Average Cost of Life Insurance by Age, Term & Coverage

The average cost of a 20-year term life insurance policy is $50 a month for a 40-year-old with $500,000 in coverage.

Find Cheap Life Insurance Quotes in Your Area

How much is life insurance?

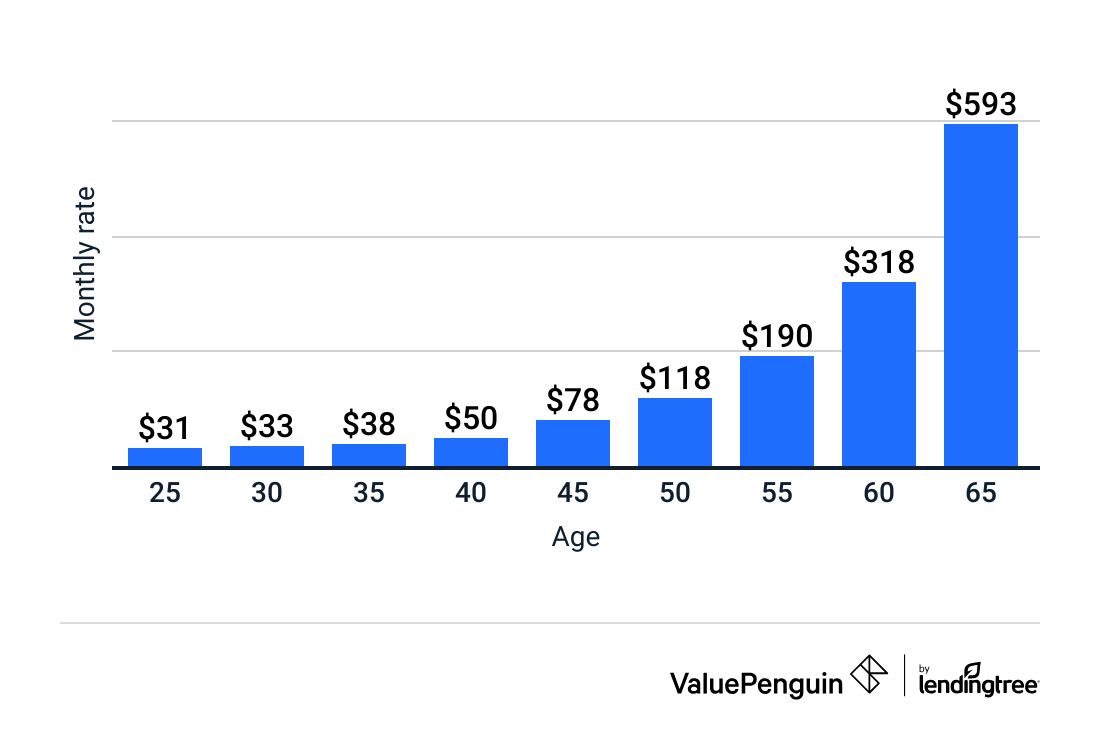

Life insurance rates increase as you get older.

The average cost of life insurance is $31 per month at age 25.

But at age 65, a life insurance policy costs about $593 per month.

Life insurance companies mostly base their rates on your age and health status, but they also factor in your job, your weight, whether you smoke and even your family health history. Unlike other kinds of insurance, life insurance quotes aren't affected by your location.

Jump to rates by:

Average term life insurance rates by age

Life insurance companies use age as an important factor for your premium. Rates increase as you age due to a decrease in your life expectancy.

The increase in monthly premiums as you age is much smaller if you are young, compared to when you are older. For example, the average life insurance quote only increases by 6% between ages 25 and 30, but it jumps much higher between ages 60 and 65 — an average increase of 86%, or $275 per month.

Monthly cost of term life insurance by age

Age | Nonsmoker | Smoker |

|---|---|---|

| 25 | $31 | $86 |

| 30 | $33 | $92 |

| 35 | $38 | $117 |

| 40 | $50 | $179 |

| 45 | $78 | $277 |

| 50 | $118 | $426 |

| 55 | $190 | $663 |

| 60 | $318 | $1,007 |

| 65 | $593 | $1,528 |

Quotes are based on a 20-year term life insurance policy with a death benefit of $500,000.

The differences in premiums are even greater if you smoke. Smokers, on average, pay premiums that are 218% higher for life insurance policies when compared to applicants who are nonsmokers.

Average cost of life insurance by gender

Besides age, life insurance quotes vary depending on your gender. On average, men pay 23% more for term life insurance than women.

This is because men tend to have shorter life expectancies compared to women. Life insurers take this into account and charge men more expensive rates than a woman who is the same age.

