Homeowners Insurance

More Than 6 in 10 Say Their Jewelry Is Uninsured, Even With Coverage Costs as Low as $12 a Year

Valentine's Day is a time when loved ones exchange precious gifts. But people don't always consider what would happen if these prized possessions were lost, stolen or damaged.

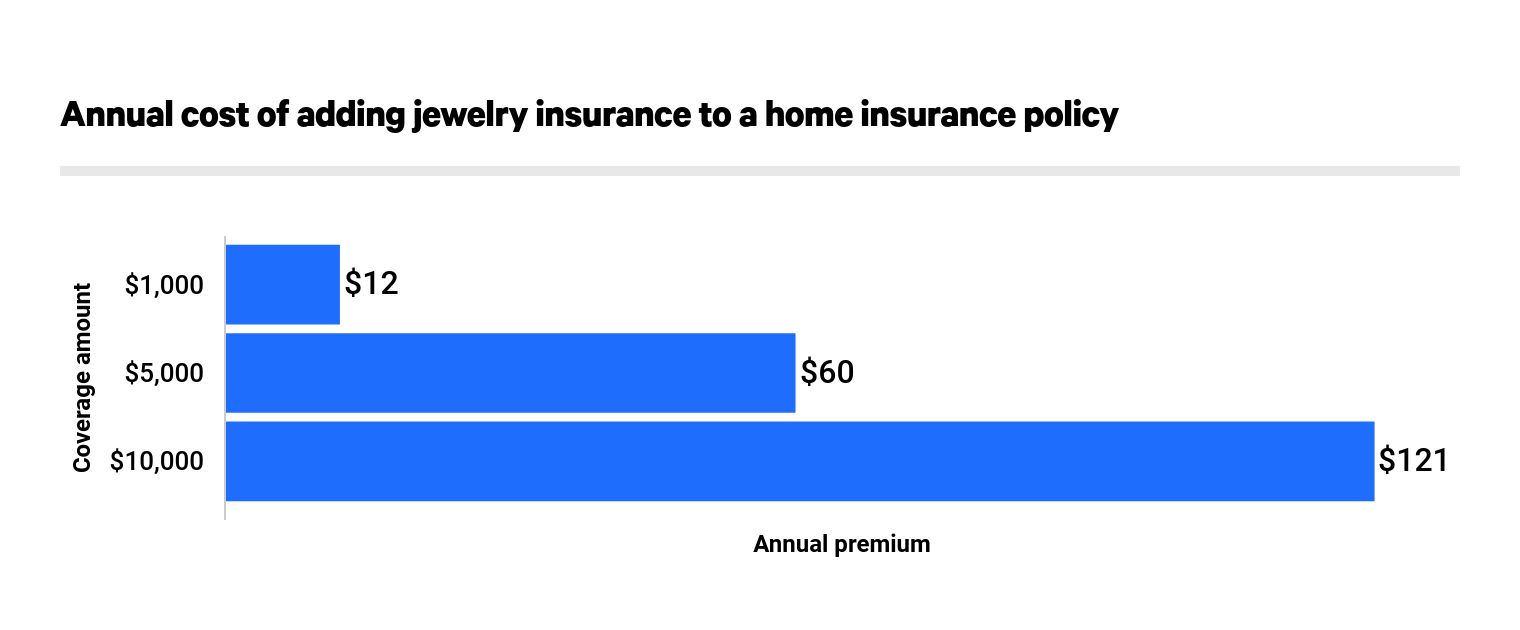

The latest ValuePenguin survey found that more than 60% of respondents said their jewelry was uninsured, a staggering percentage considering it can cost as little as $12 a year on average to add jewelry coverage to a home or renters insurance policy. Without insurance, you could be left without that special ring, necklace or earrings — and regretting not having coverage.

In addition, we provide an analysis of the benefits and costs of jewelry insurance policies.

Key findings

- Twenty-seven percent of consumers who have $10,000 or more worth of jewelry in their household don’t have insurance for those valuables.

