Best and Cheapest Home Insurance Companies in Maine (2024)

State Farm is the best cheap home insurance in Maine at $618 per year for $350,000 in dwelling coverage.

Compare Home Insurance Quotes from Companies in Maine

Best and Cheapest Home Insurance in ME

ValuePenguin's experts compared cost, customer service, reliability and coverage benefits to find the best insurance companies in Maine. Average rates are based on thousands of quotes using every residential ZIP code in Maine. Full methodology

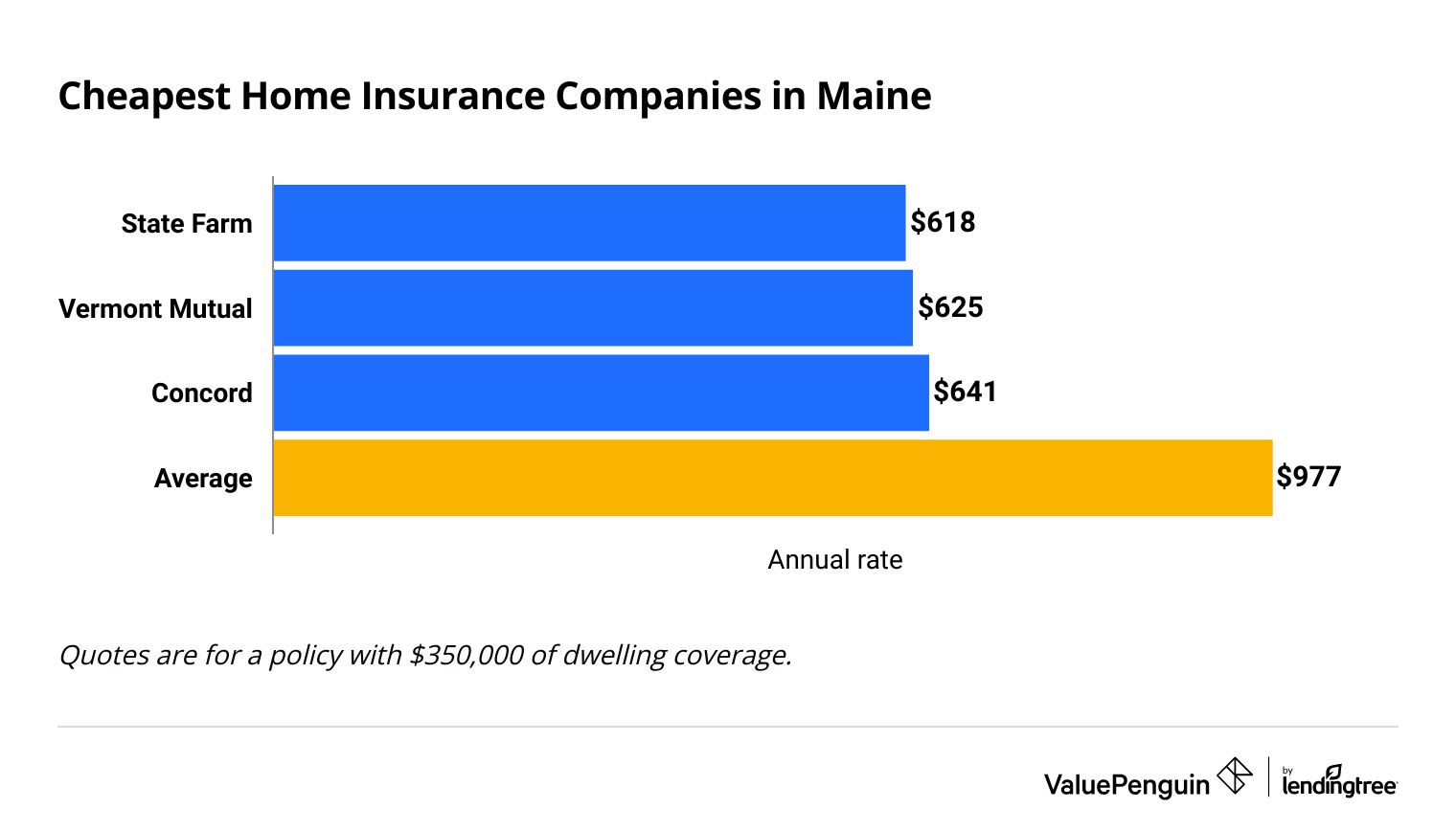

Cheapest home insurance companies in Maine

Overall, State Farm has the cheapest home insurance in Maine.

In Maine, home insurance from State Farm costs $618 per year, on average, for $350,000 of dwelling coverage. That's 37% cheaper than the average rate for the state.

Compare Home Insurance Quotes from Companies in Maine

State Farm has low rates for all home sizes. However, depending on the value of your home, it may not be the absolute cheapest company available.

For example, if you have a small home, Vermont Mutual would be the cheapest option. A policy there costs an average of $391 per year for $200,000 of dwelling coverage, while at State Farm the same level of coverage costs an average of $433 per year.