Monthly life insurance rates by gender

30 year old

40 year old

50 year old

Policy value | Male | Female |

|---|---|---|

| $250K | $21 | $18 |

| $500K | $33 | $28 |

| $1M | $58 | $49 |

Monthly premiums are for a life insurance policy with a term length of 20 years.

30 year old

Policy value | Male | Female |

|---|---|---|

| $250K | $21 | $18 |

| $500K | $33 | $28 |

| $1M | $58 | $49 |

Monthly premiums are for a life insurance policy with a term length of 20 years.

40 year old

Policy value | Male | Female |

|---|---|---|

| $250K | $30 | $25 |

| $500K | $50 | $41 |

| $1M | $93 | $76 |

Monthly premiums are for a life insurance policy with a term length of 20 years.

50 year old

Policy value | Male | Female |

|---|---|---|

| $250K | $67 | $52 |

| $500K | $118 | $92 |

| $1M | $226 | $173 |

Monthly premiums are for a life insurance policy with a term length of 20 years.

Find Cheap Life Insurance Quotes in Your Area

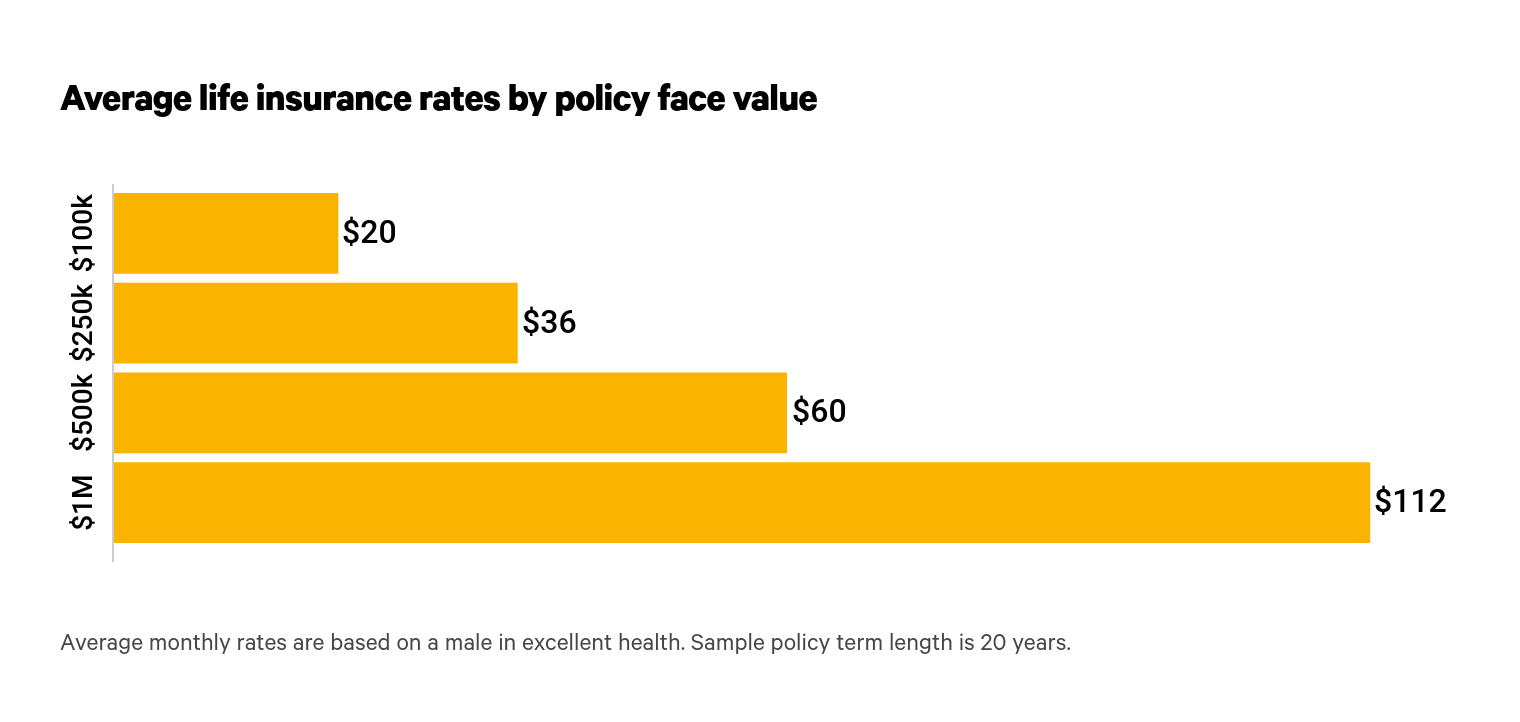

Term life insurance rates by policy size

The dollar amount that would be paid to your beneficiaries when you die, which is called the life insurance policy's face value, is essential to your financial planning. For this reason, you should carefully evaluate and determine the correct face value depending on your assets and future expenses. By choosing an accurate face value for your life insurance policy, you can adequately provide for your loved ones.

