Flood Insurance in Georgia: Cost and How to Get Coverage

The average cost of flood insurance in Georgia is $883 per year for a government-backed policy from the National Flood Insurance Program (NFIP).

You can get a policy through many regular insurance companies. Flood insurance isn't usually required, but your mortgage lender can require you to get a policy if you live in a place with a high chance of flooding, according to FEMA (Federal Emergency Management Agency).

Find Cheap Homeowners Insurance Quotes in Georgia

Average cost of flood insurance in GA

In Georgia, the average cost of flood insurance is $883 per month or $74 per month.

That will get you a National Flood Insurance Program (NFIP) policy with $265,120 in coverage for your home and personal belongings.

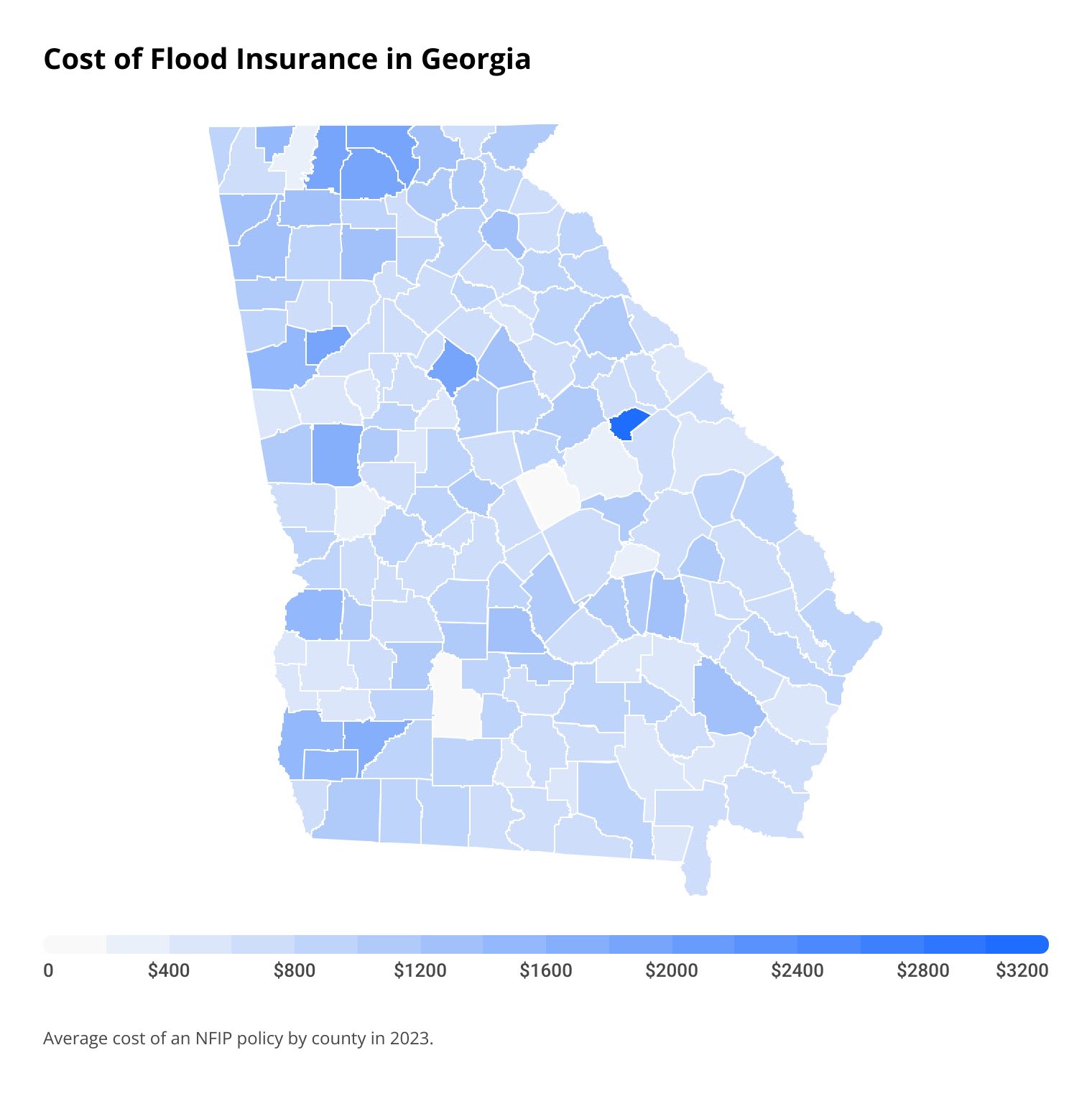

Flood insurance rates in Georgia can differ by more than $3,000 per year, depending on where you live. The biggest factor is how likely your home will flood based on where it is.

Flood insurance rates in Georgia by city

City | Avg. annual cost |

|---|---|

| Abbeville | $806 |

| Acworth | $559 |

| Adairsville | $767 |

| Adel | $559 |

| Albany | $884 |

The government backs flood insurance policies from NFIP, but you do buy them through private insurance companies. That means no matter what insurance company you use, you'll pay the same amount for National Flood Insurance Program flood insurance.

Do I need flood insurance in Georgia?

If you live in areas that are somewhat likely to flood, mortgage lenders will often make you get flood insurance.

Legally, you're not required to have flood insurance, but it's often a good idea.

