Home Insurance vs. Condo Insurance: What's the Difference?

Condo insurance is cheaper than home insurance because it only covers what's inside your unit, not the full structure of the building.

Find Cheap Condo Insurance Near You

How is condo insurance different from homeowners insurance?

The main difference between home and condo insurance is that condo insurance costs less and has less coverage. That's because when you live in a condo, the condo association has a master policy that covers the structure of the building and any shared areas.

- Your condo insurance policy protects what's inside your unit, such as the floors and walls, improvements you make, your belongings and accidents or injuries.

- Home insurance covers everything on the property including things like the roof, furnace and shed, as well as your belongings and accidents or injuries.

Parts of the insurance policy | Condo (HO-6 policy) | House (HO-3 policy) |

|---|---|---|

| Dwelling | Covers only your unit | Covers the full building, yard and shed |

| Personal property | Covers your belongings against the types of damage listed in the policy | Covers your belongings against most types of damage, unless they're specifically mentioned |

| Liability | Included | Included |

| Loss assessment | Included | Optional |

| Average cost | $531/year | $2,147/year |

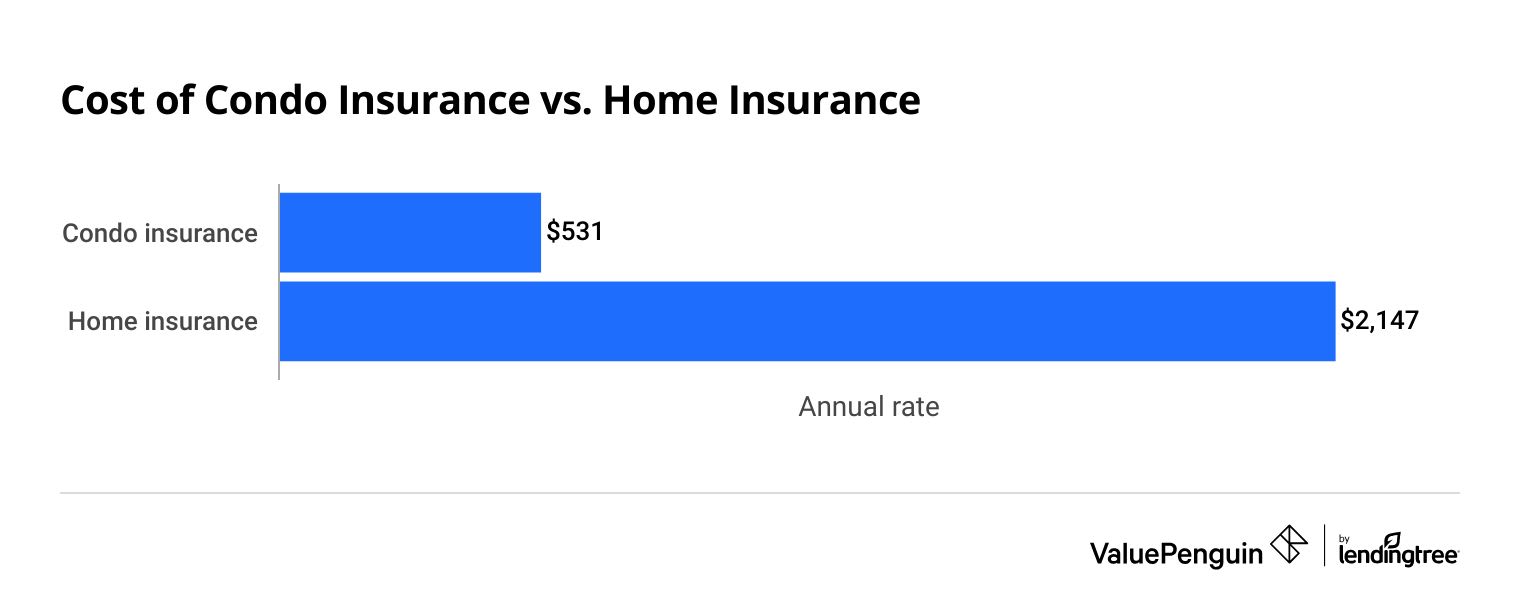

Cost of condo insurance vs. homeowners insurance

Condo insurance costs about a quarter of the price of home insurance because it covers much less.

How much cheaper is condo insurance vs. home insurance?

By living in a condo, you'll save about $1,631 per year on insurance versus living in a stand-alone house.