Your life insurance can be vital for your spouse in paying a mortgage, covering expenses for raising a child or even paying for your funeral. Consider what your family will have to pay for when you are gone as you decide how much life insurance to get.

Term life insurance rates by policy length

Examining quotes for 10- and 20-year term life policies, the shorter the term length of a life insurance policy, the cheaper the life insurance premiums you will have to pay each year.

We have broken down the premiums by what is called rating class. A rating classification is the health rating that the life insurance company assigns to you after you have taken a medical exam. The rating you get directly affects the rate you pay for your life insurance policy. These metrics are determined by each individual life insurance provider, but only vary slightly across the industry. Health indicators such as blood pressure, smoking and cholesterol levels impact your rating classification.

10-year term life insurance rates

People who are on a tight budget may prefer 10-year policies because they offer some of the cheapest rates available. A 10-year policy can also be useful for someone who may not need long-term insurance.

Monthly cost of 10-year term life insurance

Value |

Healthy

|

Average

|

Smoker

|

|---|---|---|---|

| $100K | $16 | $19 | $22 |

| $250K | $23 | $28 | $37 |

| $500K | $35 | $44 | $61 |

| $1M | $59 | $76 | $110 |

20-year term life insurance rates

The most popular term life insurance option on the market, the 20-year term policy, provides longer coverage than its shorter 10-year counterpart, though it comes with higher annual rates.

These policies are usually recommended for young families who often have large debts and expenses, such as mortgages and school loans, that would be harder to pay without one parent's income.

The 20-year term is typically long enough for the family to substantially pay down these debts and reduce the potential risk of someone else having to foot the bill should something happen.

