Homeowners Insurance

Tornadoes Caused $2.5 Million in Damage Per Storm Across U.S. in Past Decade

Tornadoes affect far more states than those that comprise Tornado Alley — the stretch of the central U.S. where clashes of cold and warm air can produce the right conditions for tornadic activity — a ValuePenguin study of the last decade of data from the National Weather Service (NWS) and the National Centers for Environmental Information (NCEI) reveals. In the past decade, tornadoes have caused more than $14.1 billion in total damage across the U.S.

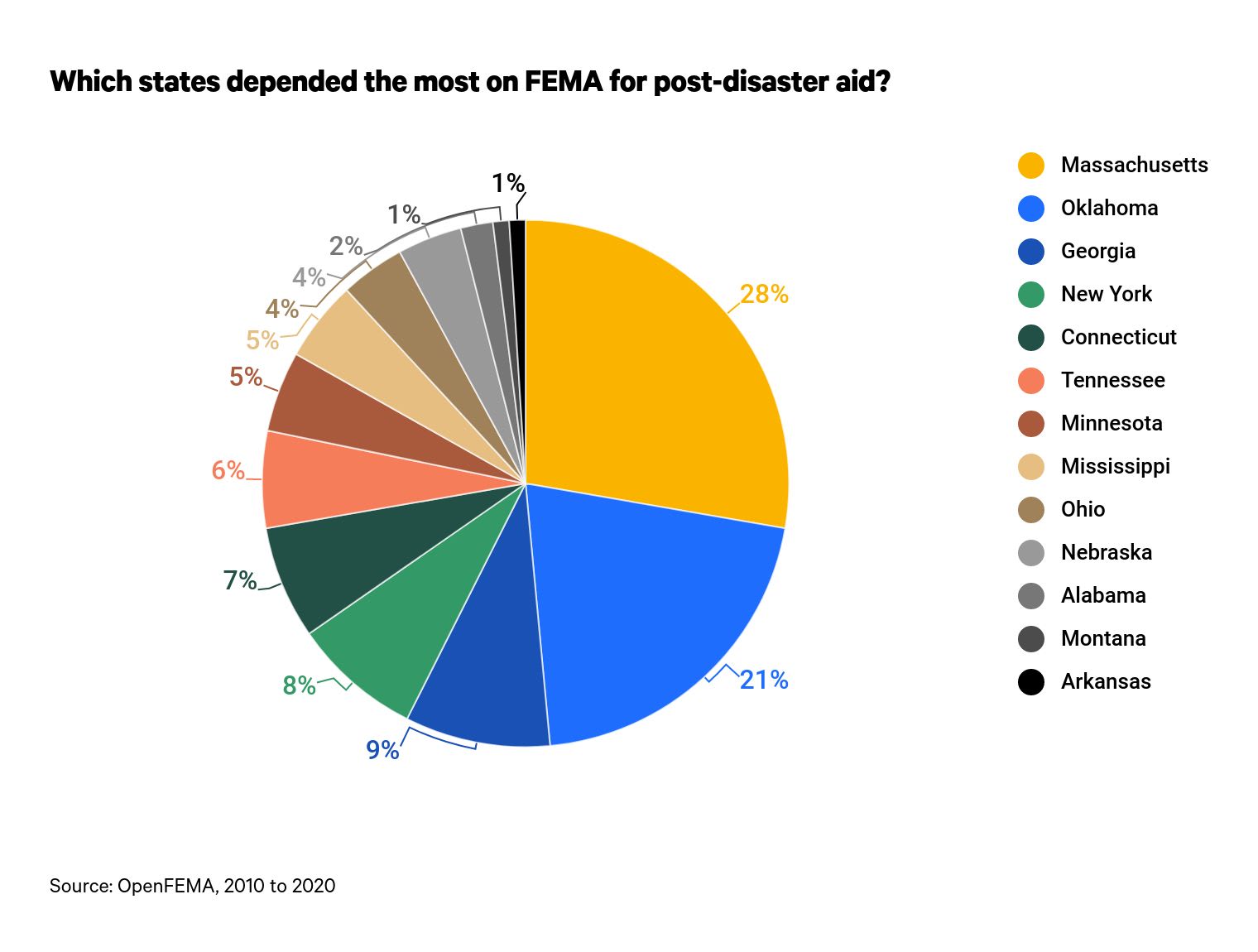

From 2010 through 2020, tornadoes resulted in $2.5 million in property damage per storm. In response to the devastation, the Federal Emergency Management Agency (FEMA) allotted nearly $360 million in public assistance to states that were hit especially hard by tornadoes — more than $22 million per disaster declaration. FEMA's records show that just two states received nearly 50% of the agency's disaster relief funds during this period, with unlikely Massachusetts leading the way.

