Health Insurance

Nearly Half of Insured Americans Skip Dental Visits, Procedures Due to Cost

Some people are afraid to go to the dentist — and the pandemic didn’t help. At the beginning of the coronavirus crisis, the American Dental Association recommended that dentists put elective procedures on hold. A few months later, the Centers for Disease Control and Prevention (CDC) called for nonemergency dental care to resume, issuing guidance on best practices for sterilization and disinfection. Still, this didn’t alleviate everyone’s fears.

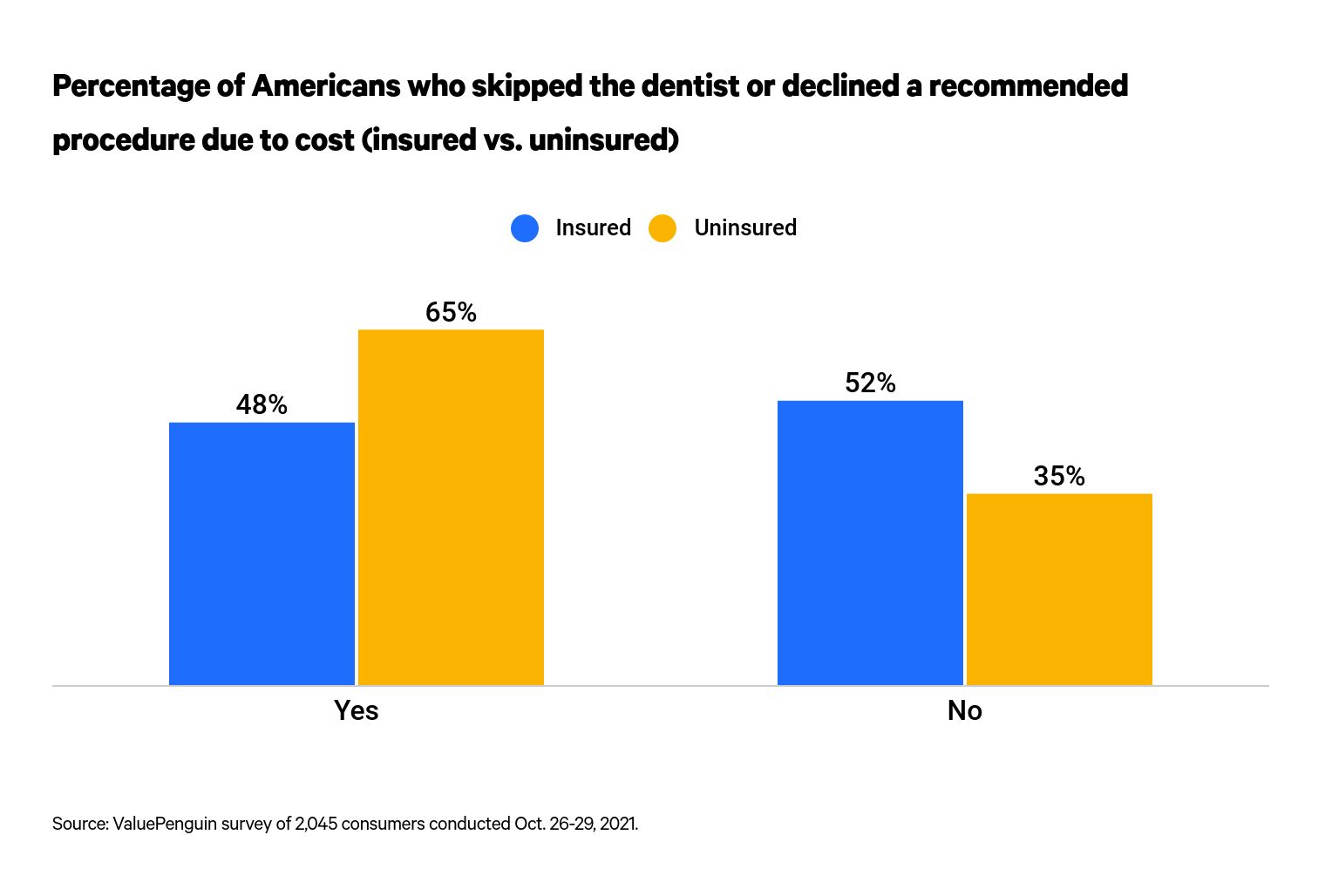

On top of these challenges, 48% of insured Americans have skipped dental visits or recommended procedures because of cost, according to the latest ValuePenguin survey of more than 2,000 Americans. When looking at Americans without dental insurance, that percentage jumps to 65%.

Not getting routine and recommended dental care is risky and can have unintended health consequences. Below, you’ll find an overview of some of the most interesting details and tips on finding affordable dental insurance or care when needed.

- Key findings

- Is it bad to skip the dentist? Nearly half of insured Americans have done so because of cost

- Not taking better care of teeth tops list of dental regrets; uninsured Americans twice as unhappy about their teeth overall

- How often Americans go to the dentist, what they’re having done — and whether their dental insurance has done its job

- Tips for choosing a dental insurance plan

- Methodology

Key findings

- Nearly half (48%) of Americans with dental insurance have skipped dental visits or recommended procedures due to cost. Among those who aren’t insured, 65% have skipped the dentist for the same reason.

- Baby boomers are least likely to have dental insurance, and most say it’s due to Medicare. 38% of baby boomers don’t have dental insurance, and 42% within that group say it’s because their Medicare plan doesn’t cover dental.

