The Best and Cheapest Homeowners Insurance in Kansas (2024)

Auto-Owners has the cheapest home insurance in Kansas, with rates averaging $2,367 per year.

Compare Home Insurance Quotes in Kansas

Best Cheap Home Insurance in Kansas

ValuePenguin reviewed quotes from top insurance companies for hundreds of ZIP codes in Kansas. Our experts chose the cheapest and best insurance companies after a review of each company's rates, coverage options, discounts and customer service. See the full methodology.

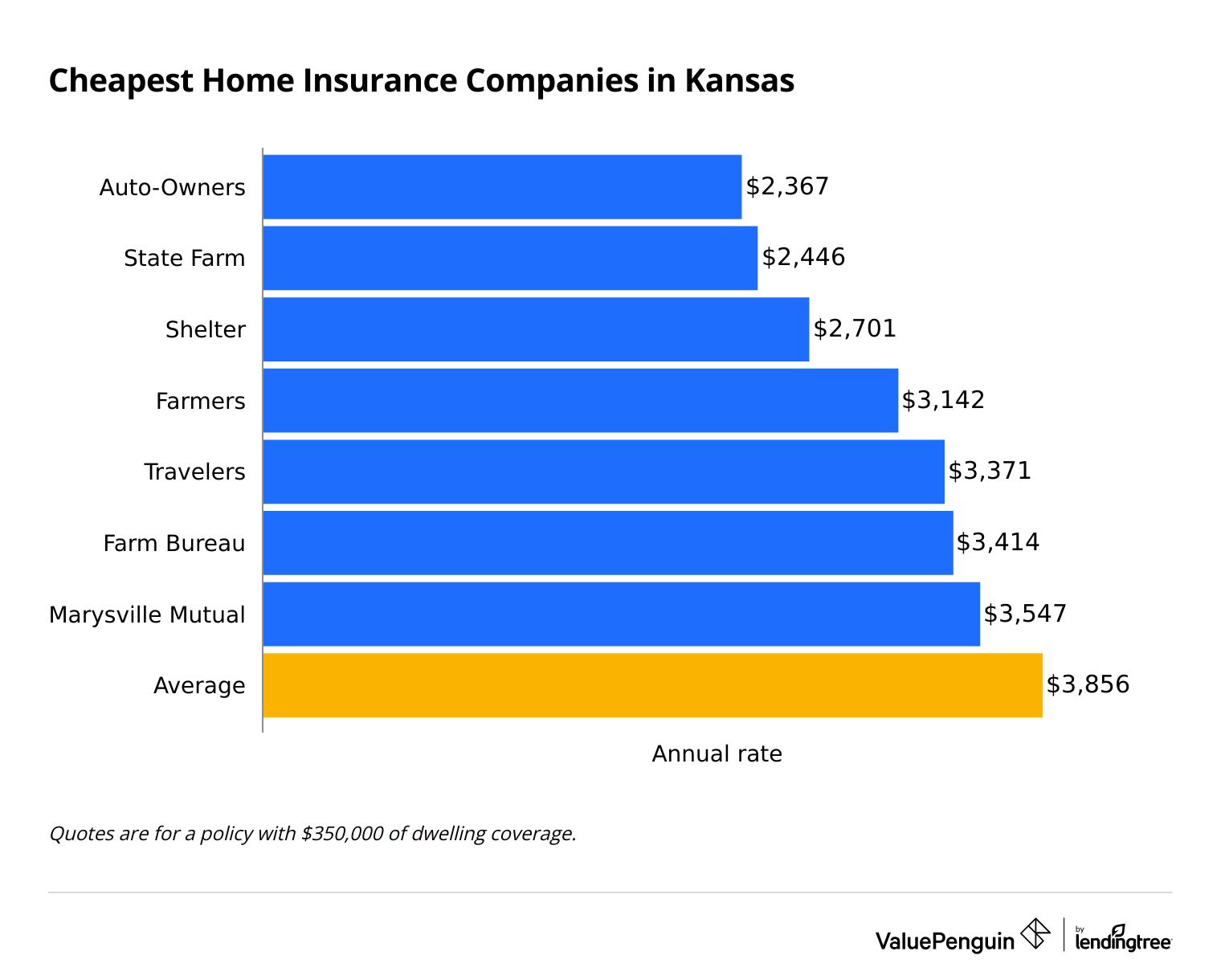

Cheapest homeowners insurance companies in Kansas

Auto-Owners has the cheapest home insurance in Kansas, with a policy costing $2,367 per year, on average.

That's almost $1,500 cheaper than the state average cost of home insurance, which is $3,856. State Farm is also a cheap choice, especially if you want to bundle your auto and home insurance.

