The Best and Cheapest Home Insurance Companies in Oregon (2024)

Travelers has the best cheap home insurance in Oregon at $948 per year.

Compare Home Insurance Quotes in Oregon

Best cheap home insurance in Oregon

ValuePenguin collected thousands of home insurance quotes from hundreds of zip codes in Oregon. Coverage, discounts and customer satisfaction were used alongside rate data to select the best Oregon homeowners insurance companies.

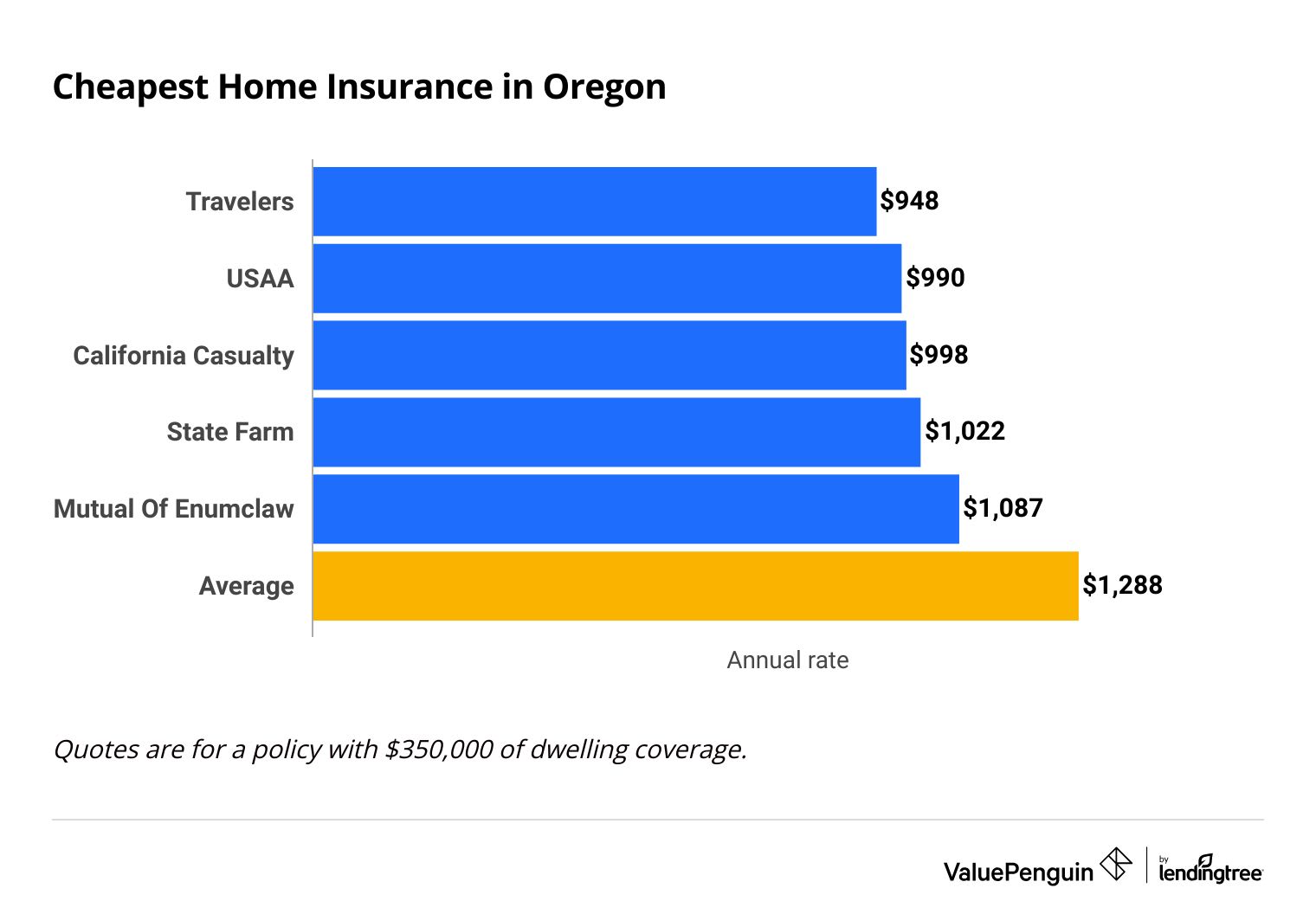

Cheapest home insurance companies in Oregon

Travelers has the cheapest homeowners insurance quotes in Oregon. It charges an average of $948 per year for $350,000 of dwelling coverage. That's roughly 26% cheaper, or $340 per year less, than the Oregon state average.

Find Cheap Homeowners Insurance Quotes in Your Area

Cheap annual home insurance quotes in Oregon

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $671 | ||

| State Farm | $757 | ||

| Nationwide | $764 | ||

| USAA | $764 | ||

| California Casualty | $795 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $671 | ||

| State Farm | $757 | ||

| Nationwide | $764 | ||

| USAA | $764 | ||

| California Casualty | $795 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| Travelers | $948 | ||

| USAA | $990 | ||

| California Casualty | $998 | ||

| State Farm | $1,022 | ||

| Mutual Of Enumclaw | $1,087 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| USAA* | $1,221 | ||

| Mutual Of Enumclaw | $1,362 | ||

| State Farm | $1,363 | ||

| California Casualty | $1,371 | ||

| Travelers | $1,393 | ||

*USAA is only available to military members, veterans and their families.

$1 million

Company | Annual rate | ||

|---|---|---|---|

| USAA* | $1,872 | ||

| State Farm | $2,283 | ||

| Mutual Of Enumclaw | $2,322 | ||

| California Casualty | $2,481 | ||

| Travelers | $2,788 | ||

*USAA is only available to military members, veterans and their families.

Common natural disasters in OR

Depending on where you live in Oregon, you're home may be at risk for earthquakes, wildfires and landslides. Earthquakes are more common and severe in the western portions of the state, while wildfires are more common inland, in the eastern, central and southern parts of the state.

