Homeowners Insurance

1 in 4 Americans Don’t Have a Fire Extinguisher

Although 28% of Americans have experienced an electrical fire, most aren't following basic precautions that would lower their risk of another fire, according to a new ValuePenguin survey of more than 1,200 respondents. Twenty-nine percent of people don't keep a fire extinguisher in their home or aren't sure whether they have one. In the same vein, 28% of people haven't verified in the past three months that their smoke detectors are working.

Further, a significant percentage of people may be inadvertently increasing their risk of experiencing a fire. Fifty-seven percent of people admit to leaving heat-producing appliances plugged in when they're not in use, and 56% have accidentally left these appliances plugged in or on.

While home and renters insurance do in most cases cover the damage a fire could cause, one-quarter of people don't have adequate coverage to guard against fire damage, or they aren't sure if they do. Another 10% of Americans don't have any home or renters insurance coverage.

Key findings

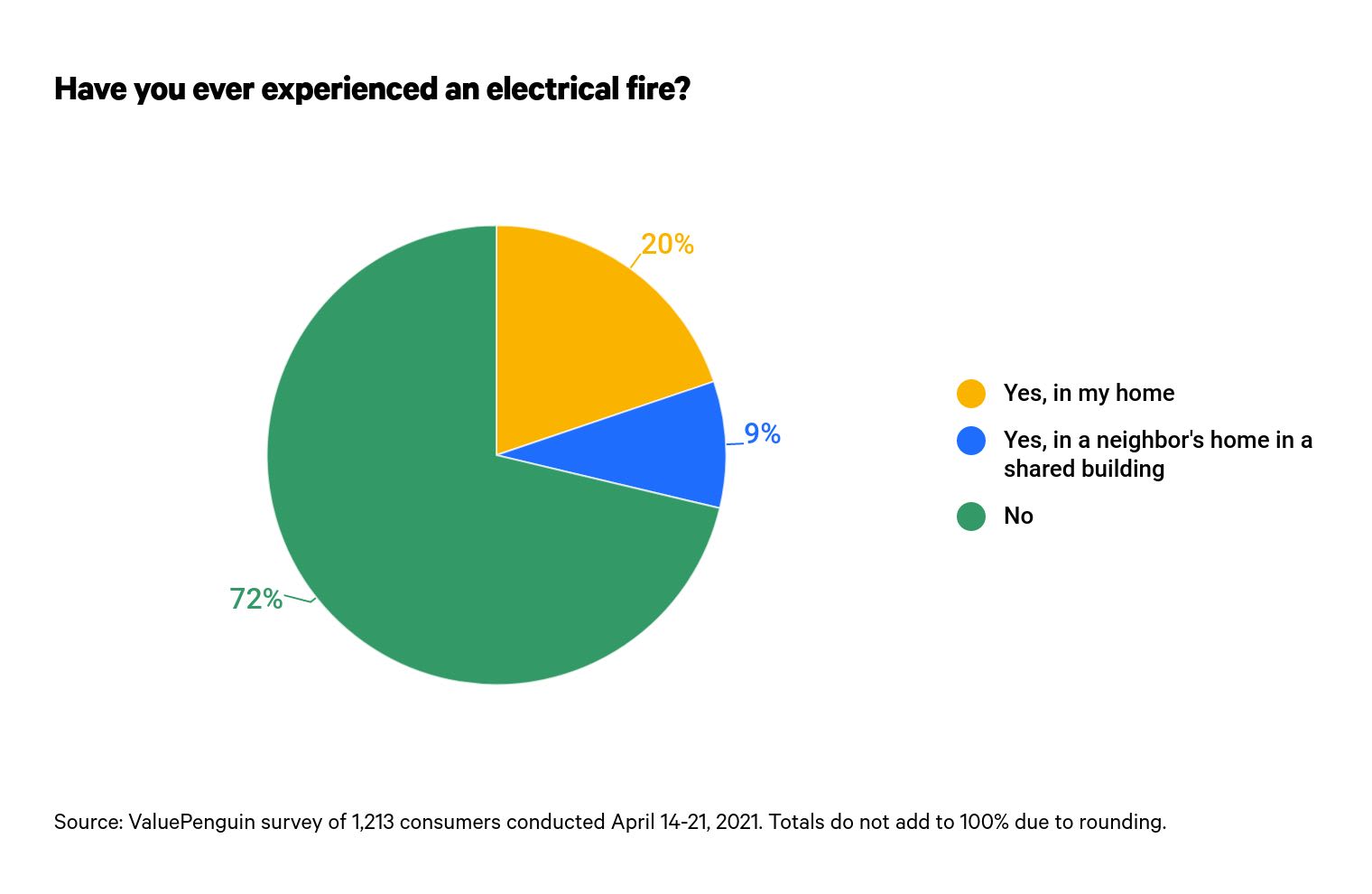

- At least 1 in 4 Americans have experienced an electrical fire. Of that group, 20% say the fire occurred in their home, while 9% say the fire happened in a neighbor’s home in a shared building.