Monthly cost | Annual cost | |

|---|---|---|

| Condo insurance | $44 | $531 |

| Home insurance | $179 | $2,147 |

The average cost of condo insurance is $531 per year for a typical policy. Rates can vary by location and company. Geico is one of the best condo insurance companies and has an average rate of $413 per year.

The average cost of home insurance is $2,147 per year. That's for a policy that covers an entire house with $350,000 in dwelling coverage and has $100,000 in liability coverage.

Why monthly bills might be similar in a condo and home

With a condo, you'll have to pay condominium fees which can be a few hundred dollars per month. This is how the condo association can buy its master insurance policy for the building, as well as pay for repairs, property maintenance and landscaping.

So even though you pay less for condo insurance than home insurance, overall, your monthly bills might not be lower after considering the monthly fee for your building.

Dwelling insurance coverage: Condo vs Home insurance

| Condo insurance dwelling coverage will pay to repair or rebuild the interior of your unit. It covers parts of your condo unit that are not already covered by the condo association's policy. | |

| Home insurance has more dwelling coverage than condo insurance, protecting the full structure of the home and all of its components, from roof to basement. It also covers other structures on the property like a shed or pool. |

What does dwelling coverage protect in your home or condo?

A policy's dwelling coverage pays for damage to the physical structure of your home or condo.

You'll need less dwelling coverage with condo insurance than home insurance. That's because with a condo, coverage is split between your condo insurance policy and the master policy of the condo association.

- The dwelling coverage of your condo insurance will cover the permanent parts inside your unit, such as the walls and floor.

- Insurance from the condo association will cover shared areas such as elevators, pools and hallways, as well as the building's structure like its roof and foundation. The dues you pay to the condo association help pay for this insurance for the building.

- When you're insuring a stand-alone home, your home insurance policy needs to cover everything that's attached to your home including walls, roof, floors, plumbing and the furnace. It also covers outside structures like pools, sheds, garages and fences.

Your policy should cover any upgrades or changes you've made to your condo, as well as any parts of the condo that are not covered by the building's insurance policy.

The dwelling coverage amount with a condo insurance policy is usually about a third of the coverage you have for your belongings. So when getting a condo insurance quote, you'll usually start by estimating the value of your stuff first, and using that amount to calculate your dwelling coverage.

This is another way that condo insurance is different from home insurance. With a home insurance policy, you'll start with the dwelling coverage as the larger number, and then calculate coverage for your belongings as a percent of that.

Your condo insurance policy works alongside the building's master insurance policy, with each covering different things.

Your condo insurance policy will always need to cover improvements or permanent updates you make to your own condo. This means your policy needs high enough limits to cover the value of things like new kitchen countertops, bathroom updates or a home office you added.

But the overall building policy only covers some things inside your unit. That's why it's important to read the building's insurance policy to know how much condo insurance coverage you need.

There are three types of insurance policies your condo association could have.

-

Some buildings may only cover the frame of the building and common areas, which is called bare walls coverage. Everything that's inside the walls of your unit is your responsibility. For these situations, make sure your policy has enough coverage to pay for all types of damage within the walls of your unit.

- Other buildings will have policies that also cover structural parts of your home like the windows, walls, floors, cabinetry and fixed appliances. This is called a single-entity policy. With these policies, the building's coverage is only for the standard fixtures inside the condo. If you make improvements, your policy will need to cover the extra value of the updates you've made.

- The most robust policies are when buildings cover all types of fixed features in your condo including plumbing and electrical wiring. If your building has one of these policies, you won't need to have as much dwelling coverage on your policy.

Water backup coverage is more important to get when you live in a condo than when you live in a stand-alone home. That's because when you live in a multi-unit building, plumbing issues in other units could also cause an issue for your condo.

Water backup coverage is usually cheap, about $30 per year. And it will protect you if a plumbing problem anywhere in your building causes water to back up into your condo.

Water backup coverage is especially important if your building has older pipes or if you live in a ground floor because backups can be more likely.

Loss assessment coverage: Condo vs Home insurance

| In a condo, loss assessment coverage protects you if your building has to file an insurance claim. | |

| Stand-alone homes don't need loss assessment coverage unless you have a homeowners association with its own insurance policy. |

When would you use loss assessment coverage?

Loss assessment coverage pays for costs that are passed on to you when your community association files an insurance claim.

This coverage can be added on to either a condo or home insurance policy. But you'll only need it when there is a community association that also has insurance.

-

Loss assessment can help pay for your portion of the deductible if the condo or home association files a claim through its insurance policy.

