Best & Cheapest Home Insurance Companies in Nevada (2024)

State Farm has the best insurance for Nevada homeowners at around $971 per year.

Compare Home Insurance Quotes in Nevada

Best cheap Nevada home insurance

Choosing a homeowners insurance company means finding the company with the best rates, policy features and customer service quality. ValuePenguin gathered hundreds of quotes from insurance companies across Nevada to determine the top home insurance for most people.

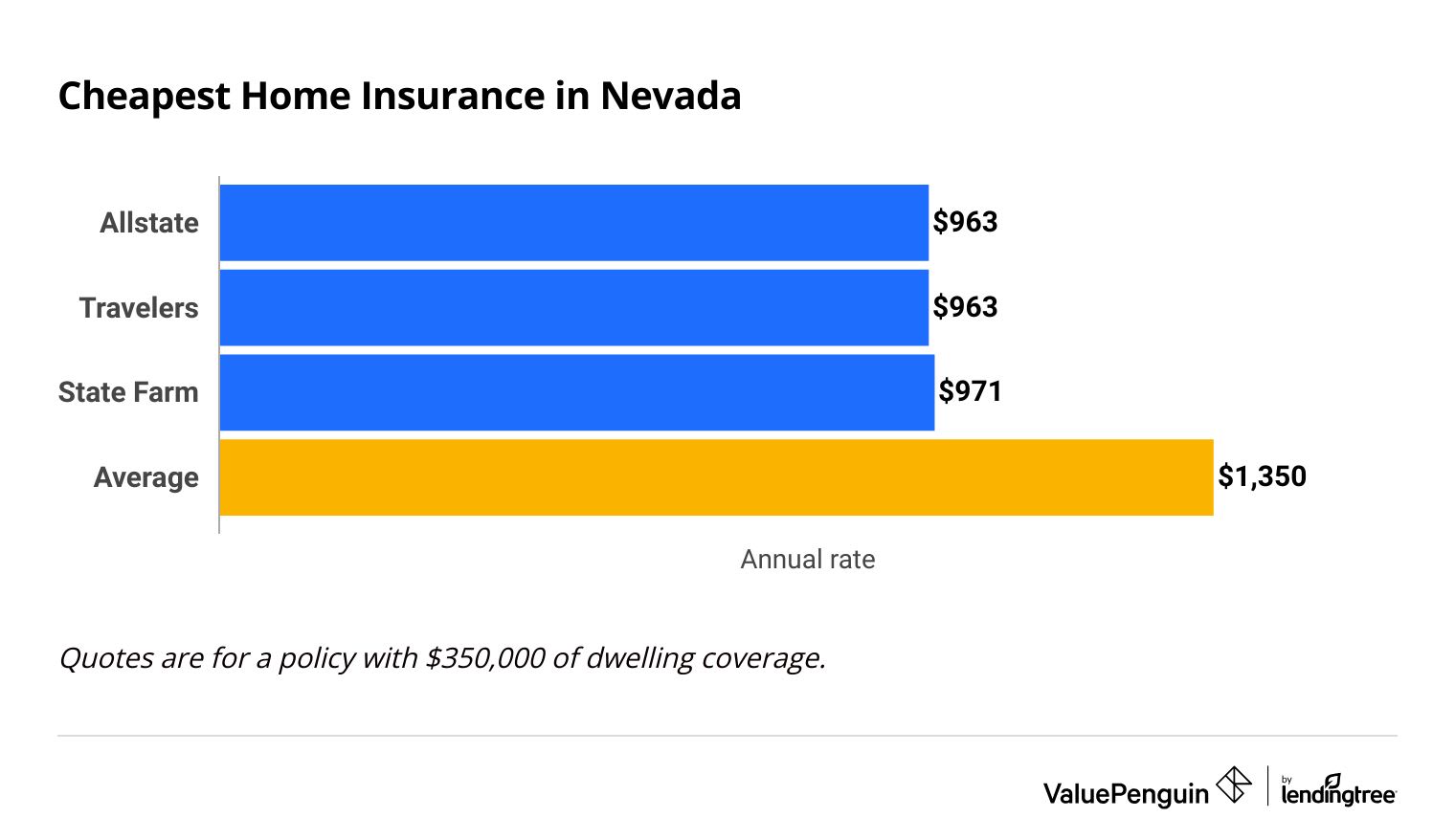

Cheapest homeowners insurance in Nevada

Allstate and Travelers have the cheapest home insurance quotes in Nevada.

