Homeowners Insurance

82% of Parents Think It’s Safe for Kids to Play With Fireworks or Sparklers

With summer heating up in the U.S. and so many celebrations missed due to the coronavirus pandemic, it’s conceivable that the demand for fireworks could stay as high as it was during last year’s record-breaking season. Though experts advise consumers to let professionals spark the fuses, 59% of Americans still plan to set off fireworks this summer.

Accidents can happen under any condition, but a lack of training can certainly lead to more or worse accidents and possible financial liability. ValuePenguin researchers surveyed 1,100 consumers to see who might be playing with fire.

Key findings

- Experts encourage consumers to watch fireworks only at professional displays, but most Americans ignore that advice. 74% of respondents — and 86% of parents with kids younger than 18 — plan to be around nonprofessionals setting off fireworks this summer. A further 59% plan to set off their own.

- Be wary of illegal, professional-grade or homemade fireworks. 22% of Americans admit to using these types of fireworks, which account for most fireworks-related accidents.

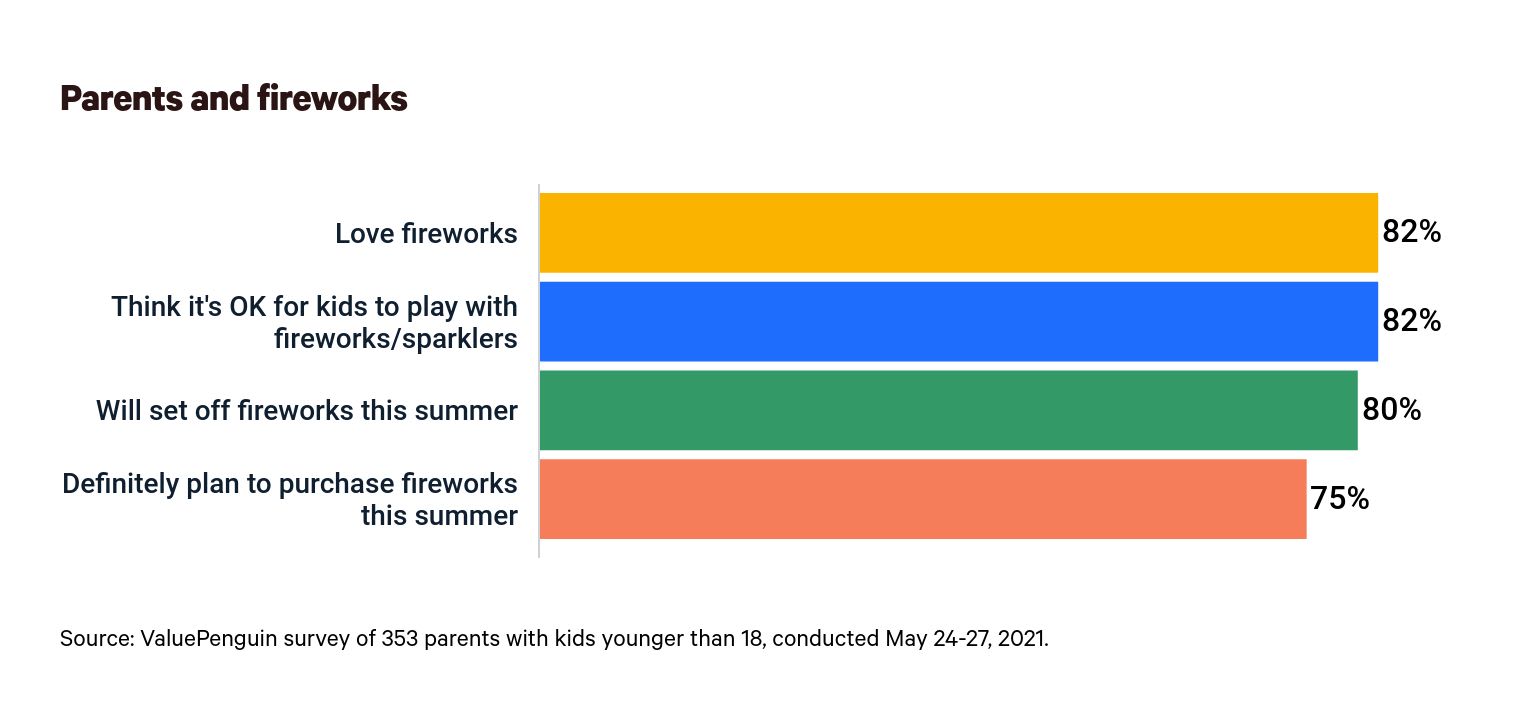

- Fireworks safety education for parents is critical. 82% of parents with kids younger than 18 think it’s OK for children to play with fireworks or sparklers. Those without kids are more likely to believe this is unsafe. Regardless of whether an adult is present, experts say children should never handle fireworks themselves.

- Fireworks can result in injuries and even deaths. 21% of Americans have been injured due to fireworks or sparklers, though less than half had to go to the emergency room. Gen Zers (30%) and men (25%) are among those most likely to be injured.

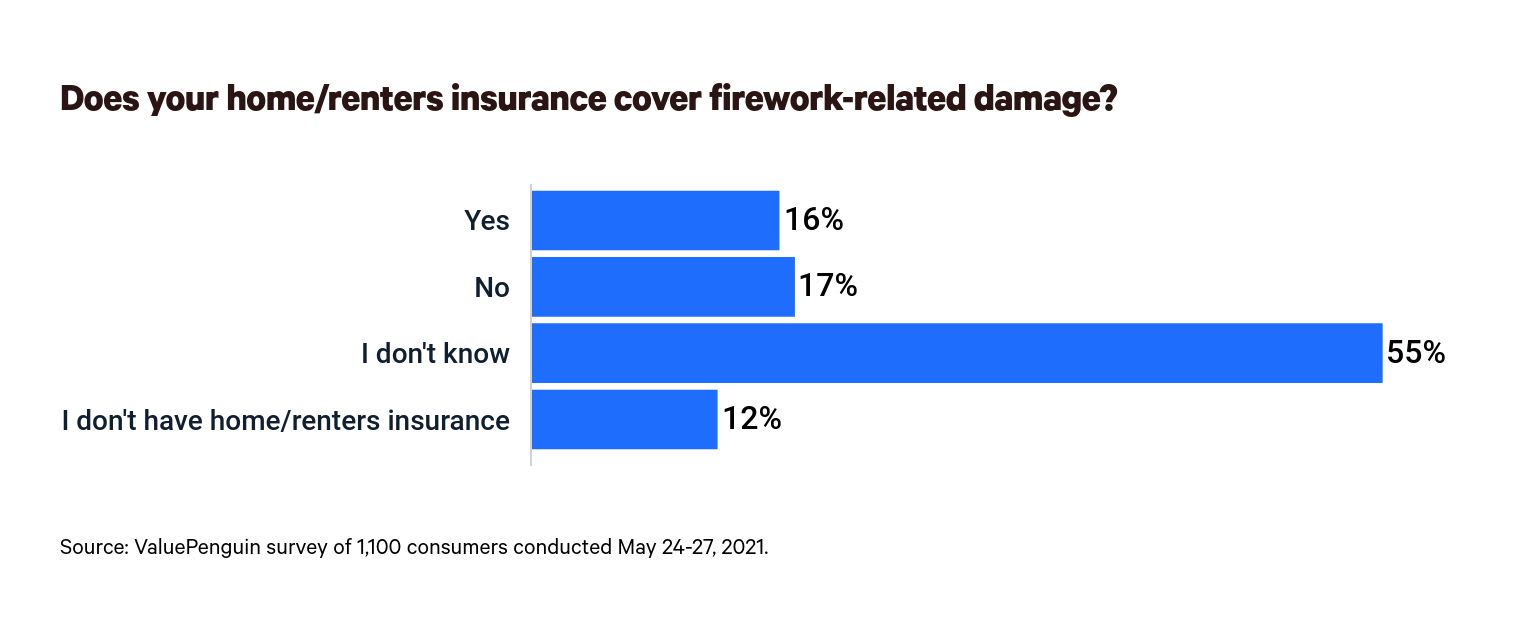

- If you’re setting off fireworks at home, know the insurance-related risks as well as the safety dangers. 55% of Americans have no idea if their home/renters insurance policy covers fireworks-related damage. While most policies cover fires, fireworks can be another story, especially if the damage is caused by illegal activity.

