When is Car Insurance Tax-Deductible?

Find Cheap Auto Insurance Quotes in Your Area

Your insurance premium and deductible are the two payments you'll make related to your car insurance. There are circumstances under which each can be written off or deducted from your taxes.

If you use your car for business, you can subtract your insurance deductible from your taxes, but the process can be complicated.

For instance, you can't simply subtract your deductible from your taxable income.

When is your auto insurance premium tax deductible?

If you own a car you use exclusively for business purposes, then all costs associated with it — including gas, maintenance and insurance premiums — are deductible as business expenses. For example, if you are a self-employed contractor and need to drive your supplies around in a truck, which can be expensive to insure, then you may deduct your premiums from your taxes.

There are some crucial nuances to understand before writing off your car insurance.

- A car you use to commute to and from work doesn't qualify as a business expense and is not tax exempt. For that reason, you can't write off any car expenses related to commuting.

- You also can't write off your car insurance if your business or employer already reimburses you.

You can partially write off car insurance if your car is used for both business and personal use

If your car is used for both reasons, you may deduct your insurance from your taxes for the percentage of time you use your car for business. If you use it for business half the time, you may deduct 50% of the yearly auto insurance costs from your taxes.

Airbnb Owners and Renters

If you operate an Airbnb or rent a home, any travel expenses related to maintaining the home are tax deductible. So, if you drive to the house for upkeep, cleaning or to let in a guest, you are allowed to write off a portion of the insurance to account for that trip.

Keep in mind that if you only do this once in a while, or it's a short drive, the deduction will not amount to much. It will ultimately be a small part of your total driving throughout the year. But if you frequently make trips to your rental property, the savings can add up quickly.

Uber and Lyft drivers

If you drive for a rideshare company, you may need to have special insurance to protect yourself and your passengers. For the time you use your car as a taxi, your auto insurance is deductible.

If you are required by state law to have rideshare insurance that goes into effect while you are driving, you can deduct the entire premium for that coverage from your taxes.

In addition, if your state and insurance company allow you to use your personal insurance for rideshare, you can calculate your deductible time by dividing your monthly car insurance payment by the percentage of time you use the car for ridesharing.

For example, if you drive two hours daily getting groceries, picking up kids, etc., and then drive three hours for Lyft at night, you can say you use your car for ridesharing 60% of the time (three Lyft hours/five total hours per day). So if your monthly car insurance premium is $120, you can deduct $72 per month, or $864 per year.

Writing off your car insurance deductible

You're generally unable to deduct personal losses due to casualty or theft, regardless of whether an insurance policy covers the loss. There is one exception: property losses in one of the few federally mandated disaster areas that are a direct result of the disaster. For example, in 2017 the only disasters that qualified were Hurricanes Harvey, Irma and Maria and the California wildfires.

If you suffer a financial loss involving your car due to such a disaster, you can write it off on your taxes. However, you can't write off any loss you were compensated for(by insurance, for example). You can only do this for the dollar amount you actually lost. This typically includes your car insurance deductible and the repair cost if the damage is not covered by your insurance.

Additionally, you must subtract $500 from the loss to determine how much you can write off.

For example, suppose you had a car worth $15,000 that was destroyed in a wildfire. Comprehensive coverage, which is optional, would cover that damage.

- If you had comprehensive coverage with a deductible of $1,000, your insurance company would pay you $14,000. You'd subtract $500 from the deductible, and you could use the remaining $500 as a deduction on your taxes.

- But if you don't have comprehensive, you wouldn't receive any money from the insurance company. So you'd be able to write off the entire value of the car, minus $500, as a loss: in this case, $14,500.

Keeping accurate records for tax filing

Keep good records if you deduct car insurance expenses from your yearly tax bill. One of the key perks of rideshare driving is flexibility: You may drive five hours one day, one hour the next and seven another day.

If you drive sporadically for your business, knowing how much you drove during the year can be difficult unless you keep track throughout the year. Write down every time you were driving on the clock, plus a good estimate of all the times you drove off the clock.