Monthly cost of 20-year term life insurance

Value |

Healthy

|

Average

|

Smoker

|

|---|---|---|---|

| $100K | $17 | $19 | $23 |

| $250K | $25 | $30 | $38 |

| $500K | $40 | $49 | $65 |

| $1M | $69 | $86 | $117 |

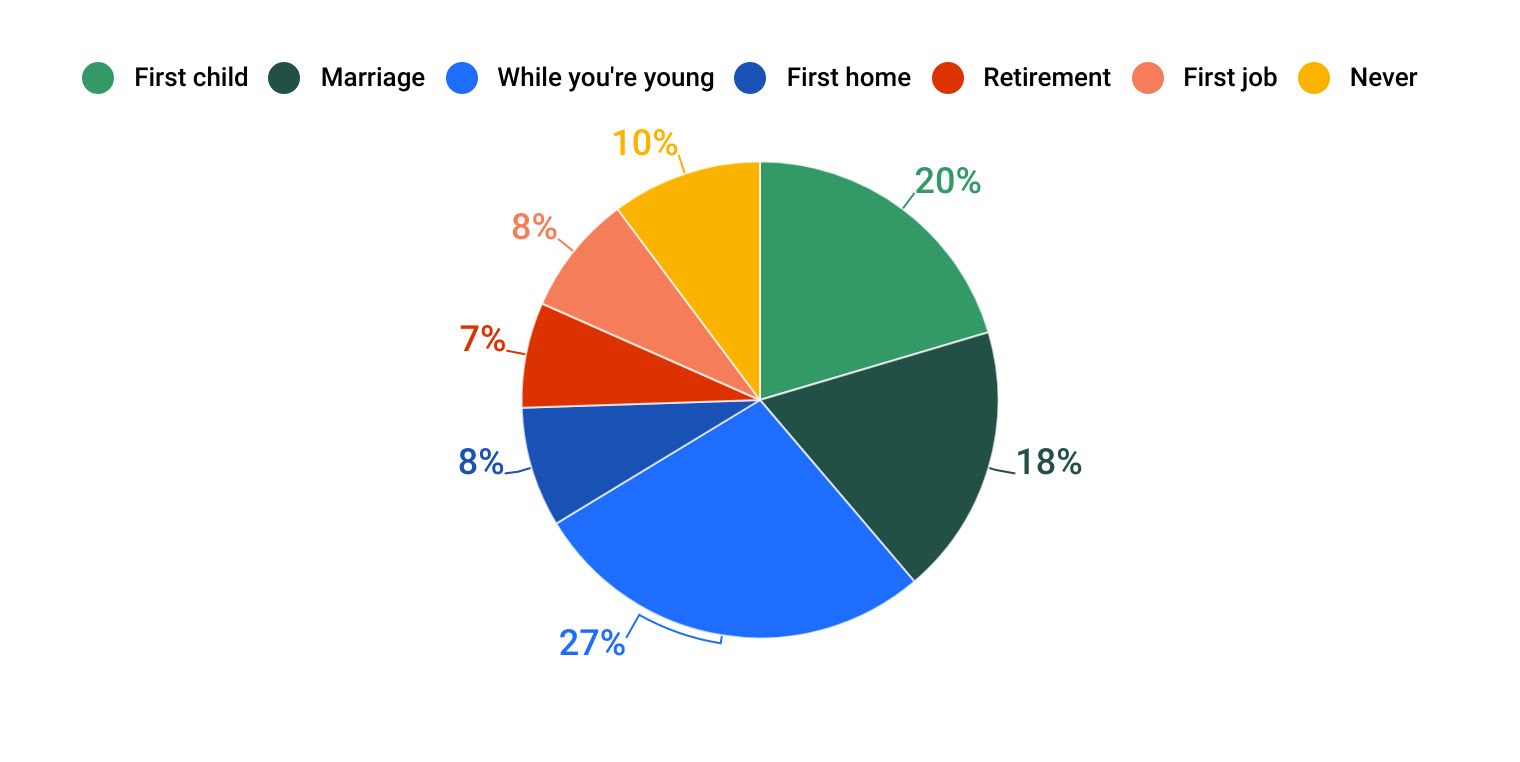

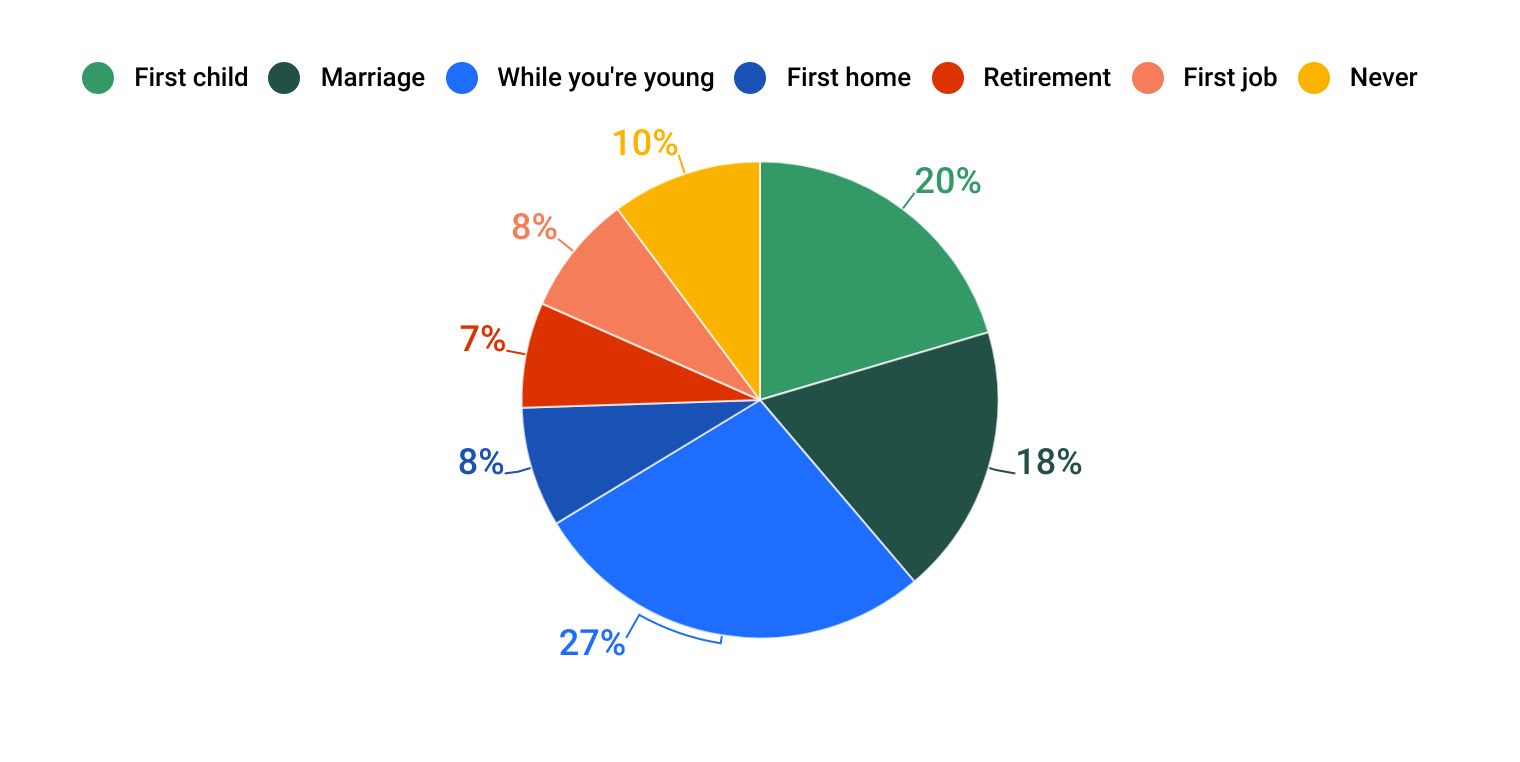

When is life insurance worth the cost?