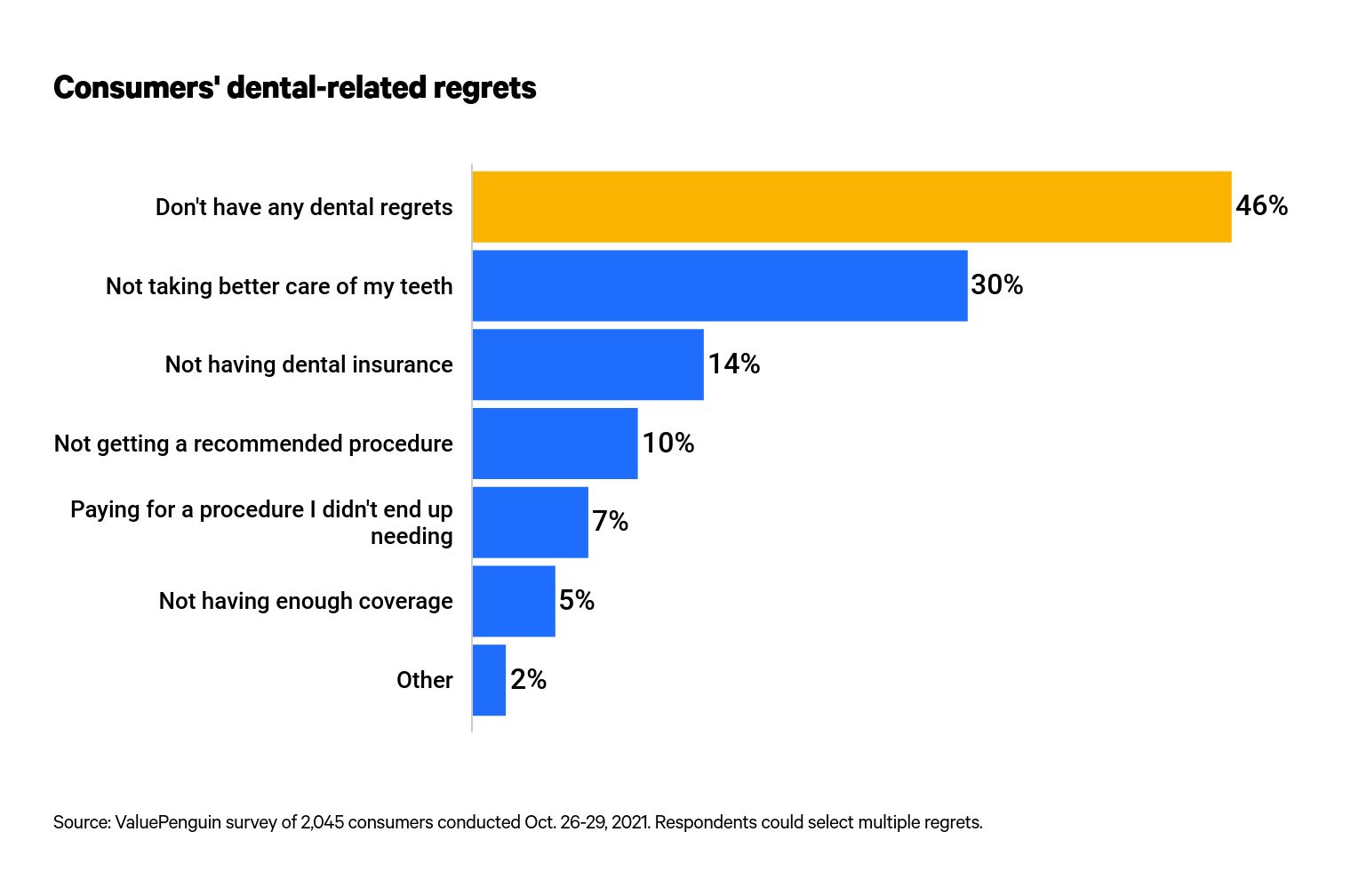

- Nearly 30% of those without dental insurance regret not being covered. And 30% of all Americans (both insured and uninsured) regret not taking better care of their teeth.