No pro, no problem? Most consumers seem comfortable with amateur pyrotechnicians

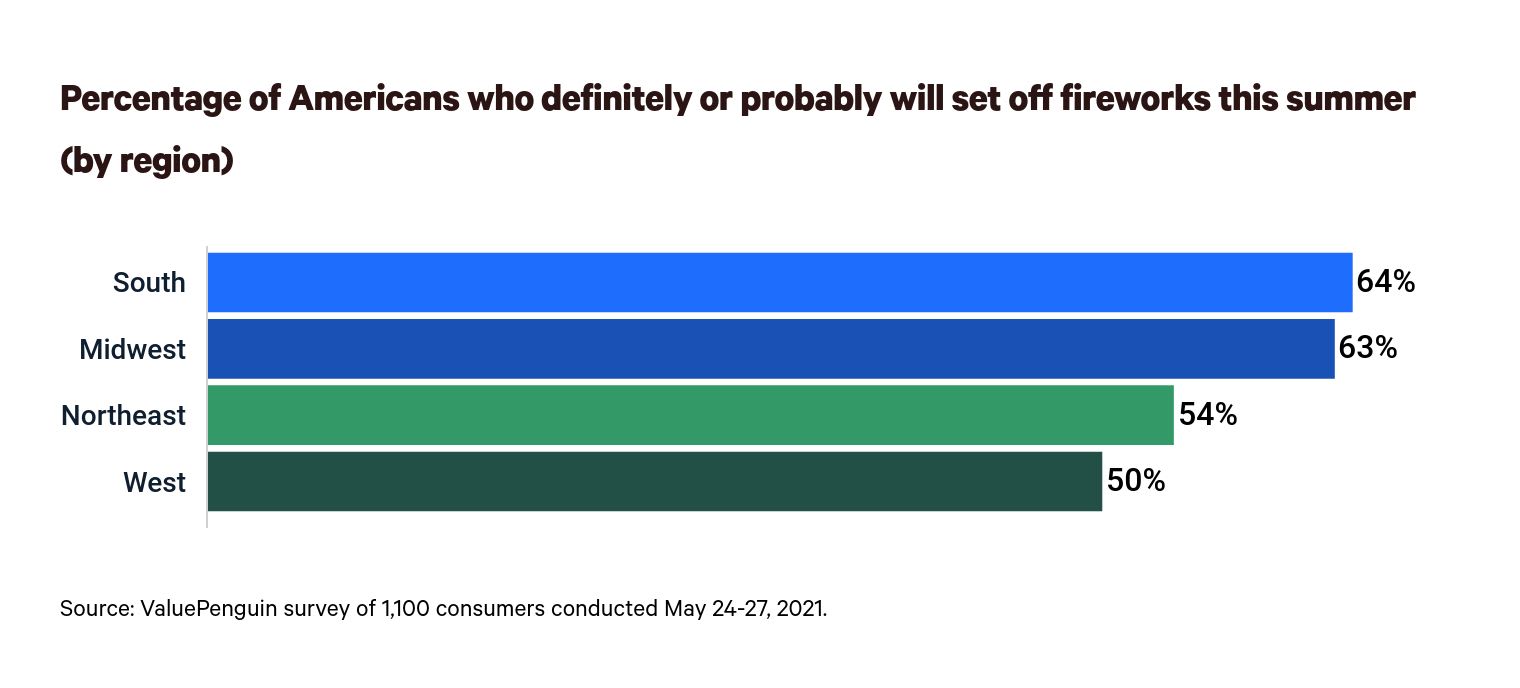

Should organizers of fireworks shows begin with a warning for viewers not to try this at home? Maybe so, as 74% of consumers — and 86% of parents with kids younger than 18 — plan to be around nonprofessionals setting off fireworks this summer. Consumers in the South and the Midwest may be more likely to host DIY fireworks shows, according to the survey findings.