Find Cheap Home Insurance Quotes in Kansas

Cheap home insurance in Kansas

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Shelter | $1,573 | ||

| State Farm | $1,714 | ||

| Auto-Owners | $1,724 | ||

| Farmers | $2,011 | ||

| Pioneer State Mutual | $2,153 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Shelter | $1,573 | ||

| State Farm | $1,714 | ||

| Auto-Owners | $1,724 | ||

| Farmers | $2,011 | ||

| Pioneer State Mutual | $2,153 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Auto-Owners | $2,367 | ||

| State Farm | $2,446 | ||

| Shelter | $2,701 | ||

| Farmers | $3,142 | ||

| Travelers | $3,371 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Auto-Owners | $3,203 | ||

| State Farm | $3,267 | ||

| Shelter | $3,864 | ||

| Farmers | $4,303 | ||

| Travelers | $4,348 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $5,626 | ||

| Farmers | $6,607 | ||

| Westfield | $7,530 | ||

| Shelter | $7,581 | ||

| Travelers | $7,777 | ||

What home insurance coverage do I need in Kansas?

Kansas is traditionally part of Tornado Alley, which means high winds, tornadoes and hail are common. And most counties in Kansas have experienced flooding. Home insurance usually covers damage from wind, tornadoes and hail. But home insurance never covers flooding.

Best home insurance in Kansas: Auto-Owners

-

Editor's rating

- Cost: $2,367/yr

Auto-Owners has cheap rates, great coverage and good service.

Pros:

-

Cheap rates

-

Lots of coverage options

-

Local agents

Cons:

-

No online quotes

Auto-Owners stands out as the best home insurance in Kansas for most people because of its cheap rates, high customer satisfaction, and extensive coverage options and discounts. The company has the cheapest home insurance in Kansas for policies with $350,000 and $500,000 in dwelling coverage. It also has cheaper-than-average rates for homes with $200,000 and $1 million in dwelling coverage.

If you want to customize your policy to your needs, Auto-Owners has plenty of optional add-on coverages. One that might be especially good for Kansas homeowners is the inland flood coverage. This add-on lets you get flood coverage on your home insurance policy, which is rare. Usually you need a separate flood insurance policy. But nearly every county in Kansas has had a flood, so it's important coverage to have.

Auto-Owners also has good customer service and local agents to help you. The company has 60% fewer complaints about its home insurance compared to an average company its size, according to the National Association of Insurance Commissioners (NAIC). But you have to work with a local agent to get a quote, because Auto-Owners doesn't have an online quote option.

Best home insurance in Kansas for bundling: State Farm

-

Editor's rating

- Cost: $2,446/yr

State Farm has cheap rates for auto and home insurance in Kansas.

Pros:

-

Cheap home insurance rates

-

Cheap auto insurance rates for bundling

-

Local agents

Cons:

-

Fewer coverage options than some other companies

-

Not as many discounts as some other companies

State Farm is the best option if you want to bundle your auto and home insurance, because it has cheap car and home insurance rates in Kansas. Its home insurance rates in Kansas are only slightly more expensive than Auto-Owners' rates, and still well below the state average. And State Farm has the cheapest full coverage car insurance in Kansas, with an average rate of $126 per month.

State Farm also has good customer service, with an average amount of complaints according to the National Association of Insurance Commissioners (NAIC). But State Farm isn't the best option for customizing your Kansas home insurance policy. The company doesn't have as many coverage options or discounts as some other insurance companies.

Best local home insurance company in Kansas: Marysville Mutual

-

Editor's rating

- Cost: $3,547/yr

Marysville Mutual specializes in Kansas insurance.

Pros:

-

Founded in Kansas

-

Cheap rates

-

Local agents

Cons:

-

Limited online features

-

May have fewer coverage options than larger companies

Marysville Mutual was founded in Kansas in 1888 and continues to specialize in Kansas insurance. If you want to keep your insurance with a local company, Marysville Mutual is a good option. The company offers cheaper-than-average rates for home insurance, as well as coverage for farms, rented homes and some coverage for small businesses.

Marysville Mutual doesn't directly sell car insurance, though, so it might not be a good option for bundling. You can get a car insurance policy from their partner, North Star Mutual, but you might not get a multi-policy discount. You also can't get an online quote with Marysville Mutual. You have to work with one of the 240 agencies in Kansas.

Average cost of homeowners insurance in Kansas

Home insurance in Kansas costs $3,856 per year for $350,000 in dwelling coverage.

Kansas has the third-highest home insurance rates in the country. Rates are only higher in nearby Nebraska and Oklahoma.

The high home insurance rates in Kansas are likely because of how common wind and tornado damage is in the state. But Tornado Alley has begun to shift, with the most severe weather happening in Tennessee and Kentucky. If severe weather becomes less common in Kansas, home insurance rates could go down.

Average cost of home insurance in Kansas by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $2,505 |

| $350,000 | $3,856 |

| $500,000 | $5,145 |

| $1,000,000 | $9,394 |

The more expensive your home is, the more you'll pay for home insurance. Insurance companies know that higher-end homes are more expensive to repair or rebuild, so they charge higher rates to account for the more expensive claims.

Kansas home insurance rates by city

Home insurance in Wichita, the largest city in Kansas, costs $4,463 per year.

That's 16% more than the state average. But home insurance in Kansas City costs $3,285 per year, on average, which is 15% cheaper than average. Similarly, in the state capital of Topeka, the average cost of home insurance is $3,458 per year, 10% cheaper than average.

