Credit Cards

Credit Card Usage and Ownership Statistics

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Citi is an advertising partner.

The credit card industry has a huge effect on everyday life in the U.S., as the average American owns multiple credit cards with balances reaching thousands of dollars. Credit card ownership and usage are, at least partly, driven by a few key credit card industry trends, like easy access to credit. Below, we examine credit card statistics and trends for individuals and the industry alike.

Card ownership and usage: Quick facts

Credit card statistics on the average American: The average American has a credit card balance of $5,910 and a credit score of 714. [1]

Question | Figure |

|---|---|

| What is the average credit card debt per person? | $5,910 |

| What is the average credit score? | 714 |

| What is the average credit utilization rate? | 28% |

| What percentage of people have a credit card? | 82% [2] |

How do people use credit cards?

Out of 165.3 million credit card users [3], many cardholders carry a balance month to month. The Q3 2022 report by the American Bankers Association — the most recent available — highlights that 43.4% of credit card users are revolvers, meaning they carry a balance to the next month at least once every quarter. Another 33.6% of credit card users are transactors, which means they don't carry a balance and have no financing charges. The remaining 23.0% of credit card users show no activity. [4]

Credit cards trail slightly behind debit as the most popular payment option, according to 2022 findings from the Federal Reserve Diary of Consumer Payment Choice (28% of respondents preferred credit as a form of payment in 2021, versus 29% for debit and 20% for cash). That’s a significant change from 2019, when consumers preferred debit by 6 percentage points over credit (30% versus 24%) and even preferred cash over credit (26% to 24%). [5]