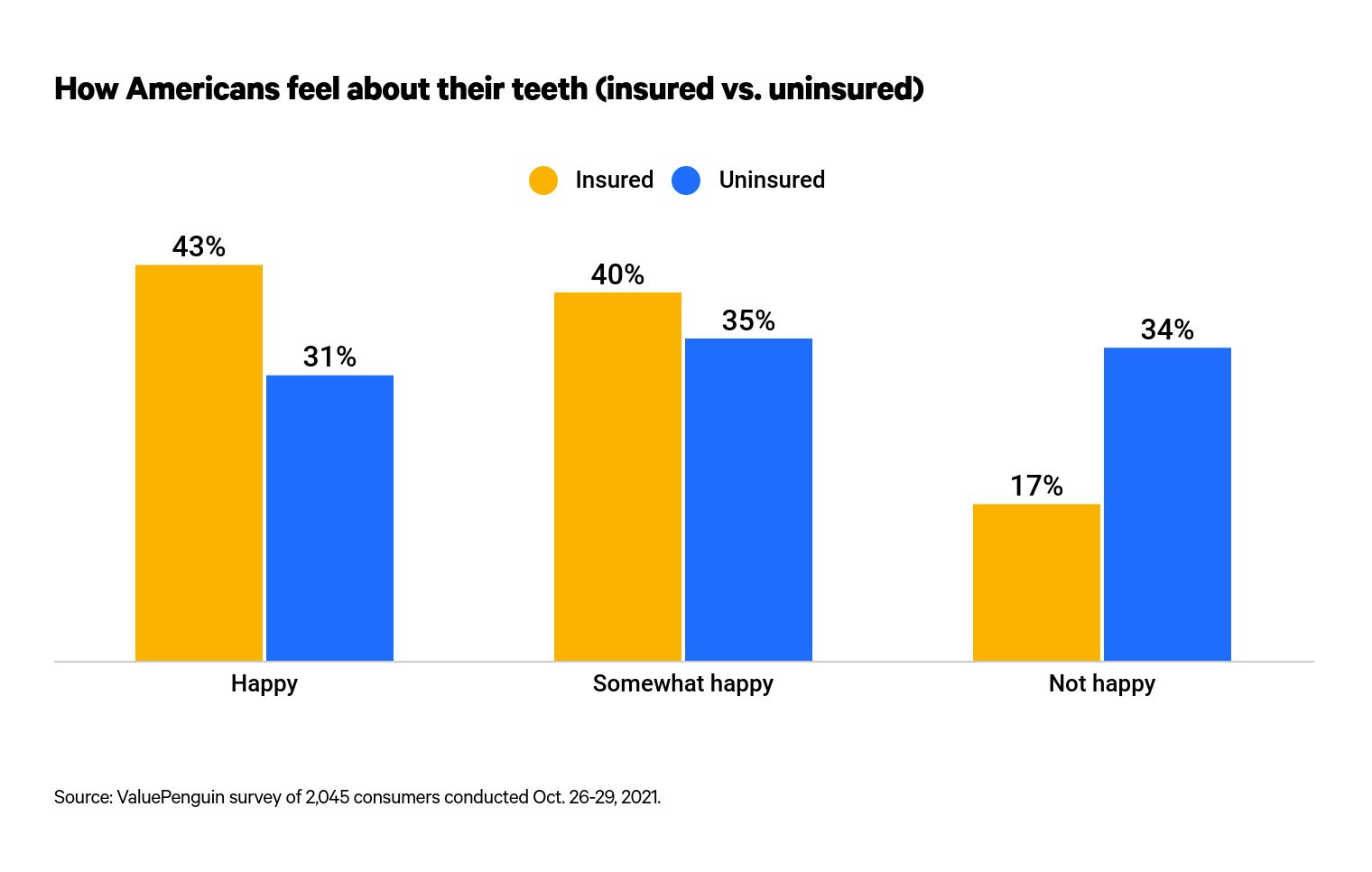

- Those without dental insurance are twice as likely to be unhappy with their teeth as those who are insured. 34% of those without insurance are not satisfied with the condition of their teeth, compared with 17% of those who are insured.

