Best and Cheapest Home Insurance in New Mexico (2024)

State Farm has the cheapest home insurance in New Mexico, for an average of $1,298 per year.

Compare Home Insurance Quotes in New Mexico

Best Cheap Home Insurance in NM

ValuePenguin compared cost, customer service, reliability, coverage benefits and extra features to find the best insurance companies in NM.

Our experts collected thousands of quotes across hundreds of ZIP codes from New Mexico's top home insurance companies.

Cheapest home insurance rates in New Mexico

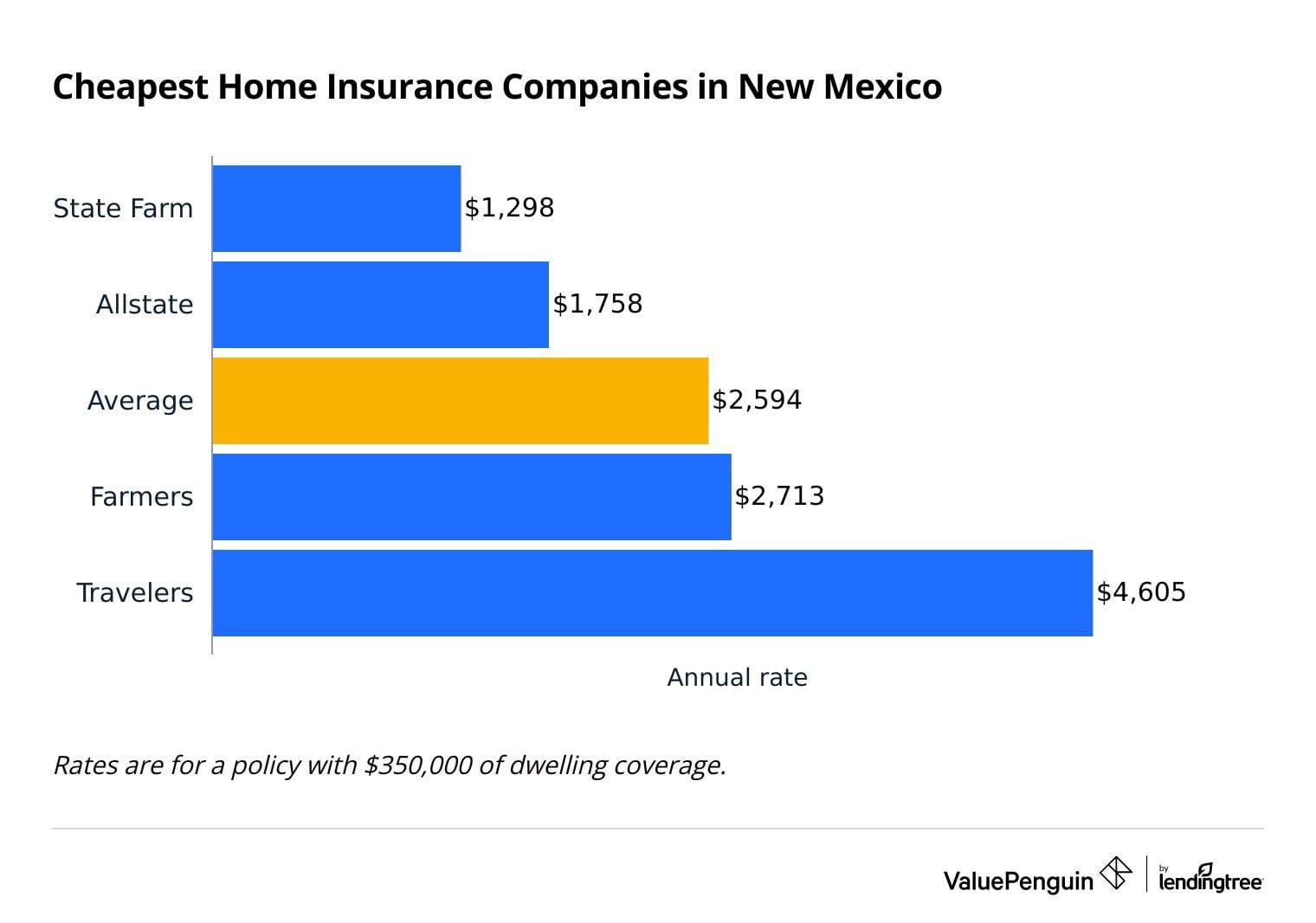

State Farm has the cheapest home insurance rates in New Mexico, at $1,298 per year for a policy with $350,000 of dwelling coverage.

Allstate also has affordable policies, for 29% less than the state average.

