Health Insurance

More Than Half of People Weren't Able to Answer ValuePenguin's Health Insurance Questions

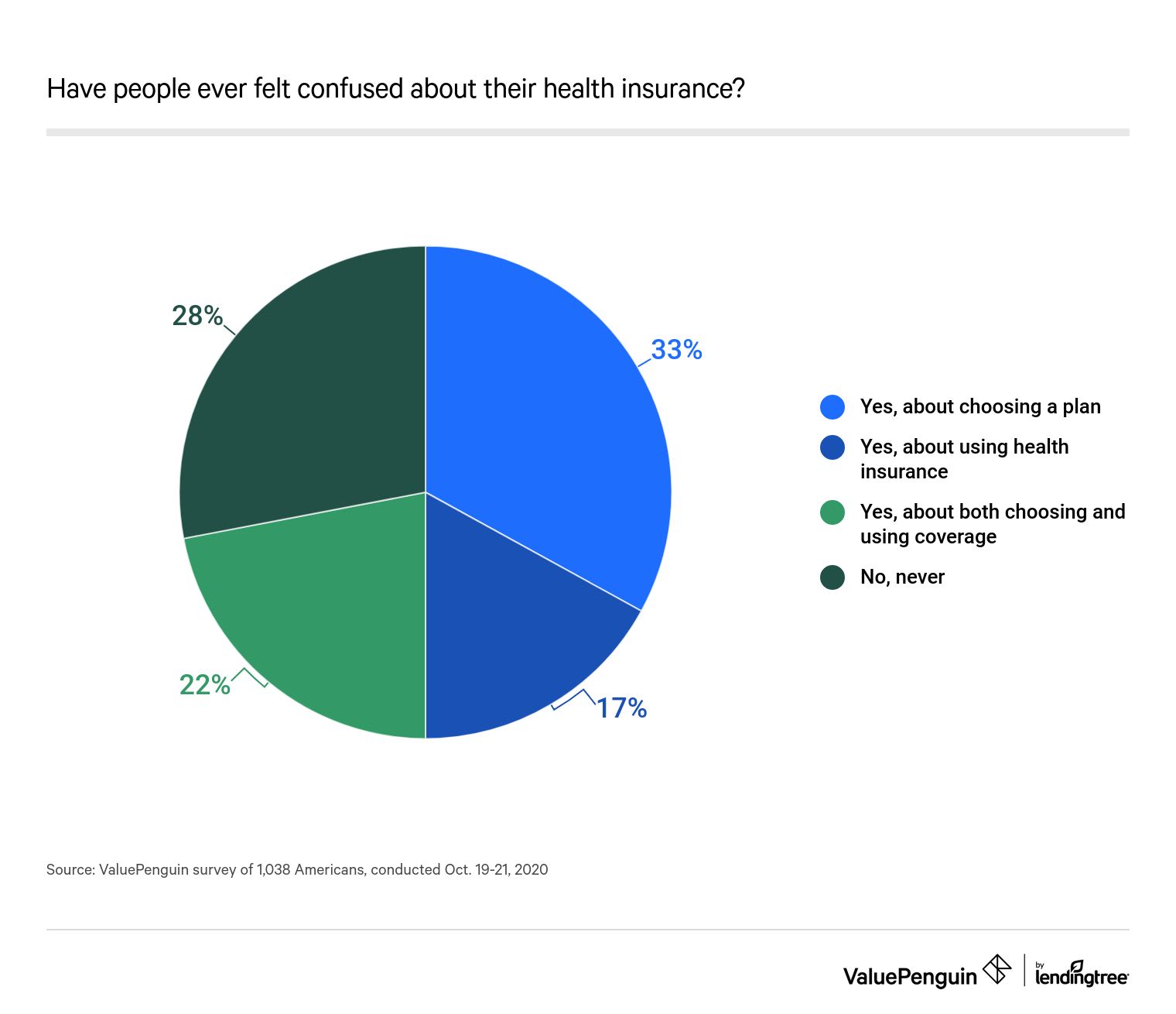

A ValuePenguin survey of 1,000-plus Americans exposed the uncertainty that many feel about health insurance, as only 28% of people have never been confused about their coverage. But more typically, Americans expressed uncertainty about getting health insurance or using their policies.

This confusion has financial consequences for policyholders — and can impede public health improvements. In fact, 57% said they sometimes avoided medical care because they weren’t sure if their insurance would cover any expenses. Additionally, more than a third of respondents weren't sure if their insurance would cover a COVID-19 test.