Both companies charge around $963 per year for $350,000 of dwelling coverage. That's $387 per year less than the Nevada state average, which is $1,350 per year.

State Farm is only slightly more expensive at $971 per year. However, State Farm has better customer service reviews than Allstate or Travelers. That makes it a great option for most Nevada homeowners.

Find Cheap Homeowners Insurance Quotes in Your Area

Allstate has better rates for expensive homes. It's the cheapest option for Nevada homes that would cost $500,000 or $1 million to rebuild.

Cheap home insurance quotes in Nevada by dwelling coverage

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $621 | ||

| State Farm | $695 | ||

| Allstate | $740 | ||

| Farmers | $937 | ||

| AAA | $1,048 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $621 | ||

| State Farm | $695 | ||

| Allstate | $740 | ||

| Farmers | $937 | ||

| AAA | $1,048 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $963 | ||

| Allstate | $963 | ||

| State Farm | $971 | ||

| Farmers | $1,401 | ||

| American Family | $1,459 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,225 | ||

| State Farm | $1,322 | ||

| Travelers | $1,398 | ||

| USAA | $1,840 | ||

| American Family | $1,843 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,839 | ||

| State Farm | $2,365 | ||

| Travelers | $2,729 | ||

| American Family | $2,940 | ||

| USAA | $3,039 | ||

Best Nevada homeowners insurance for most people: State Farm

-

Editor's rating

- Cost: $971/yr

State Farm is the best choice for most Nevadans because of its low rates and great service.

Pros:

-

Affordable rates

-

Reliable customer service

Cons:

-

Limited coverage options and discounts

-

Some people can't buy a policy fully online

State Farm costs an average of $971 per year for $350,000 of dwelling coverage in Nevada. That's $379 per year less than the state average.

It also offers affordable coverage for expensive homes. At $1,322 per year, State Farm is the second-cheapest company for policies with $500,000 of dwelling coverage.

Although State Farm doesn't have the cheapest rates in Nevada, its competitive prices are backed by quality customer service.

Homeowners in Nevada can count on State Farm to help fix their homes quickly after an accident. The company earned a good score on J.D. Power's customer satisfaction survey. State Farm also gets fewer complaints than an average company of its size, according to the National Association of Insurance Commissioners (NAIC).

However, State Farm's home insurance coverage options are fairly limited. It doesn't offer common add-ons like replacement cost coverage for your belongings, which would be important if your belongings were damaged and you wanted to replace them with brand new items.

Cheapest homeowners insurance in Nevada: Travelers

-

Editor's rating

- Cost: $963/yr

Travelers has the cheapest home insurance rates in Nevada for affordable homes.

Pros:

-

Cheapest quotes in Nevada

-

Lots of coverage options

Cons:

-

Mixed customer service reviews

-

Limited discounts

Travelers homeowners insurance costs an average of $963 per year for $350,000 of dwelling coverage in Nevada. That's cheaper than the state average by $387 per year. Travelers is also the cheapest option in Nevada for $200,000 of dwelling coverage, at just $621 per year.

Although it offers the cheapest home insurance in Nevada, Travelers has mixed customer service reviews.

It gets less than half as many complaints as an average company of its size, according to the NAIC. However, Travelers earned a below-average score on J.D. Power's customer satisfaction survey. While you may not have a bad experience with Travelers, chances are you can find better service elsewhere.

Best home insurance in Las Vegas, NV: Allstate

-

Editor's rating

- Cost: $978/yr

Allstate has affordable rates in Las Vegas and lots of ways to customize your coverage.

Pros:

-

Cheap home insurance in Las Vegas

-

Many ways to upgrade your coverage

-

Lots of discounts

Cons:

-

Average customer service

-

Bad for bundling due to pricey auto rates

Allstate offers some of the best home insurance rates in Las Vegas, NV.

An Allstate policy costs $978 per year for $350,000 of coverage, which is $432 per year cheaper than average.

