Best Cheap Health Insurance in Maine (2024)

The cheapest Silver health insurance plan in Maine is Anthem Clear Choice Silver, at $480 per month.

Find Cheap Health Insurance Quotes in Maine

The cheapest Silver health plan in Maine is the Anthem Clear Choice Silver, which is the cheapest Silver plan in the majority of counties. However, the cheapest plan for you may depend on the level of coverage you choose and where you live.

In Maine, the average cost of a Silver health insurance plan is $582 per month for a 40-year-old.

The best health insurance company in Maine is Harvard Pilgrim, which has a strong four-and-a-half star rating out of five. However, Elevance is the most popular company, selling 53% of all health insurance plans in Maine.

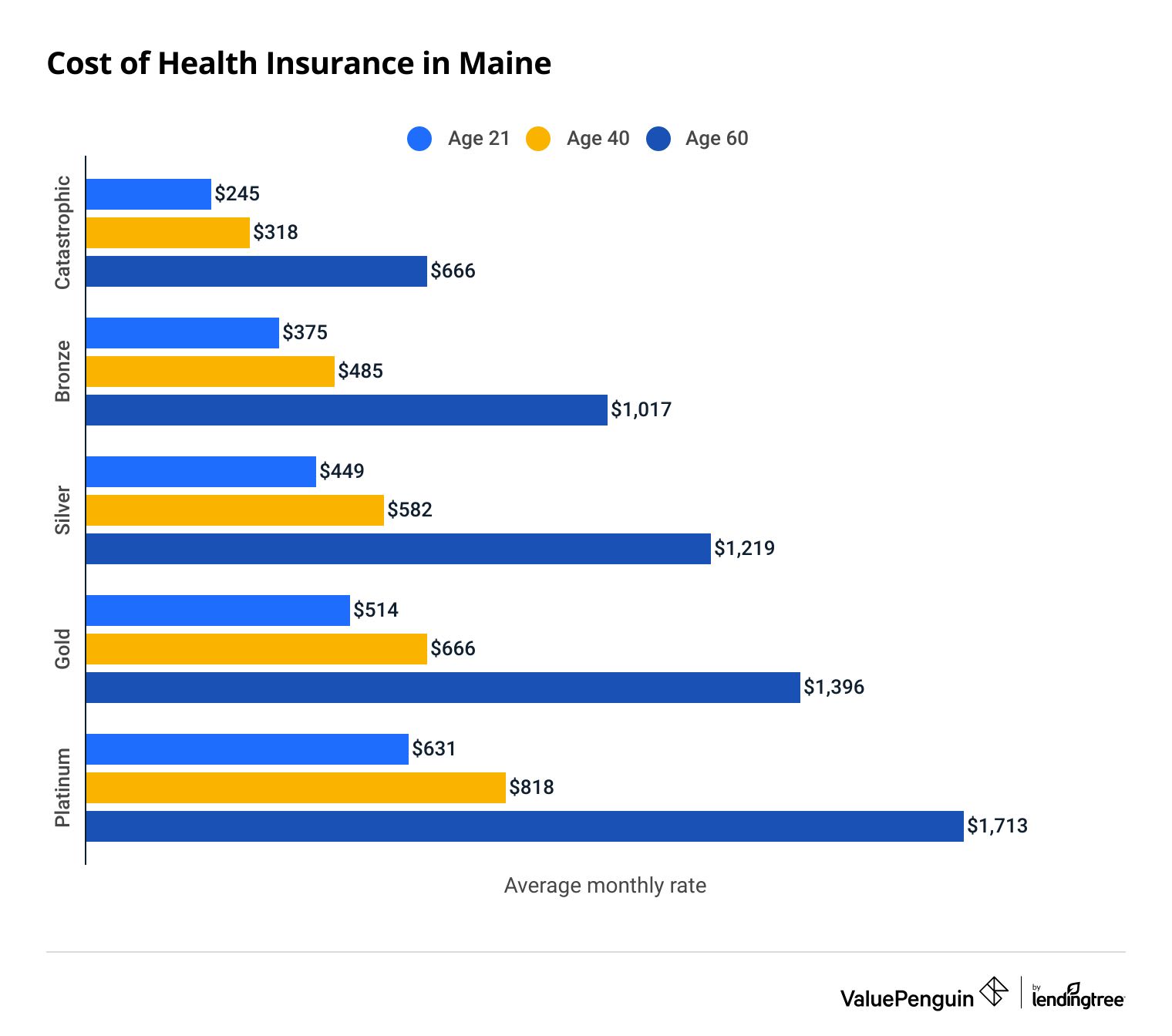

How much does health insurance cost in Maine?

Health insurance costs an average of $582 per month in Maine for a 40-year-old with a Silver plan.

Your age, location and plan level all influence your health insurance costs. Use the information below to find the cheapest policy available for each plan tier.

Cheapest health insurance in Maine

Plan tier | Cheapest plan | Monthly cost |

|---|---|---|

| Catastrophic | Health Options Clear Choice Catastrophic HMO NE | $276 |

| Bronze | Anthem Bronze X Tiered 8000 | $404 |

| Silver | Anthem Clear Choice Silver | $480 |

| Gold | Anthem Clear Choice Gold | $551 |

| Platinum | Health Options Clear Choice Platinum PPO NE | $729 |

Monthly costs are for a 40-year-old in Maine.

Keep in mind that higher tiers have more expensive monthly rates but lower out-of-pocket costs. That means a Gold plan is typically a better option if you have an ongoing illness, while a Bronze or Silver plan makes more sense if you're in good health.

Health insurance plan availability varies by county. That means the best cheap health insurance policy for you might differ from the above plans.

For example, Taro has the cheapest plans in Portland and Cumberland County. But in the rest of Maine, you're better off with Elevance (formerly Anthem).

