Cigna Medicare Advantage Plans Review (2024)

Cigna has some of the cheapest Medicare Advantage plans of any major company. But the company's service isn't the best.

Compare Medicare Plans in Your Area

Consider Cigna for Medicare Advantage if price and the flexibility to see a wide range of doctors are high priorities for you. Cigna's average rates for Medicare Advantage (Part C) are much lower than other companies.

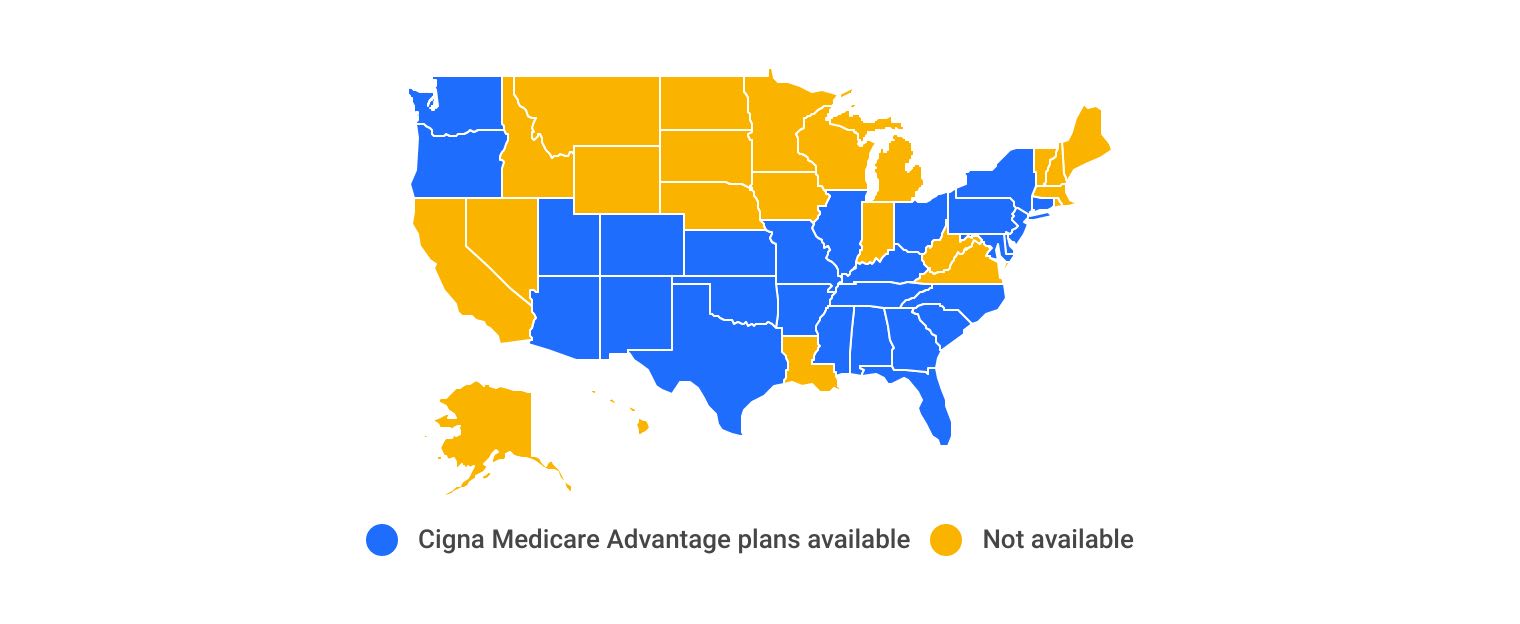

But Cigna struggles with customer service, and you can only get its coverage in 28 states plus Washington, D.C.

Cigna Medicare Advantage plans to become Blue Cross Blue Shield in 2025

Cigna has sold its Medicare business to the Blue Cross Blue Shield affiliate Health Care Service Corp. (HCSC). So if you have a Cigna Medicare Advantage plan, it will become a Blue Cross plan in 2025.

This is a good thing for Cigna customers because Blue Cross Blue Shield is one of the best insurance companies. Plus, HCSC's Medicare Advantage plans have higher customer satisfaction than Cigna's.