Landslides are a common hazard in the more mountainous parts of the state, such as the Cascade and Coastal mountain ranges. However, even one-quarter of relatively flat Multnomah County is at risk for landslides.

Best homeowners insurance in OR for most people: Travelers

-

Editor's rating

- Cost: $948/yr

Travelers has the cheapest homeowners insurance quotes in Oregon.

Pros:

-

Affordable rates

-

Few complaints

-

Green home discounts

-

Extra coverage options available

Cons:

-

Few discounts

-

Low J.D. Power customer satisfaction score

Oregon residents who want the best rates for homeowners insurance should consider Travelers. It offers the cheapest rates for inexpensive to moderate homeowner's coverage.

Travelers has a range of coverage add-ons, such as extra protection for your personal items and water backup. You can also take advantage of several discounts to lower your monthly rate, including bundling discounts, green home and loss-free discount .

Travelers gets roughly half as many complaints as an average insurance company its size according to the National Association of Insurance Commissioners (NAIC), an industry group. Fewer complaints suggest Travelers customers generally experience a smooth claims process.

However, Travelers scores well below average on customer satisfaction in a recent J.D. Power survey. This could mean that although Travelers customers have few complaints on average, they aren't overly happy with their coverage.

Best homeowners insurance for customer satisfaction in OR: State Farm

-

Editor's rating

- Cost: $1,022/yr

State Farm offers a combination of low rates and strong customer service.

Pros:

-

High levels of customer satisfaction

-

Cheap rates

-

Strong network of local agents

-

Good multipolicy bundling discount

Cons:

-

Few coverage extras and discounts

State Farm has the highest J.D. Power customer satisfaction score among large homeowners insurance companies in Oregon. It's a good idea to choose a company with a strong reputation for customer satisfaction because you're more likely to have a smooth claims experience. It also gets a relatively low level of complaints.

