Health Insurance

55% of Americans Struggling With Holiday Loneliness, While Many Aren’t Fully Satisfied With Their Mental Health Insurance Coverage

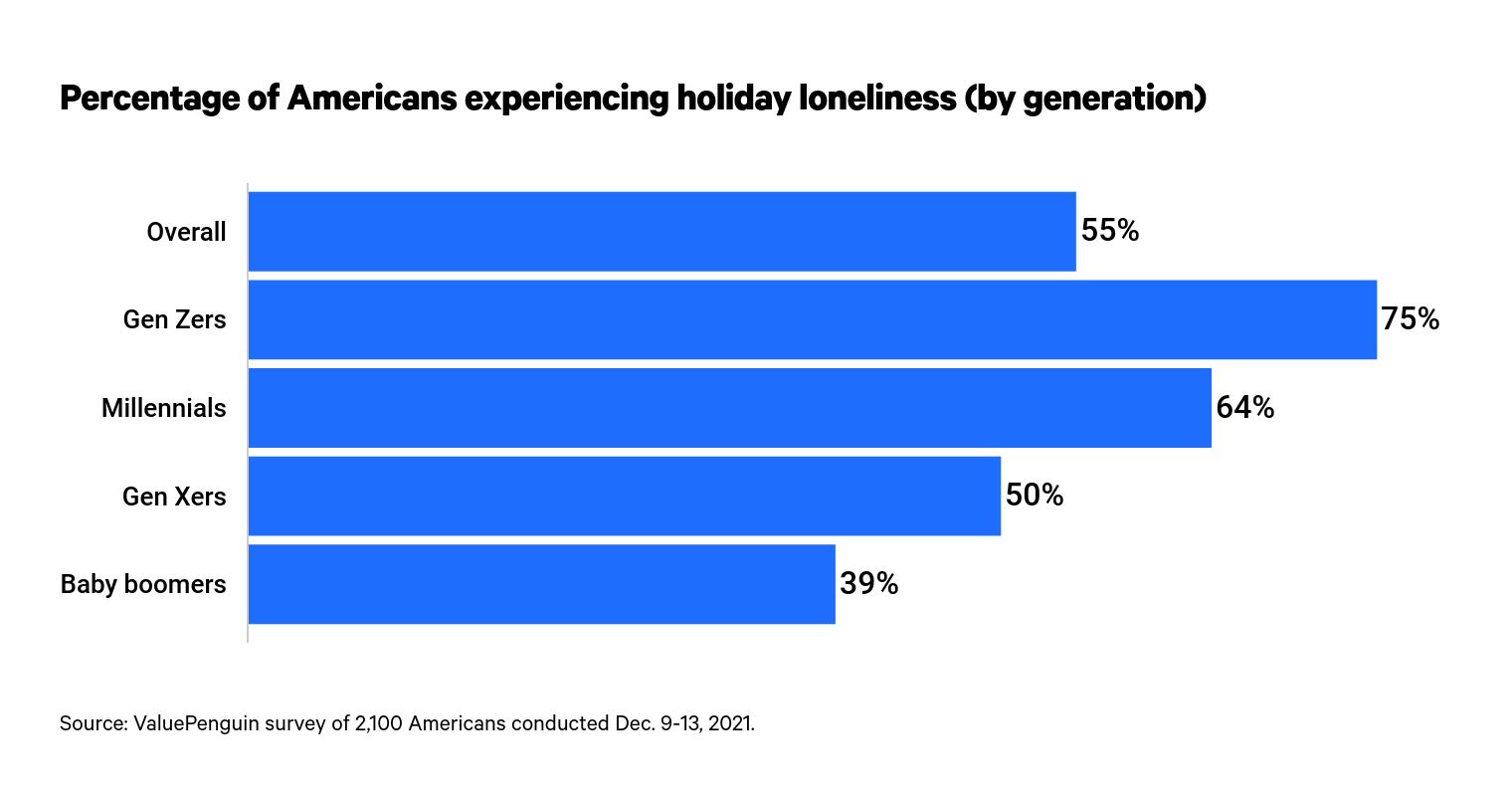

The holidays are a time many people associate with happiness and joy, yet more than half of Americans have felt different emotions this season. A sizable 55% of Americans are experiencing sadness and loneliness during the holidays this year — including 35% who say it's worse than last year — according to the latest ValuePenguin survey of 2,100 Americans.