Pros and cons

Pros

Low rates

Good coverage for chronic pain or kidney disease

Doctor flexibility

Cons

Poor customer service

Only available in 28 states

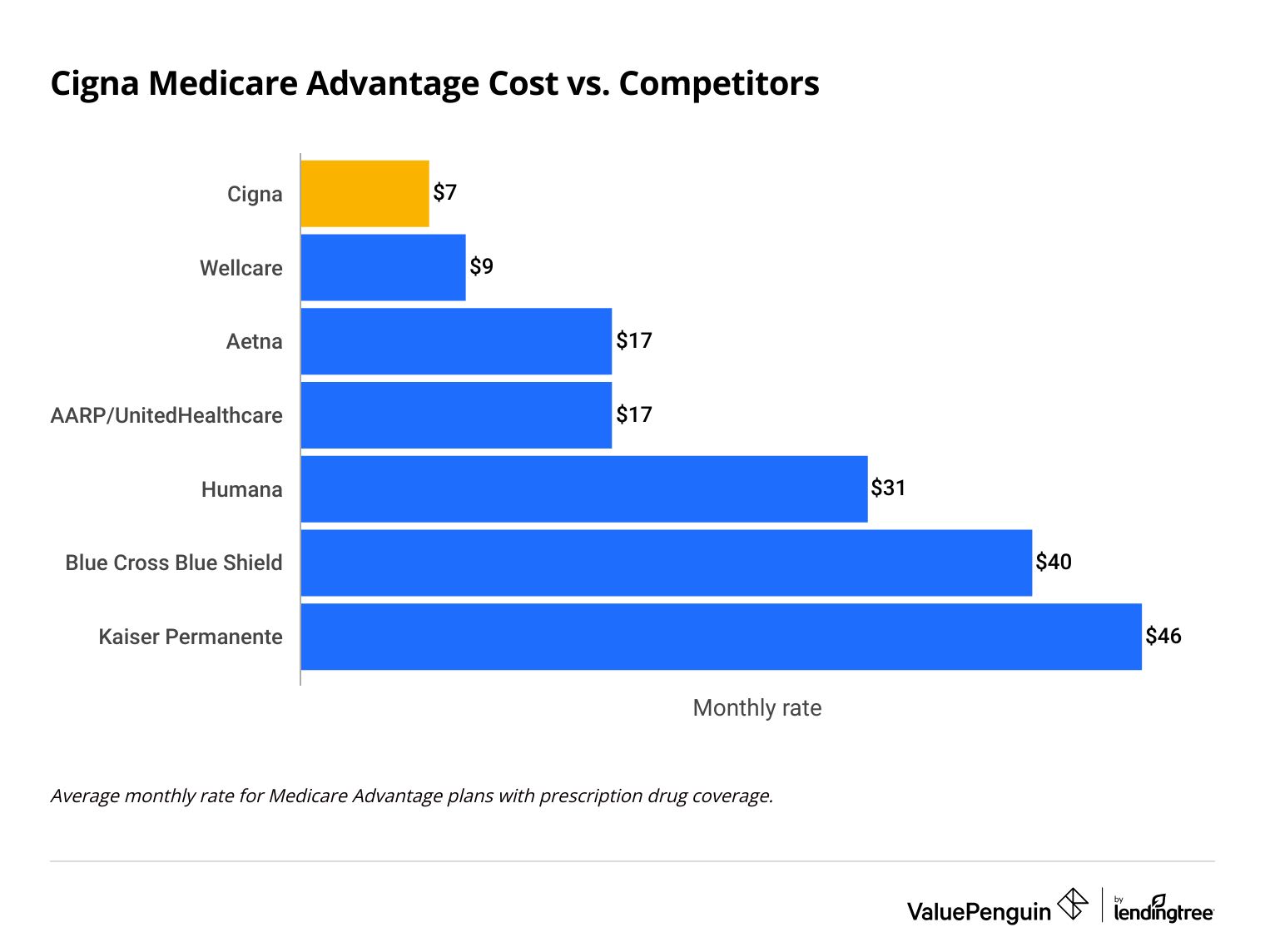

Cost of Cigna Medicare Advantage plans

Cigna has the cheapest Medicare Advantage plans among major companies.

Cigna Medicare Advantage plans cost $7 per month on average. That's $10 per month cheaper than UnitedHealthcare, the largest Medicare Advantage company in the nation, and $21 per month cheaper than the average Medicare Advantage plan.

Compare Medicare Plans in Your Area

Cigna offers a $0 per month plan option in 27 out of the 28 states where it sells Medicare Advantage policies. Maryland is the only state Cigna sells plans without a free plan option.

Residents of Washington, D.C. also have a $0 plan option.

Cigna is a good choice if you want a cheap PPO plan. PPOs don't require you to get a referral to see a specialist. That makes them a good choice for people who want a little more control over who they see.

In general, usually PPOs cost more than HMOs. However, Cigna's PPO plans cost an average of just $2 per month, compared to $10 per month for its HMO plans.

Cigna's monthly rates depend in part on where you live. For example, the average cost of a Medicare Advantage plan from Cigna in Maryland is $45 per month, while in Arizona, the average cost is $0 per month.

Cigna Medicare Advantage cost vs. competitors

Company | Monthly cost |

|---|---|

| Cigna | $7 |

| Wellcare | $9 |

| Aetna | $17 |

| AARP/UnitedHealthcare | $17 |

| Humana | $31 |

*Average monthly rate for Medicare Advantage plans with prescription drug coverage.