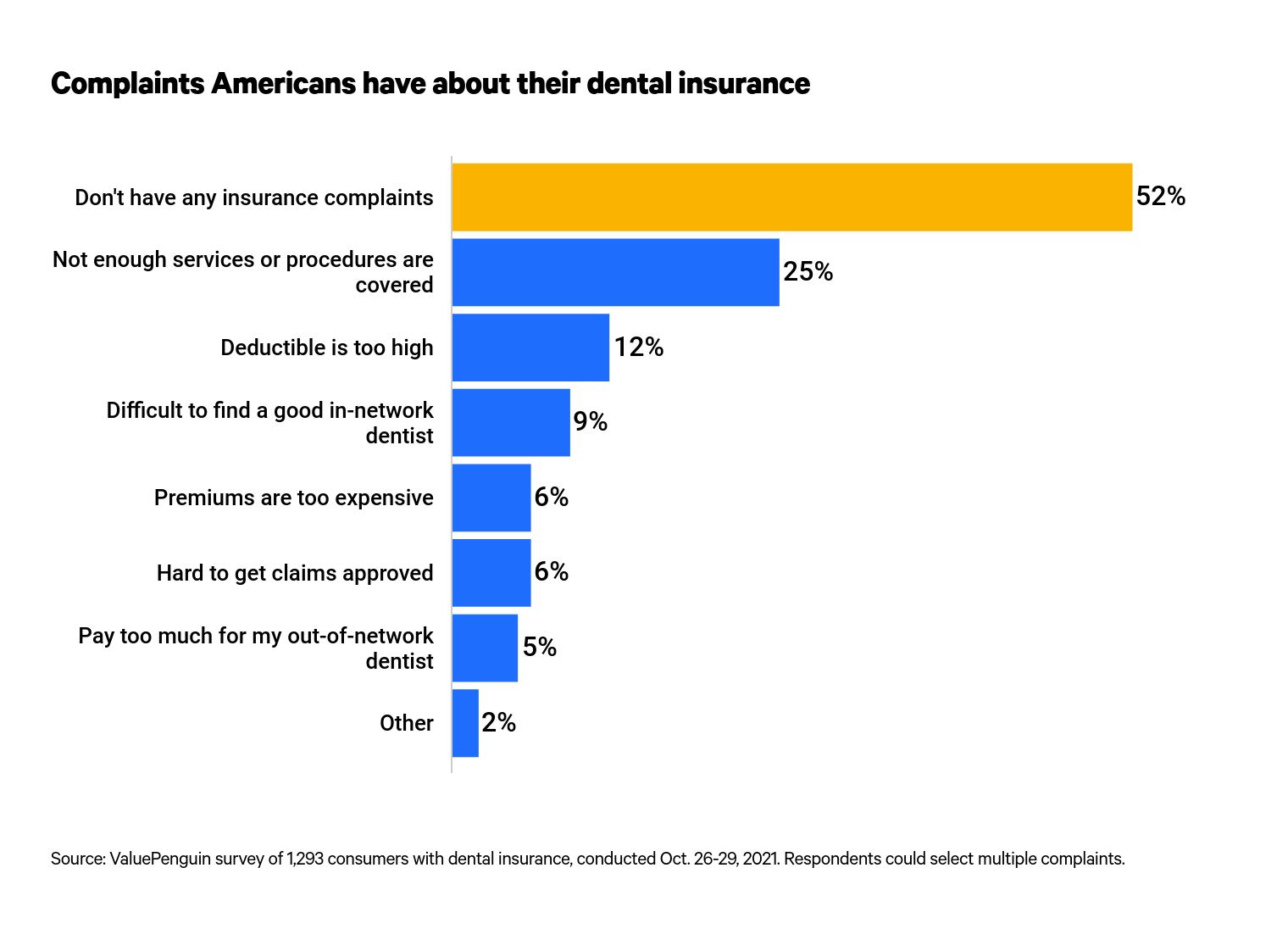

- As for consumers who have insurance, their main gripe is that not enough services or procedures are covered (cited by 25%). In total, 48% of insured Americans have at least one complaint about their policy or insurer.

Is it bad to skip the dentist? Nearly half of insured Americans have done so because of cost

Skipping the dentist comes with various risks. The CDC recommends getting preventive dental care regularly to maintain good oral health and to discover potential problems earlier. ValuePenguin technical writer Robin Townsend adds that a lack of dental care could contribute to unexpected health problems like heart disease or pneumonia.

But even dental insurance coverage may not absorb enough of the cost to help people afford the care they need. Close to half (48%) of respondents with dental insurance say they’ve declined a dentist-recommended procedure or skipped the dentist altogether due to cost concerns.

And there’s a meaningful difference between insured and uninsured Americans where dental visits are concerned. A sizable 65% of uninsured Americans say they’ve passed on dental care due to financial reasons.

The expense of going to the dentist has negatively impacted women (57%) more than men (51%). And Gen Xers (ages 41 to 55) are most likely to have skipped the dentist because of cost, anxiety or both, at 58%.

Fear of the dentist gets in the way of oral health for many people, but Gen Zers (ages 18 to 24) lead the pack. At 17%, this group has skipped the dentist due to fear or anxiety more than any other generation.

Medicare and dental insurance coverage

As noted, those with dental insurance are 17 percentage points more likely to get routine or recommended dental procedures than those without. And more baby boomers (ages 56 to 75) lack dental coverage (38%) than any other generation, with most pointing to Medicare shortcomings as the underlying reason.

Medicare provides very little financial assistance for dental care. With Medicare Part A hospital insurance, you may be covered for complicated or emergency dental services received during an inpatient hospital stay. Cleanings, dentures, tooth extractions and other dental procedures, however, aren’t covered by Medicare.

Medicare recipients who want to establish services can seek supplemental dental coverage via many Medicare Advantage plans, which private insurers run. Even these options, however, can come with a cap on benefits.

U.S. Rep. Lloyd Doggett of Texas in July introduced the Medicare Dental, Vision and Hearing Benefit Act of 2021. The bill was referred to the Subcommittee on Health, where it remains.