Best and cheapest ME home insurance by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $391 | |

| State Farm | $433 | ||

| Farmers | $533 | ||

| Concord | $534 | |

| Frankenmuth | $650 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Vermont Mutual | $391 | |

| State Farm | $433 | ||

| Farmers | $533 | ||

| Concord | $534 | |

| Frankenmuth | $650 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $618 | ||

| Vermont Mutual | $625 | |

| Concord | $641 | |

| Farmers | $983 | ||

| Chubb | $1,086 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Concord | $818 | |

| State Farm | $823 | ||

| Vermont Mutual | $872 | |

| Farmers | $1,474 | ||

| Chubb | $1,487 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,427 | ||

| Concord | $1,516 | |

| Vermont Mutual | $1,696 | |

| Chubb | $2,791 | ||

| Frankenmuth | $2,992 | ||

What home insurance do I need in Maine?

- A standard home insurance policy will pay for damages caused by winter storms, hail, wind and fire. Make sure to get a policy with dwelling coverage that's high enough to cover the cost of rebuilding your home. This will protect you in a worst case scenario if your home is destroyed.

- If your home is at risk of flooding, you'll need to buy a separate flood insurance policy to pay for water damage. Flood insurance will cover damage that's caused by coastal flooding, overflowing rivers, or flash-flooding due to heavy rain. However, your regular home insurance policy usually covers water damage if frozen pipes burst and flood your home.

Best overall home insurance in Maine: State Farm

-

Editor's rating

- Cost: $618/yr

State Farm has great customer service and affordable rates, making it the best home insurance for most people.

-

Costs 37% less than average

-

Great for bundling with car insurance

-

Easy claims process

-

Basic coverage options

-

Not the cheapest if you have a small home

-

Can't buy a policy entirely online

State Farm is the best home insurance company for most people in Maine. It's a good overall company, with reliable coverage, great customer satisfaction and affordable rates.

State Farm is also the best company in Maine for bundling home and car insurance.

- Bundle of home and auto: You'll save an average of 24% by getting both home and auto insurance from State Farm. That savings is on top of the low rates you can get from buying policies separately.

- Home insurance only: Home insurance rates from State Farm are often the cheapest you can get, costing an average of $618 per year for $350,000 in coverage. That's 37% less than the state average.

- Auto insurance only: State Farm also has cheap car insurance rates in Maine, averaging $73 per month for full coverage.

An important downside is that State Farm doesn't have many options for coverage add-ons. So if you want more robust coverage, it may be worth it to pay more to get a policy from Frankenmuth.

Also, State Farm is a major national company. If you'd rather get insurance from a company that's based in New England and uses local independent agents, choose either Concord Group or Vermont Mutual. These two alternatives also have great customer satisfaction and good rates.

Best home insurance coverage options: Frankenmuth

-

Editor's rating

- Cost: $1,149/yr

Frankenmuth has great options for extra coverage, making it a good choice for high-value homes.

-

Few customer complaints

-

Options to cover second homes

-

Available through local independent agents

-

Expensive rates

-

Can't get a quote online

Frankenmuth is the best home insurance company if you're willing to pay more to get a wider set of coverage options. These extra options include:

- Guaranteed replacement cost

- Liability coverage for secondary or seasonal homes

- Sewer and drain backup

- Higher limits for valuables like jewelry and art

- Mortgage expenses after a claim

- Identity theft protection

Frankenmuth also has highly-rated customer service and few complaints. So if you do need to file a claim, it might be easier to get insurance to pay for the damages.

The downsides of Frankenmuth home insurance is that it's expensive and there are few discounts available. This means that quotes can start high, even before you add on extra coverage options.

If you'd rather a company that balances affordable rates with coverage add-ons, consider getting a home insurance quote from Concord Group. It doesn't offer as many coverage options as Frankenmuth, but it has some of the most useful ones, such as guaranteed home replacement coverage . Plus, Concord's rates are about a third cheaper than the average rate in the state.

Best insurance for mobile homes and tiny homes: Farmers

-

Editor's rating

- Cost: $983/yr

Farmers and its subsidiary, Foremost, have the best coverage options for mobile homes, tiny homes and cabins.

-

Covers many types of damage

-

Specialty policies for tiny homes, seasonal camps, travel trailers and older mobile homes.

-

May be expensive

Farmers offers the best mobile home insurance policies through its subsidiary, Foremost. You can also get specialty homeowners insurance policy to cover unique properties including seasonal camps or solar-powered tiny homes. Plus, Farmers is one of the few companies that will cover older mobile homes.

Policies cover a wide range of damages including:

- Wind and hail

- Vandalism and theft

- Damage from a care

- Lightning

- Fire

- Explosions

- Falling objects

Farmers gives you the option to upgrade your policy by getting replacement cost coverage. This means that insurance will pay more if you file a claim, so you'll have fewer costs yourself.

Replacement cost coverage is especially useful for mobile homes because their value can drop quickly. For example, a 10-year-old mobile home could be worth only about 80% of its ticket price when it was new. A typical insurance policy would pay you that lower value. But a replacement cost policy will pay out the cost to purchase a similar mobile home at today's prices.