But while the federal government's efforts to repair tornado damage pose a multibillion-dollar financial commitment, data from insurers doesn't indicate that affected property owners will face huge premium increases if a storm destroys their homes. Rather, rate information shows an average per-year increase of only $180 in the states most likely to experience the greatest number of tornadoes.

Key findings

- In the past decade, tornadoes have caused $2.5 million in damage per storm, for a total of more than $14.1 billion — along with nearly 1,000 deaths.

- Since 2010, FEMA has allotted $359,768,106 in public assistance to states that have been hit by strong tornadoes — or $22,485,507 per disaster that required federal assistance.

- Just five states (Texas, Illinois, Mississippi, Alabama and Arkansas) account for more than half of the damage caused by tornadoes during this time. And two states received just shy of 50% of FEMA's money during this period — with Massachusetts leading the way.

- Tornadoes affected every state except Alaska in the last decade, causing at least thousands of dollars of property damage in all but two states and the District of Columbia.

- In the 13 states that are most prone to tornadoes, homeowners generally don't face punitive increases to their premiums after a catastrophic loss. Insurance rates increased by an average of 8% following a total loss.

Tornadoes caused more than $2.5 million in property damage per storm and resulted in nearly 1,000 fatalities

From 2010 to 2020, a total of 5,710 tornadoes spawned across every state but Alaska — even one in Washington, D.C. Combined, tornadoes destroyed more than $14.1 billion in property and crops across the 48 states that had damages. In each of Alabama, Texas, Mississippi and Illinois, twisters dealt out more than $1 billion in damages. These states, all in or adjacent to Tornado Alley, saw 1,167 storms from 2010 to 2020 — one-fifth of the country's total. However, many of the places that experienced the most storms and the most damage aren't necessarily tornadic hot spots.

Despite experiencing fewer tornadoes relative to the most-affected areas, Ohio, Tennessee, Georgia and North Carolina suffered more economic devastation than states with more storms.

A comparison of the distribution of storms and the total amount of damage they inflicted shows that the amount of tornadoes an area experienced didn't have a directly proportional relationship to the cost of damage the storms caused.

Our comparison showed that the states in the top 25th percentile experienced at least 185 tornadoes during the last decade. At the same time, storms wrought at least $325.7 million worth of destruction to the top quarter of most-damaged states. But the states at the top of both categories weren't the same.

Five states — Florida, Oklahoma, Minnesota, Colorado and Nebraska — experienced a higher proportion of total tornadoes relative to other states, but saw less damage. There were an average of 218 tornadoes in these states, higher than the 185 that marks the top 25% most-affected states. At the same time, storms caused more than $122.5 million in property damage in these states, on average — closer to the median in terms of damage.

Similarly, relatively fewer storms hit Ohio, Tennessee, Georgia and North Carolina compared to the most-affected states. But the storms that did hit these four were more damaging to these communities. While an average of 149 tornadoes touched down in these states from 2010 to 2020, they caused an average of nearly $696.4 million in damage — more than double the threshold of damage experienced by states in the top 25% of most financially devastated regions.

State | Storms | Total damage | Deaths |

|---|---|---|---|

| Texas | 513 | $1,680,406,750 | 35 |

| Kansas | 290 | $592,861,900 | 4 |

| Florida | 261 | $103,238,400 | 3 |

| Illinois | 247 | $1,417,129,000 | 23 |

| Oklahoma | 216 | $188,914,500 | 69 |

| Missouri | 216 | $674,986,150 | 174 |

| Louisiana | 215 | $470,875,700 | 16 |

| Mississippi | 211 | $1,465,197,100 | 94 |

| Minnesota | 208 | $212,086,500 | 5 |

| Colorado | 205 | $2,753,000 | 0 |

| Iowa | 204 | $407,948,300 | 4 |

| Nebraska | 202 | $105,584,000 | 2 |

States ordered by number of tornadoes.

FEMA devoted more than $22 million per storm to help states recover from tornado-inflicted damage

While the National Weather Service reported a total of 5,710 storms from 2010 to 2020, not every storm produced enough devastation to warrant federally backed disaster relief from FEMA. In fact, the agency's records convey that there were only 16 disaster declarations that necessitated federal assistance.

How does FEMA help after a tornado? FEMA provides disaster grant assistance that aids in debris removal, emergency response and protective measures, and the restoration of publicly owned facilities, including repair or replacement after a natural disaster. The agency also grants money to the state, but our figures don't reflect these funds.