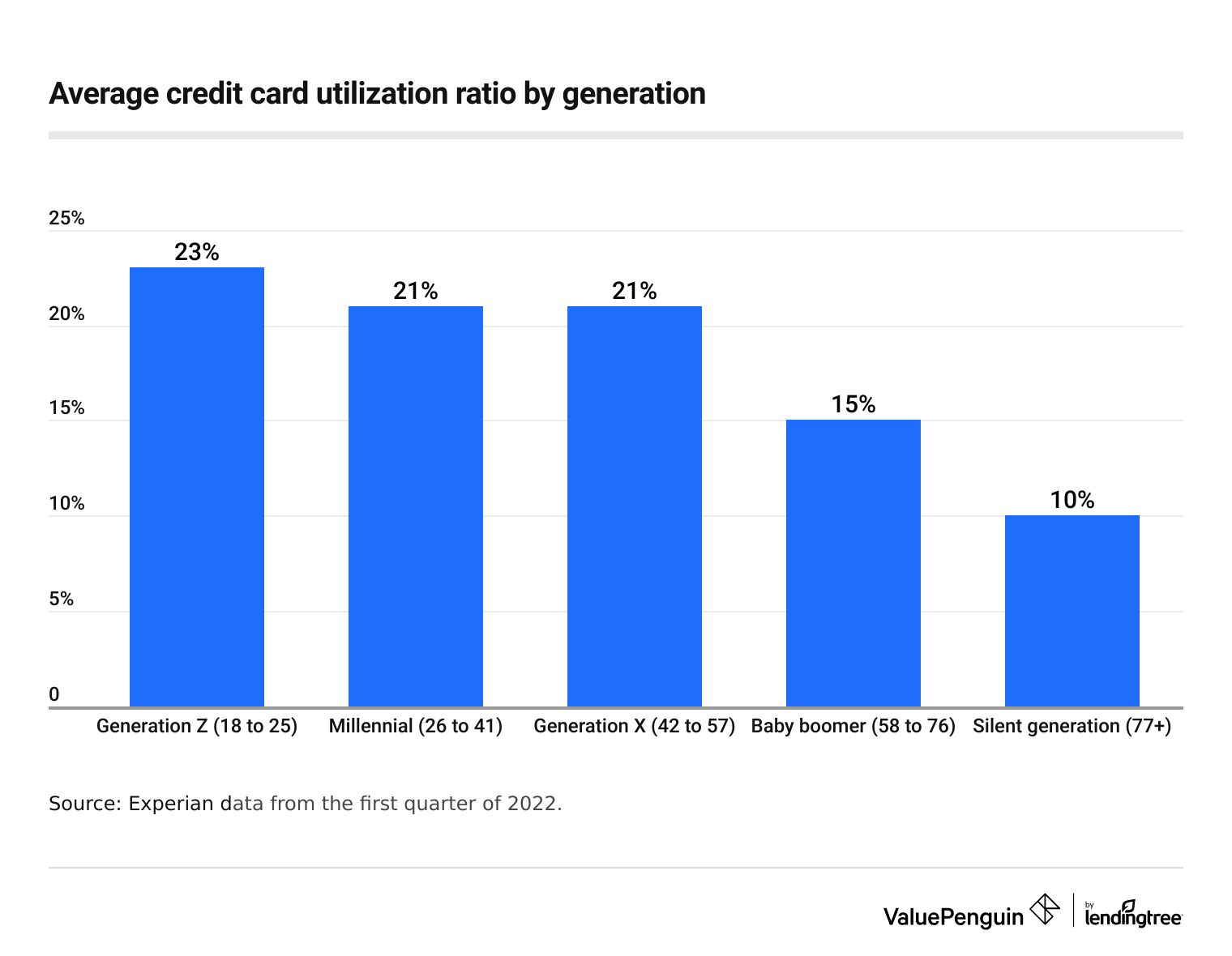

Credit card utilization rates

U.S. consumers, on average, use 28% of their credit card limits. [1] According to an earlier report, Generation Zers have the highest average revolving credit utilization rates at 23% (as of the first quarter of 2022). [6]

Credit limits

What is the average credit limit? Credit limits vary widely depending on a consumer's creditworthiness. The average credit limit for a new account was $5,421 in the first quarter of 2023 (up from $5,226 in the first quarter of 2022), according to a TransUnion report. [3]

Credit card delinquency

In the first quarter of 2023, 8.24% of credit card account balances were at least 90 days late. This is a decrease from the first quarter of 2022, when 8.42% of credit card accounts had a delinquency greater than 90 days. [7]

Credit card ownership and debt statistics

A survey conducted by the Federal Reserve revealed that 82% of American adults owned at least one credit card in 2022. [2]

Credit card ownership by age: People older than 60 are most likely to own a credit card (92%). The rate of credit card ownership decreases by age bracket: 86% for people ages 45 to 59, 79% for people ages 30 to 44 and 67% for people ages 18 to 29. [8]

Credit card statistics by state

Residents of Minnesota have the highest average credit score in the nation at 742, while residents of Mississippi have the lowest at 680. [9] Mississippi residents also have the highest credit utilization rate at 31%, which is 3 percentage points higher than the national average. [10]

State | Average FICO credit score (September 2022) | Average credit card utilization ratio (May 2020) |

|---|---|---|

| Alabama | 691 | 29% |

| Alaska | 723 | 29% |

| Arizona | 712 | 26% |

| Arkansas | 694 | 28% |

| California | 721 | 24% |

| Colorado | 730 | 24% |

| Connecticut | 725 | 24% |

| Delaware | 714 | 25% |

| District of Columbia | 716 | 24% |

| Florida | 707 | 28% |

| Georgia | 694 | 30% |

| Hawaii | 732 | 26% |

Source: Average FICO credit scores are from September 2022, while average credit card utilization ratios are from May 2000, both from Experian.