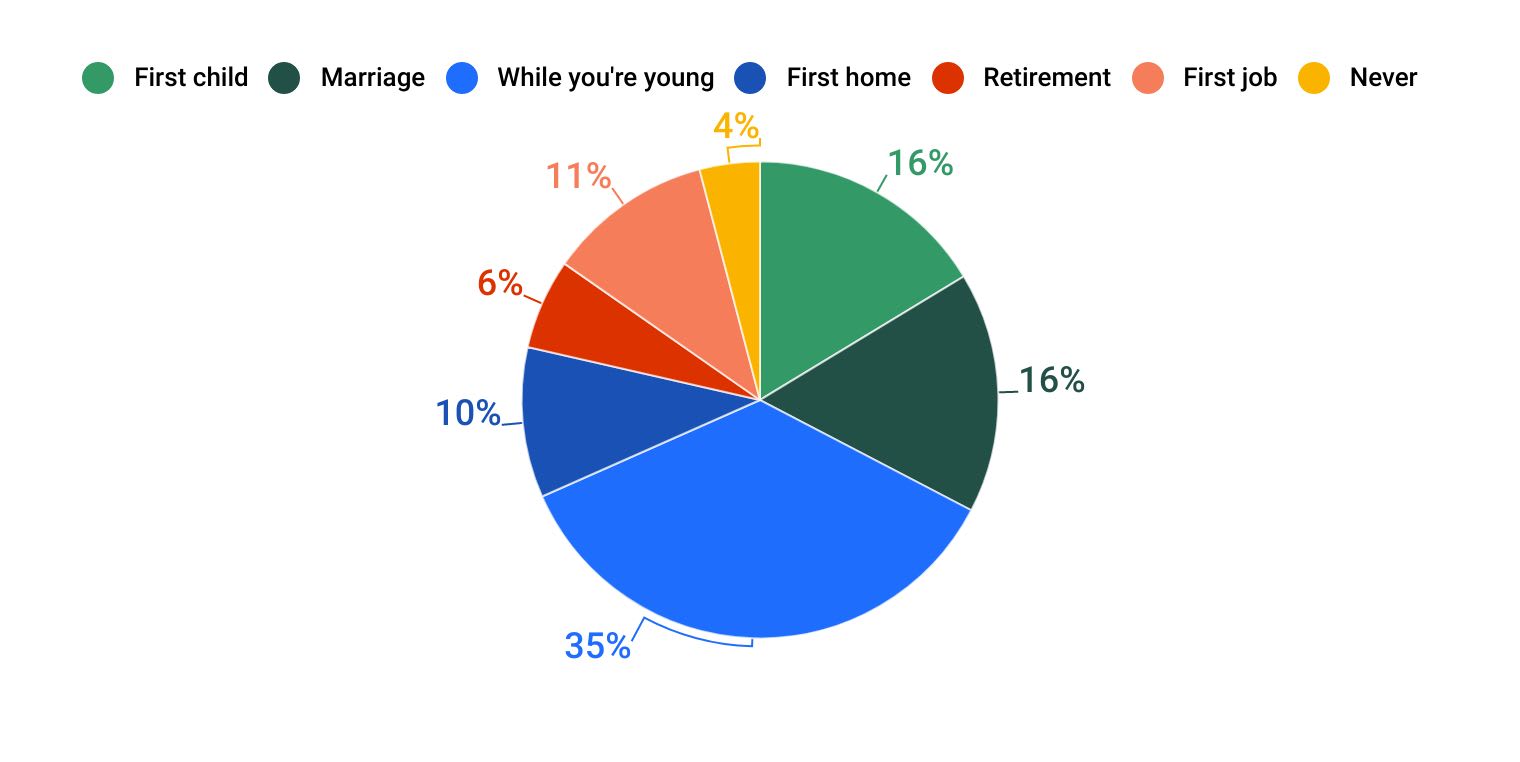

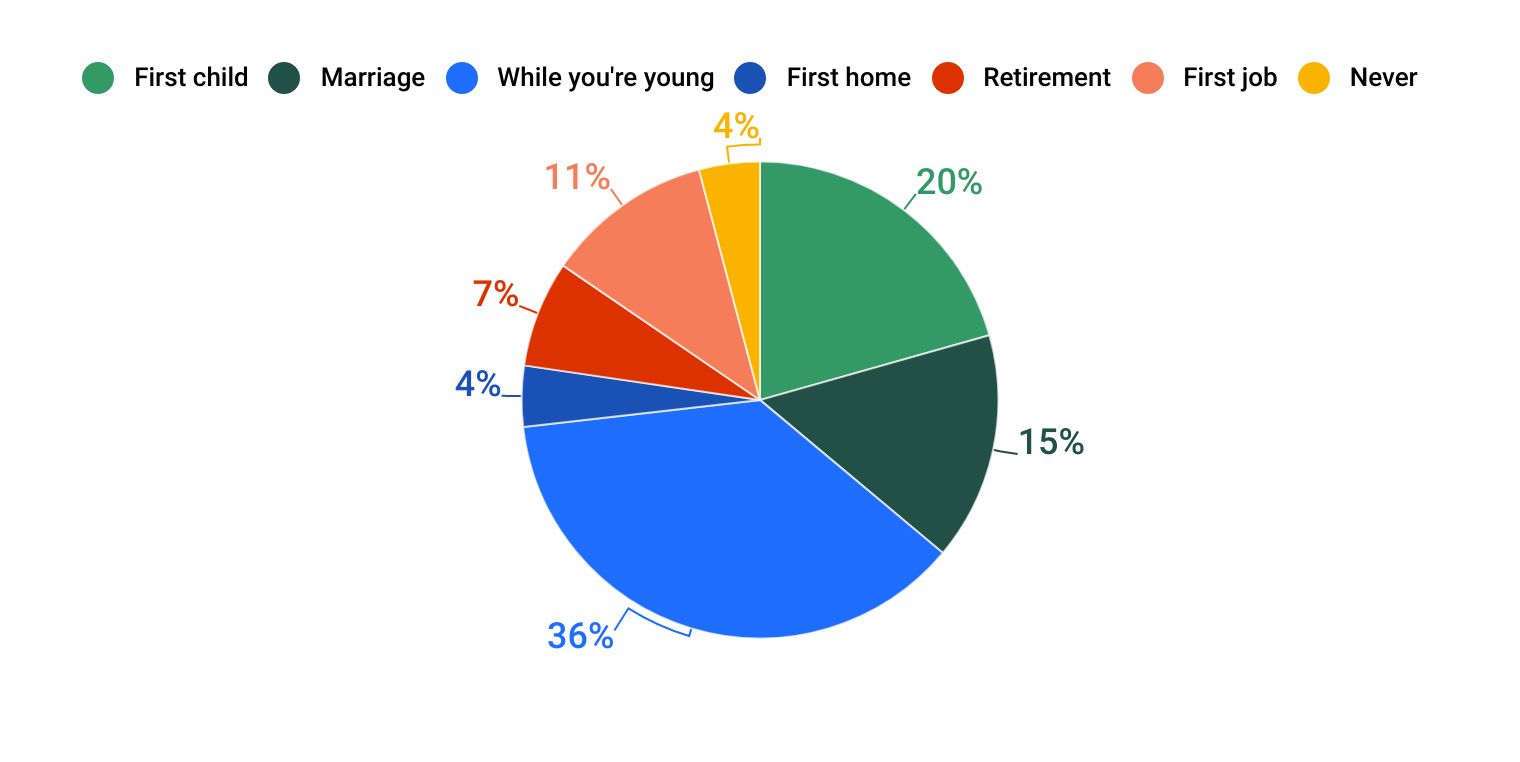

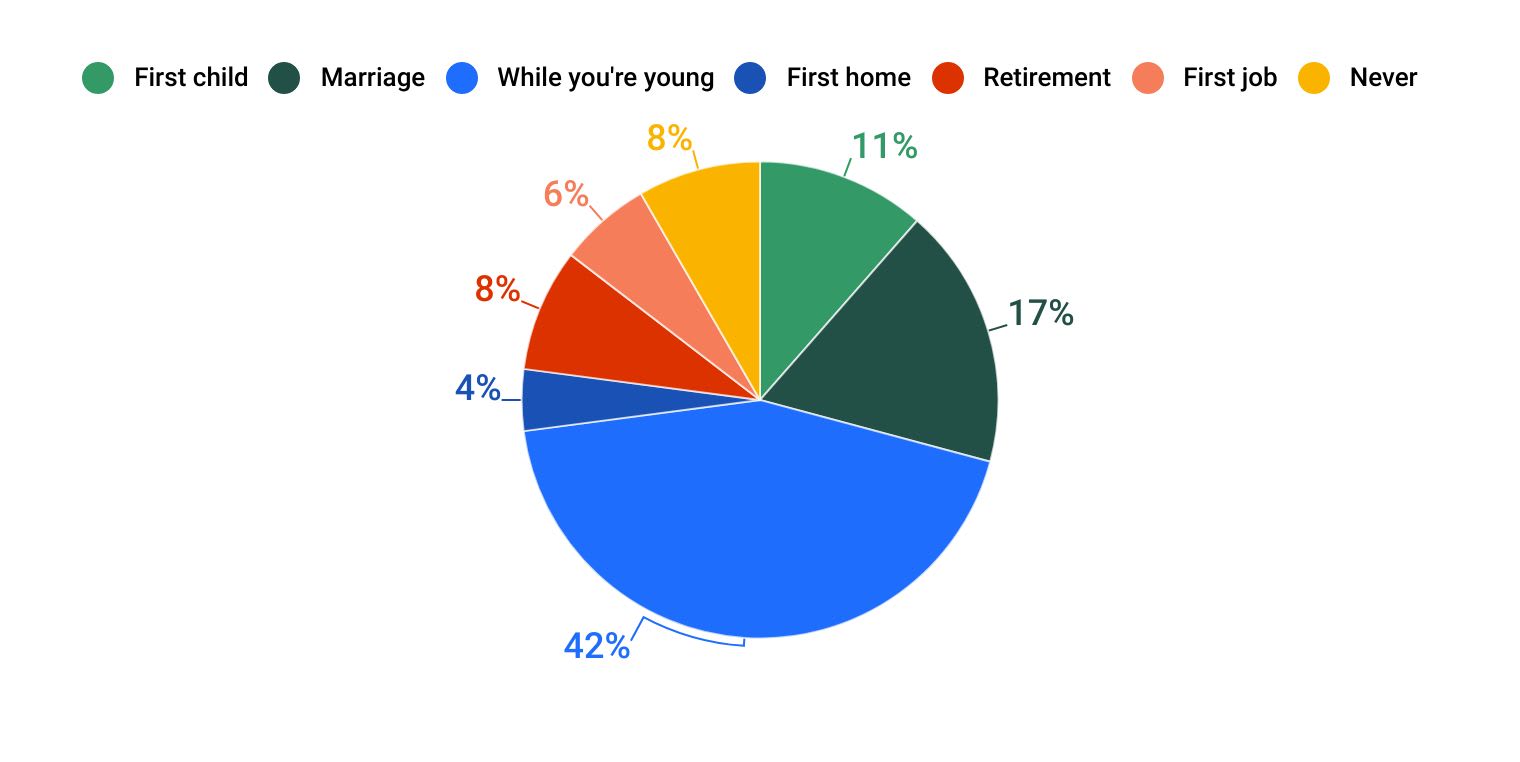

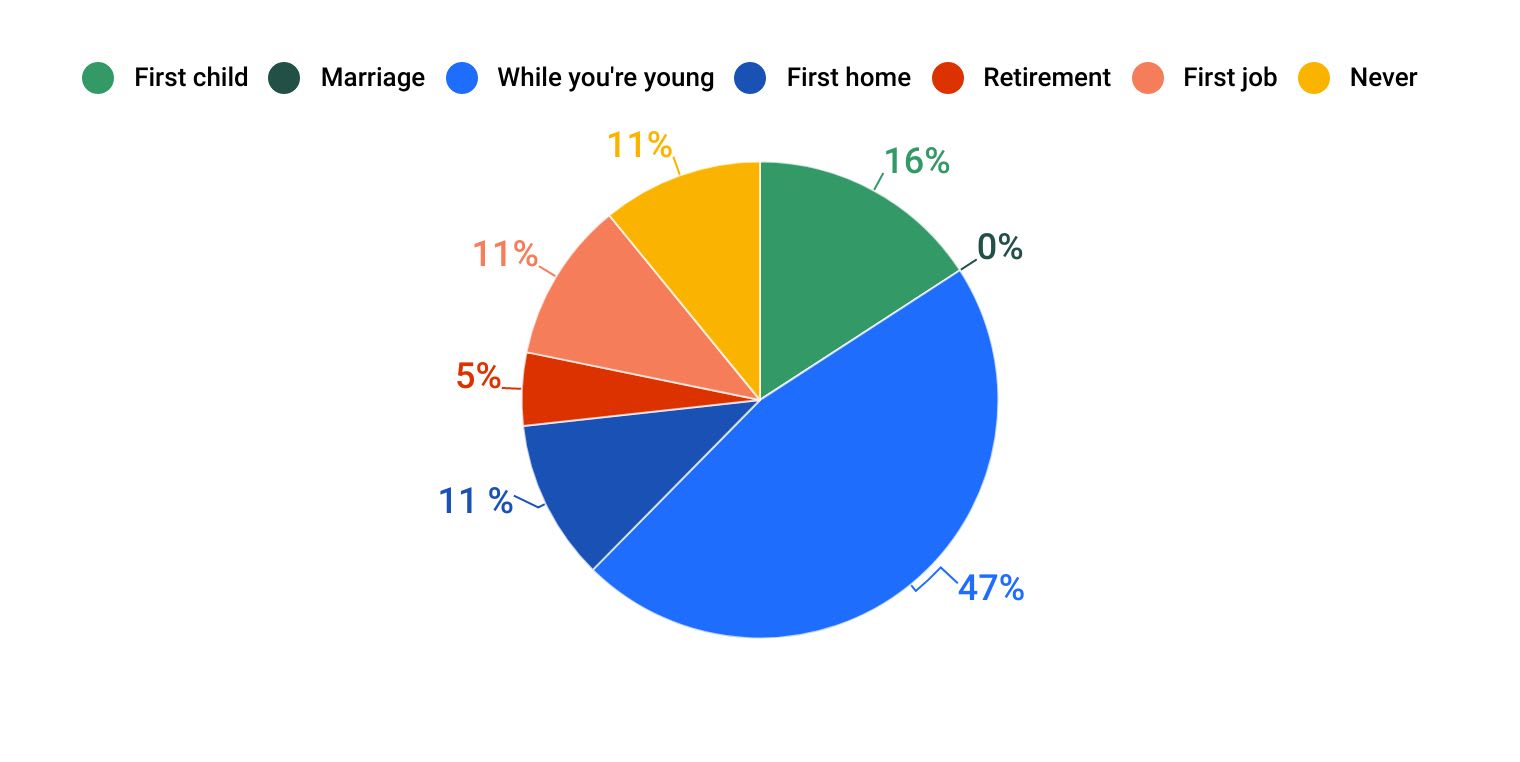

According to a ValuePenguin survey, more than a third (35%) of the total respondents did not have a life insurance policy.

When pressed about the main reason behind this decision, more than 40% of people said that it is too expensive to buy life insurance. Over half (53%) of baby boomers (adults between the ages of 54 and 72) do not currently have life insurance because they think policy premiums are too steep. Investing in a policy when you're young can be cost-effective, and boomers are feeling the effects of not purchasing life insurance until later in life.

However, when asked, "When should you purchase a life insurance policy?" over 37% of people responded, "While you are young and healthy."

When should I purchase life insurance?

Gen Z

Millennial

Gen X

Baby boomer

Silent generation

Gen Z

Millennial