ValuePenguin explored the reasons that may trigger these feelings during the holidays. We also looked into whether people have been seeing a therapist and explored some barriers that might stand in the way of mental health treatment.

Key findings

- 55% of Americans are experiencing the holiday blues, with many saying their loneliness is worse than last year. Gen Zers (75%) and single adults (65%) feel lonelier than their counterparts.

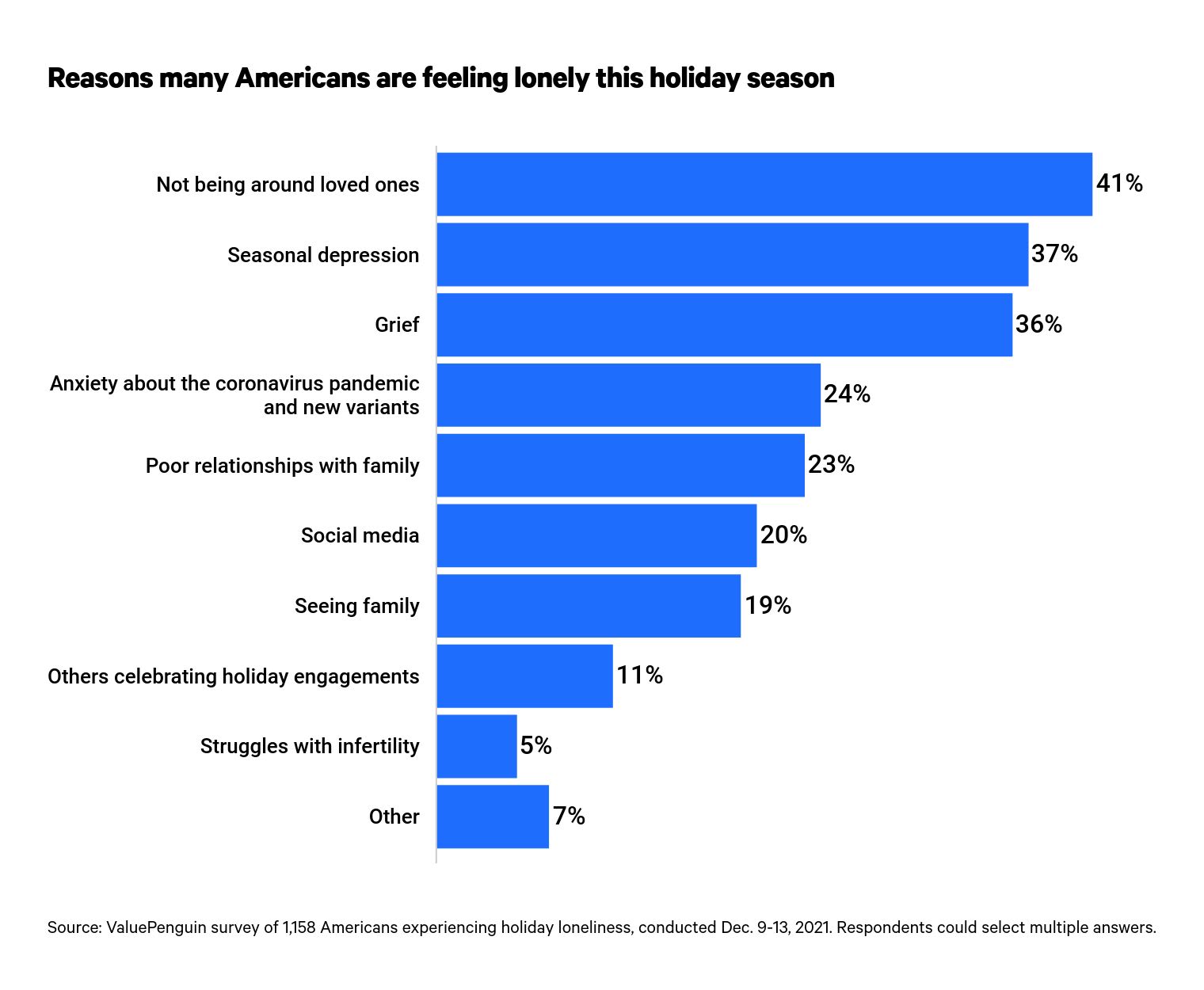

- Among those feeling lonely, the top reasons cited are not being around loved ones (41%), seasonal depression (37%) and grief (36%). Additionally, more than a quarter of Gen Zers and millennials attribute their loneliness to social media.