Compare Home Insurance Quotes in New Mexico

Best cheap homeowners insurance in NM by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $956 | ||

| Allstate | $1,142 | ||

| Farmers | $1,391 | ||

| Travelers | $2,943 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $956 | ||

| Allstate | $1,142 | ||

| Farmers | $1,391 | ||

| Travelers | $2,943 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,298 | ||

| Allstate | $1,758 | ||

| Farmers | $2,713 | ||

| Travelers | $4,605 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,618 | ||

| Allstate | $2,170 | ||

| Farmers | $4,034 | ||

| Travelers | $5,995 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,508 | ||

| Allstate | $3,249 | ||

| Farmers | $8,141 | ||

| Travelers | $10,567 | ||

Home insurance in New Mexico costs an average of $2,594 per year. Rates in New Mexico overall are 21% more expensive than the national average of $2,151.

What home insurance do I need in NM?

Wildfires and flooding are the most common dangers to homes in New Mexico.

Most basic home insurance policies cover wildfire damage in New Mexico. However, your insurance company may not cover wildfire damage if your home is in a high-risk area. If your insurance doesn't cover wildfire damage, you should consider buying a separate fire insurance policy.

Damage from a flood is never covered by homeowners insurance. If you live near a river or other NM area prone to flooding, you should consider buying flood insurance, which pays for damage from a flood.

Best home insurance in New Mexico for most people: State Farm

-

Editor's rating

- Cost: $1,298/yr

State Farm has reliable customer service and the cheapest rates for most homeowners.

Pros:

-

Cheapest quotes in NM

-

Dependable service

-

Cheap auto rates if you bundle

-

Lots of local agents

Cons:

-

Few coverage options and discounts

-

May need an agent to buy a policy

Home insurance from State Farm costs 50% less than the overall state average in New Mexico.

Besides offering consistently affordable rates for home insurance, State Farm is a great choice for bundling auto insurance, too. It's one of the cheapest options for car insurance in the state. But State Farm doesn't offer many other discounts for things like green upgrades or military service.

State Farm has the highest overall customer rating in New Mexico, thanks to its personalized service and easy-to-use online tools. They have excellent J.D. Power ratings for customer satisfaction, and they receive one-quarter fewer complaints than the average company their size.

One downside to State Farm is that it offers very limited add-ons for customizing your policy, such as cost replacement coverage. But it does have the standard coverage options like property coverage and personal liability, but only.

Best coverage options: Allstate

-

Editor's rating

- Cost: $1,758/yr

Allstate has the widest variety of coverage options in New Mexico, plus affordable prices.

Pros:

-

Lots of coverage options

-

Affordable prices

-

Good discounts

Cons:

-

Mid-level customer service

-

Bad for bundling

Allstate has a wider selection of extra coverage options than its competitors. It offers tailored benefits like short-term home rental (Airbnb), sports equipment and instrument coverage, and business property like a home office.

It also offers replacement cost coverage for its home insurance policies, too. For example if you bought a TV three years ago for $2,000 that is now worth $1,000 because it's older, Allstate will pay you $2,000 to replace it.

Allstate offers some good discounts as well, such as lower rates for signing up in advance of when you need a policy or for having safety features. The company does offer a bundling discount, but Allstate's auto insurance is generally expensive in New Mexico, so it may not save you much money.

Customer service at Allstate is good, but not great. It receives slightly fewer complaints from customers than other companies, but was poorly rated in JD Power's claims satisfaction survey. That suggests you might run into issues when filing a claim, like a delay or a denied claim.

Best for green homes: Travelers

-

Editor's rating

- Cost: $4,605/yr

Owners of eco-friendly houses will find valuable discounts and coverages at Travelers.

Pros:

-

Useful benefits for green homes

-

Strong customer service

Cons:

-

Very expensive

-

Mediocre discounts

Travelers has useful benefits for green homes in New Mexico.

Homeowners that have been LEED certified green save 5% on a Travelers home policy.

It also offers optional coverage that provides extra money to replace a damaged part of your home with green materials. This could be better insulation to reduce heating and cooling bills or a more efficient washing machine that uses less water.

Like most home insurance companies, Travelers also covers rooftop solar panels and any other existing upgrades you've made, such as high-efficiency windows.

Travelers has lots of other coverage options, too. This includes things like extra protection for jewelry, or an umbrella insurance policy. It also offers replacement cost coverage , as well as additional replacement cost coverage .

However, Travelers home insurance is the most expensive option in New Mexico, as its rates were nearly four times higher than the cheapest option, State Farm. Customers looking for an affordable rate for their home insurance should look elsewhere.

Average home insurance cost in New Mexico

The average cost of homeowners insurance in New Mexico is $2,594 per year.

New Mexico prices are 21% higher than the national average of $2,151 per year.