Finding your best health insurance coverage in Maine

Remember that your health insurance options will depend on which part of Maine you call home. Someone from Bangor will have a different set of options compared to a person who lives in Portland.

In addition to your location, consider your health when shopping for a plan. Bronze plans have low monthly costs, but you'll pay more if you access health care by going to the doctor or getting a prescription filled.

Platinum health insurance plans have the most expensive monthly rates but the lowest out-of-pocket costs. The cheapest Platinum plan in Maine, the Health Options Clear Choice Platinum PPO NE, has just a $500 deductible. By contrast, the cheapest Bronze plan, the Anthem Bronze X Tiered 8000, has an $8,000 deductible.

While it's tempting to go with the plan that has the cheapest monthly rates, it's important to step back and consider the full cost of your health insurance. If you can't afford to pay a Bronze plan's $8,000 deductible, you should go with a more expensive plan option even if it means paying a higher monthly rate.

People who have low incomes will usually get the best deal on a Silver plan since these plans qualify for both premium tax credits, which reduce your monthly bill, and cost-sharing reductions (CSRs), which lower your out-of-pocket costs. Other metal tiers are only eligible for premium tax credits.

Gold and Platinum plans: Best for high medical costs

Gold and Platinum health plans have the most expensive monthly rates, but they typically offer the cheapest out-of-pocket expenses, such as deductibles and copays. So if you have high expected medical expenses, such as costly ongoing prescriptions, a higher tier may be your best choice for health insurance.

Silver plans: Best for most people

Silver plans are often the best health insurance option if you're looking for a middle ground to balance affordable rates and out-of-pocket costs. They also are eligible for cost-sharing reduction (CSR) subsidies for lower-income households, which can help to make your health care more affordable.

Bronze and Catastrophic plans: Best for healthy people with emergency savings

Bronze and Catastrophic plans often have the cheapest monthly health insurance rates, making them great choices for young, healthy people with low expected medical costs. Keep in mind that Catastrophic plans aren't available unless you're under the age of 30 or you qualify for a certain exemption, so this option may not be available to you. Catastrophic plans also are not eligible for premium tax credits.

Medicaid: Best if you have a low income

Maine expanded Medicaid for residents under the Affordable Care Act (ACA), so if your income is less than about $20,000 for a single person or $41,000 for a family of four, you may qualify for Medicaid or a qualified health plan.

Are health insurance rates going up in Maine?

For 2024, health insurance costs in Maine increased for most plans by an average of 17%.

Tier | 2022 | 2023 | 2024 | Change (2023 to 2024) |

|---|---|---|---|---|

| Bronze | $369 | $415 | $485 | 17% |

| Silver | $465 | $506 | $582 | 15% |

| Gold | $519 | $573 | $666 | 16% |

| Platinum | $633 | $688 | $818 | 19% |

Monthly costs are for a 40-year-old.

Find Cheap Health Insurance Quotes in Maine

Best cheap health insurance companies in Maine

Harvard Pilgrim has the best-rated health insurance plans in Maine. Its top-quality plans have four and a half out of five stars according to ValuePenguin editors. There are currently four health insurance companies on the Maine state exchange:

Company | Cost | ||

|---|---|---|---|

| Harvard Pilgrim | $593 | ||

| Elevance (formerly Anthem) | $553 | ||

| Community Health Options | Not yet rated | $600 | |

| Taro | Not yet rated | $529 |

Average monthly cost for a 40-year-old buying a Silver plan in Maine. Ratings are based on editor review of the company.

Harvard Pilgrim and Elevance have the best cheap health insurance plans. These companies have widespread and highly-rated plan options.

Taro has the cheapest overall average rate in Maine, but its plans are only available in Cumberland County.

Community Health Options has the highest average price of any health insurance company in Maine. A 40-year-old will pay 13% more on average for a Silver plan from Community Health Options.

Cheapest health insurance plan by Maine county

The county where you live in Maine will determine the health insurance companies and plans available. Use the following table to find the most affordable Silver plan in your county.

Shop for plans online through CoverME, also called Obamacare Maine, to find policies available in your area.

Cheapest health insurance by ME county

County | Cheapest Silver plan | Monthly rate |

|---|---|---|

| Androscoggin | Anthem Clear Choice Silver | $534 |

| Aroostook | Anthem Clear Choice Silver | $588 |

| Cumberland | Taro Health Silver Clear Choice | $521 |

| Franklin | Anthem Clear Choice Silver | $534 |

| Hancock | Anthem Clear Choice Silver | $588 |

Cheapest Silver plan with rates for a 40-year-old

Short-term health insurance in Maine

You cannot buy short-term health insurance in Maine. Although it's legal to sell short-term health insurance policies in Maine, no health insurance companies currently offer that product.

Frequently asked questions

What is the average monthly cost of health insurance in Maine?

The average cost of a Silver health insurance plan in Maine is $582 per month for a 40-year-old. Both your age and the type of health insurance plan you buy will influence the price you pay.

Is there free health insurance in Maine?

Medicaid, also called MaineCare, is a form of free government health insurance for people with low incomes. You can qualify for MaineCare if you make less than about $20,000 for a single person or roughly $41,000 for a family of four.

What is the most popular health insurance in Maine?

Elevance (formerly Anthem) is the most popular health insurance company in Maine, selling 53% of the state's health insurance plans through CoverME, Maine's state health marketplace. It also has a low monthly rate, averaging $553, and is the cheapest health insurance company in 15 of Maine's 16 counties.

Methodology

Maine's 2024 health insurance plans, costs and ratings were taken from the CoverME state health insurance exchange. Using the premiums, averages were determined for a variety of variables such as plan tier, age and county.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.