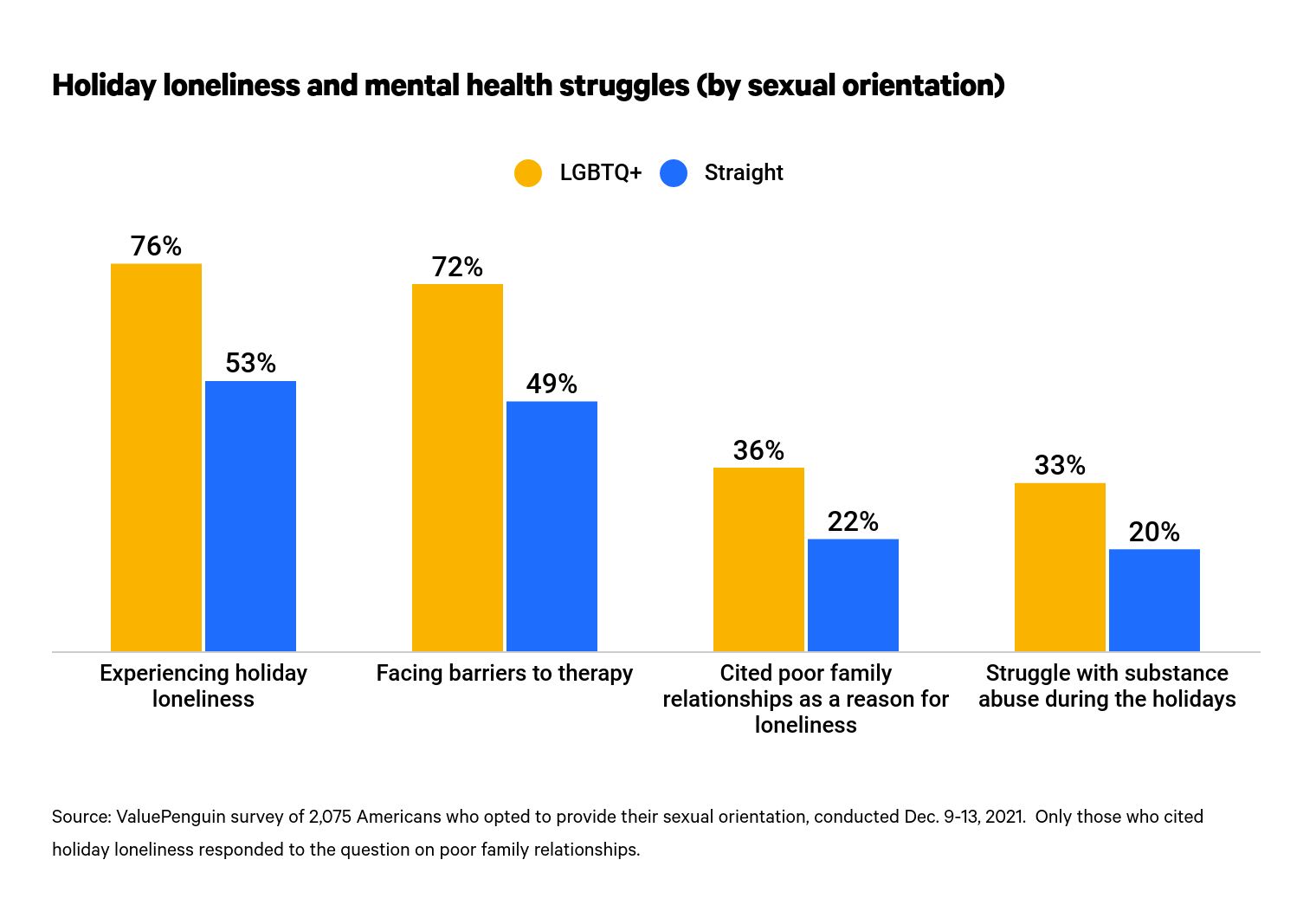

- Members of the LGBTQ+ community face more holiday loneliness than any other demographic analyzed, with 76% experiencing the winter blues. LGBTQ+ Americans are more likely to cite poor relationships with family members as the reason for their loneliness, and 33% say they struggle with substance abuse during the holidays.

- To cope with holiday loneliness, 20% of Americans are taking a social media break, while 13% are seeing a therapist. Others are turning to less healthy coping mechanisms, with 21% struggling with substance abuse during the holidays.

