Best and Cheapest Home Insurance Companies in Hawaii (2024)

State Farm is the best homeowners insurance in Hawaii for most people, with an affordable rate of $464 per year.

Compare Home Insurance Quotes from Companies in Hawaii

Best cheap home insurance in Hawaii

ValuePenguin experts chose the top home insurance companies in Hawaii based on reliability, coverage options and affordability.

Average rates are calculated for the top companies in Hawaii by getting thousands of quotes using every residential ZIP code in the state. Full methodology

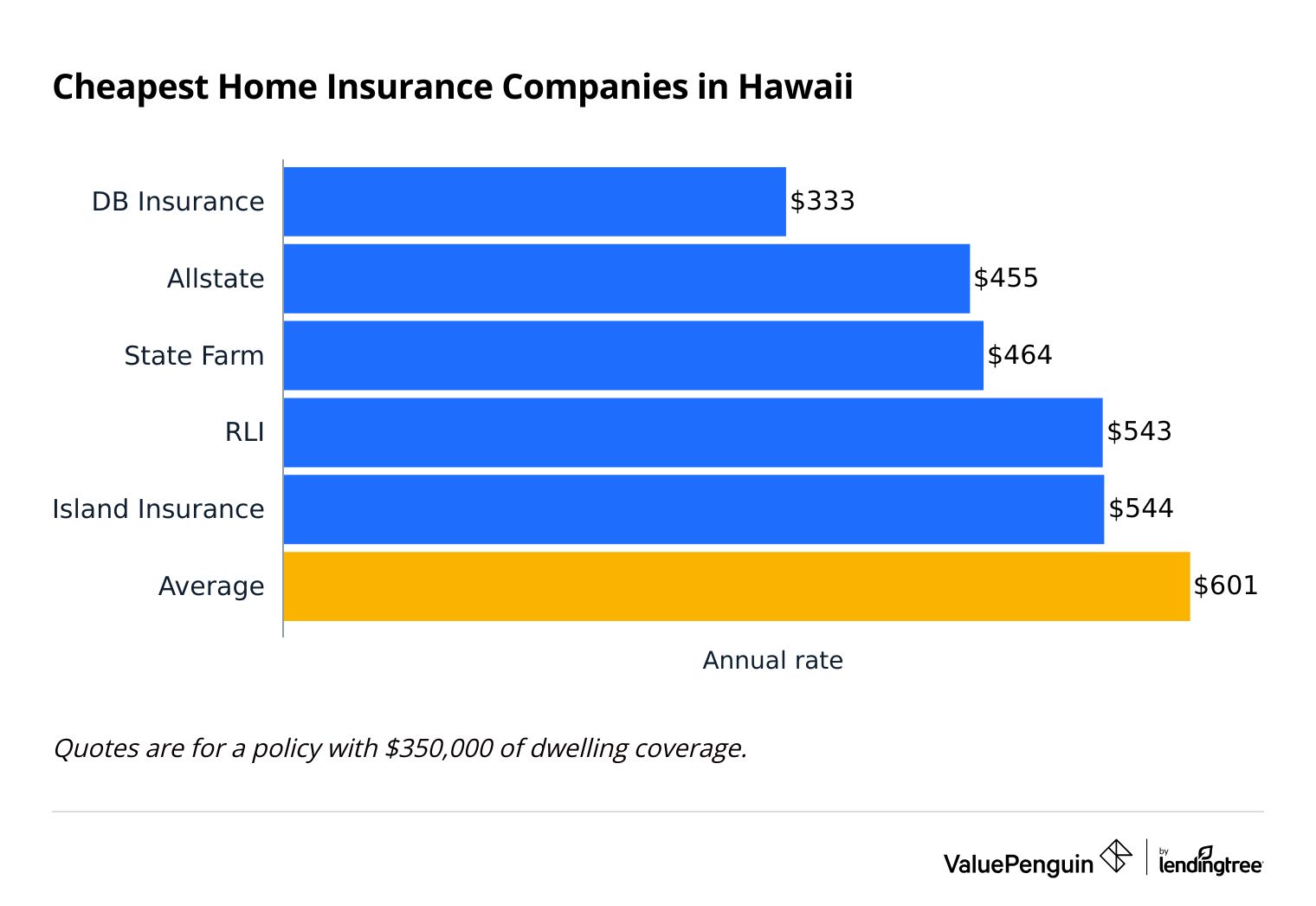

Cheapest home insurance in Hawaii

DB Insurance has the cheapest home insurance rates in Hawaii, at $333 per year for $350,000 in coverage.

Compare Home Insurance Quotes from Companies in Hawaii

DB Insurance has home insurance rates that are about 44% less than average, across all levels of coverage. So no matter what the value of your home is, DB insurance is usually a good deal.

Cheap homeowners insurance in Hawaii by coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| DB Insurance | $200 | |

| State Farm | $276 | ||

| Allstate | $279 | ||

| Island Insurance | $322 | |

| RLI | $344 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| DB Insurance | $200 | |

| State Farm | $276 | ||

| Allstate | $279 | ||

| Island Insurance | $322 | |

| RLI | $344 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| DB Insurance | $333 | |

| Allstate | $455 | ||

| State Farm | $464 | ||

| RLI | $543 | |

| Island Insurance | $544 | |

$500,000

Company | Annual rate | ||

|---|---|---|---|

| DB Insurance | $483 | |

| Allstate | $631 | ||

| State Farm | $681 | ||

| RLI | $774 | |

| Island Insurance | $796 | |

$1 million

Company | Annual rate | ||

|---|---|---|---|

| DB Insurance | $984 | |

| RLI | $1,060 | |

| Allstate | $1,389 | ||

| State Farm | $1,403 | ||

| Island Insurance | $1,633 | |

What home insurance do I need in Hawaii?

Your home insurance policy will cover many ways in which your Hawaiian home could be damaged. Policies usually cover wildfires, wind damage and vandalism. You may need to add on coverage for:

Best for most people: State Farm

-

Editor's rating

- Cost: $464/yr