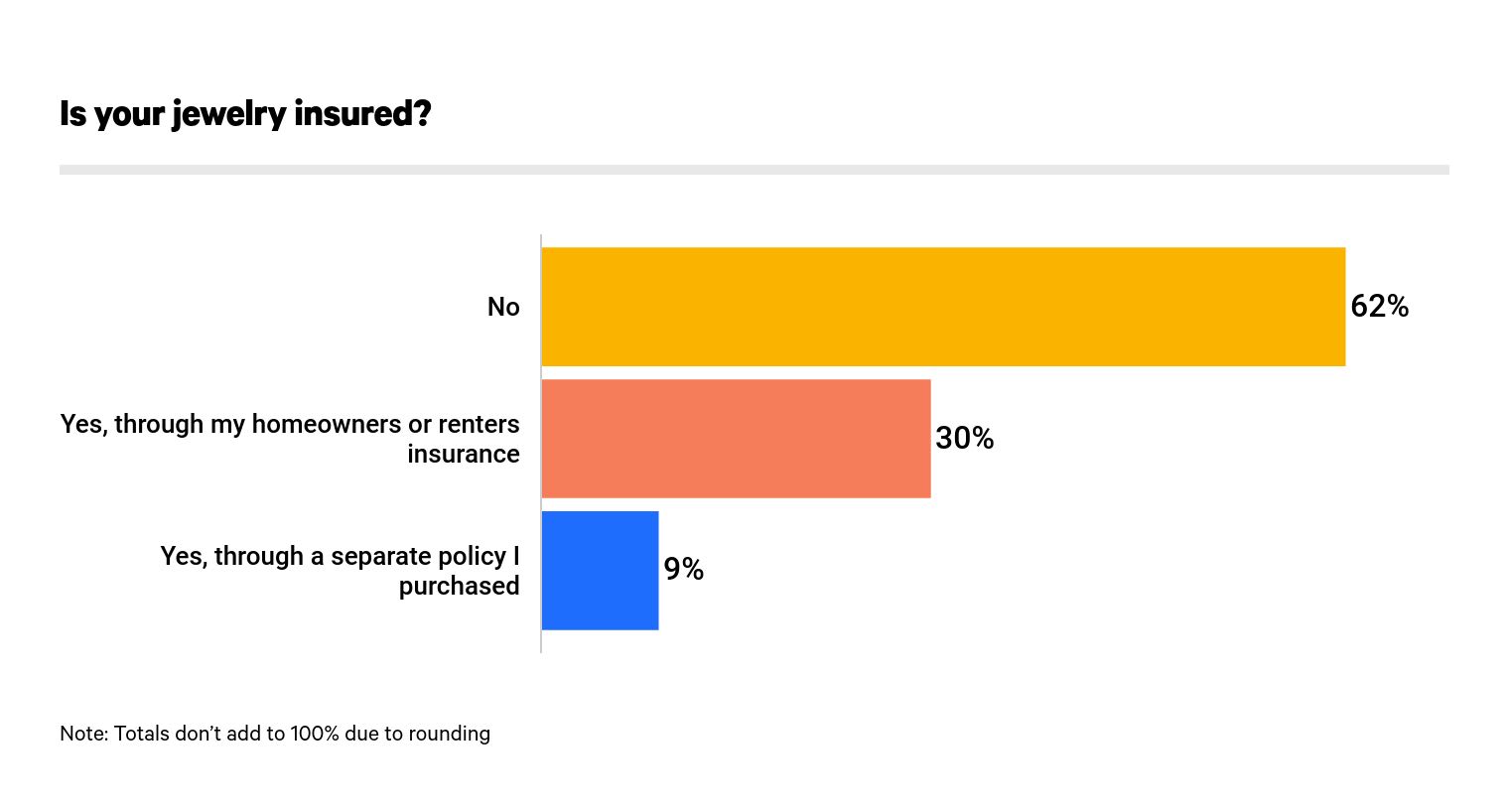

- Sixty-two percent of all consumers say their jewelry (regardless of value) isn’t insured, 30% say it’s insured through a homeowners or renters insurance policy, and 9% have a separate coverage policy. Separately, 69% of women say their jewelry isn’t insured.

- Just more than a third of consumers with insurance say they only insure important or valuable jewels rather than all of their jewelry.

- It costs $121 yearly, on average, to add $10,000 of jewelry insurance to a home insurance policy.

Although 73% of respondents with $10,000 or more in valuables have coverage, the majority of our respondents don’t have jewelry insurance

In 2020, the average cost of an engagement ring, according to The Knot, was $5,500. But our survey found that almost two-thirds of people don't have insurance for their engagement rings and other valuables. Specifically looking at jewelry in that $5,000 to $10,000 range where the average engagement ring falls, 29% don't have any insurance coverage.

As suspected, the percentage who said they didn't have insurance coverage increased as the estimated value of the jewelry dropped. For individuals with less than $1,000 in jewelry, 85% didn't have insurance.

