) |

| Nissan Leaf S | $29,990 | $22,490 | Honda Civic Sedan ($19,450) |

Prices are for the base model of vehicles without added features.

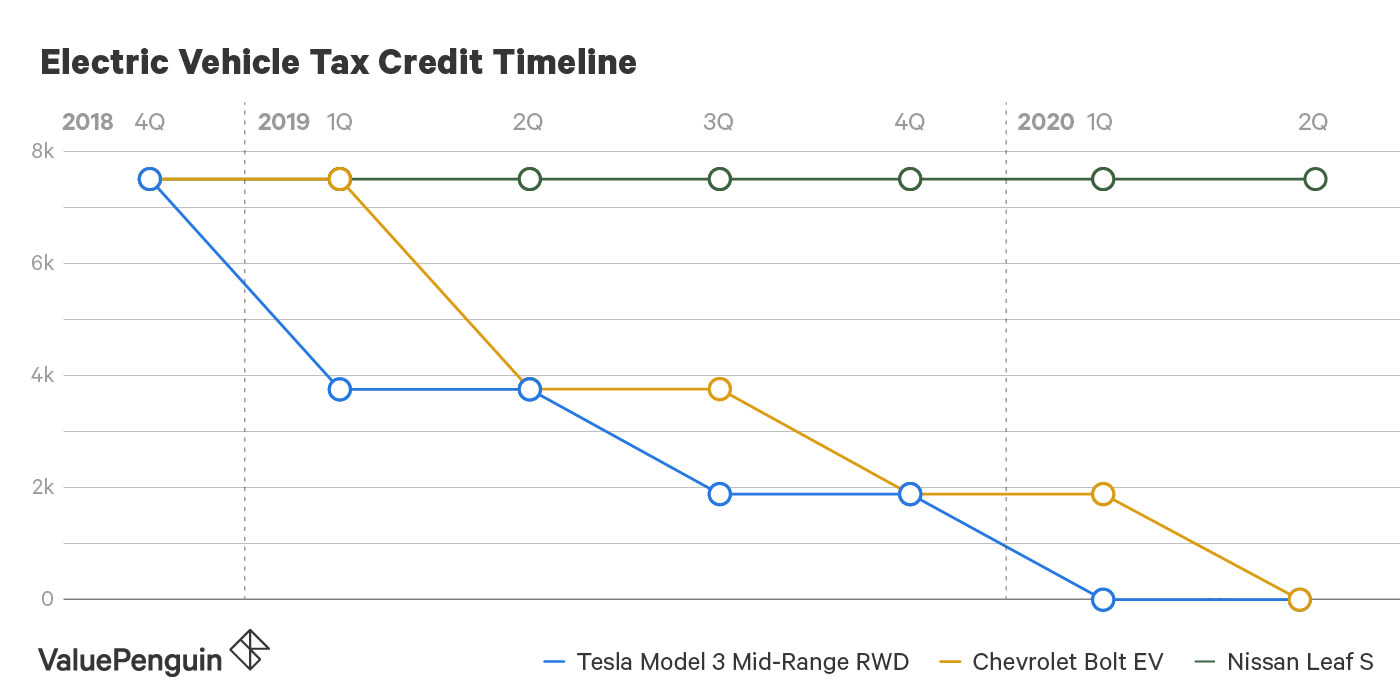

But these credits don't last forever. The Qualified Plug-In Electric Vehicle Tax Credit, as it is named, phases out over time when a manufacturer has sold 200,000 qualifying electric vehicles, and some of the biggest EV manufacturers have reached the cutoff. Tesla reached the limit in the third quarter of last year, and its federal tax credit fell to $3,750 for cars purchased in the first half of this year. The tax credit will then fall again (to $1,875) for the last six months of 2019 before completely expiring in 2020.

General Motors (and thus Chevrolet) reached the limit in the fourth quarter of last year, meaning its credit will halve in the second quarter of 2019, halve again in the fourth quarter and expire completely in April 2020. On the other hand, Nissan has reportedly sold less than 130,000 EVs in the U.S., and is highly unlikely to breach the 200,000 limit within the next year.

Adding to buyer urgency is the fact that a car needs to be delivered within a qualifying quarter to qualify for a credit. For example, if you want to get a $3,750 credit for purchasing a Model 3, you'll need it to be delivered before the end of June, before the credit halves again to $1,875. If you're looking to get the full $7,500 credit for purchasing a Chevrolet Bolt, you'll need to purchase the car before the end of March, when GM tax credits will halve to $3,750.

State and local incentives affect electric car costs, too

The federal government isn't the only entity offering incentives to purchase EVs, as plenty of states offer rebates or tax credits that can be claimed immediately upon purchase of your electric car. Moreover, these discounts function independently from the federal tax credit sales limit, meaning they are more likely to be available for years to come. These policies can be combined with the federal tax credits to see substantial savings on your purchase.

Below we have provided a selection of incentives showing some of the major ways consumers can save. Several local utility companies may also offer discounts or benefits if you are an electric vehicle owner. Shoppers making their first EV purchase can visit the U.S. Department of Energy website to browse savings options.

