Homeowners Insurance

As Burglaries Decrease, Thieves Find More Value in Fewer Stolen Goods

According to the FBI's most up-to-date Crime in the United States study, the number of burglaries in the country fell from 1.4 million to 1.2 million in 2018, a 12% decrease from the year before. This drop closes out a decade that saw burglaries fall by 45%, down from 2.2 million, at the end of 2018.

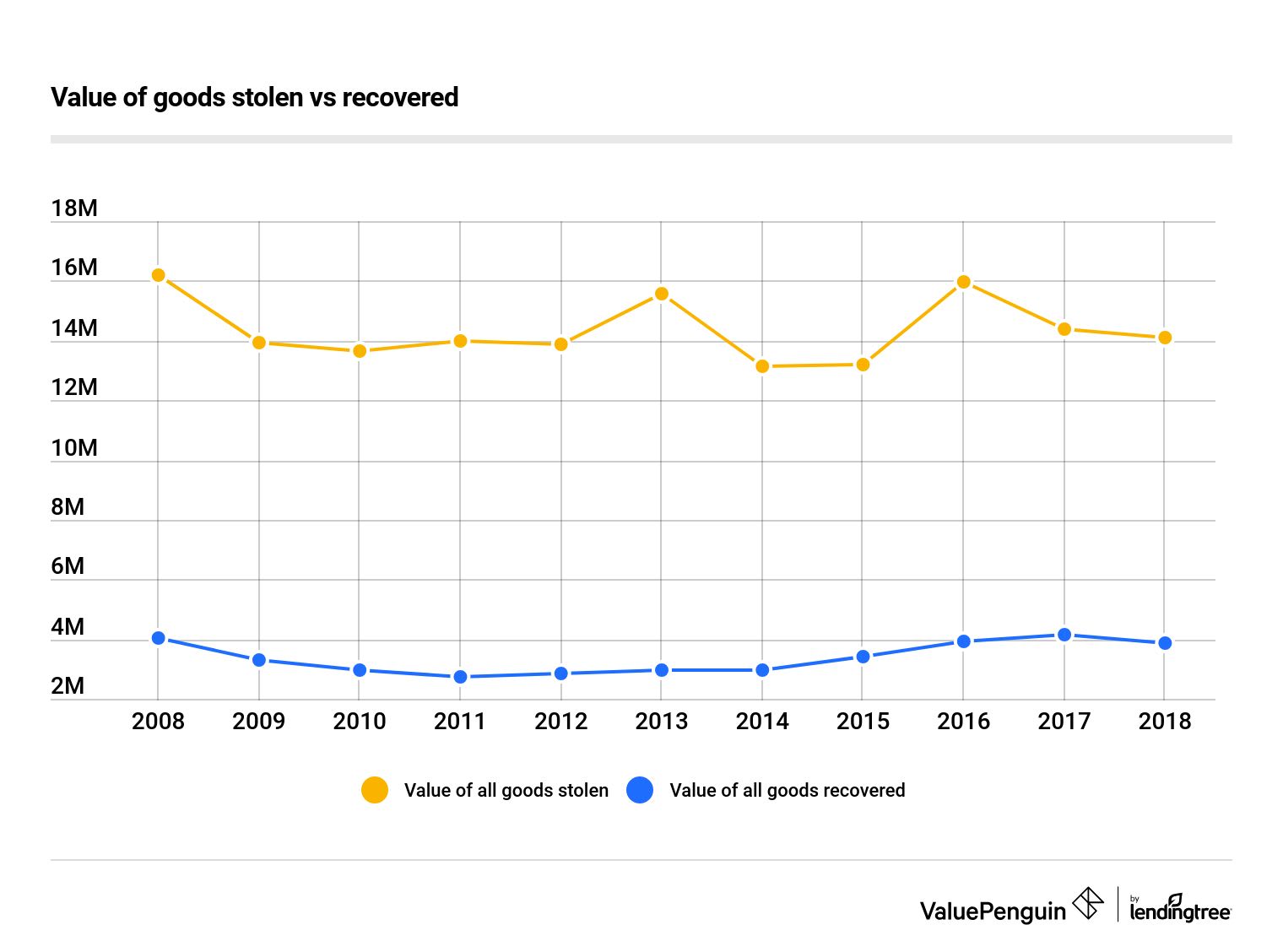

During the same time, data shows that the value of stolen property has only slightly decreased compared to the number of burglaries. Since 2008, the value of stolen property has only dropped by about 13% overall. Underscoring this slow decrease, between 2015 and 2018 the downward trend actually reversed course, with the value of stolen goods increasing.