The good news is, consumer-grade fireworks have gotten much safer as their use has grown in popularity. Of course, safer doesn’t mean foolproof — fireworks-related injuries are on the rise again. In fact, the National Electronic Injury Surveillance System (NEISS) reports a 770% increase in fireworks-related injuries in 2020 compared to the year before.

From 2011 to 2020, there were nearly 50,000 fireworks injuries in the U.S.

Year | Number of fireworks injuries | Year-over-year increase |

|---|---|---|

| 2011 | 2,648 | -- |

| 2012 | 2,640 | -0.3% |

| 2013 | 6,858 | 159.8% |

| 2014 | 6,587 | -4.0% |

| 2015 | 5,493 | -16.6% |

| 2016 | 5,131 | -6.6% |

| 2017 | 6,824 | 33.0% |

| 2018 | 1,333 | -80.5% |

| 2019 | 1,282 | -3.8% |

| 2020 | 11,154 | 770.0% |

While it’s plausible that pandemic-related cancellations of professional fireworks displays may have led to more amateur use last summer, 59% of respondents say they still plan to set off fireworks of their own this summer.

While most Americans seem to stick to consumer-grade fireworks, 22% of folks say they’ve used illegal, professional-grade or homemade fireworks. Coincidentally, another 21% of respondents have been injured using fireworks.

Of course, consumer-grade and professional fireworks options can both cause damage or injury, but the latter causes most fireworks-related incidents, according to the National Safety Council.

Parents love fireworks, but do they love liability?

If there were no joy in watching the colorful explosions light up the sky, there would probably be far fewer fireworks-related accidents. But the fact is, consumers love fireworks, with 75% of consumers overall and 82% of those with children younger than 18 agreeing. It appears if folks broadly know the dangers associated with fireworks, they’re willing to take risks to have fun.

Though most parents may prefer or require adult supervision, 82% of parents with children younger than 18 think it’s generally OK for kids to play with fireworks or sparklers. Whether an adult is present or not, accidents can still happen — especially when volatile explosives are involved. Some parents may think sparklers are safer, but the National Fire Protection Association reports sparklers account for more than a quarter of fireworks-related emergency room visits.

Younger consumers are more likely to be injured by fireworks or sparklers than older consumers. NEISS data shows Americans ages 15 to 19 accounted for nearly a quarter of fireworks-related injuries from 2011 to 2020.

Backing that up, ValuePenguin researchers found Gen Zers reporting the highest rate of fireworks injuries, with rates dropping for older generations:

- Gen Zers: 30%

- Millennials: 26%

- Gen Xers: 20%

- Baby boomers: 10%

Overall, most of the reported injuries didn’t require an emergency room visit, but the risks don’t stop at burns and bruises.

In case of emergency, do you know if you’re covered?

Not only can fireworks cause bodily harm, but the risk of property damage should also make consumers think before they light the fuse. The National Fire Protection Association reports fireworks caused more than 19,000 fires in 2018 — the latest available data.

Despite the evident risk, more than half of consumers have no idea whether their home insurance plan covers fireworks-related damage. Though most policies cover fire damage, 55% of respondents aren’t sure if that coverage would extend to damage caused by fireworks.

In reality, consumers who cause an accident using legal fireworks should typically be covered. "Homeowners insurance does cover damage from fires and explosions and, by effect, damage from fireworks," ValuePenguin insurance analyst Andrew Hurst says.

However, those consumers who admit to using illegal or professional-grade fireworks could find themselves in trouble should an accident happen. "If a homeowner damages their own home with illegal fireworks, they won't receive coverage," Hurst says.