Improving access to dental, vision and hearing coverage is part of the Biden administration’s fiscal agenda, but a Medicare dental provision isn’t part of the latest version of the Build Back Better spending and tax plan.

Until there’s a change, there are some strategies you can use to get a cheap dental cleaning without insurance. From joining a dental network to visiting a dental school to trying a do-it-yourself dental cleaning kit, you can find more affordable ways to take care of your teeth if you don’t have dental coverage in place.

Not taking better care of teeth tops list of dental regrets; uninsured Americans twice as unhappy about their teeth overall

Dental insurance isn’t required under the Affordable Care Act, also known as "Obamacare." Nonetheless, it’s available under some health care plans or stand-alone policies.

Many of those who don’t secure dental insurance end up wishing they had coverage. Close to 3 in 10 (28%) uninsured Americans regret not having dental coverage in place. Across all respondents, the percentage of Americans who regret not having this coverage is 14%.

Three in 10 Americans regret that they didn’t take better care of their teeth. And this is more common among those who earn less money. In households that earn less than $50,000 a year pretax, an average of 34% experience oral-care-related unhappiness.

Similarly, a significant proportion of Americans are unhappy with the overall condition of their teeth. Again, there’s a meaningful difference between the uninsured (34% are unhappy) and those who are fortunate enough to have dental coverage in place (17% are unhappy).

Regret about overall dental condition is more common among the following groups:

- Households earning less than $35,000 a year (35%)

- Gen Xers (28%)

- Women (25%)

Parents must care not only for their dental health but for their children’s. It’s a burden many feel both mentally and financially. In fact, 37% of parents with kids younger than 18 say their children’s dental expenses are a financial strain for the family.

How often Americans go to the dentist, what they’re having done — and whether their dental insurance has done its job

More than a third of Americans — 36% — don’t go to the dentist at least once a year. (And when you look at those with the lowest household incomes, that percentage jumps to 50%.)

Nearly 1 in 4 (24%) Americans visit the dentist once a year, 31% go twice a year and 9% make more than two trips to the dentist annually.

Some dental visits, of course, are for cosmetic purposes. In fact, 42% of Americans have spent money on cosmetic dental procedures at some point during adulthood. The most common procedures were:

- Crowns (18%)

- Professional-grade teeth whitening (10%)

- Braces or Invisalign (8%)

- Dental implants (6%)

Americans have also spent money on plenty of standard dental procedures. Nearly 7 in 10 (68%) respondents have had a cavity filled, compared with:

- Tooth extraction (51%)

- Root canal (35%)

- Braces before adulthood (21%)

Those with dental insurance are more likely to have spent money on both cosmetic and standard dental procedures. And 31% of those without insurance have had a root canal, which can cost nearly $1,000 for those without insurance.

Finally, Americans who are fortunate enough to have dental coverage are still left disappointed in many cases. Almost half (48%) of Americans are unhappy about at least one aspect of their coverage. The most common pain point (25%) is that many dental services and procedures are excluded even with coverage.