The chance of recovering stolen property has slightly improved since 2008—but it's still unlikely.

Key findings

- Thieves have gotten smarter: Even though the total number of burglaries has decreased by 45% since 2008, the total value of stolen goods has only dropped by about 13%.

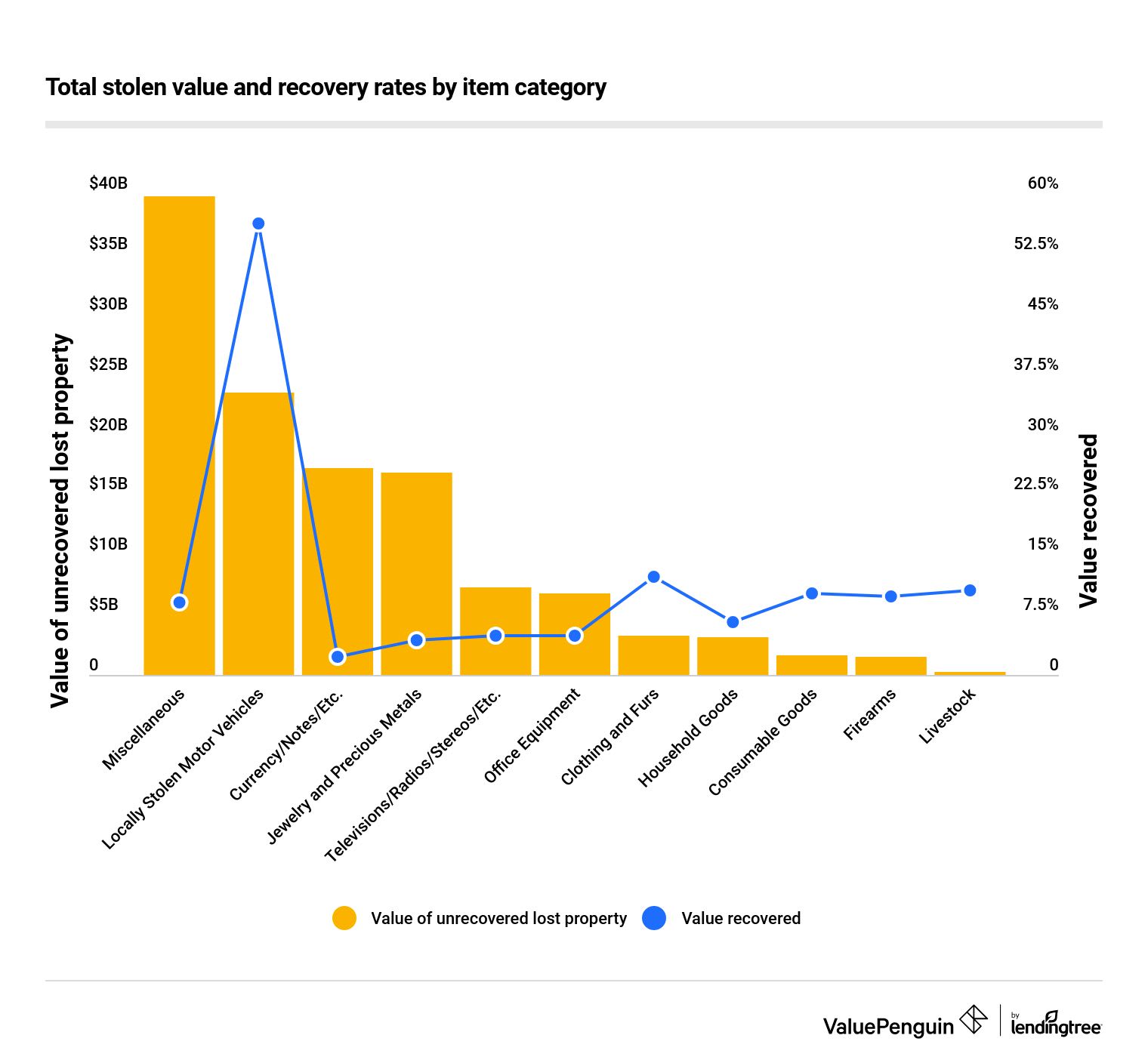

- Unrecovered value equaled $120 billion from 2008 to 2018 for all forms of property, with stolen motor vehicles representing the most valuable category among stolen items.