- If you live in a high-risk flood zone, you will likely need to get flood insurance. Those zones include two kinds of places. Coastal Areas with waves at least 3 feet high are listed as Zone V on FEMA's flood maps. One-hundred-year flood plains, also called special flood hazard areas (SFHAs), are usually labeled Zone A.

- If your mortgage is from a federally regulated bank and you live in a high-risk flood zone, it is mandatory to carry flood insurance.

- If you live in an area with medium or low risk of flooding, you usually don't need flood insurance, though it's not always a bad idea. On FEMA flood maps, these zones start with the letters B, C and X.

When do you need flood insurance if it's not required?

If you think there's a chance a flood could damage your home, it's often a good idea to get flood insurance.

Even a small amount of flooding can cause a lot of damage. An inch of water can do $25,000 in damage to an average-size home, according to FEMA. And your basic home insurance won't pay for those repairs.

Even if you're not in a high-risk flood zone, your home is not fully safe from flooding. Four in 10 flood insurance claims happen in areas FEMA rates as having low or medium flood risk. Part of that is because FEMA maps are based on historical flood risks instead of projections of where they might happen in the future.

Changes in weather patterns and landscape can raise the risk of flooding more than flood maps show.

Find Cheap Homeowners Insurance Quotes in Georgia

How to get cheap flood insurance in Georgia

Georgia homeowners can buy cheap flood insurance either from from the National Flood Insurance Program (NFIP) or from a private flood insurance company.

You'll buy a policy through an insurance company in both cases. But the flood insurance coverage you get will be a little bit different depending on which option you go with.

National Flood Insurance Program coverage has the same rates no matter which insurance company you choose.

If your current home insurance company offers NFIP policies, it's a good idea to ask for a flood insurance quote. If your home is damaged by a storm, you'll likely have an easier time with claims because you're only working with one company.

Largest NFIP flood insurance companies in Georgia

Find Cheap Homeowners Insurance Quotes in Georgia

The biggest downside of NFIP coverage is that you can only get up to $250,000 in protection for your home's structure and another $100,000 to cover your stuff. Commercial coverage allows for higher limits.

If your home would be expensive to rebuild or you have a lot of expensive furniture and belongings, coverage from a private company could be a better idea. Private companies allow you to get more coverage, but rates may be higher.

Largest private flood insurance companies in GA

Company | Market share | |

|---|---|---|

| Geico | 14% | |

| Liberty Mutual | 13% | |

| Zurich | 11% | |

| AIG | 11% |

| Sompo | 9% | |

Companies like Farmers, Geico and Allstate can sometimes offer flood insurance quotes online, however most of the time you'll have to work with an agent to purchase a policy.

What does flood insurance in Georgia cover?

Flood insurance covers the structure of your home and the belongings inside that have been damaged after a flood.

You can get up to $250,000 in coverage to repair or rebuild your home with a National Flood Insurance Program (NFIP) policy. This is called your dwelling coverage.

If you have a home that would cost more than $250,000 to rebuild, you have two options. You can get excess flood insurance, which gives you coverage on top of a government policy, or you can purchase flood insurance directly with a private company that offers higher limits.

What does dwelling coverage protect?

- The main structure of your house, including walls, window, doors and the roof

- Permanent flooring like hardwood and carpet

- Garages, including detached garages

- Heating and cooling systems, such as the hot water heater, furnace, HVAC and electrical system

- Built-in appliances like a fridge or stove

- Also pays for removing debris

What does personal property coverage protect?

- Furniture

- Electronics, like TVs and computers

- Smaller appliances, like toasters and microwaves

- Clothes

- Artwork, firearms, jewelry and other valuables, up to $2,500

- Window treatments and rugs

You can only get $100,000 in coverage for your personal property with an NFIP policy. This is called contents coverage by the NFIP.

What won't be covered by flood insurance?

- Cash and physical stock certificates

- Your pool or hot tub

- Landscaping

- A deck or fencing

- Gold, silver, other precious metals

- Food and lodging after a flood

If you want protection for decks, fencing or your pool, you'll need to look at private coverage. NFIP flood insurance policies won't cover those.

NFIP insurance won't pay for hotel stays, meals or other living expenses should your house become uninhabitable because of a flood. These are called additional living expenses and you'll need an add-on to a private policy to have them covered.

Frequently asked questions

What is the average cost of flood insurance in Georgia?

The average cost of flood insurance in Georgia is $883 per year. That's for a National Flood Insurance Program (NFIP) with an average of $265,120 in total coverage. Your rate will change depending on the way your house is built and where you live.

Is flood insurance required in Georgia?

Flood insurance is not legally required in Georgia. However, if you have a mortgage, you will likely need to get flood insurance if you live in places where it historically floods more often.

What is the Flood Zone A in Georgia?

Flood Zone A is a label for places with a 1% chance of flooding in a given year, or 26% chance of flooding during a 30-year mortgage. In Georgia, flood zones that start with A are usually found along the coast and are common through much of Savannah.

Methodology and sources

The average cost of flood insurance in Georgia is based on policy overall numbers from FEMA (Federal Emergency Management Agency) and the National Flood Insurance Program (NFIP) for every county and larger town or city in the state.

Data on the largest flood insurance companies in Georgia is from S&P Global and its database of insurance information. Other sources include Floodsmart.gov and FEMA's flood maps.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.