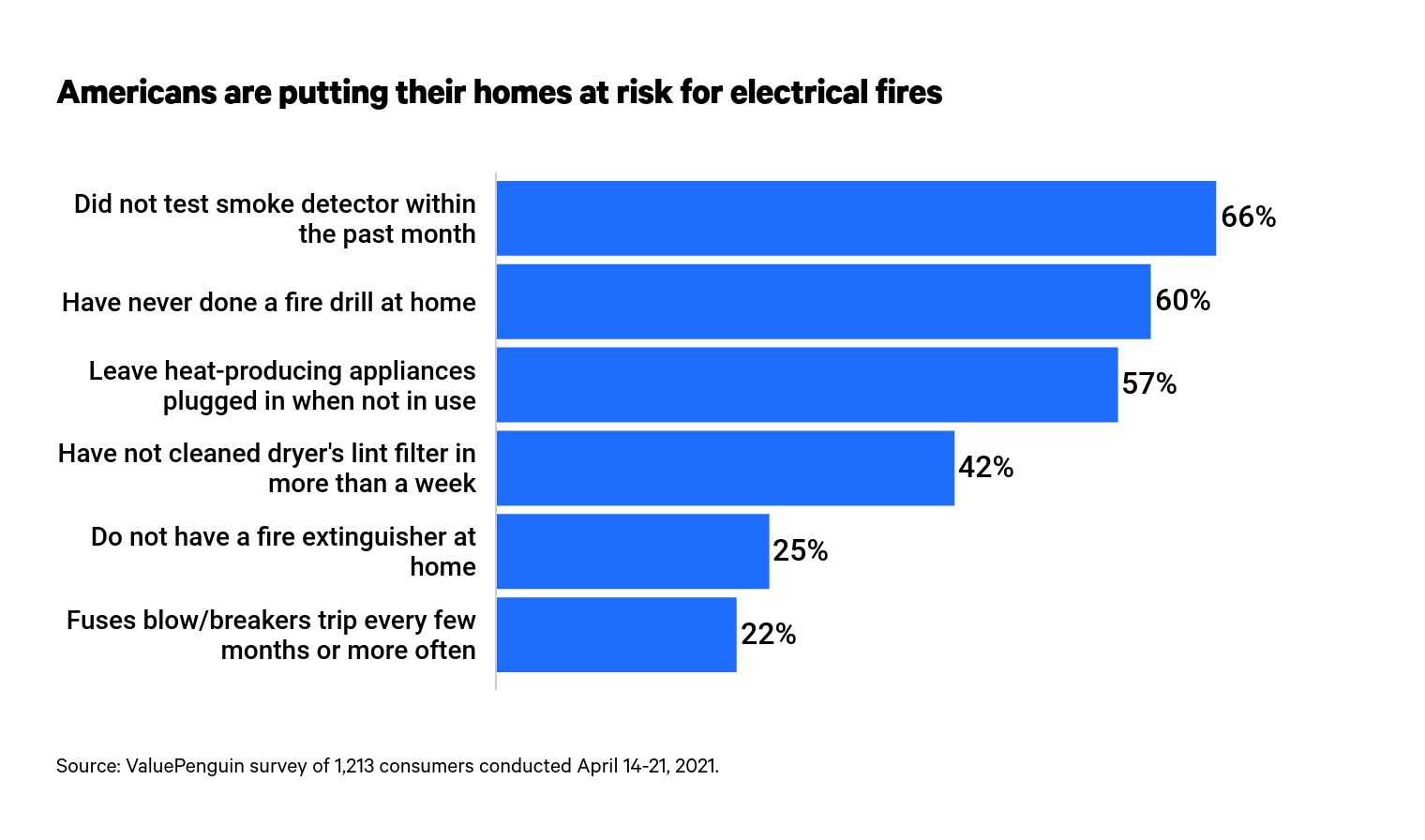

- The majority of Americans aren’t following expert guidelines for preventing electrical fires. Two-thirds of Americans didn’t test their smoke detectors last month, 57% leave heat-producing appliances plugged in when they’re not in use, and 42% haven’t cleaned their dryer’s lint filter in more than a week.