- It's unlikely you'll get an item back you lose to theft: Only 24% of the total value of property stolen this decade was recovered.

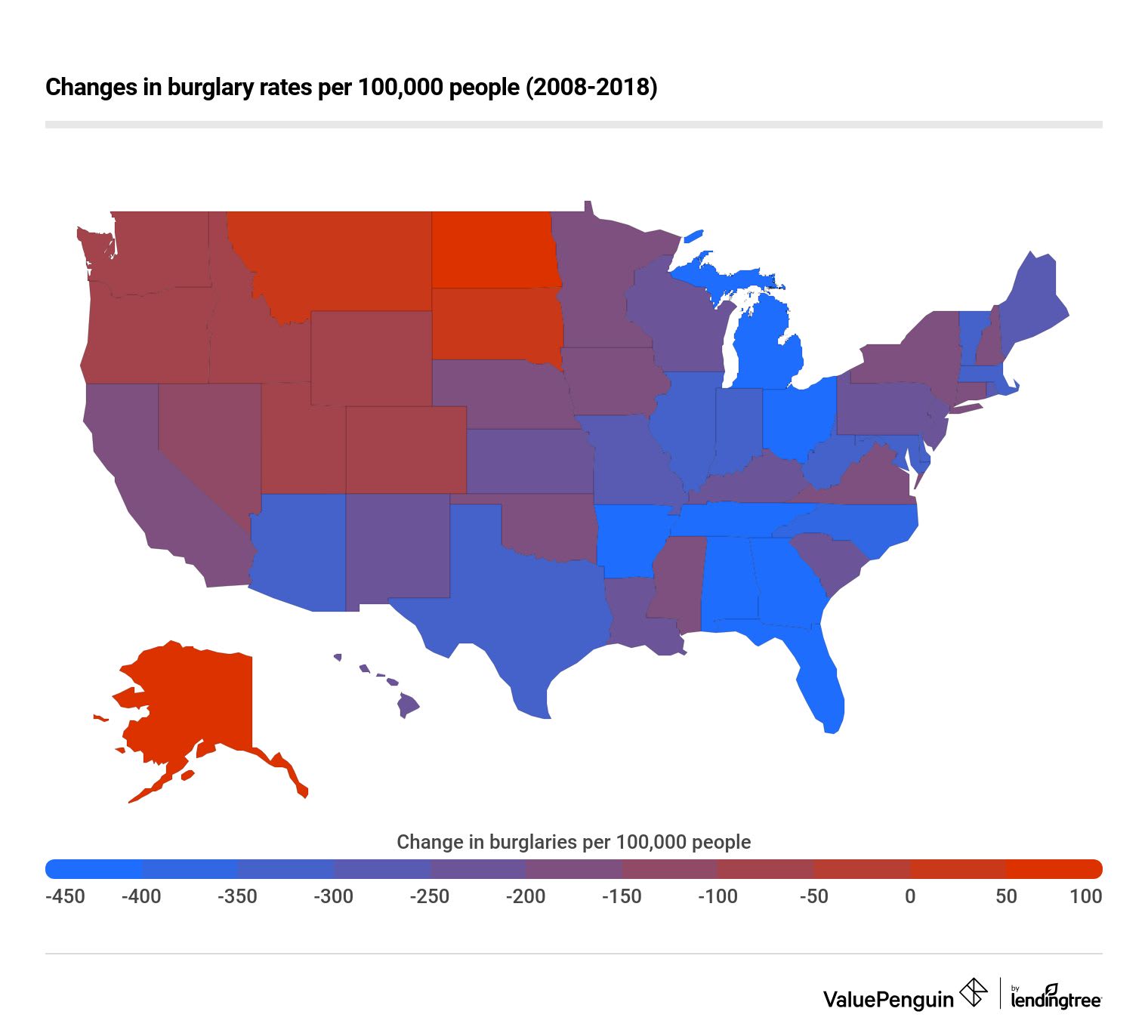

- From 2008 to 2018, Florida experienced the most improvement in its burglary rate, while North Dakota suffered the largest increase in burglaries.

