Best and Cheapest Home Insurance in Missouri (2024)

AAA has the best and cheapest home insurance in Missouri for most people, costing an average of $1,579 per year.

Compare Home Insurance Quotes in Missouri

Best Cheap Home Insurance in Missouri

To help homeowners in Missouri find the best home insurance, ValuePenguin gathered quotes from nine home insurance companies in every ZIP code in the state. Our experts reviewed each company's rates, coverage options, discounts and customer service to pick the best and cheapest home insurance companies in Missouri. See the full methodology.

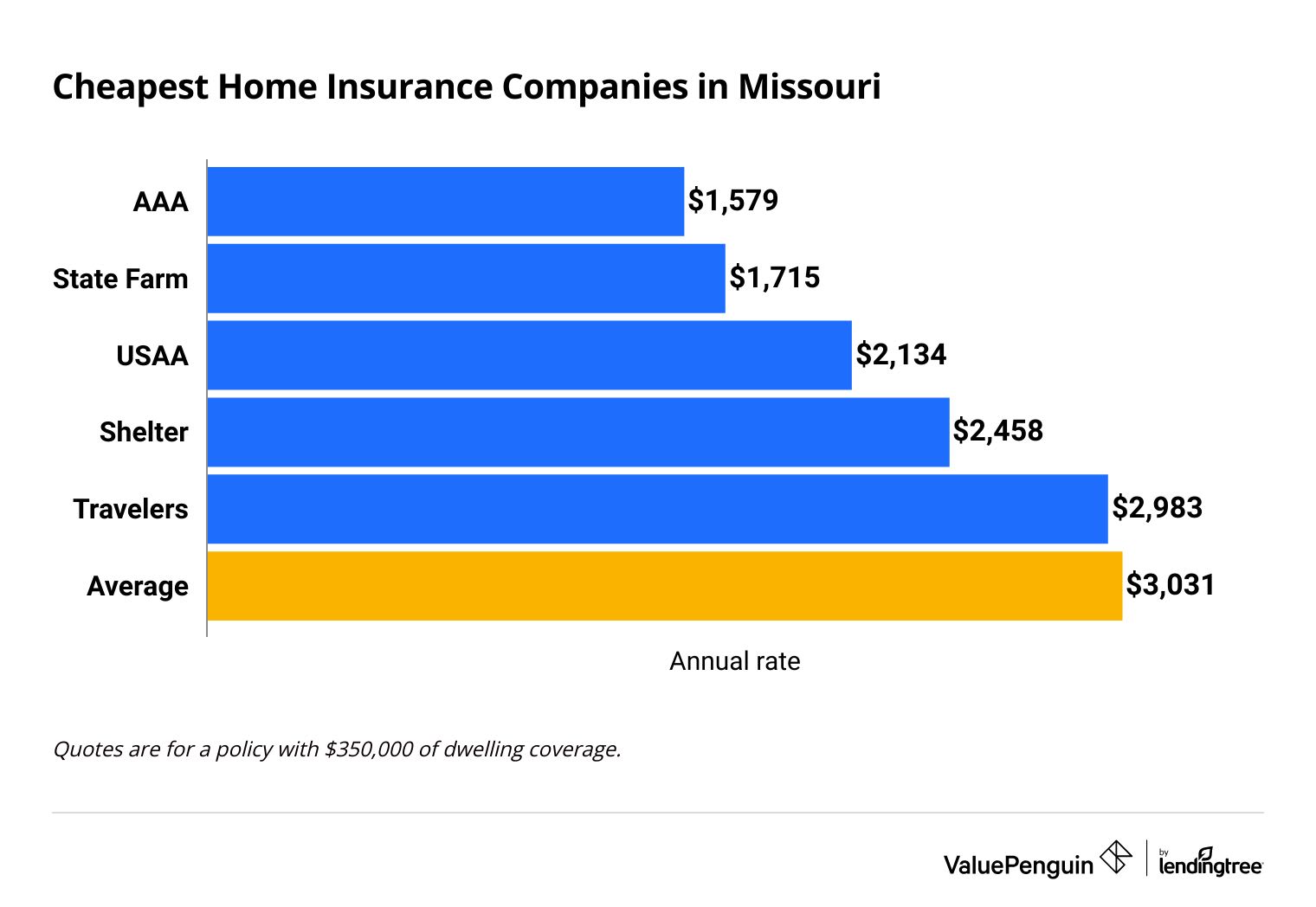

Cheapest homeowners insurance companies in Missouri

AAA has the cheapest home insurance rates in Missouri for most people.