In addition, Allstate is the most affordable option for expensive homes in Las Vegas. A policy with $500,000 of dwelling coverage costs just $1,246 per year from Allstate. That's $644 per year less than the citywide average.

Allstate also offers lots of coverage upgrades to help personalize your protection. Las Vegas homeowners can add extra protection for valuables like golf clubs, jewelry and artwork. Allstate also offers coverage for vacation rentals if you only spend part of the year in your Las Vegas home.

However, Allstate customers have mixed feelings about the company's service. It gets 10% fewer complaints than an average company of a similar size, according to the NAIC. But J.D. Power gave Allstate a below-average customer satisfaction score based on feedback from its customers.

That means you can probably count on Allstate to pay your claim in a timely manner, but the process may be more difficult than with other companies.

$200,000

$350,000

$500,000

$1 million

Company | Annual rate |

|---|---|

| Travelers | $609 |

| State Farm | $738 |

| Allstate | $748 |

| Farmers | $950 |

| AAA | $1,058 |

| American Family | $1,134 |

| USAA | $1,179 |

| Country Financial | $1,629 |

$200,000

Company | Annual rate |

|---|---|

| Travelers | $609 |

| State Farm | $738 |

| Allstate | $748 |

| Farmers | $950 |

| AAA | $1,058 |

| American Family | $1,134 |

| USAA | $1,179 |

| Country Financial | $1,629 |

$350,000

Company | Annual rate |

|---|---|

| Travelers | $955 |

| Allstate | $978 |

| State Farm | $1,032 |

| Farmers | $1,426 |

| AAA | $1,474 |

| American Family | $1,483 |

| USAA | $1,601 |

| Country Financial | $2,328 |

$500,000

Company | Annual rate |

|---|---|

| Allstate | $1,246 |

| State Farm | $1,405 |

| Travelers | $1,407 |

| American Family | $1,875 |

| AAA | $1,957 |

| USAA | $1,987 |

| Farmers | $2,116 |

| Country Financial | $3,126 |

$1 million

Company | Annual rate |

|---|---|

| Allstate | $1,877 |

| State Farm | $2,515 |

| Travelers | $2,787 |

| American Family | $2,997 |

| USAA | $3,266 |

| AAA | $3,366 |

| Farmers | $4,048 |

| Country Financial | $5,689 |

Average cost of homeowners insurance in Nevada

The average cost of homeowners insurance in Nevada is $1,350 per year.

That's 37% cheaper than the national average cost, making Nevada the 11th-cheapest state in the country for home insurance.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $965 |

| $350,000 | $1,350 |

| $500,000 | $1,807 |

| $1,000,000 | $3,166 |

Home insurance in Nevada costs $294 per year less than coverage in neighboring California, on average. That's partially because many California homes have a higher risk for wildfire damage than those in Nevada.

Average cost of Las Vegas home insurance

Home insurance in Las Vegas costs an average of $1,410 per year.

That's more expensive than the Nevada average by $60 per year.

Las Vegas also has more expensive rates than most of its metropolitan area, including Summerlin South, Henderson and North Las Vegas.

City | Annual rate |

|---|---|

| Boulder City | $1,185 |

| Summerlin South | $1,214 |

| Henderson | $1,269 |

| Enterprise | $1,278 |

| Spring Valley | $1,358 |

| North Las Vegas | $1,383 |

| Las Vegas | $1,410 |

| Paradise | $1,475 |

| Winchester | $1,627 |

Cost of home insurance in Nevada by city

Paradise Valley has the cheapest home insurance rates in Nevada, while Winchester has the most expensive rates.

Homeowners in Paradise Valley, a small town in northern Nevada, pay around $1,129 per year for $350,000 of dwelling coverage.

That's about $500 cheaper than home insurance in Winchester, a town in Clark County that includes part of the Las Vegas strip. Homeowners in Winchester pay an average of $1,627 per year. This may be due to the high crime rates in Winchester, which means insurance companies believe homeowners there are more likely to file a claim in the future.

Home insurance quotes in Nevada by city

City | Annual rate | % from avg. |

|---|---|---|

| Las Vegas | $1,410 | 4% |

| Alamo | $1,223 | -9% |

| Amargosa Valley | $1,328 | -2% |

| Austin | $1,191 | -12% |

| Baker | $1,201 | -11% |

Rates are for a policy with $350,000 of dwelling coverage.