- Fire drills and fire extinguishers are critical in protecting families should electrical fires occur, but consumers miss the mark here. 60% of Americans have never done a fire drill in their current home, and 1 in 4 say they don’t have a fire extinguisher.

- Renters and those living in multi-unit buildings need more education about electrical safety. These consumers are less confident in their ability to protect themselves and their homes from an electrical fire than homeowners and those living in single-family homes.

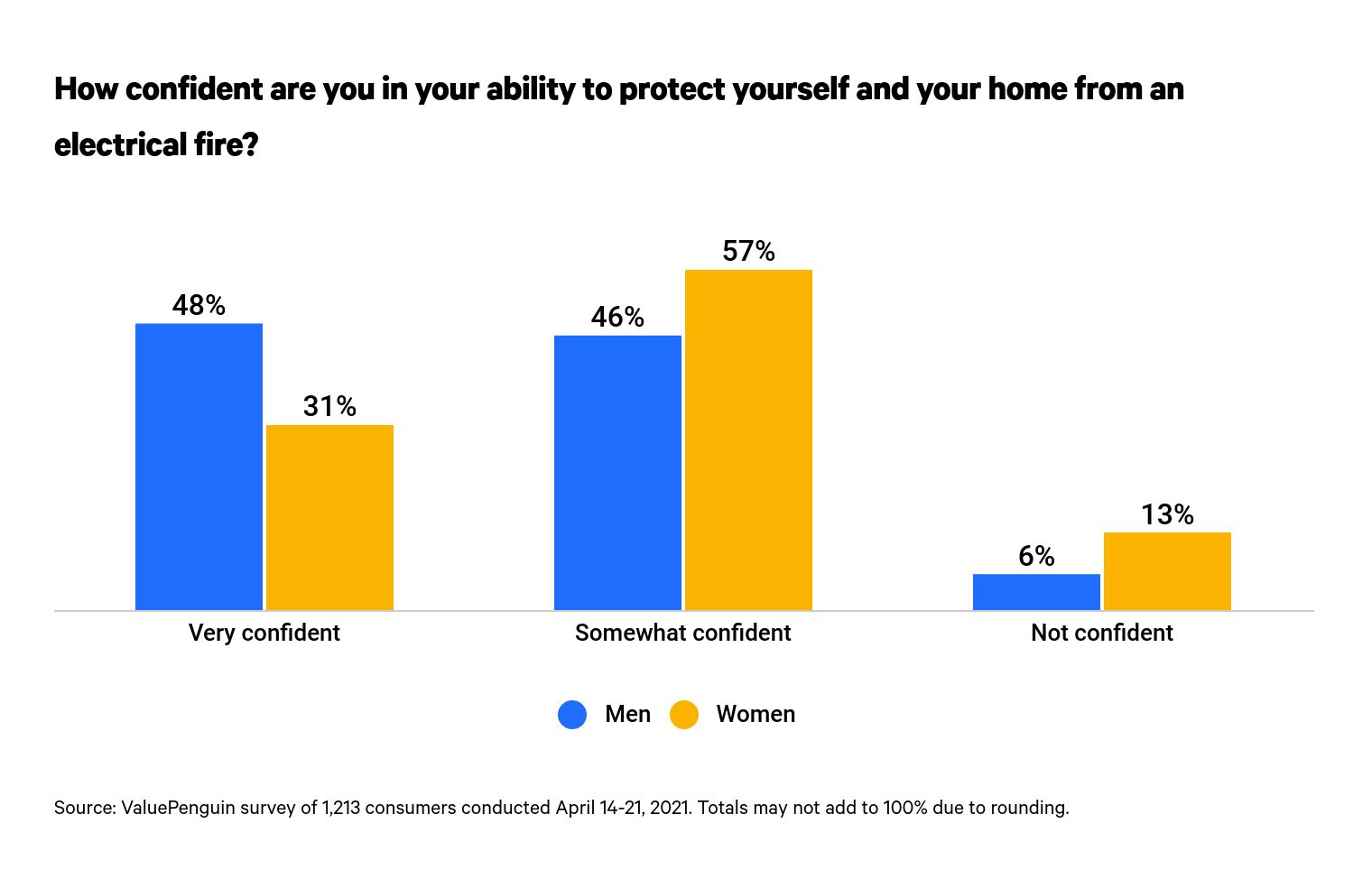

- Women are more than twice as likely as men to say they’re not at all confident in their ability to protect themselves from an electrical fire. 13% of women cite this lack of confidence versus just 6% of men.