For example, say your condo needs to file an insurance claim to pay for siding damage after a storm. The building's insurance policy could have a $100,000 deductible. You and your neighbors could each get a bill for a few thousand dollars to pay for the building's deductible. The loss assessment part of your insurance plan will pay for your costs, up to the limits on your policy.

-

Loss assessment coverage can also pay for any extra costs if the building's insurance policy is maxed out.

For example, if someone is badly injured in your condo's pool, their claim for damages could be higher than the amount of insurance that your building has. Rather than you having to pay your portion of the bill, your insurance policy's loss assessment coverage can help pay.

Personal property coverage: Condo vs Home insurance

| Personal property coverage for your belongings is the same, whether you have condo insurance or home insurance. | |

| In a condo, the building's policy won't cover your things. You're responsible for insuring all of your belongings. |

What does personal property coverage pay for?

The personal property part of a condo or home insurance policy covers the things you own.

- Furniture and home decor

- Clothing

- Appliances

- Electronics and computers

- Jewelry and valuables, up to a limit

You'll set a limit for your personal property coverage that's based on the value of what you have.

- If you have fewer belongings, you don't need as much insurance so you can lower the limits of your personal property coverage.

- You'll need more coverage if you have expensive gear, luxury items, or lots of belongings to fill a large space. Home insurance policies often have higher personal property limits because homes tend to be larger than condos.

Whether you have home or condo insurance, your policy will cover theft, including if someone breaks in or if a package is stolen from your doorstep. However, it's only worth filing a claim if the value of what's stolen is higher than your plan's deductible.

How does liability coverage differ between home and condo insurance??

| A condo insurance policy's liability coverage will pay for injuries that happen within your unit. Injuries in the common areas — like the complex's pool — would be covered by the complex's liability insurance. | |

| A home insurance policy's liability coverage would pay for injuries anywhere inside your home, as well as in the yard or pool. |

What does liability coverage pay for in your home or condo?

Liability insurance covers the legal and medical costs if someone is injured or if you accidentally damage someone else's property.

Your condo insurance policy will cover injuries that occur inside your unit, and the building's overall policy will cover injuries that happen in shared areas, such as if someone slips on the ice steps of an entrance.

A home insurance policy covers liabilities across your entire property, rather than just what happens inside your condo.

Homeowners usually need more liability insurance than condo owners.

That's because standalone homes often have more ways that people can get hurt. The liability portion of your policy can help protect you from the cost of legal fees or any money you could owe if it's your fault.

Whether you live in a condo or a house, you should get as much liability coverage as you can reasonably afford. It's cheap to add on more coverage, and it can give you peace of mind knowing you'll be protected from potentially high legal fees or medical bills.

Other types of homes: Insurance for a condo vs. co-op vs townhouse

There isn't a separate insurance policy type of co-ops or townhomes. Instead, you'll need to choose either a home or condo insurance policy and customize it for your needs.

- Co-ops usually need a condo insurance policy. That's because the multi-unit buildings have a building association with a master insurance policy to cover its structure and shared areas. With a co-op, you'll typically only need a condo insurance policy to cover your unit.

-

To get insurance for a townhouse, you'll usually need a policy similar to a stand-alone home. That's because the side-by-side units are usually purchased with a piece of land. The home insurance policy can cover all the parts of your townhouse, as well as the yard and shed.

Townhouses may also have a community insurance policy to cover sidewalks, community spaces, and any shared infrastructure such as the roof. Be sure to check the community's insurance policy to make sure you get the right amount of coverage for things that are not already covered by the community policy.

Frequently asked questions

Why is condo insurance so much cheaper than home insurance?

Condo insurance gives you less coverage than home insurance, which is why it's about a quarter of the price. With a condo, you only need to get insurance to cover the inside of your unit. With a house, you have to insure more square footage of a full building, including the roof and basement, as well as what's in your yard, such as a pool or shed.

What type of homeowners insurance policy do you need for a condo?

A condo insurance policy covers the inside of your unit with what's called a HO-6 insurance policy. A standalone home needs insurance to cover the whole property which is called a HO-3 insurance policy.

Sources and methodology

Rates for condo insurance and homeowners insurance are a national average.

- Condo insurance rates are from a report from the National Association of Insurance Commissioners (NAIC) about HO-6 policies.

- Homeowners insurance rates are based on quotes from for every residential ZIP code in the United States, from the largest homeowners insurance companies in every state. Home insurance quotes are based on $350,000 in dwelling coverage, $100,000 in liability coverage and a policy with a $1,000 deductible.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.