State Farm has reliable coverage, great customer service and affordable rates.

-

Cheap home insurance

-

Good customer satisfaction

-

Easy claims process

-

Basic set of coverage options

-

Home and car insurance bundle may be expensive

State Farm is one of the best homeowners insurance companies in the country because of its reliable coverage with good customer service and lots of discounts.

State Farm home insurance has not had major rate increases in Hawaii since the Maui wildfires.

State Farm costs about 23% less than average. And its home insurance rates have remained steady in 2024, even as many other insurance companies are increasing prices.

The downside is that State Farm probably won't be the best deal for combining home and auto insurance policies. Its car insurance rates in Hawaii are about 19% more than average.

Best local insurer: Island insurance

-

Editor's rating

- Cost: $544/yr

Island Insurance is your best choice if you want helpful local agents and a company that's based in Hawaii.

-

Good for bundling home and auto insurance

-

Helpful local agents

-

Home insurance is not the cheapest

-

High rate of customer complaints

-

Expensive for condo insurance

Island Insurance is the best choice if you're willing to pay more to get hands-on customer support from local agents.

Island Insurance is not as cheap as companies such as State Farm or DB Insurance. This extra cost may be worth it to use a company that's based in Hawaii, rather than a mainland company.

Island does have cheap car insurance that costs about 20% less than average. And if you bundle your home and auto insurance policy, you'll get extra savings.

- 18% off your auto policy + $50 off per car

- 10% off your home, condo or renters policy

An important downside is that Island Insurance receives 34% more formal complaints than average. So even though agents are friendly, Island may not be as reliable for providing coverage as a large company like State Farm.

Condo insurance from Island Insurance is expensive. It can cost $701 per year, based on sample rates from Hawaii's insurance division. That means it's 37% more expensive than the average cost of condo insurance in Hawaii.