Cigna Medicare Advantage plan options

Cigna offers several different Medicare Advantage plan options. To compare the plans, it helps to review the monthly rate, network type and costs you have to pay yourself. This method can help you decide if a plan is right for you.

Cigna Preferred Medicare HMO vs. Cigna True Choice Medicare PPO

The Cigna Preferred Medicare HMO and Cigna True Choice Medicare PPO are two of Cigna's most widely available plans. Both plans cost $0 per month, although you still have to pay your $174.70 monthly Medicare Part B rate.

With Cigna True Choice Medicare PPO, you'll pay more if you visit the doctor frequently. But, it offers better flexibility to see the doctors and specialists you want without a referral.

Cigna Preferred Medicare HMO | Cigna True Choice Medicare PPO | |

|---|---|---|

| Network type | HMO | PPO |

| Monthly premium | $0 | $0 |

| Drug deductible | $1 | $0 |

| Out-of-pocket maximum | $4,829 | $5,515 |

*Rates, deductibles and out-of-pocket maximums are averages.

Along with standard Medicare Advantage plans, Cigna sells special plans for people who have certain ongoing conditions like cancer or heart failure, called Chronic SNPs (C-SNPs). They also offer plans that help you coordinate your Medicare and Medicaid coverage if you're enrolled in both programs, called Dual-Eligible Special Needs Plans (D-SNPs).

Cigna Medicare Advantage benefits and features

Most of Cigna's Medicare Advantage plans come with extra benefits.

- Over-the-counter (OTC) benefit: You get an allowance every quarter to buy over-the-counter medications and health products, like bandages and medical ID bracelets.

- Transportation: This includes coverage for vans, taxis, wheelchair-equipped vehicles and even Lyft ridesharing in some areas.

- Dental, vision and hearing coverage: Most plans have coverage for dental, vision and hearing appointments. Some Cigna Medicare Advantage plans offer more coverage.

- Silver&Fit: This gives you access to a fitness center membership or home-based program, depending on your needs.

- Meal delivery: If you've had a hospital or skilled nursing facility stay, Cigna will deliver up to 14 healthy meals during your recovery.

Where are Cigna Medicare Advantage plans available?

Cigna sells Medicare Advantage plans in 28 states and Washington, D.C.

Compare Medicare Plans in Your Area

In most states, you have the option to buy either an HMO or a PPO plan. However, in Maryland, Cigna only sells HMOs. In New York, only PPOs are available.

States where Cigna sells Medicare Advantage plans

- Alabama

- Arizona

- Arkansas

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Illinois

- Kansas

- Kentucky

- Maryland

- Mississippi

- Missouri

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- Washington, D.C

Customer reviews and complaints

Cigna has worse customer satisfaction than many other health insurance companies.

Cigna gets more than two and a half times more complaints overall than expected for a company its size, according to the National Association of Insurance Commissioners (NAIC). Not all these complaints are about Medicare Advantage plans. However, the high number of issues could mean that you'll also encounter problems when you file a claim.

Cigna Medicare Advantage customer satisfaction

Rating agency | Score |

|---|---|

| NCQA health plan rating | 2.5 out of 5 |

| CMS star rating | 3.5 out of 5 |

| J.D. Power ranking | 2nd place out of 6 companies |

| NAIC score | 2.6 times more complaints than average |

Cigna Medicare Advantage plans in Texas, however, have above-average customer service according to J.D. Power. Cigna was not rated in the other states that J.D. Power looked at.

Overall, Cigna's Medicare Advantage plans have a slightly below average 3.5 out of 5 quality rating from the Centers for Medicare and Medicaid (CMS). Cigna scores particularly well for its pain management and kidney disease monitoring coverage. However, the company has a low score for rheumatoid arthritis management and osteoporosis management.

Cigna's Medicare Advantage plans score above average on preventive treatment, according to the National Committee for Quality Assurance (NCQA). However, Cigna has a mediocre 2.5 out of 5 rating for overall treatment and a middle-of-the-road 3 out of 5-star rating for patient experience.

Frequently asked questions

Is Cigna Medicare a good choice?

Cigna Medicare Advantage plans are a good choice if you want a cheap policy. In most areas, Cigna has $0 Medicare Advantage options.

How much does a Cigna Medicare Advantage plan cost?

A Cigna Medicare Advantage plan costs $7 per month, on average. In most areas, Cigna sells at least one plan without a monthly cost.

Is Cigna Medicare Advantage a PPO or HMO?

Cigna sells both HMO and PPO Medicare Advantage plans. HMO plans cost an average of $8 per month, and PPO plans cost an average of $2 per month, which is less than average.

Methodology and sources

Medicare Advantage rates and star ratings came from Medicare.gov and the Centers for Medicare & Medicaid Services (CMS). Other sources include Cigna, J.D. Power, the National Association of Insurance Commissioners (NAIC) and the National Committee for Quality Assurance (NCQA).

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.