AAA home insurance costs $1,579 per year for a policy with $350,000 of dwelling coverage. That's about half of the average cost for home insurance in Missouri, which is $3,031 per year.

Find Cheap Home Insurance Quotes in Missouri

State Farm and USAA also have cheap rates, but you can only get USAA if you're a military member or qualifying family member. The best way to find cheap home insurance in Missouri is to get quotes from several companies and compare the rates and coverage.

Cheap home insurance in Missouri

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| AAA | $1,022 | ||

| State Farm | $1,215 | ||

| USAA | $1,605 | ||

| Shelter | $1,660 | ||

| Travelers | $1,920 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| AAA | $1,022 | ||

| State Farm | $1,215 | ||

| USAA | $1,605 | ||

| Shelter | $1,660 | ||

| Travelers | $1,920 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| AAA | $1,579 | ||

| State Farm | $1,715 | ||

| USAA | $2,134 | ||

| Shelter | $2,458 | ||

| Travelers | $2,983 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| AAA | $2,176 | ||

| State Farm | $2,290 | ||

| USAA | $2,676 | ||

| Shelter | $3,309 | ||

| Travelers | $3,986 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $3,919 | ||

| USAA | $4,326 | ||

| AAA | $4,559 | ||

| Shelter | $6,075 | ||

| American Family | $6,256 | ||

What home insurance coverage do I need in Missouri?

Missouri homes should be built to withstand high winds and tornadoes, ice and snow storms, and floods. Having the right home insurance coverage can give you peace of mind that, if your home is damaged, you'll be able to repair it. Damage caused by high winds, tornadoes, ice and snow are usually covered by home insurance, but you will need a separate policy for flood damage.

Best home insurance in Missouri for most people: AAA

-

Editor's rating

- Cost: $1,579/yr

AAA has cheap rates and good customer service.

Pros:

-

Cheap rates

-

Good customer service

-

Extra perks

Cons:

-

Requires a membership

-

Not as many extra coverages as some other companies

AAA has the cheapest home insurance rates in Missouri for several different levels of dwelling coverage. If you need $200,000, $350,000 or $500,000 in dwelling coverage, AAA is the best bet.

But AAA does require you to become a member to buy their insurance. Memberships in Missouri range from about $36 to $95 per year. But because AAA's home insurance rates are so cheap, the membership might be worth it.

Plus, having an AAA membership gives you more than just access to their insurance products. You also get the company's popular roadside assistance; discounts on things like airline tickets, rental cars, restaurants and movie tickets; access to travel guides and more.

Best Missouri home insurance for bundling: State Farm

-

Editor's rating

- Cost: $1,715/yr

State Farm has cheap car and home insurance rates in Missouri.

Pros:

-

Cheap home insurance rates

-

Cheap rates for car insurance bundling

-

Local agents available

Cons:

-

Customer satisfaction is only average

-

Not as many coverages and discounts as some companies

State Farm has cheap rates for both home and car insurance in Missouri, making it a great choice if you want to bundle your policies. Bundling is an easy way to save on insurance in Missouri, and choosing a company that already has cheap rates can help you save even more. Plus, buying your car and home insurance from the same company can also make managing your policies easier.

State Farm has the second-cheapest home insurance in the state at $1,715 per year. That's $1,316 cheaper than the state average. The company also has the cheapest full coverage car insurance in Missouri at $122 per month.

However, State Farm doesn't offer as many discounts and extra coverages as some companies. If you want to personalize your policy, Travelers is a better option.

Best home insurance in Missouri for coverage options: Travelers

-

Editor's rating

- Cost: $2,983/yr

Travelers has lots of extra coverages to customize your policy.