The biggest downside to Farmers is that its home insurance rates are typically higher than other companies, averaging $1,463 per year for standard home insurance in Maine. However, the rates vary widely based on your home's age, location, type of structure and if you own or rent your home's lot.

Average home insurance cost in Maine

Home insurance in Maine costs an average of $977 per year for $350,000 of coverage.

Home insurance is cheaper for less costly homes. Rates average $624 per year for $200,000 in dwelling coverage.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $624 |

| $350,000 | $977 |

| $500,000 | $1,354 |

| $1,000,000 | $2,600 |

Maine is the third cheapest state for home insurance. Its average rates of $977 per year are about half the national average of $2,151 per year.

Nearby states of Vermont and New Hampshire have similar home insurance rates as Maine.

In contrast, if you are a snowbird who spends the winters in Florida, the average cost of home insurance in Florida is $3,382 per year.

Maine homeowners insurance quotes by city

Home insurance in Portland, ME costs an average of $1,017 per year, which is 4% more than the state average.

- The cheapest city in Maine for homeowners insurance is Portage Lake in the far north of Aroostook County. Here, rates average $882 per year.

- Home insurance is most expensive in Saco, the coastal town between Kennebunkport and Portland, with average rates of $1,083 per year. Saco homes have been getting hit with more storm damage in recent years as the protective shoreline has eroded. The greater the risk of damage, the higher homeowners insurance rates will be.

City | Annual rate | % from avg |

|---|---|---|

| Abbot | $979 | 0% |

| Acton | $963 | -1% |

| Addison | $1,004 | 3% |

| Albion | $1,014 | 4% |

| Alfred | $956 | -2% |

Rates are for a policy with $350,000 of dwelling coverage.

Best home insurance companies in Maine

State Farm is the best home insurance company in Maine because of its good customer satisfaction and reliable claims process.

In addition to State Farm, several other home insurance companies in Maine also have good ratings and satisfied customers. These include Concord, Frankemuth and Vermont Mutual.

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Concord | Low | |

| Frankenmuth | Low | |

| Vermont Mutual | Low | |

| Hanover | Low |

What are the biggest risks for Maine homes?

Snow, ice and winter storms

Maine's winter weather can cause many types of home damage. Pipes in your home can freeze from the cold weather. Roofs can fail from the accumulated weight of snow and ice. Melting snow can cause ice dams on your roof, leading to water damage in your attic and inside your walls.

Homeowners insurance coverage usually includes damage caused by snow and winter weather. However, coverage for frozen pipes can vary by policy. For example, you may need to add on underground line coverage for an exterior water supply or sewer line. Your policy may also not cover frozen pipes to a swimming pool or in an unheated part of your home.

Floods

Flooding causes some of the most expensive property damage in Maine. For example, a major storm in January 2024 caused more than $34 million in flood damage.

Homeowners insurance does not cover flood damage. So to protect yourself from having to pay for repairs yourself, you can buy a flood insurance policy. Flood insurance costs an average of $980 per year in Maine. However, rates vary based on the chances your home will be damaged by a flood.

Wind

High wind is common across Maine, and both inland and coastal areas can get up to 70-mph-winds that can topple trees and tear shingles off a roof.

Homeowners insurance policies cover wind damage. It also covers tree removal if one falls on your house during a storm. But your home insurance company may also ask you to do preventive maintenance by removing potentially dangerous trees.

How to get cheaper home insurance in Maine

-

The best way to save on a policy is to compare home insurance quotes from multiple companies.

Each company calculates rates in different ways. So by getting multiple quotes, you can find the cheapest company for your home.

-

Home insurance discounts can also help you save on home insurance.

You may be able to get a discount by installing smoke detectors, having security cameras, paying your bill on time, bundling with auto insurance and more. Maine home insurance rates have gone up 15% in the past five years. But you could save as much as 24% by bundling your home and auto insurance.

Frequently asked questions

How much is homeowners insurance in Maine?

The average cost of homeowners insurance in Maine is $977 per year for $350,000 of dwelling coverage. That's $81 per month.

Who has the cheapest homeowners insurance in Maine?

State Farm has the cheapest homeowners insurance in Maine for an average sized home. A policy costs $618 per year for $350,000 in coverage. That's 37% cheaper than the average rate in the state. Depending on the size of your home, you may also get cheap rates from Vermont Mutual and Concord.

Who has the best mobile or manufactured homeowners insurance in Maine?

Farmers has the best mobile or manufactured home insurance in Maine. The company has great coverage options, and it will even cover mobile homes if they're older, used only part of the year, or while being moved to a new location.

Methodology

The best home insurance companies in Maine were selected based on ValuePenguin's expert analysis comparing customer satisfaction, affordability, reliability and coverage options.

Average rates are based on thousands of insurance quotes from every residential ZIP code in Maine, using the top home insurance companies in the state. Rates are for a 45-year-old married man with no prior insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Averages are based on $350,000 of dwelling coverage unless otherwise specified.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Additional sources include:

- J.D. Power customer satisfaction survey

- ValuePenguin's ratings

- National Association of Insurance Commissioners (NAIC)

- NOAA Storm Event Database

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.