Gen X

Baby boomer

Silent generation

Life event | Gen Z | Gen Y | Gen X | Boomer | Silent gen. |

|---|---|---|---|---|---|

| First child | 20% | 16% | 20% | 11% | 16% |

| Marriage | 18% | 16% | 15% | 17% | 0% |

| While you're young | 27% | 35% | 36% | 42% | 47% |

| First home | 8% | 10% | 4% | 4% | 11 % |

| Retired | 7% | 6% | 7% | 8% | 5% |

| First job | 8% | 11% | 11% | 6% | 11% |

| Never | 10% | 4% | 4% | 8% | 11% |

Frequently Asked Questions

Is buying life insurance worth it?

For most people, the answer to this question depends on their family situation. Life insurance is most important for those who are income earners for their household. If anything should happen to you, your income will be difficult for your family to replace if you don't have enough coverage.

How much does life insurance cost for a family of four?

We've found that the average cost of life insurance is about $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000. You should think of this number strictly as a baseline — your own rates for life insurance will change depending on your age, the insurer you choose and the amount of coverage you get.

At what age should I get life insurance?

Since the cost of life insurance rises as you get older, the most cost-effective strategy is to buy it as soon as you know that you need it. For most people, that moment arrives when they get married or have a child, but coverage can become necessary in any situation where you know someone else will be relying on you financially.

Methodology

Average life insurance rates by age are based on quotes from five of the largest insurers: John Hancock, MassMutual, New York Life, Securian and Transamerica. Costs shown are for a man in excellent health. Gender life insurance rate charts used the same insurers and included applicants in excellent health.

Data from this study showing the cost by policy term length was sourced from Northwestern Mutual Life Insurance. Life insurance figures are based on four policy amounts ($100K, $250K, $500K, and $1 million) across four rate classes. Below is the breakdown of each rate class:

Preferred plus policies assume no tobacco use in five years, no serious medical issues, cholesterol levels below 200 and blood pressure that doesn't exceed 130/80.

Preferred policies assume no tobacco use in three years, above-average health, no serious medical issues, cholesterol levels below 240 and blood pressure that doesn't exceed 135/85.

Select policies assume no tobacco use in 12 months, good health, blood pressure below 140/90 and cholesterol levels below 300.

Standard policies assume tobacco use in the past year, good health, cholesterol below 300 and blood pressure readings below 140/90.

ValuePenguin by LendingTree commissioned Qualtrics to conduct an online survey of 1,029 Americans to understand their feelings towards life insurance. The survey was fielded May 24-27, 2019.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.