In Oregon, State Farm charges $1,022 per year for $350,000 of dwelling coverage on average.

You'll save $266 per year with State Farm compared to the Oregon state average for homeowners insurance. If you have a more expensive home, State Farm becomes an even better deal.

If you don't qualify for USAA, State Farm has the second cheapest quotes for $500,000 of coverage behind Mutual of Enumclaw and the cheapest quotes for $1 million in coverage.

State Farm maintains a strong network of local agents. Although you can get a homeowners quote through the State Farm website, you'll have to work with an agent to finish the quote.

Best Oregon homeowners insurance for wildfire protection: Mutual of Enumclaw

-

Editor's rating

- Cost: $1,087/yr

Mutual of Enumclaw customers can take advantage of a private firefighter service making it the top choice for wildfire-prone parts of Oregon.

Pros:

-

Access to a private firefighter service

-

Very few customer complaints

-

Affordable rates

-

Strong network of local agents

Cons:

-

No online quotes

-

Policy information only available through an agent

You don't have to pay anything extra to use Mutual of Enumclaw's private firefighting force. You automatically qualify for this service when you buy a homeowners policy through the company. That makes it a good choice for those who live in the more wildfire-prone areas of Oregon, particularly in the drier and more mountainous interior of the state.

Mutual of Enumclaw also has some of the best rates among homeowners insurance companies in Oregon. You'll pay $1,087 on average for $350,000 of dwelling coverage in Oregon. That represents a savings of $201 per year compared to the Oregon state average.

Oregon residents who have high-value homes can save even more with Mutual of Enumclaw. It has the cheapest rates for $500,000 of dwelling coverage and the second-cheapest rates for $1 million of coverage, outside of USAA, which only sells insurance to current and former members of the military and their families.

Mutual of Enumclaw has a strong network of local agents, which can mean a more personalized buying experience. However, if you prefer the convenience of buying and managing your policy online, you should look elsewhere.

Mutual of Enumclaw doesn't currently offer online quotes. In addition, it has a fairly bare-bones website. That means if you have a question about your policy, it's more likely you'll have to pick up a phone and speak to an agent or representative.

Average cost of homeowners insurance in OR

Oregon has the eighth-cheapest homeowners insurance in the country with an average cost of $1,288 per year or $107 per month.

That's roughly 43% cheaper than the national average. Factors like climate, theft, home repair costs and natural disaster frequency all impact how much you pay for homeowners insurance.

Average cost of home insurance in Oregon

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $943 |

| $350,000 | $1,288 |

| $500,000 | $1,752 |

| $1,000,000 | $3,250 |

Keep in mind that your home insurance rates will differ depending on where you live in Oregon. Larger cities like Portland, Hillsboro, Gresham, Corvallis, Eugene and Salem have rates below the Oregon state average. By contrast, the most expensive home insurance rates can be found in Mosier, a small town of less than 500 residents directly on the Columbia River.

Cost of OR home insurance by city

Corvallis has the cheapest home insurance rates in Oregon while Mosier has the most expensive.

Where you live can have a big impact on your home insurance rates. Areas with more crime, higher labor and/or materials costs or more frequent natural disasters tend to have higher rates.

City | Annual rate | % from avg |

|---|---|---|

| Adams | $1,413 | 10% |

| Adel | $1,531 | 19% |

| Adrian | $1,435 | 11% |

| Agness | $1,425 | 11% |

| Albany | $1,157 | -10% |

Rates are for a policy with $350,000 of dwelling coverage.

The best home insurance companies in Oregon

Travelers offers the best combination of affordable rates and strong customer service for Oregon homeowners with cheap or average-priced homes.

State Farm and Mutual of Enumclaw both offer excellent service, coverage and prices, particularly if you have a more expensive home. USAA also has high levels of customer satisfaction and competitive prices. However, only veterans, current military members and their families qualify for USAA policies.