Tornadoes that FEMA committed federal assistance to yielded more than $22 million in damage per storm. Moreover, only 13 states experienced these storms despite the fact that there were 16 separate disaster declarations that necessitated a federal response. Since few states — Mississippi, Oklahoma and Arkansas — experienced more than one disaster that resulted in a FEMA response, the per-disaster cost at the state level was astronomical.

The state that most depended on FEMA funds was not in Tornado Alley. A severe outbreak in 2011 resulted in Massachusetts receiving more than $100 million in FEMA money — 28% of the total amount that the agency dedicated to after-storm responses during the time frame ValuePenguin examined. Oklahoma, much more conventionally associated with frequent tornadoes, received 21% of the public assistance funding.

FEMA public assistance money is different from property damage. For this study, property and crop damage were combined into one concise figure, though they are split in the National Weather Service's records.Property damage broadly encapsulates damage a storm causes, as documented by a range of sources, including the insurance industry, state and local officials, and journalists. Comparing public assistance funds to the overall damage a storm caused underscores the severity of federally designated disaster events relative to regular property damage.

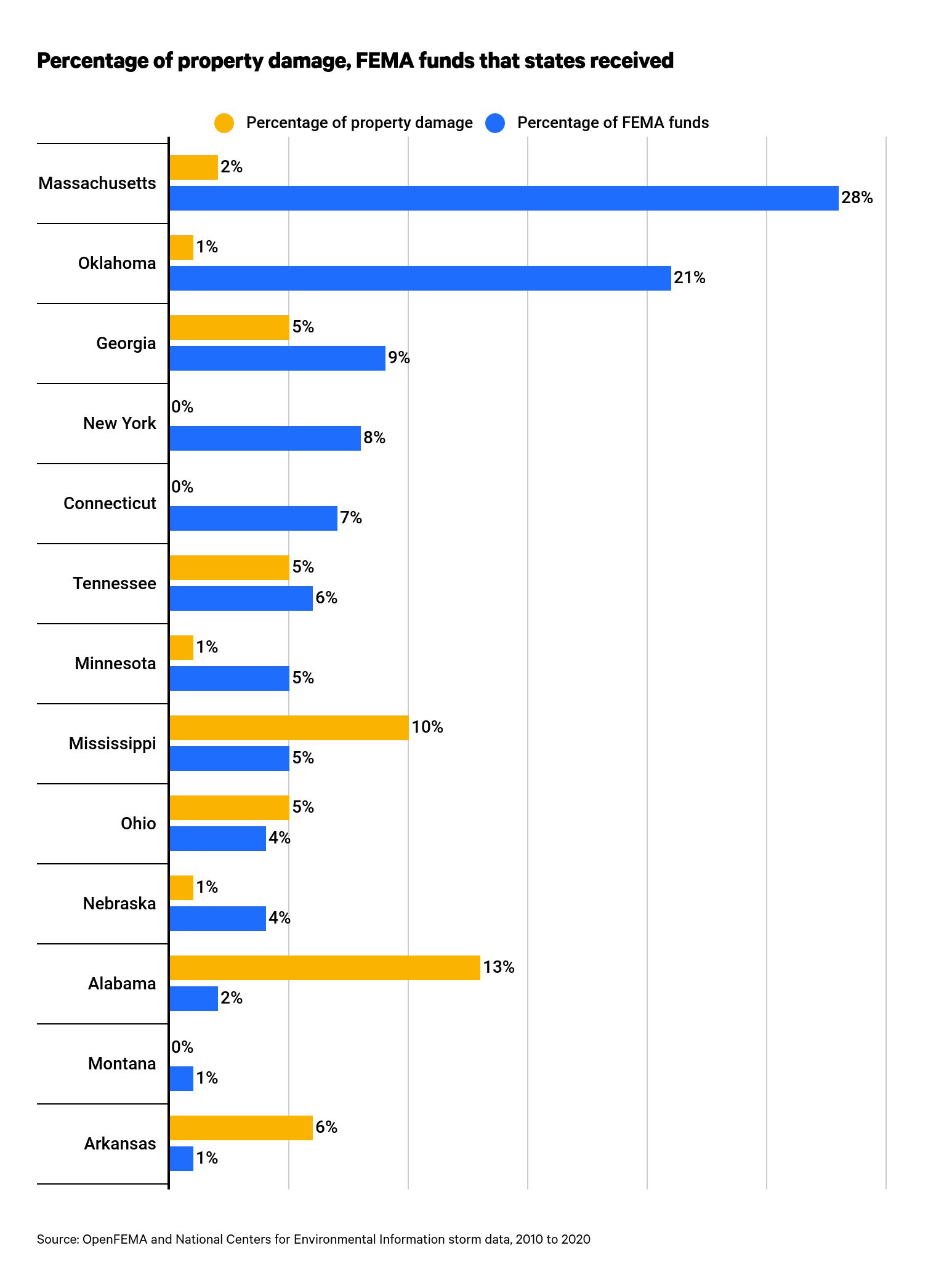

For instance, Connecticut, another unlikely casualty of the New England 2011 tornado outbreak, received more than $24.7 million in FEMA funding. The NCEI shows that the 21 tornadoes that Connecticut experienced from 2010 to 2020 resulted in just nearly $9.8 million in property damage. This means that public assistance outran property damage by 253% in Connecticut.

State | Property damage | FEMA funds | FEMA funds to property damage |

|---|---|---|---|

| Connecticut | $9,772,000 | $24,738,993 | 253% |

| New York | $57,507,000 | $29,527,634 | 51% |

| Massachusetts | $243,463,300 | $100,452,147 | 41% |

| Oklahoma | $188,914,500 | $76,338,674 | 20% |

| Nebraska | $96,627,000 | $13,098,375 | 14% |

| Montana | $33,056,500 | $4,095,886 | 12% |

| Georgia | $653,599,000 | $32,553,937 | 5% |

| Tennessee | $720,122,000 | $20,667,668 | 3% |

| Ohio | $780,848,500 | $15,036,096 | 2% |

| Mississippi | $1,384,782,600 | $17,018,757 | 1% |

| Minnesota | $208,038,500 | $17,285,168 | >1% |

| Alabama | $1,898,707,700 | $5,464,731 | >1% |