Cheapest home insurance in Hawaii: DB Insurance

-

Editor's rating

- Cost: $477/yr

DB Insurance has the cheapest home insurance rates in Hawaii, but it may be difficult to get a policy.

-

Costs 44% less than average

-

Few customer complaints

-

Pulling back in HI after Maui wildfires

-

Can't get a quote or file a claim online

DB Insurance has the cheapest home insurance in HI if you can get a policy.

DB home insurance policies are 44% cheaper than average rates in Hawaii. That's a very good deal. However, after the wildfires in Maui, the company is said to be reducing its policies by 30%.

- You might not be able to get a new policy unless your home has a low risk of being damaged.

- If you currently have a policy, you may not be able to renew it.

DB Insurance gets about half as many complaints as average, showing it has good customer service.

The downside is that the website is outdated. You can't file a claim online or get a quote through the website.

Best for military families: USAA

-

Editor's rating

USAA stands out for its excellent customer service and policy extras.

-

Great customer service

-

Unique coverage for military needs

-

Good for bundling home and auto

-

Availability limited to the military

-

No online quotes

For Hawaii's military members and families, USAA home insurance is the best wayto get custom policies with great customer service.

Home insurance from USAA comes with special coverage designed for military families, such as protecting your uniform if it's damaged while you're on active or reserve duty. USAA also automatically includes replacement cost coverage as a part of its standard policy. Other companies charge you extra for this.

USAA's condo insurance rates are very cheap, about 87% less than average according to the HI insurance division. However, it may not have the best rates for standalone homes.

USAA is also a good option for bundling home and auto insurance. It's one of the cheapest car insurance companies in Hawaii.

How much does home insurance cost in Hawaii?

Home insurance in Hawaii costs an average of $601 per year for $350,000 of coverage, or $866 per year for $500,000 of coverage.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $370 |

| $350,000 | $601 |

| $500,000 | $866 |

| $1,000,000 | $1,695 |

Hawaii has the cheapest home insurance in the country. Its rates are about 72% less than the national average of $2,151 per year for $350,000 in coverage.

However, Hawaii homeowners may need to buy additional types of insurance such as earthquake insurance or flood insurance for hurricanes. This adds to the overall insurance costs for Hawaiians.

Hawaii home insurance rates by island

Home insurance rates are similar across all Hawaiian islands except O'ahu.

Home insurance costs about 1% less on O'ahu than other Hawaiian islands, based on the same type of building with similar risks.

$350,000 policy | $500,000 policy | $1 million policy | |

|---|---|---|---|

| O'ahu | $598 | $861 | $1,685 |

| Big Island | $603 | $869 | $1,703 |

| Kaua'i | $603 | $869 | $1,703 |

| Maui | $603 | $869 | $1,703 |

| Moloka'i | $603 | $869 | $1,703 |

Annual home insurance rates by dwelling coverage amount

Home insurance rates by Hawaiian city

Home insurance in Honolulu costs $598 per year for $350,000 in coverage and $1,685 per year for $1 million in coverage.

It's slightly more expensive to get home insurance in Hilo than in Honolulu. Home insurance in Hilo costs $603 for a $350,000 policy and $1,703 for a $1 million policy.

City | Annual rate | % from avg |

|---|---|---|

| Ahuimanu | $598 | -1% |

| Aiea | $598 | -1% |

| Ainaloa | $603 | 0% |

Rates are for a policy with $350,000 of dwelling coverage.

Best home insurance companies in Hawaii

State Farm had the best customer satisfaction in Hawaii.

State Farm customers are satisfied with their overall home insurance policies and the claims process, according to J.D. Power.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| RLI | Low | |

| AIG | Average | |

| DB Insurance | Average | |

| Island Insurance | Average |

RLI Insurance is a good home insurance company for specialized coverage. It has options to cover a home that's in a remote area, is owned by a family trust or is under construction.