Pros:

-

Numerous extra coverages

-

Lots of discounts

Cons:

-

Not as cheap as some companies

-

Low customer satisfaction

Travelers is a great option if you want to add extra coverage to your policy to personalize it. The company offers several add-ons, called endorsements, that let you add specific coverage to your policy.

For example, you can add Travelers' "green home coverage" if you have made environmentally-friendly updates to your home. The coverage can also be used if you want extra coverage to repair your home with environmentally-friendly materials after a claim. You can also add coverage for jewelry and other high-value items, identity fraud and sump pump failures.

But J.D. Power reported that Travelers has below-average customer satisfaction. Before buying a policy from Travelers, consider talking to current customers and seeing what their experience has been. And while Travelers' rates are slightly cheaper than the state average, they aren't the lowest in the state.

Average home insurance cost in Missouri

Home insurance in Missouri costs $3,031 per year for a policy with $350,000 in dwelling coverage.

Missouri's home insurance rates are significantly higher than some other states. In nearby Iowa, for example, home insurance costs $2,108 per year for the same level of coverage. And in Illinois, a policy costs $2,132 per year, on average. Home insurance in Missouri is more expensive because homes there are more likely to be damaged by hail and wind than in many other states.

However, in two other nearby states, Arkansas and Kansas, home insurance rates are higher than in Missouri. In Arkansas, a policy costs an average of $3,235 per year, while in Kansas, the average policy costs $3,856 per year. Presumably, in these states, the risk of home damage is higher than it is in Missouri, which would lead insurance companies to increase rates.

Average cost of homeowners insurance in Missouri by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $2,018 |

| $350,000 | $3,031 |

| $500,000 | $4,136 |

| $1,000,000 | $7,768 |

More expensive houses cost more to repair or rebuild if they're damaged or destroyed, which is why home insurance rates increase with the value of the house. Insurance companies know that the claims on these homes will be higher, so they charge higher rates to compensate.

Missouri homeowners insurance rates by city

Fenton, a suburb of St. Louis, has the cheapest home insurance in MO at $2,380 per year.

Anderson, a city in southwest Missouri, has the most expensive home insurance rates. A policy with $350,000 in dwelling coverage costs $3,566 per year there. That's about 18% higher than the state average.

In Kansas City, Missouri's largest city, home insurance costs $3,489 per year. But in St. Louis, the second-largest city, a policy costs an average of $2,796 per year, about 8% less than the state average.

City | Annual rate | % from avg |

|---|---|---|

| Adrian | $3,466 | 14% |

| Advance | $3,067 | 1% |

| Affton | $2,391 | -21% |

| Agency | $3,428 | 13% |

| Airport Drive | $3,419 | 13% |

Rates are for a policy with $350,000 of dwelling coverage.

Best-rated homeowners insurance companies in Missouri

USAA, AAA and State Farm have the best-rated home insurance in Missouri.

All three companies have cheap rates and good customer service. However, you can only get USAA if you're a current military member, veteran or qualifying family member. For everyone else, AAA and State Farm are the best options.

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| AAA | Low | |

| State Farm | Average | |

| American Family | Low | |

| Shelter | Average |

What kind of home insurance is important in Missouri?

Like other states in the Midwest, Missouri can experience strong thunderstorms, high winds and tornadoes in the summer, and snow and ice storms in the winter. Floods are also common in Missouri. Home insurance typically covers most of these damages, but a separate policy will be needed for floods and possibly other conditions.

Is wind damage covered by Missouri home insurance?

Most home insurance policies automatically cover wind damage, including from tornadoes. You might have a separate wind and hail deductible, though, which means you would have to pay a higher amount before your coverage kicks in. And if your home is in poor condition, your roof might not be covered.

Missouri has 702 wind storms in 2023, in addition to 27 tornadoes. Wind can damage your roof and siding, and it can also blow loose objects into your house. And if the wind damages your roof, you could also have water damage from rain.

You can also lower the risk of wind damage by maintaining your home.