Average cost of home insurance in NM by dwelling coverage amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,608 |

| $350,000 | $2,594 |

| $500,000 | $3,454 |

| $1,000,000 | $6,116 |

Homeowners insurance in New Mexico is in the middle compared to its neighboring states. Home insurance in Arizona is $1,993 per year, while it's $3,694 per year in Texas. Homeowners in Texas have the fourth-highest insurance rates in the country.

New Mexico home insurance rates by city

The cheapest town in New Mexico for home insurance is Sunland Park, with an average cost of $1,333 per year, while the most expensive city is Kenna at $11,562 per year.

Residents of Kenna pay more than 10 times as much as Sunland Park homeowners for insurance, likely due to its remote location and high fire risk.

Home insurance in Albuquerque, the largest city in New Mexico, costs $2,075 on average, 20% less than the state average. Residents of Las Cruces, the state's second-largest city, pay an average of $1,546, or 40% cheaper than the typical price statewide.

City | Annual rate | % from avg |

|---|---|---|

| Abiquiu | $1,758 | -32% |

| Adelino | $1,935 | -25% |

| Agua Fria | $1,336 | -49% |

| Alamo | $1,708 | -34% |

| Alamogordo | $1,739 | -33% |

Rates are for a policy with $350,000 of dwelling coverage.

Best home insurance companies in New Mexico

State Farm has the best customer service for homeowners in New Mexico, with positive reviews from homeowners and personalized service.

Travelers and Allstate also had relatively few complaints from customers, suggesting you're likely to be happy with the service you receive.

New Mexico home insurance company reviews

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| Allstate | Average | |

| Travelers | Average | |

| Farmers | High |

When you're buying home insurance in New Mexico, great service is often just as important as price.

A dependable home insurance company will make filing a claim much easier if you need to fix or replace your home or belongings after damage. On the other hand, insurance companies with poor service may take a long time to fix your home and replace your stuff. Or you could end up spending more money on repairs.

What home insurance do I need in New Mexico?

Homes in New Mexico are at the greatest risk from wildfires and flooding.

While some of the damage from these perils is covered by your insurance, you may need to get additional coverage to fully protect your home.

Does home insurance cover wildfires in NM?

Yes, damage from wildfires are usually covered by homeowners insurance. Fire is one of the named perils included in even the most basic home insurance.

Wildfires are especially common in the more mountainous areas of New Mexico, which are more forested. If you live in a very high-risk area for wildfires, it's possible that you may need to contact multiple insurance companies to find a quote.

Does home insurance in NM cover flooding?

Unfortunately, flooding is almost never covered by home insurance policies. You can buy a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a policy through a private insurer to cover damage from flooding.

Floods are not common in New Mexico, but they can be a risk during major storms, especially if you live near a big river like the Rio Grande.

Wildfires can also increase the risk of flooding. Fire-damaged land can't trap water as well, so places that have recently had a large wildfire are more likely to flood. For example, the South Fork and Salt wildfires in summer 2024 led to severe flooding in Ruidoso.

How to get cheaper home insurance in New Mexico

The three best ways to get cheaper home insurance in New Mexico are to compare quotes, qualify for discounts and change your coverage.

Comparing prices from several companies is the easiest way to lower your home insurance payments, though it takes a little legwork.

There's a difference of $3,307 per year between New Mexico's cheapest and most expensive home insurance companies. That's why it's important to get prices from at least three companies, and to check prices again every few years.

Most home insurance companies offer at least a few discounts to help you save on home insurance.

You'll typically get the best discount for bundling your home insurance with a cheap auto insurance policy in New Mexico. Some companies also offer discounts for safety upgrades, government employees or retirees.

You can cut your home insurance rates by increasing your deductible or lowering your coverage limits.

A higher deductible means the insurance company will pay you less money to fix your damaged home. It's important to choose a deductible you can easily pay in an emergency.

You can also lower your coverage limits or get rid of coverage extras you may not need. However, make sure your limits are high enough to cover the cost of rebuilding your home and replacing your belongings if you have a major accident.

Frequently asked questions

How much does home insurance cost in New Mexico?

The average cost of home insurance in New Mexico is $2,594 per year, which is 21% more expensive than the national cost of home insurance, $2,151.

Who has the best home insurance in New Mexico?

State Farm offers the best home insurance in New Mexico, with the cheapest rates along with well-rated online tools and customer service.

Who has the cheapest home insurance in New Mexico?

State Farm has the cheapest home insurance rates in New Mexico at $1,298 per year. That's half the state average.

Methodology

To find the best homeowners insurance in New Mexico, ValuePenguin collected quotes from the top companies across every residential ZIP code in the state. Rates are for a 45-year-old married man with no prior insurance claims.

Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. Quadrant's rates were publicly sourced from insurer filings and should only be used for comparative purposes.

Home insurance ratings are based on complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.