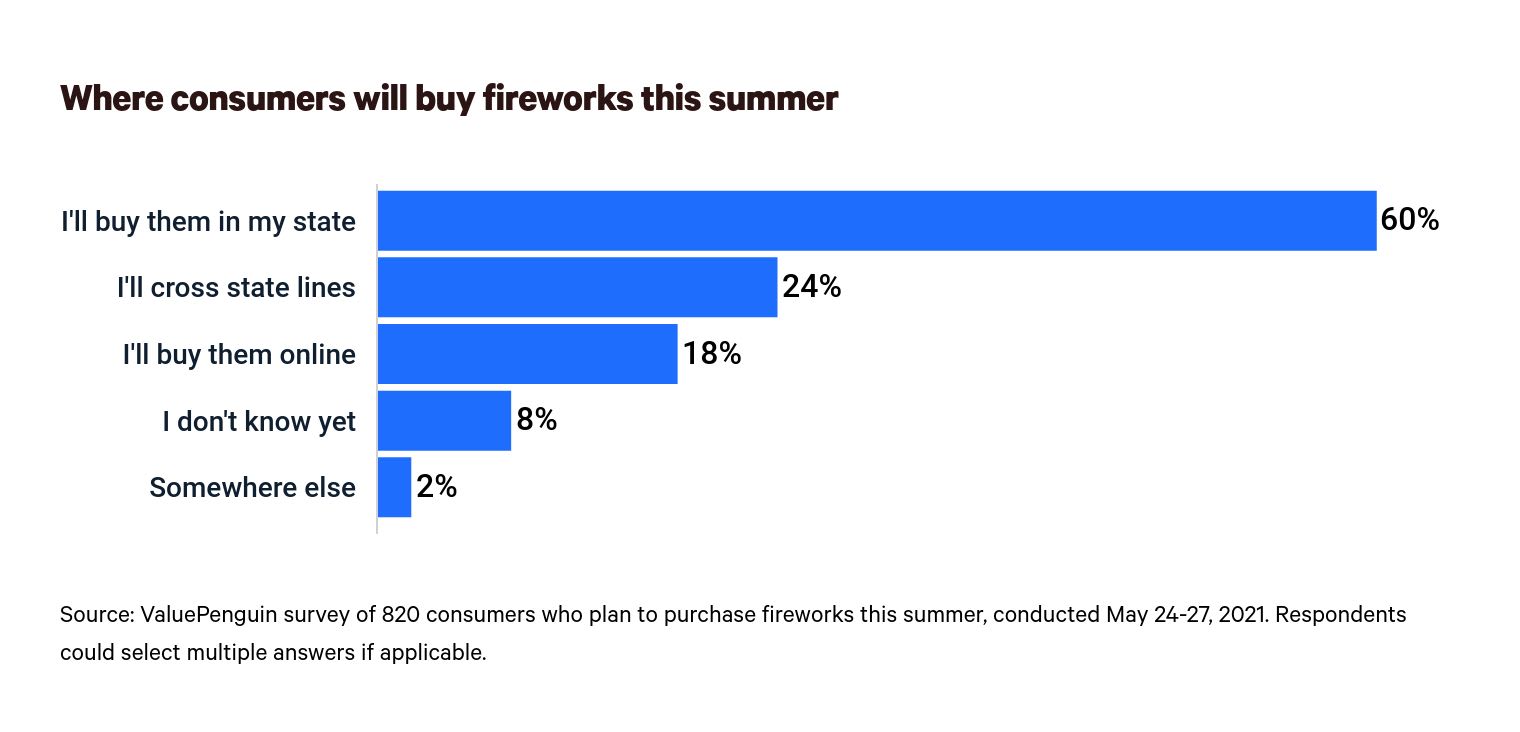

Since fireworks laws vary by state, researching local regulations should be part of consumers’ safety precautions. The 24% of respondents who say they will cross state lines to acquire fireworks may want to make other plans.

Though your health insurance policy should still help you pay for injuries resulting from prohibited fireworks use, consumers should generally try to avoid costly emergency room visits.

Safety first

As with any activity that involves risk — whether it’s necessary, like driving, or more for fun, like fireworks — people should prioritize safety for their physical wellness and financial health.

Protecting your home by avoiding unnecessary risks like fireworks can certainly lead to fewer insurance payouts and less money spent on repairs.

That’s not to say your home insurance rates will drop if you skip the fireworks, but adding fire detection or extinguishing devices might help. Plus, they might come in handy for homeowners who go on with their fireworks shows anyway.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,100 U.S. consumers from May 24 to May 27, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.