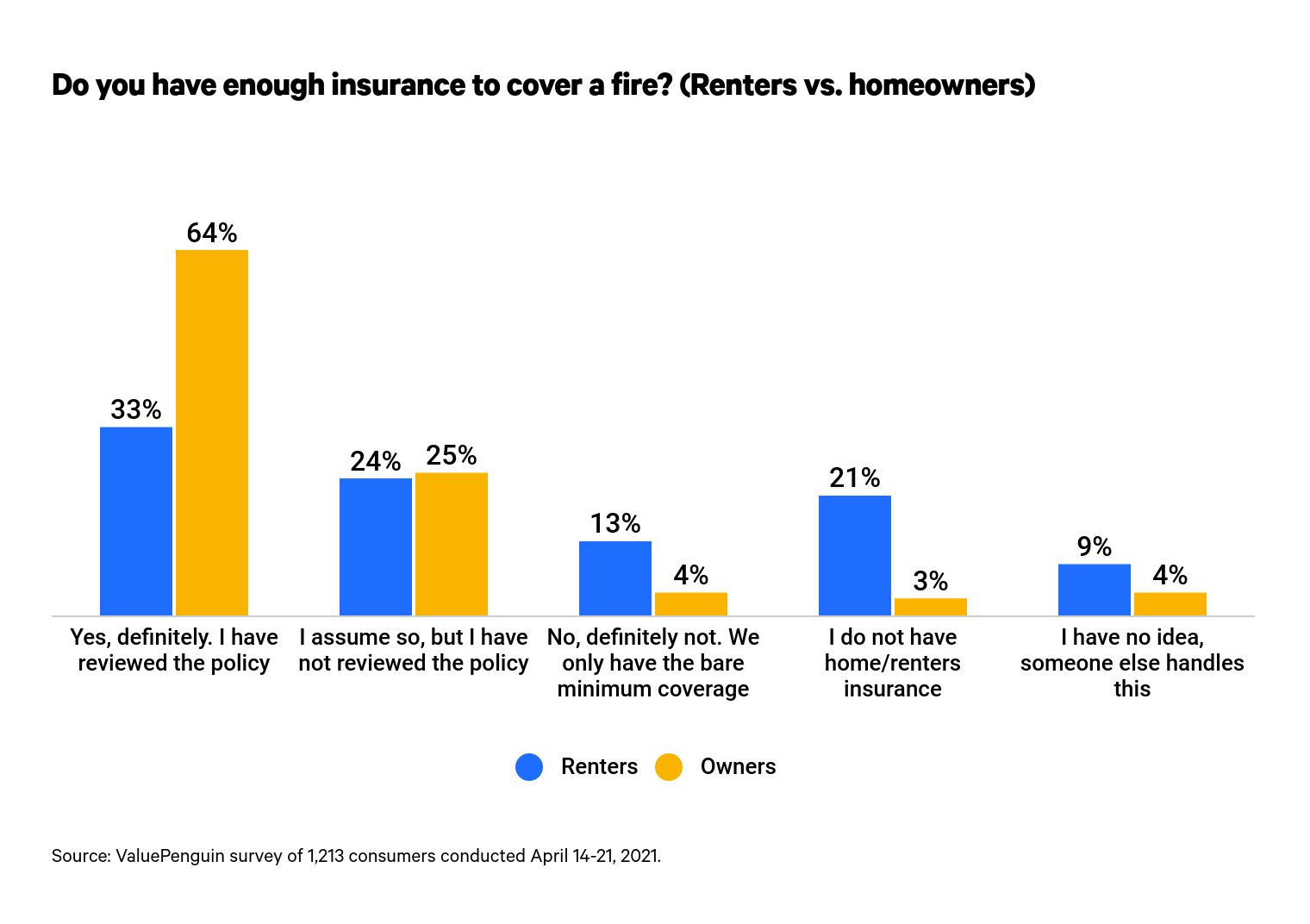

- Half of Americans aren’t sure if they have enough home or renters insurance to cover a fire. Renters are much less confident than owners that they have enough insurance to cover a fire — 33% of renters say they definitely have enough coverage versus 64% of owners.