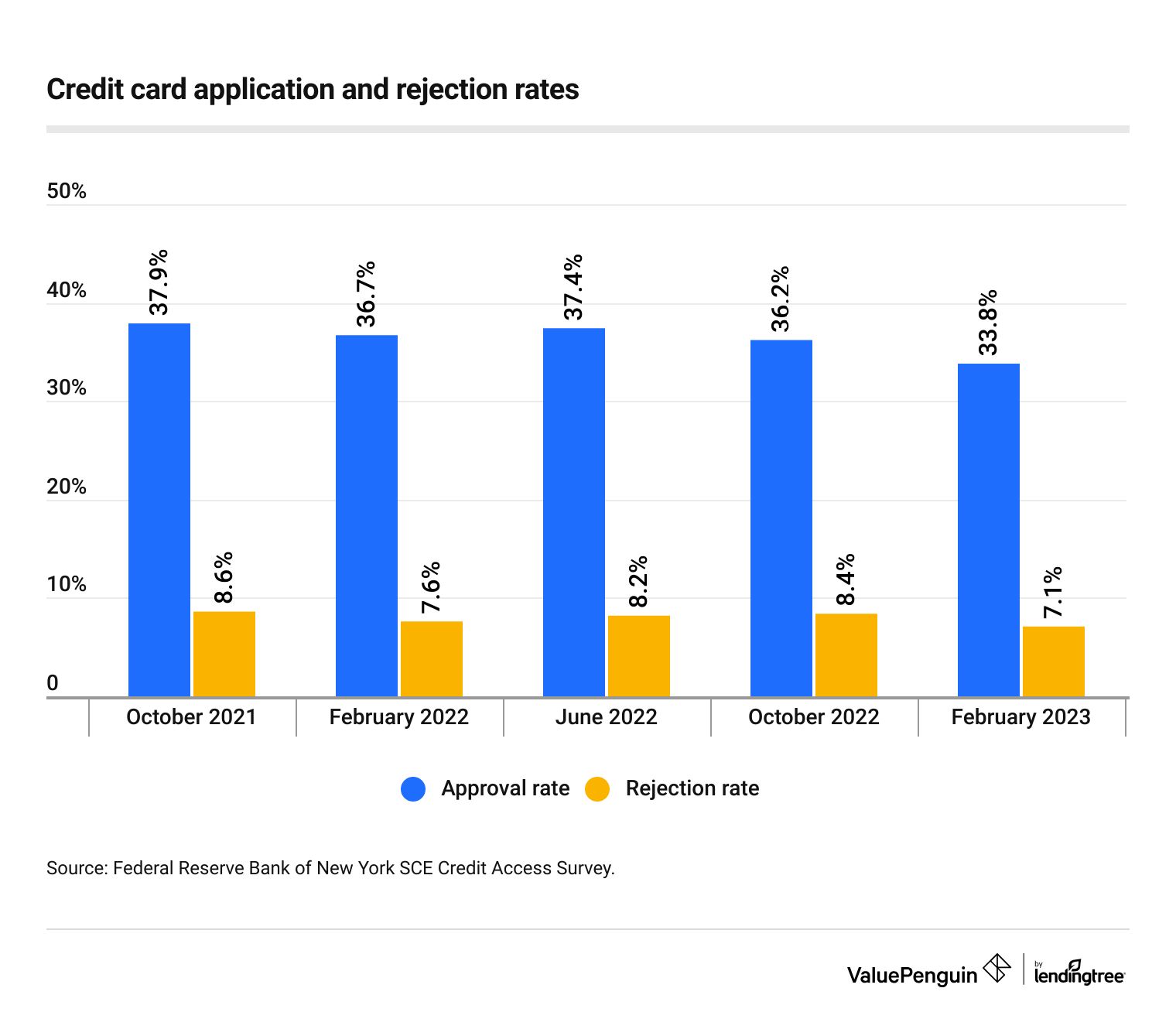

Credit card application and rejection rates

Credit card application rates declining: According to a survey from the Federal Reserve Bank of New York, 24.2% of respondents in February 2023 said they submitted a credit card application in the past 12 months. This is down from 27.7% in June 2022, but well above the 15.7% in October 2020 at the height of the coronavirus pandemic. [11]

Respondents’ expectation of their credit card application being rejected increased slightly, up to 24.4% in February 2023 from 23.8% in October 2022. Still, that’s far lower than 35.1% in October 2020. [11] Credit access also decreasing: The per-applicant credit approval rate (for all types of credit) fell to 33.8% in February 2023 from 36.2% in October 2022. However, the rejection rate fell as well, dropping to 7.1% in February 2023 from 8.4% in October 2022. [11]

Credit access also decreasing: The per-applicant credit approval rate (for all types of credit) fell to 33.8% in February 2023 from 36.2% in October 2022. However, the rejection rate fell as well, dropping to 7.1% in February 2023 from 8.4% in October 2022. [11]