Homeowners Insurance

54% of People Worry They Can't Afford Disaster Debt

A natural disaster or emergency could financially devastate many Americans, with 54% of consumers fearing the impact would be too expensive to afford. Of those Americans, more than one-quarter (26%) strongly question their ability to recover financially.

While consumers may have doubts about the state of their finances after an emergency, they’re more optimistic about generally being prepared for a disaster, according to the latest ValuePenguin survey of nearly 2,200 Americans. Across six emergencies — from hurricanes to floods to earthquakes — just 12% of respondents admit to not being prepared for a single one. However, responses on the specifics around preparations suggest the sentiments of many don't line up with their actions.

Key findings

- More than half of consumers worry about the financial implications of a natural disaster. Fifty-four percent of respondents don’t think they could afford the costs of such emergencies, especially millennials (60%).

- Sixty-seven percent of homeowners in hurricane-prone states don’t have or don’t know whether they have a flood insurance policy, even though flooding isn’t covered under a standard homeowners insurance policy. Likewise, 66% of homeowners at risk of earthquakes don’t have a separate policy.

- Fifty-two percent of consumers who experienced a natural disaster say they weren’t as prepared as they could have been. Americans age 55 and younger are most likely to regret their lack of preparation.

- Americans are least prepared for earthquakes and wildfires. On the other hand, extreme heat and winter storms are the disasters for which consumers feel most confident about their preparedness.

- Consumers aren’t prepared for emergency evacuations. Six in 10 Americans either don’t have an emergency evacuation kit (50%) or don’t know if they have one (10%). And 53% of pet owners don’t have a fleshed-out plan for their pet should they need to evacuate.

More than a quarter of Americans strongly believe they wouldn't be able to withstand the financial impact of a disaster

Fifty-four percent of consumers worry that they wouldn't be able to afford the costs arising from an emergency or disaster — and more than a quarter (26%) express this fear strongly. Just 10% of consumers disagree strongly with the idea that they couldn’t afford an emergency.

Millennials (ages 25 to 40) most commonly feel uneasy about the financial impact of emergencies. Of this demographic, 32% strongly agree that an emergency would carry a financial burden that may be too expensive. Gen Xers (ages 41 to 55) are the second-most likely to agree strongly with this, at 28%, followed by Gen Zers (ages 18 to 24) at 21% and baby boomers (ages 56 to 75) at 19%.

Gen Zers are most likely to strongly disagree that an emergency or disaster would bring financial impacts that would be too expensive for them to overcome.

Consumers who are worried they wouldn't be able to afford the financial impacts of an emergency or natural disaster

Generation | Agree | Disagree | Neither |

|---|---|---|---|

| Gen Zers | 55% | 18% | 27% |

| Millennials | 60% | 17% | 23% |

| Gen Xers | 54% | 19% | 27% |

| Baby boomers | 47% | 27% | 27% |

Source: ValuePenguin survey of 2,173 consumers. Totals may not add to 100% due to rounding.

Twenty-six percent of all consumers neither agree nor disagree with the notion that an emergency would prove too costly for them. This population segment is larger than the percentage of people who aren't worried a disaster would be too expensive for them. Uncertainty trickles down to the realm of insurance, too.

Eleven percent of respondents aren't sure if they carry insurance to protect them against floods or earthquakes. Gen Zers most commonly aren’t sure about their coverage compared to other generations (19%), with baby boomers (12%), Gen Xers (11%) and millennials (10%) following.

Additionally, researchers found that among homeowners in hurricane-prone areas, 67% don't have or don’t know whether they have a flood insurance policy, even though flood damage isn't covered by standard homeowners insurance. Not only that, but coverage from the National Flood Insurance Program generally carries a 30-day waiting period. Sixty-six percent of those living in earthquake-prone regions don't have or don’t know if they have coverage against that peril.

Does home insurance coverage protect against floods and earthquakes? No. Policyholders must pay for separate forms of insurance to be fully protected against flood and earthquake damage. Flood and earthquake coverage policies have their own limits of liability, deductibles and claim processes, just like a common homeowners insurance agreement.

More than half of people who have experienced a natural disaster weren’t as prepared as they could have been

Twenty-three percent of consumers have never experienced a natural disaster. Not only is it more common for people to have encountered a dangerous natural disaster, but there's a sizable percentage of people who have been through more than one event.

Of those who have experienced a natural disaster, 39% wish they had been more prepared. While 48% were as prepared as they could have been, 14% weren’t prepared at all. Gen Xers most commonly weren't prepared for past emergencies (18%), while 54% of baby boomers — the highest mark of any demographic — were as prepared as possible.

Regardless of whether they've experienced a natural disaster, consumers feel most confident they could adequately prepare for extreme heat. Seventy-seven percent of Americans think they could ensure their safety and the safety of their family and home in the event of a heat emergency — 37% of whom are very confident in their ability to prepare themselves. Seventy-two percent feel they could prepare for bad winter weather.

But no more than 62% of consumers expect to be prepared for other serious weather events. Confidence in hurricane and flood preparedness is relatively high among consumers — 62% are confident they could ensure their safety after experiencing flood damage, while 60% feel this way about a potential hurricane. If a tornado formed, 58% believe they could adequately prepare, with this number shrinking to 46% for wildfires and earthquakes.

Although more than six in 10 people think they could ensure the safety of their home and family in the event of a flood, just 17% know they have acceptable insurance protection against floods.