Gardner, a city to the southwest of Kansas City, has the cheapest home insurance in Kansas, with average rates at $3,029 per year. Beeler, a small town in West Central Kansas, has the most expensive home insurance, costing $4,789 per year, on average.

City | Annual rate | % from avg |

|---|---|---|

| Abbyville | $4,312 | 12% |

| Abilene | $3,745 | -3% |

| Admire | $3,563 | -8% |

| Agenda | $3,650 | -5% |

| Agra | $4,232 | 10% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated homeowners insurance companies in Kansas

Auto-Owners, Farm Bureau and Marysville Mutual are the best-rated home insurance companies in Kansas.

All three companies have good customer service and low rates. State Farm is also a good option for customer satisfaction.

Company |

Rating

|

Complaints

|

|---|---|---|

| Auto-Owners | Low | |

| Farm Bureau | Low | |

| Marysville Mutual | Low | |

| State Farm | Average | |

| American Family | Low |

What kind of home insurance is important in Kansas?

Knowing what weather patterns are common in Kansas can help you choose the right home insurance and understand what's covered.

Kansas' location in the Plains means its weather changes frequently and dramatically. Summers can bring extreme heat and strong storms. Winters are milder than in more northern states, but can still come with cold, snow and ice.

Does Kansas home insurance cover wind and tornadoes?

Home insurance almost always includes coverage for wind and tornado damage. It never hurts to check, though, especially since wind damage is common in Kansas. The state recorded 39 tornadoes and 761 non-tornado wind storms in 2023.

Home insurance policies often include a separate deductible for wind and hail damage. For example, you might pay a $1,000 deductible if you file a claim for water damage. But if you file a claim for wind or hail damage, you could pay a higher amount, or even a percentage of the total damage. Make sure you know if your policy has a wind and hail deductible and how much it is, so you're prepared if you need to file a claim.

Does home insurance in Kansas cover hail damage?

Home insurance usually covers hail damage. That's good news, considering that hail is very common in the state. Kansas had 459 hail storms in 2023.

A separate wind and hail deductible might apply, just as is the case with tornado damage. And if your roof or other parts of your home are old or not well maintained, you might not have any coverage, or less coverage than you expect.

Does Kansas home insurance cover floods?

Home insurance does not cover flood damage. You need to buy a separate flood insurance policy to get flood coverage.

Nearly every county in Kansas has had at least one flood since 1953, when records started. Atchison, Doniphan, Leavenworth and Wyandotte Counties, which border the Missouri River, are at particularly high risk for flooding.

How to save on Kansas home insurance

Home insurance in Kansas isn't usually cheap, but you can work to lower your rate in a few ways.

Shop around. Each home insurance company sets its own rates. That means comparing quotes can help you find the cheapest price for the coverage you need. You can do this yourself by getting several quotes online, by phone or in person. Or you can have an independent agent get quotes for you.

Bundle your policies. Bundling just means insuring your home and cars with the same company. Bundling discounts are some of the biggest savings that companies offer. You might also get a bundling discount for buying umbrella, boat or motorcycle insurance.

Update your roof. Roof damage is common in Kansas and is usually caused by wind or hail. Newer roofs are less likely to be damaged, so you'll often get a discount. If you don't want to get a new roof, keeping yours in good condition can lower the risk of damage. This helps keep your rates low because you're less likely to file a claim.

Having a realistic expectation of cost is important, and Kansas home insurance is expensive. Buying a policy just for a cheap rate could mean you're missing important coverage. That can cost you more in the long run, since you would have to pay for home damage yourself.

Frequently asked questions

How much is home insurance in Kansas?

Home insurance costs an average of $3,856 per year in Kansas. That's $1,705 more per year than the national average, which is $2,151. It's the third-most-expensive state for home insurance, behind Nebraska and Oklahoma.

Who has the cheapest homeowners insurance in Kansas?

Auto-Owners has the cheapest home insurance in Kansas, with an average rate of $2,367 per year for a policy with $350,000 in dwelling coverage. Auto-Owners is also cheapest for homes with $500,000 in dwelling coverage. If you need less coverage, Shelter could be a good choice. And if your home is worth $1 million, State Farm is a cheap option.

Why is Kansas home insurance so expensive?

Kansas home insurance is expensive because the risk for home damage, usually from tornadoes and wind, is high. The more likely homes are to be damaged, the higher insurance rates will be. That's because insurance companies know they'll have to pay claims, so they charge higher rates to prepare.

Methodology

ValuePenguin got quotes from the largest home insurance companies across hundreds of ZIP codes in Kansas. Our experts used a 45-year-old married man with no home insurance claims as the policy owner. The quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

All rates are from Quadrant Information Services, which gets rates from publicly available insurance company filings. Home insurance costs change based on your age, location, home info, claims and more. Your quotes will likely be different from the quotes in this report.

Ratings for each insurance company are based on ValuePenguin's analysis of average rates, coverages, discounts, customer complaint data from the National Association of Insurance Commissioners (NAIC) and scores from J.D. Power's home insurance customer satisfaction survey.

Other sources include the Federal Emergency Management Agency (FEMA), Kansas Tourism, Scientific American and the Storm Prediction Center.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.