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Average | |

| State Farm | Average | |

| Mutual Of Enumclaw | Low | |

| Nationwide | Average | |

| Travelers | Average |

When looking for the best homeowners insurance company in Oregon, it's important to balance cost, coverage and customer satisfaction. It rarely makes sense to go with the cheapest rate if you're not also getting strong customer service and the coverage you need. That's why it can sometimes make sense to pay a little more for a policy from a company that has a good customer service reputation.

Common natural disasters in Oregon

Depending on where you live in Oregon, you may need to buy extra coverage to protect against earthquakes, landslides and wildfires. Homeowners insurance doesn't typically cover earthquakes and landslides. You'll need to buy separate policies to protect against these hazards.

The Western portions of Oregon have a higher risk of earthquakes compared to the Eastern part of the state while landslides and mudslides occur most frequently in hilly and mountainous areas.

Keep in mind that major earthquakes are relatively rare. That means you may be better off not buying insurance even if you live in an area with an elevated risk of this peril.

Most homeowners insurance policies cover wildfires. However, it's a good idea to check before you buy since some companies might not offer coverage in high-risk areas.

Consider Mutual of Enumclaw if you live in a part of Oregon prone to wildfires.

Mutual of Enumclaw is unique among Oregon homeowners companies in that customers have access to a private team of firefighters. This service comes standard with a regular homeowners policy at no extra cost to you.

Tips to get cheaper home insurance in Oregon

You can save on your Oregon homeowners policy by comparing rates, taking advantage of discounts and raising your deductible.

Compare rates from different companies

One of the easiest ways to save money on your homeowners policy is to compare quotes from different companies. For example, you could save $1,275 per year simply switching from Country Financial to Travelers.

Remember that cost is just one factor to consider when buying home insurance. When comparing two or more companies, you should always consider other relevant information like customer satisfaction, extra coverage options and available discounts.

Take advantage of discounts

When shopping for homeowners insurance in Oregon, it's important to remember that you won't always pay your quote price. That's because most companies offer several different discounts that you can take advantage of.

These range from claims-free discounts and price breaks for new homeowners to bundling discounts that let you save when you buy more than one type of insurance through that company.

It's important to take discounts into account when comparing quotes because a company with average prices but steep discounts can often beat out a company with low prices but few discounts.

Consider raising your deductible

You can usually lower your monthly rate by raising your deductible. This is one of the easiest and most straightforward ways to save on your homeowner's policy. However, it's also one of the riskiest since you're responsible for paying your entire deductible.

Make sure that you have enough money in your savings account to pay for your deductible without otherwise causing you financial hardship.

Frequently asked questions

What company has the cheapest homeowners insurance in Oregon?

Travelers has the cheapest homeowners insurance in Oregon for policies with $350,000 of coverage to repair your house, called dwelling coverage. Travelers also gets roughly half the number of complaints compared to an average insurance company of the same size, and it offers many discounts and coverage add-ons.

What are the best insurance companies in Oregon?

Travelers offers the best combination of affordable rates and quality coverage for most Oregon residents. You should consider Mutual of Enumclaw or State Farm if you have a high-value house, since these companies offer more competitive rates for higher levels of coverage.

Does State Farm insure homes in Oregon?

Yes, State Farm insures homes in Oregon. It's also one of the best companies in OR because of its high-quality customer service, low rates and strong bundling discount.

Methodology

Quotes were taken from every zip code in Oregon for 10 of the largest home insurance companies in the state. Quotes are for a 45-year-old married man with no prior insurance claims and include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Cost data came from Quadrant Information Services which were publicly sourced from insurance company filings. These figures are intended for comparative purposes only.

Company quality ratings were created using complaint data from the National Association of Insurance Commissioners (NAIC), the J.D. Power customer satisfaction survey, and ValuePenguin's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.