State | Incentive | Savings |

|---|---|---|

| California | Clean Vehicle Rebate Project | $2,500 |

| Colorado | Plug-in Electric Vehicle Tax Credit | $5,000 ($2,500 for leasing) |

| New York | Plug-In Electric Vehicle Rebate Program | $2,000 |

EV tax credits have an uncertain future

Our numbers assume that the Qualified Plug-In Electric Vehicle Tax Credit will remain in its current form, but the policy's future is uncertain, and prospective EV buyers should monitor political developments.

The most drastic alternative currently proposed would end the tax credit entirely. In early October, Sen. John Barrasso introduced a bill to the U.S. Senate to end the tax credit for the purchase of new electric vehicles completely after a previous attempt in 2017. However, a bill introduced to Congress earlier this year represented a change in the other direction.

Sponsored by Rep. Peter Welch, it would remove the 200,000 manufactured car threshold and replace it with a 10-year limit. If passed, this would allow auto manufacturers that are already triggering a sunset of tax credits, such as Tesla and GM, to continue to take advantage of the tax credit for the next decade.

How car insurance will affect electric car costs

Auto insurance, a mandatory purchase in almost all states, can be a major additional cost when purchasing a car. Auto insurance rates tend to rise each year, and that pattern is likely to continue in the near future. As a result, from an insurance perspective, we don't see a notable cost advantage to buying an electric car now versus a year from now.

Below, we noted how electric vehicle insurance costs stack up against comparably priced gas models. For the Chevrolet Bolt and Tesla Model 3, insurance costs tended to be similar for a similarly priced gas model, differing on average by 3% to 4%. However, we found the Nissan Leaf was much cheaper to insure versus a car with a similar base price.

Electric car model | Insurance cost | Gas model comparable | Insurance cost |

|---|---|---|---|

| Chevrolet Bolt | $3,594 | Volkswagen GTI Autobahn | $3,453 (-3.9%) |

| Tesla Model 3 Mid-Range | $3,604 | BMW 330i Gran Turismo | $3,483 (-3.4%) |

| Nissan Leaf | $3,255 | Subaru WRX - Premium | $3,709 (+13.9%) |

Insurance cost is an average of four major auto insurers: Geico, Progressive, State Farm and Liberty Mutual. Rates are for a 30-year-old single male in New York State with good driving history including $50,000 in bodily injury liability per person, $100,000 in bodily injury liability per accident and $50,000 in property damage per accident. Comparable gas models selected were based on cars with a similar manufacturer suggested retail price to the electric car.

How Gas Prices Affect Your Electric Car Savings

Electric car owners can save money not just through access to tax credits but also through the cheaper cost of electricity compared to gas. However, the amount of savings is dependent on the relative cost of gas to electricity, generally varying based on movements in gas prices, which are more volatile than electricity prices.

We found that gas price savings for electric cars come out to approximately $4,900 over six years if gas prices remain at current levels; not as high as the period from 2011 to 2016, but still sizable. If gas prices were to spike to the recent highs of 2012 — and remain at those levels — these savings could increase to about $7,000 over six years. Conversely, if gas levels were to fall to levels closer to those from the 1990s, electric car owners would still save, but their savings would drop significantly, to approximately $600 over six years.

Gas price | Electric car savings over six years |

|---|---|

| $2.77 (average monthly gas price this year) | $4,896 |

| $3.60 (average monthly gas price in 2012, the recent high) | $7,030 |

| $1.11 (average gas price in 1990s) | $627 |

Savings are calculated when compared to a gas-powered car with the fuel efficiency of 28 miles per gallon. Electricity costs are assumed to be the current average residential cost (13.3 cents per kilowatt-hour) and electric car efficiency is assumed to be 4.3 miles per kilowatt-hour. Savings are calculated over six years, the average length of car ownership, for a driver traveling 12,000 miles per year.

When shoppers look for electric cars online, they'll see that gasoline savings factored into the cost when buying an electric car. Ultimately, they'll still pay the full sticker price, but manufacturers are giving them an estimate of how much money they'll save in energy costs over the life of their vehicle versus owning a gas-powered car.

Other factors affecting electric car prices

This study covers many of the main factors affecting electric car costs, but there are several other cost factors to consider before an EV purchase.

- Manufacturing costs: Like any burgeoning technology, the cost of electric vehicles will tend to decrease over time. Though unlikely to greatly affect costs in the near-term, electric car manufacturers will continue to increase their efficiency, especially in producing its most expensive component: the battery. Batteries make up almost half of the total costs in constructing an EV, but the cost of manufacturing a battery has dropped more than 70% in six years. Indicative of this trend is Tesla's long-stated goal of selling a base Model 3 car for $35,000, versus the current lowest base price of $46,000. Costs of electric cars are expected to continue to decrease, but the rate of this decrease is uncertain.

- Maintenance costs: Maintenance costs for EVs are lower than those of gas vehicles, representing another way the alternative vehicles could garner savings for drivers over time. In fact, a recent study found that the average electric vehicle will save more than $2,100 over 150,000 miles of driving on maintenance, repairs and tire costs compared to a gas-powered sedan. That comes out to around $168 a year assuming you driven 12,000 miles a year.