An examination of the percentage of FEMA funds a state received compared to the percentage of property damage reveals the same disparity. FEMA contributed nearly $360 million to tornado recovery. Massachusetts was allocated 28% of this sum. At the same time, the property damage that tornadoes caused in the state amounted to only 2% of the $14.1 billion in damage that storms did in the entire country. Just one disaster has the potential to rack up substantially higher recovery bills than a series of tornadoes, as long as they don't meet the government's classifications of a disaster event.

Insurance prices only rose by an average of 8% after a storm in the states where tornadoes were most likely to occur

Despite the destructive capabilities of tornadoes, insurance rate data shows that prices aren't likely to raise too highly after a storm. An analysis of the states most likely to experience the greatest number of tornadoes shows that rates rose by an average of $180 a year (8%) after a total loss. This examination focuses on the following states:

- Texas

- Kansas

- Florida

- Illinois

- Oklahoma

- Missouri

- Louisiana

- Mississippi

- Minnesota

- Colorado

- Iowa

- Nebraska

- Alabama

Kansans experienced the greatest premium increase after a storm. One total loss resulted in a price increase of 17% — $1,985 to $2,320 after the storm. Homeowners in Louisiana were the least affected by a total loss. However, while the cost of home insurance rose by just 2% following a storm, the premiums in the state were already high — $5,050.

State | Cost before loss | Cost after loss | Increase after loss |

|---|---|---|---|

| Texas | $2,789 | $3,029 | 9% |

| Kansas | $1,985 | $2,320 | 17% |

| Florida | $2,180 | $2,270 | 4% |

| Illinois | $1,257 | $1,406 | 12% |

| Oklahoma | $3,330 | $3,462 | 4% |

| Missouri | $1,950 | $2,191 | 12% |

| Louisiana | $5,050 | $5,175 | 2% |

| Mississippi | $1,513 | $1,681 | 11% |

| Minnesota | $2,197 | $2,279 | 4% |

| Colorado | $3,423 | $3,630 | 6% |

| Iowa | $1,477 | $1,538 | 4% |

| Nebraska | $2,231 | $2,556 | 15% |

States ordered according to the number of tornadoes each experienced.

Methodology

ValuePenguin collected storm data, including volume, affected states, property and crop damage and death figures, from the National Oceanic and Atmospheric Administration's (NOAA) National Centers for Environmental Information, which posts storm data aggregated from the National Weather Service.

Our data reflects unique storm episodes, rather than events. In the National Weather Service's reporting, unique episodes can have more than one event. A new event may occur when a storm crosses state lines or recedes and descends from the clouds.

Using OpenFEMA, which hosts financial information pertaining to federal aid granted to disaster zones, ValuePenguin found the number of states that received federal funds after a tornado.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, as your quotes may be different.