Consumers' behavior isn't reducing further risk, despite a history of experiencing fires

Twenty-eight percent of Americans have experienced an electrical fire. Of that group, 1 in 5 say the fire occurred in their home. Another 9% say the fire broke out in a neighbor's home with whom they share the building. While fires have affected the homes of millions of Americans, data shows that the habits and risky behavior of some homeowners aren't lowering their risk of experiencing future fires.

A significant percentage of Americans could be increasing their risk of experiencing an electrical fire by overlooking potential hazards. For example, 57% of consumers leave heat-producing appliances plugged in or turned on when they're not in use, and 56% have accidentally done so without realizing it.

An overloaded electrical system can spark electrical fires. Still, after being asked how often electricians inspect their breaker boxes, 40% of residents of homes older than 20 years say they have never had their box checked by a professional. This is especially concerning given how often some are overloading their homes' power sockets. Eleven percent say their fuses blow or their breakers trip at least once per month, while another 10% say this happens every few months.

Americans are also failing to monitor their smoke detectors and dryer filters. Two-thirds of people didn't check their smoke detectors in the past month to ensure the alarms are working. Of that group, 28% haven't checked their detectors in more than three months. Similarly, 42% of Americans with dryers haven't cleaned the lint from their filters in the past week, despite the fire risk that this poses.

Americans aren't prepared to protect themselves from a fire if one is to break out

Extinguishers — a critical tool for fire safety — are invaluable in an emergency. However, 25% of Americans say they don’t have one in their homes. An additional 1 in 10 say they have a fire extinguisher but they're unsure where it is. Renters are less likely to know where their fire extinguisher is — if they have one — than homeowners. Half of American renters don't know for sure where their extinguisher is located or don't have one, compared with 32% of homeowners.

Not having fire extinguishers — or being unsure of where their extinguishers are — is just one of the ways that Americans are unprepared to protect themselves from a fire. In fact, just 39% of people are very confident that they could protect themselves and their homes during a fire. One in 10 isn’t confident at all.

Women (13%) are more than twice as likely as men (6%) to say they're not confident at all they'd be able to protect themselves during a fire.

People may be unconfident due to a lack of planning. For instance, 60% of people have never done a fire drill in their homes. And just 1 in 5 people have staged a fire drill in their homes during the past year. Additionally, more than one-third of people don't have a fire-safe box for important documents, and another 7% say they’re not sure whether they have one.

Millions of Americans may not have enough insurance coverage to recover after a fire

Another way significant numbers of people are underprepared to experience an electrical fire is the lack of understanding many expressed regarding their home or renters insurance protection. Half of Americans either are unsure they have enough coverage to protect their assets from a fire or know they're unprotected.

One-quarter of people assume they have enough home insurance to cover fire damage. Sixteen percent of people report not knowing whether their insurance coverage is sufficient — with a portion of these people claiming that their property's home insurance coverage is someone else's job in the household. Just 7% declared they know they don’t have enough insurance to recover from a fire.

18% of people aren't sure whether their home insurance policy offers suitable protection from fires.

Fortunately for most people, a standard home or renters insurance policy covers fire damage. In fact, insurance policies extend their protection to trees and shrubbery on a property if they're affected by a fire. Insurers even cover fire damage caused by a hazard that's not covered itself, such as an earthquake. In this scenario, the insurer would cover the damage that the fire caused. However, there are a few elements that could complicate a policyholder's coverage.

Insurers don't cover losses that result from mechanical breakdown. Relatedly, electrical fires that are caused by faulty repair or poor maintenance won't be covered under most policies. A policyholder's coverage may also be complicated if the property owner has a high-risk home in a fire-prone location where insurers have limited their liabilities due to recurring losses. Policyholders should contact their insurance company to be clear on their level of protection before a fire breaks out — especially if policyholders are among the 18% who don't know what their home insurance covers.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,213 U.S. consumers from April 14-21, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

-

Gen Zers: 18 to 24

- Millennials: 25 to 40

- Gen Xers: 41 to 55

- Baby boomers: 56 to 75

While the survey also included consumers from the silent generation (defined as those age 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.