Key findings

- Few people have never had questions about getting or using health insurance. Just 28% of Americans say they've never been confused about signing up for or using health insurance.

- 45% of Americans falsely believe they can switch health insurance coverage plans anytime. Changes can only occur during open enrollment unless you experience a qualifying life event.

- About half of consumers struggle to understand key health insurance concepts. For example, 57% can’t identify the definition of an out-of-pocket maximum, 55% don’t know what a health insurance premium is, 54% are confused about deductibles and 48% don’t know what a copay is.

- More than one in five insured Americans can’t afford their out-of-pocket maximum. That jumps to 27% for women, versus 17% for men.

- 57% of insured consumers sometimes avoid seeking medical care because they’re not sure whether it would be covered by their health insurance.

Despite having coverage, most Americans conveyed a sense of uncertainty about getting or using health insurance

While just 13% of respondents didn’t have health insurance, 72% expressed having felt confused about purchasing or using health insurance — or both. However, people were generally more confident that they knew how health insurance worked than they were about which plan to get. While 55% indicated they weren't sure which coverage to choose, 39% said they've had questions about using their health insurance.

Yet, some of these people may have overestimated their knowledge of using health insurance, as ValuePenguin posed six questions dealing with various particulars of health insurance to consumers.

A number of people were stumped by questions that can be considered fairly basic. For example, 55% of consumers didn't know that a health insurance premium is the dollar amount one pays for coverage each month. Additionally, nearly four in 10 believed they could switch their health insurance coverage plan anytime. In reality, the majority of consumers can only make changes during open enrollment.