Peril | Prepared | Unprepared |

|---|---|---|

| Extreme heat | 77% | 23% |

| Winter storm | 72% | 28% |

| Flood | 62% | 38% |

| Hurricane | 60% | 40% |

| Tornado | 58% | 42% |

| Wildfire | 46% | 54% |

| Earthquake | 45% | 55% |

The table is sorted by the percentage of consumers who would feel prepared to ensure their safety in an emergency.

Although relatively few people claim to be unprepared for most disasters, the percentage who have adequate emergency supplies is low

Just 12% of people say they would be unprepared to ensure their safety in the event of any of the six emergencies examined. Yet, when asked for specifics about their preparations, consumers' responses reveal a disparity between their feelings and actions.

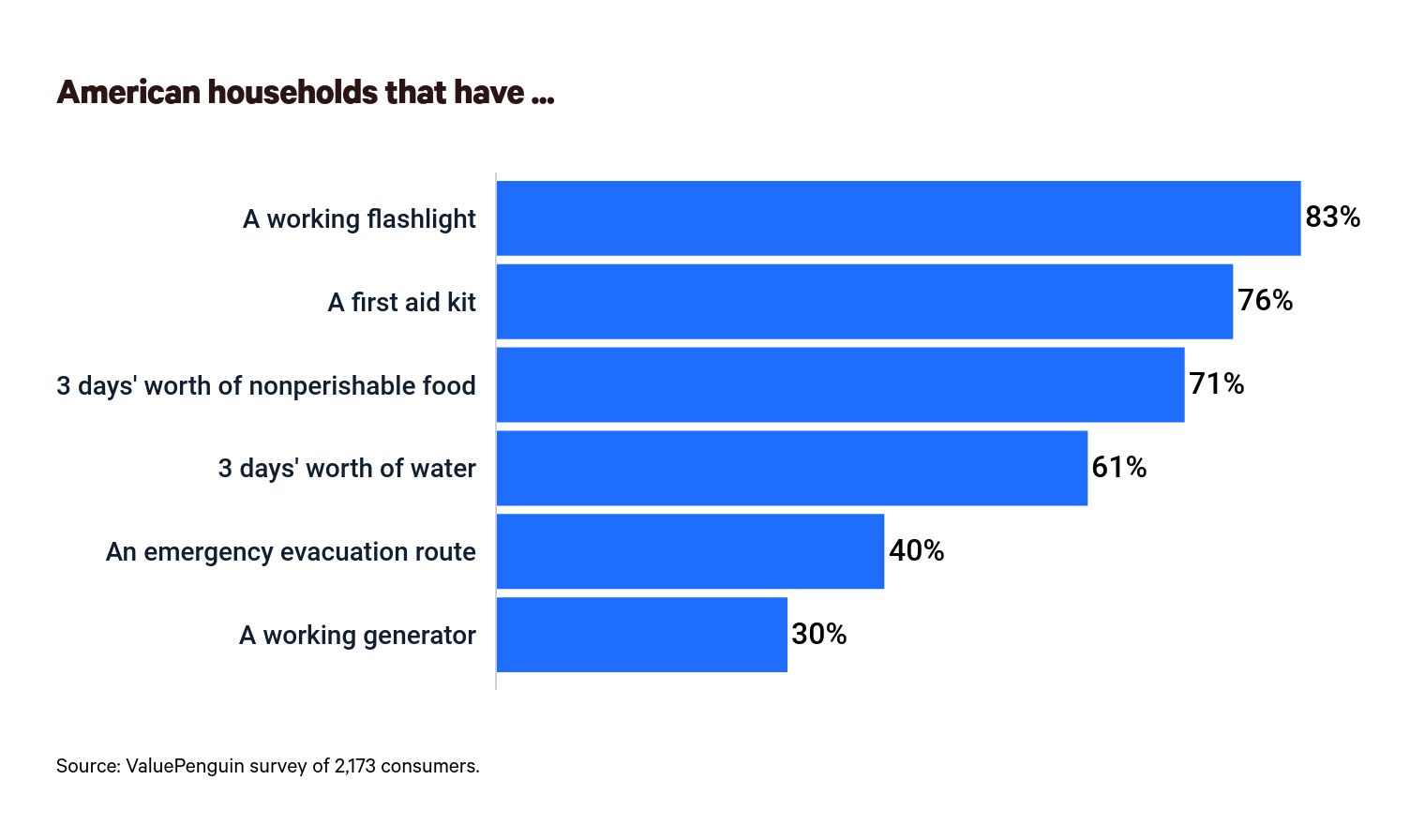

Most households (83%) have a working flashlight. A significant percentage of people (76%) have a first aid kit and three days worth of food (71%). Fewer people, though still more than half, have three days worth of water. But less than half of people have an evacuation "go bag" (40%) or a generator (30%) — deficiencies that could complicate getting through a natural disaster.

Other responses indicate insufficient levels of preparedness. Thirty percent of people don't receive emergency alerts from local authorities when emergencies are present. Forty percent aren't trained in CPR and don't live with someone who is. And 53% of people don't have a complete plan for what they would do with their pets if an emergency required evacuation.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 2,173 U.S. consumers from Aug. 9-23, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24 years old

- Millennial: 25 to 40 years old

- Generation X: 41 to 55 years old

- Baby boomer: 56 to 75 years old

While the survey also included consumers from the silent generation (those age 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.