AIG is a good home insurance company for expensive homes in Hawaii. It has high customer satisfaction, automatically includes extra coverage options and tailors policies to homes worth more than $750,000.

First Insurance is not a good insurance company for Hawaiian homes. It receives an average rate of customer complaints. However, its policies can be expensive. So far this year, its home insurance has gone up by 22% and condo insurance has gone up by 14%.

Allstate is a poor choice for Hawaii home insurance. It receives twice as many complaints as average. And its rates have been going up. The cost of home insurance has gone up by 18%, and condo insurance has gone up by 74%.

How are Hawaii's home insurance rates changing after the Maui wildfires?

In 2024, the cost of home insurance in Hawaii has increased by 9%. Condo insurance rates have increased by 19%.

Rate increases by policy type | 2023 | 2024 |

|---|---|---|

| Home insurance | 2% | 9% |

| Condo insurance | 4% | 19% |

On average, the cost of Hawaii home insurance has increased steeply since the 2023 wildfires in Maui caused more than $3 billion in insurance claims.

- Hawaii home insurance rates have increased by an average of 9% in 2024. That's much higher than typical rate increases of 1% to 3% per year.

- Condo insurance rates have been more volatile. Rates jumped by 19% in 2024 after typical increases of 1% to 5% per year.

Insurance companies have responded differently to the Maui wildfires. For example, State Farm hasn't raised rates in Hawaii, on average, while other companies are rapidly raising rates.

Largest home insurance rate increases in Hawaii

Home | Condo | |

|---|---|---|

| Liberty Mutual | 13% | 36% |

| Allstate | 18% | 74% |

| Ocean Harbor Group | 21% | 25% |

| First Insurance Company of Hawaii | 22% | 14% |

| DB Insurance | 42% | 97% |

Hawaii home insurance companies with at least 3% of the market and high average rate increases in 2024

You can still shop around for home insurance in Hawaii

Home insurance policies in Hawaii are still available from a wide selection of companies. However, smaller companies such as Universal Property & Casualty have left the state.

This means that, overall, the Hawaiian home insurance market has been resilient after the Maui wildfires. Broadly, homeowners in Hawaii are not facing the same challenges as in California, where it can sometimes be difficult to find an insurance policy.

Policy availability is also changing

Companies such as DB Insurance could be selling 30% fewer policies in Hawaii, according to recent reports. This means that current customers may not be able to renew coverage, and it could be harder to get a new policy.

Usually, homes that have the biggest risk of filing a claim are the most likely to be declined coverage.

What home insurance coverage is important in Hawaii?

A standard home insurance policy will cover many types of home damage.

In most cases, a typical home insurance policy will cover damages from wildfires. However, after the Lahaina wildfires, it's good to double-check that your policy isn't specifically excluding wildfire damage.

To have the most protection from natural disasters, get a policy that has extended replacement cost coverage. This can give you an extra cushion to help make sure that insurance will cover your costs. This coverage is especially important in Hawaii because repair costs can skyrocket when many people on the island have home damage.

You may sometimes need separate volcano insurance

Each insurance company covers volcanos differently. So you'll have to read your policy to understand if volcanoes are included or if you have to add on coverage.

- In most cases, if the heat from lava flow causes your home to catch on fire, then your home insurance will pay for damages. That's because home insurance policies cover house fires.

- But if your home is damaged from ground movements, such as a crack in the earth, you would need coverage that's specifically for either volcanoes or earthquakes.

When volcanoes erupt, it can be a long time before you are able to get back home. That's why it can be helpful to have loss of use coverage on your policy to help pay for extra living expenses such as a hotel room.

Your coverage options for volcano insurance will change based on how likely your home is to have volcano damage. This can be found using the USGS lava flow hazard map.

If you live in lava zones 1 or 2, your only option for insurance is the state insurance program, Hawaii Property Insurance Association (HPIA). This can be expensive, costing more than $6,000 per year for $300,000 in coverage.