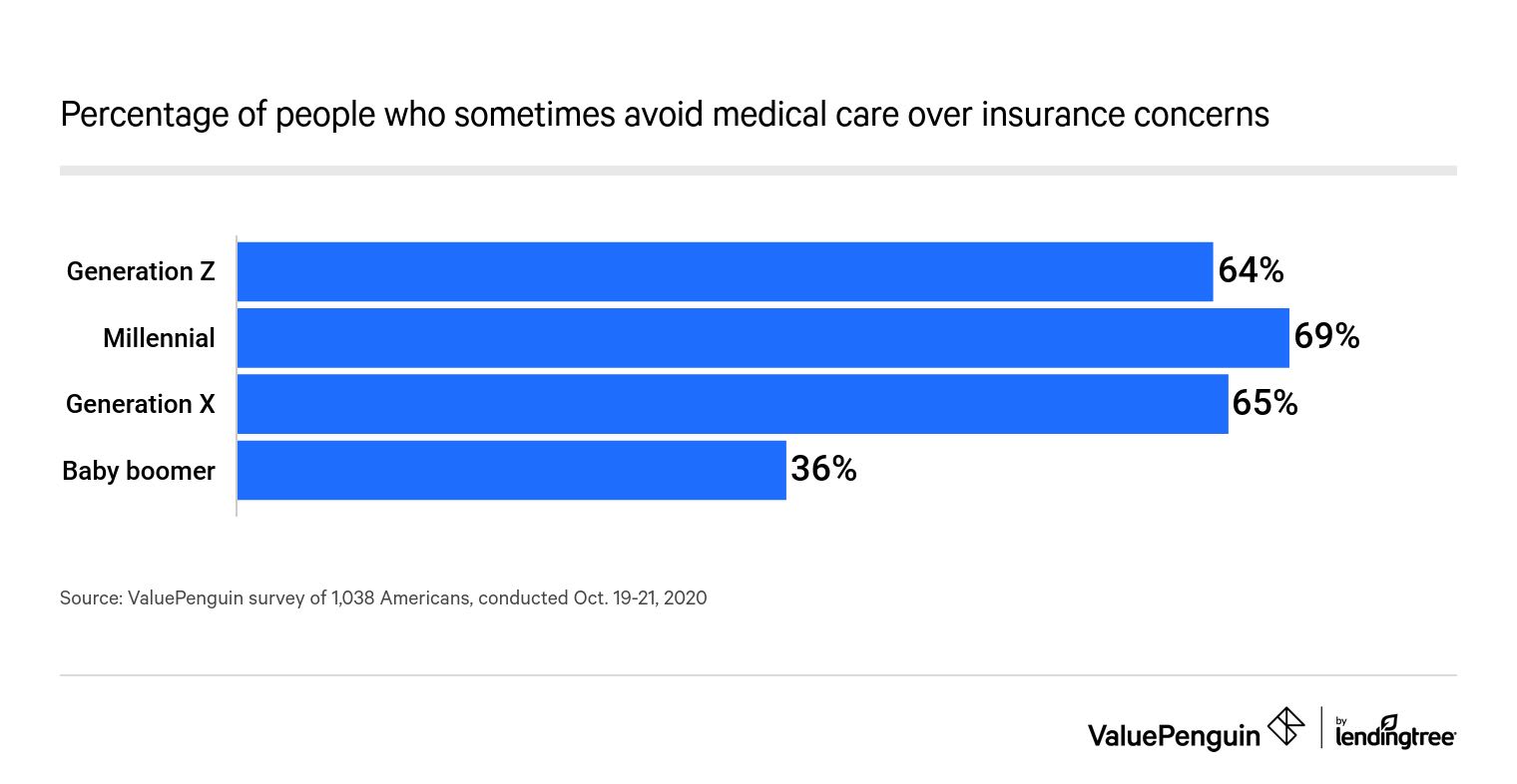

But the most worrying blind spot was that 57% of respondents said they’ve avoided medical care in the past because they weren't sure it would be covered by their health insurance policies. Young people were more likely to have avoided medical care due to uncertainty, with 69% of millennials and 64% of Generation Zers admitting they've opted not to seek care.

On average, 55% of respondents gave incorrect answers to questions about health insurance

When tallying the six questions asked by ValuePenguin, we found that 55% of people — on average — gave an incorrect answer to a given question.

A question about the difference between a health savings account (HSA) and a flexible spending account (FSA) yielded the largest percentage of wrong answers. About one-third of people believed that HSAs and FSAs were the same, while just 38% accurately identified the ownership and term of the two accounts.

The main difference between FSAs and HSAs lies in the ownership of the account. While the former accounts are owned by an individual's employer, HSAs are privately controlled. The funds in HSAs can roll over, while the guidelines governing the money in FSAs are generally less flexible.

While 55% of people didn't know what a health insurance premium was, 54% weren't clear on another cornerstone that accompanies most types of insurance plans: the deductible, which is the amount the policyholder must pay before the insurer covers any expenses.

About 24% of people confused a deductible with a copay — the fee that insurers charge policyholders for medical services, like doctor visits. Forty-eight percent of consumers, including the 24% who confused copays with deductibles, couldn't define a copay.

Fourteen percent thought a copay was the same as an out-of-pocket-maximum, which refers to the maximum amount that policyholders can spend on medical services before their insurer covers all costs. Altogether, 57% in total didn't know what out-of-pocket maximums were.

Overall, women appeared to have a stronger comprehension of health insurance than men did. Men had a higher percentage of correct answers on only two of the six questions — about deductibles and the relationship between HSAs and FSAs.

Generally, older generations were more knowledgeable about health insurance. On average, 42% of baby boomers answered a given question incorrectly. While this generation was the only one where more than half of people tended to answer correctly, the rate of incorrect responses among Gen Zers and millennials was much higher — 70% and 63%, respectively.

Americans could alleviate some of their financial worries regarding health insurance if they had a better understanding of the specifics of their policies

Amid the ongoing coronavirus pandemic, understanding one's health insurance coverage takes on greater importance. But more than a third of people weren’t sure if their insurance would cover the cost of a COVID-19 test.

Considering that 57% of people have avoided medical care when they weren't sure their insurance covered a visit or procedure, it's possible that people who don't know how their insurance treats a COVID-19 test would avoid testing and potentially spread the virus unknowingly.

While confusion about the specifics of health insurance pervades among most policyholders, anxieties about the cost of coverage appeared even among those who understood their policies — and it's not limited to the coronavirus. For example:

- Thirty-seven percent were sure they could afford their out-of-pocket maximums.

- Twenty-two percent were certain they couldn't.

- Thirty-one percent said that it depended on other factors.

It's possible that more people would be certain they could meet their health insurance expenses if they were more knowledgeable about their policies. On the other hand, the anxieties about cost could grow if policyholders initially mistook a component of their insurance for another, cheaper expense.

About one in 10 respondents said they had no idea what their out-of-pocket maximum was, but nearly six in 10 demonstrated that they didn't know what the term meant — even if they thought they did. This dissonance goes to show that a lack of knowledge about the intricacies of health insurance could be preventing policyholders from budgeting effectively and getting the treatment they need.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,038 American consumers, with the sample base proportioned to represent the overall population. We defined generations as the following ages in 2020:

- Generation Z: 18 to 23

- Millennial: 24 to 39

- Generation X: 40 to 54

- Baby boomer: 55 to 74

The survey was fielded Oct. 19 to 21, 2020.