You should hold onto your driving records for at least three years. Should the IRS ever ask you to justify your car insurance tax write-offs, you will need to show proof.

How to deduct your car insurance on your tax forms

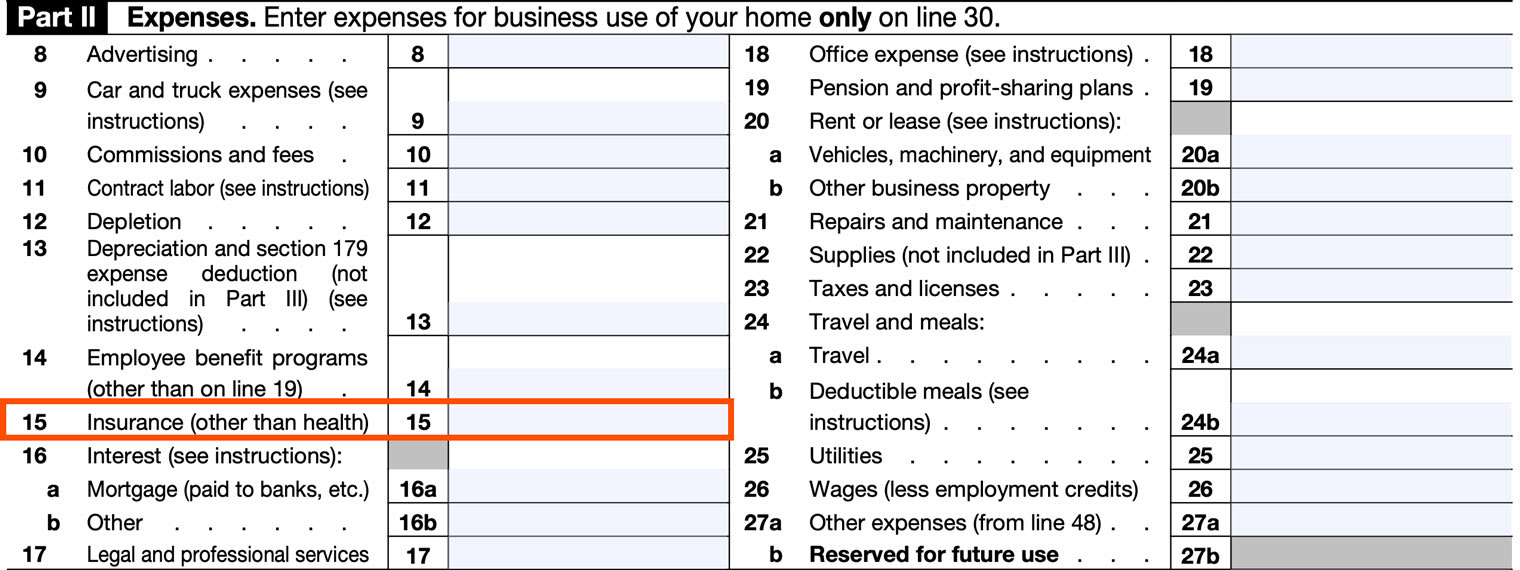

If you are self-employed, including as a rideshare driver, you will file a Schedule C tax form, which includes a section for your deductible insurance expenses.

Below, see where to fill in car insurance expenses on your Schedule C.

Remember that you can only write off insurance expenses if the total amount you're eligible to deduct exceeds the standard deduction.

Car insurance expenses rarely amount to more than a couple thousand dollars a year. As a result, you will usually need to have more deductions, such as business expenses, mortgage interest or certain education expenses, to be eligible for itemized deductions.

Consult your accountant if you're unsure

It's best to do your taxes correctly the first time: A few dollars saved is not worth the time and expense of a possible audit. If you're unsure if you're eligible to deduct your car insurance from your income taxes, consult an accountant or someone well-versed in tax law.

If you're doing your taxes using a service like TurboTax, certain levels of its product includes on-call customer service with trained accountants ready to answer your questions. If you use your own personal accountant, be sure to consult them.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.