A separate flood insurance policy will cover hurricanes and tsunamis

Flood damage is not covered by a regular home insurance policy. Instead, a separate flood insurance policy is needed to pay for water damage from heavy rain, hurricanes, storm surge, tsunamis and overflowing rivers.

Flood insurance in Hawaii costs an average of $792 per year. But rates will change based on how close you are to the ocean or another waterway.

Typically in Hawaii, you'll need hurricane insurance to cover high-speed winds

Home insurance policies cover wind damage from a standard storm. But policies in Hawaii often won't cover damage from hurricane-force winds unless you add on a special hurricane insurance endorsement.

The average cost of hurricane insurance in Hawaii is $758 per year when you buy a policy separately. However, it's usually cheaper to buy a home insurance and hurricane insurance bundle, saving you about $100 per year.

Earthquake insurance is also a separate policy

A regular home insurance policy won't cover earthquake damage. So if your home is on the Big Island or another area where earthquakes are likely, you may want to get a separate earthquake insurance policy.

- Earthquake insurance will cover damages caused by ground movements, such as structural issues to your home or if your television falls because of the quake.

- If an earthquake causes a tsunami or flood, the earthquake policy won't pay for the water damage to your home. You would need a separate flood insurance policy for that.

How to save money on Hawaii home insurance

Comparing home insurance quotes from multiple companies is the best way to find cheap home insurance.

Home insurance rates are based on many different factors including details about your home, the area where you live and personal details such as your credit score. Each company calculates its rates in different ways. That's why getting quotes is the only way to know which company is the cheapest for you.

Home insurance rates can be volatile after a natural disaster such as the Hawaiian wildfires. It can be helpful to work with an independent agent who can get your quotes from multiple companies and knows the local market and how availability and rates are changing.

Frequently asked questions

How much is home insurance in Hawaii?

The average cost of homeowners insurance in Hawaii is $601 per year for $350,00 in coverage, or $866 per year for $500,000 in coverage. That makes Hawaii the cheapest state in the country for home insurance. However, people living in other states usually won't have extra insurance costs to cover volcanoes, tsunamis, hurricanes and earthquakes.

Who has the cheapest home insurance in Hawaii?

DB Insurance has the cheapest home insurance rates for Hawaii residents, at $333 per year for $350,000 in coverage. That's nearly half of what an average policy costs.

Who has the best home insurance in Hawaii?

State Farm is the best home insurance for most homeowners in Hawaii. It has affordable rates, reliable coverage, an easy claims process and good customer satisfaction.

Is there volcano insurance in Hawaii?

Yes, you can get volcano insurance in Hawaii to protect against damage from lava, fires and ash. However, it depends on your home insurance policy if volcano damage is covered or if you need to add on this coverage. You'll need a separate earthquake insurance policy to cover damages from earth movements, such as damage to the walls of your home due to earth tremors during a volcano eruption.

Methodology

The cost of home insurance in Hawaii is based on thousands of quotes from the top companies using every ZIP code in the state. Quotes are for a 45-year-old married man with no prior insurance claims. Unless otherwise stated, averages are for a policy with $350,000 in dwelling coverage.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services, which was publicly sourced from insurance filings. These quotes should be used only for comparison purposes, as your own quotes may be different.

Additional sources:

- Rate change information for home and condo insurance is from S&P Global's report on the top 10 companies in Hawaii by market share. Average rate changes are based on total written premiums using available filings to date.

- The cost of flood insurance is based on rates from the National Flood Insurance Program (NFIP).

- Volcano insurance rates are based on estimates from real estate professionals on the Big Island.

Hurricane insurance rate information is from the State of Hawaii Insurance Division using a sample property

- Wood home built in 2008 with double walls

- Located 15 feet above sea level

- Community fire protection of Class 3 in O'ahu and Class 4 on other islands

- Dwelling coverage of $310,000

- Used as a primary residence

- No claims in the past five years

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.