- Trim trees that hang over or near your house or garage.

- Make sure your roof is in good condition.

- Secure lawn furniture before a storm.

- Install storm shutters on your windows.

Does Missouri home insurance cover hail damage?

Hail damage is usually covered by home insurance. But if your home isn't well maintained, you might not have coverage. For example, if your roof is old and already damaged, your home insurance company might decline to cover it.

Missouri recorded 400 hail storms in 2023. Only Texas, Nebraska and Kansas had more hail storms. Hail can easily damage your roof and siding. If you live in Missouri, make sure you understand how your policy covers hail damage. Just like with wind damage, you might have to pay a higher deductible if your home gets hit by hail.

Does Missouri home insurance cover snow and ice damage?

Home insurance usually covers snow and ice damage automatically. This type of damage typically takes the form of roof leaks or burst pipes. Even though most policies include this coverage, it's a good idea to talk to your insurance company to make sure.

Most counties in Missouri can expect between eight and 24 inches of snow each year. But temperatures are often close to or just above freezing. That means it's warm enough for freezing rain, which can cause tree branches to fall onto houses and damage roofs.

Is flood damage covered by Missouri home insurance?

Home insurance does not cover flood damage. You have to buy a flood insurance policy to have coverage for floods.

Every county in Missouri has had a flood. It only takes an inch of water to cause $25,000 in damage, and paying for the repairs yourself can be financially devastating. Every homeowner in Missouri should at least consider buying flood insurance.

How to save on Missouri home insurance

The best way to get cheap home insurance in Missouri is to shop around and compare rates. Each company charges its own rates, so shopping around lets you find the coverage you need at the lowest price.

Bundle your policies. Bundling means buying your car and home insurance from the same company. For most people, this is the cheapest way to get both home and car insurance. That's because bundling discounts are some of the biggest savings that insurance companies offer.

Maintain your home. Make sure your roof and siding are in good shape, your plumbing has no leaks and trees are cut back away from your home. Maintaining your homes makes damage less likely or hopefully less severe were it to occur. While this might not lower the cost of your home insurance immediately, it can help you avoid filing claims, which increases your rates.

Increase your deductible. Having a higher deductible means you'll pay more if you file a claim. Higher deductibles mean lower rates, so it can be a good way to lower the cost of your insurance. But only increase your deductible if you can afford to pay a higher amount. Home damage is unpredictable, so make sure you have the money to pay your deductible at any time.

Frequently asked questions

What is the average cost for homeowners insurance in Missouri?

Home insurance in Missouri costs $3,031 per year, on average, for a policy with $350,000 in dwelling coverage. Your rates will change depending on the company you pick, your age, your home's details, and whether or not you have filed any home insurance claims.

Is homeowners insurance required in Missouri?

Missouri state law doesn't require home insurance. But if you have a mortgage, you'll need to have a home insurance policy. Even if your home is paid off, you should probably keep your home insurance policy, unless you can afford to rebuild your home and replace your belongings if they're destroyed.

Why is Missouri home insurance so expensive?

Missouri homes are more likely to be damaged than homes in many other states. Because insurance companies know they're more likely to have to pay for home damage, they charge higher rates. That way, the companies have enough money to pay for claims when they happen.

Methodology

To find the cheapest home insurance in Missouri, ValuePenguin gathered quotes from the largest insurance companies in every ZIP code in the state. The quotes are for a 45-year-old with average credit and no claims as the policy owner, and include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin uses Quadrant Information Services for rates. The rates in Quadrant Information Systems are insurance company filings, which are publicly available. The quotes shown here are for comparison purposes only. Your age, location, claims history and home details will change how much you pay for home insurance.

Our experts analyzed each insurance company's average rates, coverages, discounts and customer service to assign a rating. Customer service was evaluated by looking at complaint data from the National Association of Insurance Commissioners (NAIC) and scores from J.D. Power's home insurance customer satisfaction survey.

Other sources include the Federal Emergency Management Agency (FEMA), the FEMA Disaster Declarations tool, the Storm Prediction Center and the University of Missouri Climate Center.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.