Tips for choosing a dental insurance plan

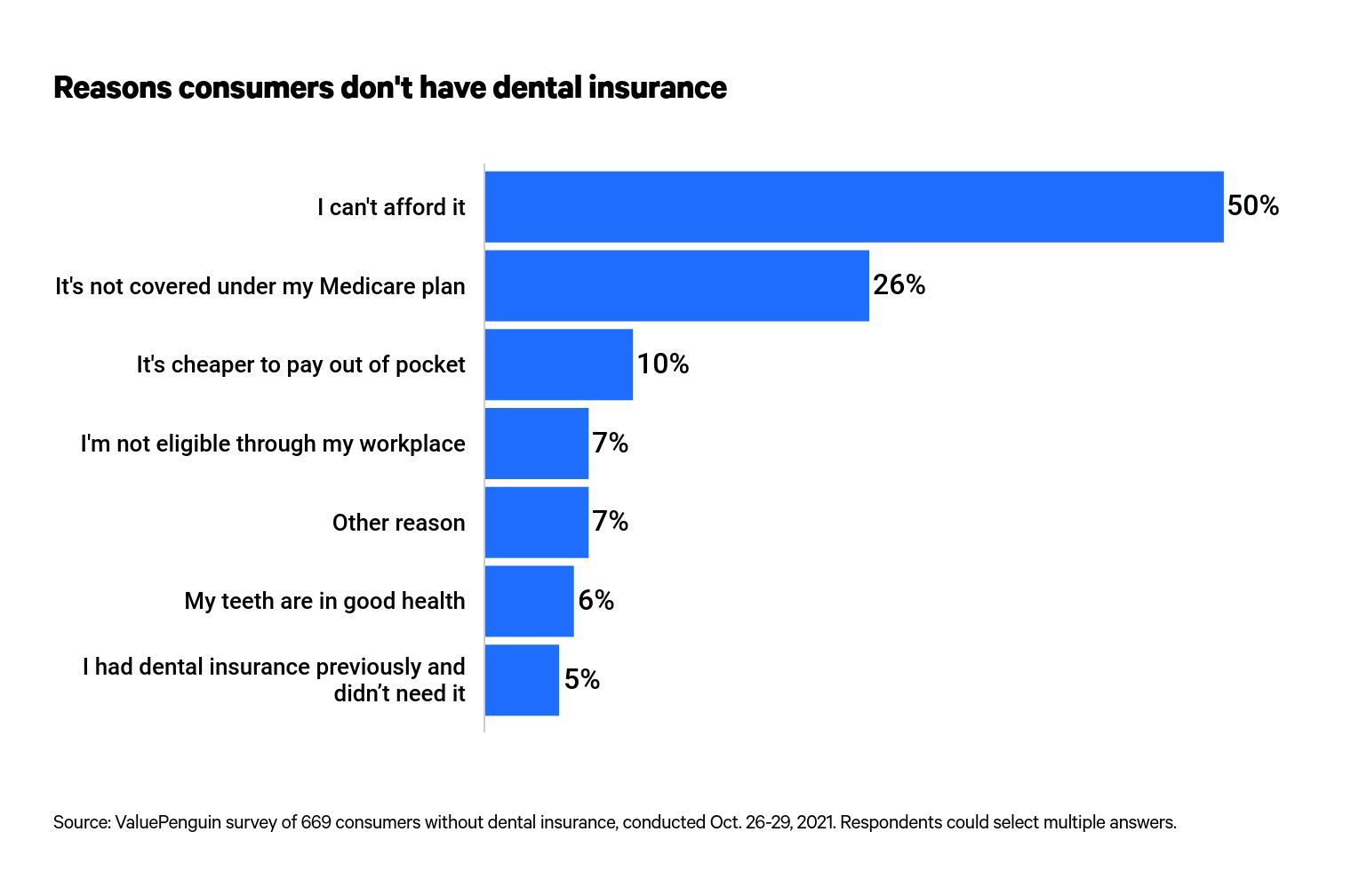

Consumers without dental insurance have plenty of reasons, from not being able to afford it to not being eligible through their employer.

But for those looking to switch dental insurers or establish dental coverage for the first time, there are a few important details you should look for in a provider.

- Review rules regarding preexisting conditions or waiting periods. Townsend warns that private dental plans aren’t subject to Medicare guidelines. Therefore, some policies may include a waiting period for preexisting conditions.

- Make sure the coverage fits your dental needs. Some dental insurance companies will provide multiple coverage levels so that you can adjust your benefits (and premiums) according to the plan that best suits you.

- Pay attention to the provider network. Even if a plan looks good on paper, Townsend advises digging deeper and looking at the provider network. You might not be happy with the policy if your preferred dentist doesn’t accept the insurance.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 2,045 U.S. consumers from Oct. 26 to Oct. 29, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.