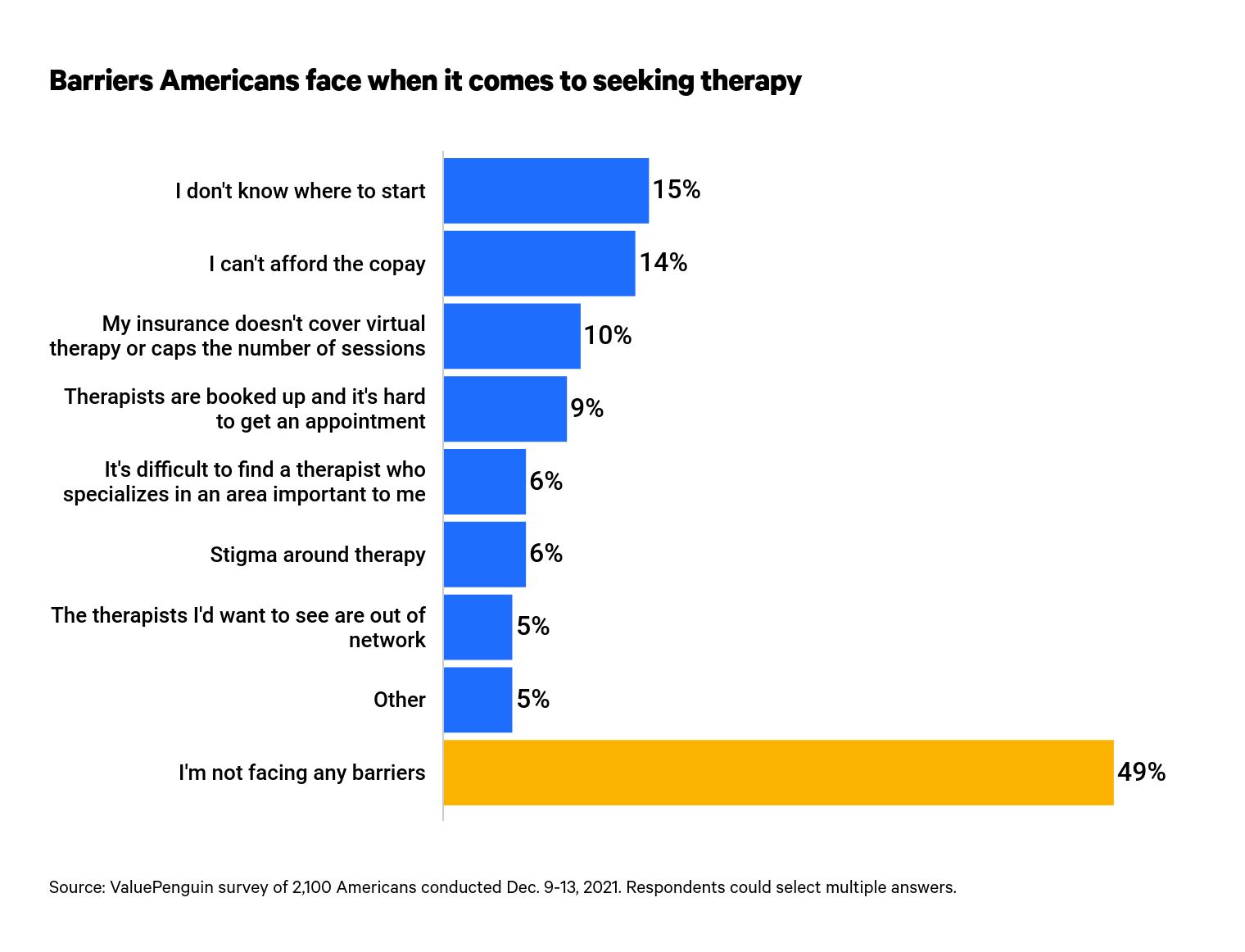

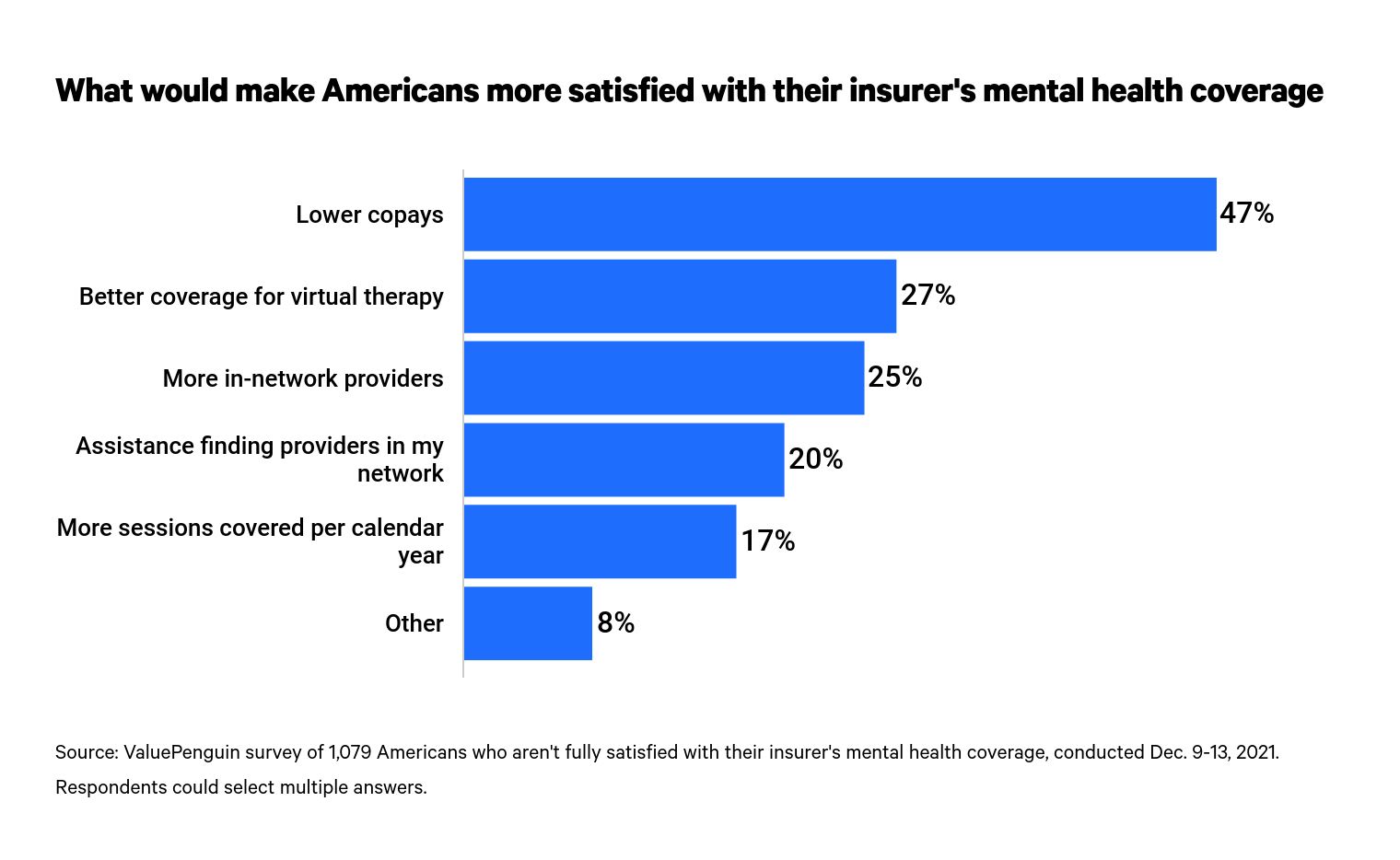

- 58% of Americans aren’t completely satisfied with their health insurance plan’s mental health coverage. These respondents would especially like to see lower copays and better coverage for virtual therapy. Additionally, more than half of Americans (51%) face at least one barrier to seeking therapy.

55% of Americans experiencing winter blues — here’s why

Despite what holiday movies and social media posts might lead you to believe, most Americans (55%) feel sad or lonely this season to at least some degree.

People of all ages experience these emotions, but Gen Zers (ages 18 to 24) are struggling this year more than any other age group.

Both men and women feel the winter blues. However, women admit to feelings of loneliness or sadness at a slightly higher rate:

- Women: 57%

- Men: 53%

Household income also appears to influence the way people experience the holidays. The majority of those earning less than $75,000 a year deal with some difficult emotions. But at $75,000 and above, a smaller percentage say they feel sad or lonely — though the number is still close to half.