Home insurance in Las Vegas, the largest city in Nevada, costs an average of $1,410 per year, which is 4% higher than the state average. In comparison, home insurance in Reno, the second-largest city in the state, costs an average of $1,249 per year.

The cost of homeowners insurance also changes depending on the value of your property and the risks particular to your location. For that reason, your own quotes may differ from your city's overall average.

Best homeowners insurance in Nevada

State Farm offers the best customer service for most Nevada homeowners.

State Farm customers file fewer complaints than average with the NAIC, which means most people are happy with their experience with the company. And it regularly scores above average on J.D. Power's customer satisfaction survey.

Best insurance companies in Nevada

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| State Farm | Average | |

| Travelers | Low | |

| American Family | Average | |

| AAA | Average |

Homeowners in Nevada with ties to the military should also consider getting a quote from USAA. The company's outstanding customer service earned USAA first place in J.D. Power's annual home insurance customer satisfaction survey. However, only military members, veterans or their families can buy insurance from USAA.

It's important for Nevada homeowners to consider customer service reviews when shopping for insurance.

Companies with excellent customer service typically have a shorter, easier claims process. This can come in handy if a disaster damages your home.

Natural disasters that affect homeowners in Nevada

Nevada's homeowners don't have to worry about as many natural disasters as other states. However, Nevada is the driest state in the U.S., so wildfires can affect some homeowners.

Does NV home insurance cover wildfires?

Homeowners insurance typically covers damage caused by wildfires.

But you should check to make sure that your dwelling coverage limit is high enough to cover the cost of rebuilding your home if it were destroyed by a wildfire. Usually, an insurance policy pays for damage based on the condition of your home prior to the incident unless you have replacement cost coverage.

If your home is in an area prone to wildfires, you should consider adding replacement cost coverage to your policy.

Sometimes, insurance companies won't offer wildfire coverage in high-risk areas.

It's important to talk to your insurance company to ensure your policy will pay for wildfire damage. If not, you might have to buy a separate insurance policy to protect your home from fires.

If you've been denied fire coverage from several companies, you can get a Fair Access to Insurance Requirements (FAIR) policy. These policies offer very basic coverage for a price that's not much different from a regular insurance policy. You may also be able to get a FAIR policy that covers only fire damage and pair it with a regular homeowners policy.

How to find the best homeowners insurance in Nevada

Nevada homeowners shopping for the best insurance should compare rates from multiple companies and consider customer service reviews.

In Nevada, the most expensive home insurance company costs more than twice as much as the cheapest option. That's why it's important for Nevada homeowners to get quotes from multiple companies before buying home insurance.

It's also important for Nevada homeowners to consider customer service reviews when shopping for home insurance. The best home insurance companies have great reviews from their customers.

ValuePenguin editors rated the best home insurance companies in Nevada based on their customer satisfaction, cost and the overall value they provide customers. You can also get a good idea of how happy a company's customers are using J.D. Power's home insurance and property claims studies, along with the National Association of Insurance Commissioners complaint index.

Frequently asked questions

What is the best homeowners insurance in Las Vegas?

Allstate has the best home insurance for most people in Las Vegas. It offers very affordable rates, lots of discounts and plenty of ways to personalize your coverage.

How much does home insurance in Nevada cost?

The average cost of homeowners insurance in Nevada is $1,350 per year, or $113 per month. That's 37% cheaper than the national average, which is $2,151 per year.

Where can I find the cheapest home insurance in Nevada?

Allstate and Travelers offer the cheapest home insurance for Nevadans, at $963 per year. That's $387 per year less than the state average.

How much is homeowners insurance in Las Vegas, NV?

Las Vegas homeowners insurance costs an average of $1,410 per year. That's $60 per year more than the Nevada state average. In comparison, home insurance in the Henderson suburb costs $1,269 per year.

Methodology

ValuePenguin gathered quotes from eight of the largest home insurance companies in Nevada for every ZIP code in the state. Quotes are for a 45-year-old married man with no prior insurance claims.

Rates include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

To determine customer service ratings, we analyzed data from the National Association of Insurance Commissioners (NAIC) complaint index, the J.D. Power home insurance customer satisfaction study and our own ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.