Although the total number of reported burglaries is decreasing, the value of stolen goods hasn't fallen by much

There were about 12 million cases of burglary reported to the FBI in 2018, a drop of 12% from the year before. The number of burglaries has decreased nearly every year since 2008, with the exception of 2011. Overall, there were about 45% fewer burglaries in 2018 compared to 2008.

After factoring in recovered value, a total of over $120 billion of property has been lost to burglaries since 2008.

Despite the decrease in burglaries, there hasn't been a precipitous decline in the total value of stolen property during the same period. From 2008 to 2018, the value of stolen property per year fell from $16 billion to $14 billion — about 13%. Additionally, this slight overall decline belies an ongoing increase in stolen value since 2014.

The bad news for victims of property crime is that over the course of the decade, only about 24% of the value of stolen property has been recovered. Moreover, in no year from 2008 to 2018 did the amount of recovered value exceed 30%. Instead, recovered value has been largely stagnant, improving by only 3% since 2008.

While fewer electronics are being stolen now than in 2008, there's been an increase in thefts of consumable goods and currency

Since 2008, the stolen value of electronics, including televisions, radios and stereos has fallen sharply — by 67% as of 2018. This is by far the steepest drop we identified, but other types of items also show large decreases in theft: Jewelry, precious metal and livestock experienced a 32% drop in stolen value since 2008.

On the other hand, the stolen value of consumable goods increased by 53% since 2008. In 2010, 2013 and 2018, the burgled value consumable goods spiked by at least 60%. About 32% more currency was stolen in 2018 than in 2008, the second largest increase over that time.

The increase of stolen currency is a particularly troubling trend for victims (and potential victims) given the low rates at which it's recovered. Only over 98% of stolen currency is lost — and data suggests that number is growing. You're also unlikely to recover your stolen jewelry or office equipment. Both have recovery rates under 5%

Despite the pronounced decrease in the theft of electronics, it's still highly improbable that you'll recover your stolen television: Less than 5% of the value of stolen electronics were recovered from 2008 to 2018.

There is some good news: If recovered, cars are more likely to retain their value after a theft than any other type of good. Over half of stolen cars were recovered over the course of the decade, even as stolen cars accounted for over $53 billion of lost value.

Our analysis of 10-year crime data shows that most states improved their burglary rates — with the exception of just four

A majority of the states in the country improved their burglary rates from 2008 to 2018. Only four states increased their burglary numbers in the decade: both Dakotas, Alaska and Montana. North Dakota had about 150 more cases of burglary per 100,000 people in 2018 — the most among all states.

Conversely, Florida was the most improved state over the decade. Despite gaining about 3 million more people during the time period, Florida's burglaries fell by nearly 500 cases per 100,000 people. After Florida, Georgia, Ohio, Arkansas, Tennessee and Michigan decreased by more than 400 cases per 100,000 people.

Overall, California accounts for the largest percentage of U.S. burglaries at 13%, a 2% increase from 2008. Other large states like Texas and Florida make up 10% and 6% of the country's burglaries, respectively. However, New York, the third-largest state, represents only about 3% of the nation's burglaries despite its size.

You can protect your belongings with homeowners or renters insurance, but a policy won't allow you to recoup the value of all of your lost belongings

Although burglary and other forms of theft are covered by standard homeowners or renters insurance policies, it could be unlikely that you'd recover the value of all of your property after a burglary. For items like firearms, jewelry and stolen currency, which account for $38 billion in lost value since 2008, most policies impose strict limits of liability of only $2,500 or less.

You can add a floater to your homeowners or renters policy. This type of coverage increases your protection for certain items. If you had a pair of $10,000 rings, you could raise your policy's limits of liability to cover the items' appraised value. This method can be expensive, but its coverage is more comprehensive than a standard policy provides.

To give yourself the best chance of regaining your stolen property, we recommend keeping track of your property using detailed lists, including receipts if possible. Insurers are obligated to replace your covered items in equal value. These lists should include not only the name of your property but also its model number and functions.

Stolen automobiles are harder to recoup even with your auto insurance. A standard liability policy won't pay for your stolen vehicle unless you have comprehensive coverage. With comprehensive coverage, you'll be reimbursed according to your car's depreciation, determined by your adjuster.

If your car has a loan, you'll need gap insurance to make up the difference between what you owe and your car's lost value. Gap insurance provides financial protection if you're unable to pay off your auto loan as fast as your car depreciates. Without gap insurance, you'll have to pay out-of-pocket to account for what you owe to your lender after you receive a payout for your stolen car.