Introverts (those generally more reserved) are more likely to struggle with the holiday blues than extroverts (those generally more outgoing), at 60% versus 47%.

The inability to be around loved ones is the most common cause of holiday loneliness. Other common triggers include anxiety about the coronavirus pandemic (24%) and poor relationships with family (23%), along with the reasons outlined below.

At 42%, women are more likely to experience holiday-related loneliness when they can’t be around their loved ones. However, more men (25%) than women (15%) point to social media as a source of negative feelings.

LGBTQ+ Americans feel most holiday loneliness

People of all sexual orientations struggle with difficult emotions during the holidays. LGBTQ+ Americans, however, experience holiday loneliness more than those who identify as straight.

People experiencing sadness or loneliness during the 2021 holiday season

LGBTQ+ | Straight | |

|---|---|---|

| Yes | 76% | 53% |

| No | 24% | 47% |

Members of the LGBTQ+ community are more likely to identify seasonal depression, grief and poor family relationships as being responsible for their loneliness. Those who are straight, meanwhile, cite not being around loved ones as a more common loneliness trigger.

Americans taking social media breaks, seeing therapists to cope with holiday loneliness

A ValuePenguin survey early in the pandemic found that 47% of people were experiencing loneliness. With that percentage rising this holiday season, several coping mechanisms may help people fight the winter blues.

Some people may gravitate toward healthier outlets, like exercising or volunteering. Other people, however, may struggle with the pull of less healthy temptations, like emotional eating or abusing substances.

One coping mechanism that seems to have a lot of appeal is taking a vacation from social media:

- 20% of Americans are taking a social media break

- 24% are considering a social media break

Seeing a therapist is an approach that 13% of Americans are using to cope with difficult emotions this year. In total, 37% of people have at least looked into therapy or signed up to see a therapist, but 24% aren’t currently seeing one. During the pandemic, 30% have relied on mental health apps to cope.

If you’re considering therapy for yourself, doing a little advanced research could be wise. Robin Townsend, a ValuePenguin technical writer whose focus is health and life insurance, says it may be best to look for a therapist who specializes in the area of your particular mental health need.

"Therapists have different techniques, so it’s important to find a provider you are comfortable with," Townsend says.

She also recommends preparing a list of questions in advance and then calling around and talking to therapists or their staff until you find a good fit. You may also want to make sure the therapist accepts your insurance plan before scheduling an appointment.

Barriers to therapy

When it comes to therapy, common barriers keep Americans from seeking treatment (or from seeing a therapist as often as they’d like). Not knowing where to start is a roadblock that 15% of people face. Another 14% of Americans say they can’t afford the copay.

Below are some other reasons people may not schedule therapy when they need it.

If you haven’t seen a therapist due to insurance or financial challenges, the following strategies could help.

- Ask about payment options. Townsend says copay challenges might be something you can overcome if your therapist offers a payment plan. Some mental health care providers may bill on a sliding scale based on your income.

- Look into cheap health insurance options. People without access to employer-sponsored health insurance may have other options for cheap health insurance. For others, their income may qualify them to get mental health and substance abuse coverage through Medicaid, though benefits vary by state. Meanwhile, children in low-income families can get mental health coverage through the Children's Health Insurance Program (CHIP).

- Get health insurance through the marketplace. Affordable Care Act (ACA) marketplace plans must provide mental health coverage. Townsend says people who get plans through the health insurance marketplace might get assistance with premiums in the form of tax credits. (Tip: Open enrollment in the health insurance marketplace for the 2022 plan year ends Jan. 15, 2022.) Through cost-sharing subsidies, enrollees can get help toward out-of-pocket expenses like deductibles, copays and coinsurance. The subsidy program and premium tax credit are based on income and family size.

- Consider alternative options. If you can’t get affordable insurance coverage, or if the coverage you have falls short of meeting your mental health needs, consider alternative options. Townsend suggests university counseling centers as a resource for active students. Nonprofit organizations like Open Path Psychotherapy Collective assist low- to middle-income households. And the National Alliance on Mental Illness offers a free phone-based service people can use for advice and assistance.

Substance abuse as a coping mechanism

Substance abuse is an unhealthy tool that some Americans use to cope with holiday loneliness. More than 1 in 5 (21%) Americans have unhealthy alcohol and/or drug habits during this time of the year, with 9% saying substance abuse is a frequent problem.

Most Americans aren’t fully satisfied with their mental health insurance coverage

Mental health coverage is available through many insurance plans. But most people who have mental health benefits are not completely satisfied with the coverage their insurance policy provides:

- 58% of Americans believe there’s room for improvement with their health insurance coverage for therapy visits.

- 42% of Americans are very satisfied with their health insurance plan's therapy benefits.

There have been recent shifts where mental health coverage is concerned during the pandemic. As people followed stay-at-home orders and tried to limit the spread of COVID-19, virtual therapy visits became a more common option.

"Many insurers understand the impact of the pandemic on mental health and have stepped up to provide improved access to mental and behavioral health services," Townsend says. "For example, some insurers are waiving cost sharing for in-network telehealth visits for medical and mental health or substance abuse disorders."

Yet despite this shift, some insurance policies failed to keep up. As a result, 27% of Americans indicate better virtual therapy benefits would make them happier with their health insurance policy’s therapy coverage.

Below are other areas where insurance providers have room for improvement, according to survey respondents.

Finding an insurance policy with good mental health benefits is important, especially if you’re in therapy or considering it. For employer-based insurance coverage, review your plan details to get familiar with your policy benefits. If mental health benefits aren’t included, Townsend says it’s worth checking to see if your employer offers an Employee Assistance Program (EAP) that could fill in the gap.

All ACA marketplace plans have to provide mental health coverage. Yet many ACA plans offer added benefits, like support you can access by phone or via an app.

"Look for extras that help to fill all your coverage needs," Townsend says.

As you shop around, Townsend says: "If you have a specific mental health specialty or provider in mind, always check to be sure your plan will cover your needs before you enroll. Look at reviews and ratings to find a plan that provides good service and pays claims promptly."

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 2,100 U.S. consumers from Dec. 9 to 13, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.