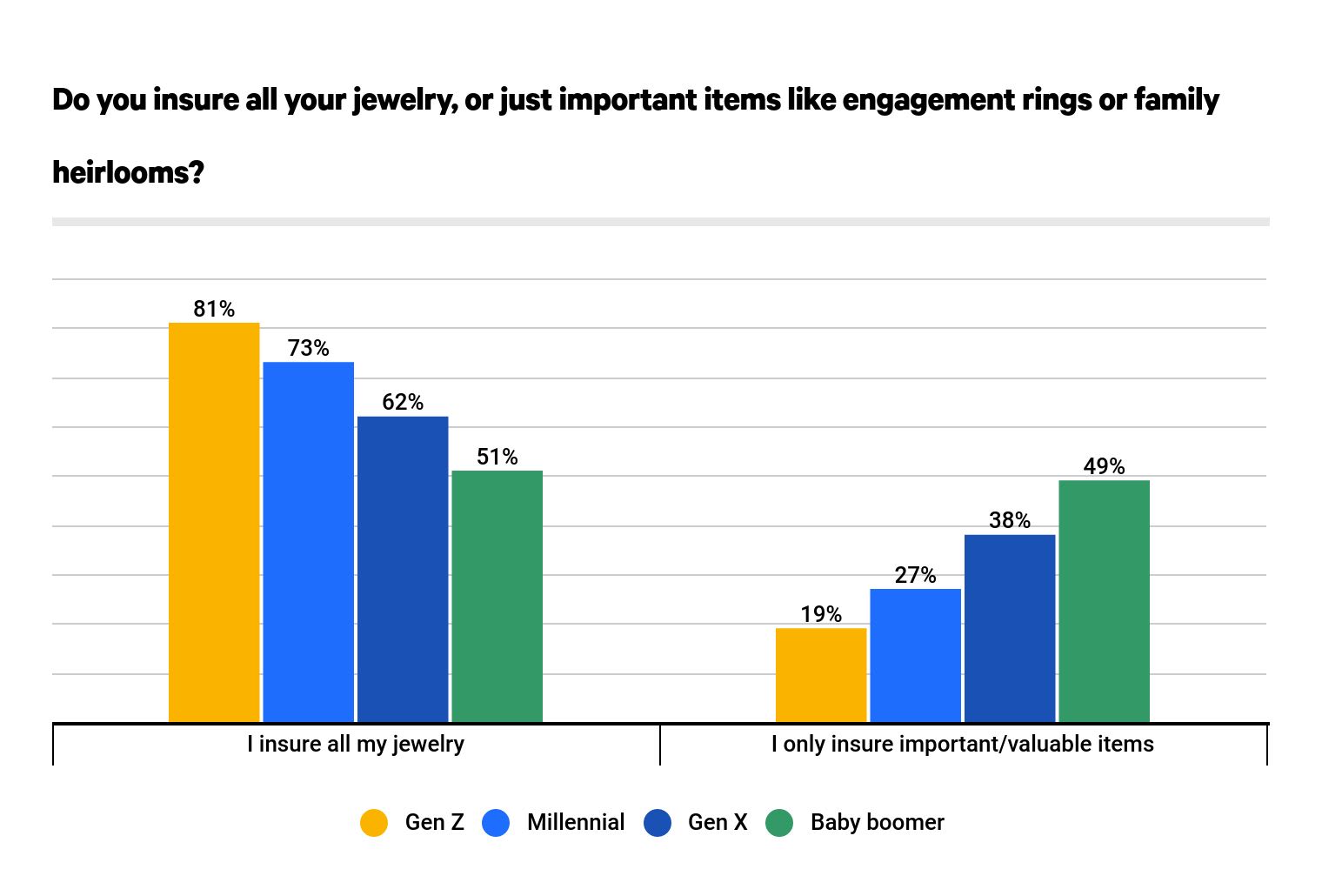

Of the individuals who did have insurance coverage, ValuePenguin followed up to see whether some or all of their valuables were covered by the plan. We found that two-thirds of respondents with insurance coverage insured all of their jewelry with their insurance policy.

Interestingly, younger individuals — Generation Zers and millennials — had the highest rates of insuring all of their valuables at 81% and 73%, respectively. When compared to the rates for baby boomers, these values are 51% higher on average.

However — overall — a person who has jewelry insurance is more than likely to insure their full collection with the insurance policy.

Should I get insurance for my jewelry?

The straightforward answer is yes, you should consider adding jewelry coverage when you purchase home insurance or a renters insurance policy if you have valuables that are expensive or carry sentimental value. In many cases, it makes sense due to how cheap these additions can be. Below, we have provided average costs to add $1,000, $5,000 and $10,000 of coverage to an HO-3 home insurance plan:

However, a few insurance companies will cap this added coverage amount at $10,000, which may not work for many. In this case, we recommend asking your insurer about jewelry riders, which can be classified as "floaters." Riders are add-ons that can supplement a standard insurance policy that covers special events. For jewelry, the floater would cover the insured item in the event of a fire, loss, theft or damage.

For individuals without a homeowners or renters policy, some insurance companies do offer stand-alone jewelry protection insurance plans. These are policies specifically for jewelry, and they often will have a high premium when compared to a floater add-on, but they’ll cover all events and accidents that may happen to your items. These should only be considered if you have a substantial collection of jewelry with high appraisal values.

Additionally, when considering what jewelry insurance to purchase, you should choose carefully since coverage will vary across many of the major insurers. You should be prepared to answer the following questions, among other ones:

- How are my items appraised to get an estimated fair market value and insurance value?

- How are claims handled after loss, theft or damage?

- Will the full cost of the item be replaced, or only up to a certain amount?

- Are there any exclusions within my policy or rider?

- Will I need to provide any proof of the loss?

Using these questions, you’ll be better prepared to ask your insurer about the specific policy it is offering — and then be better equipped to pick your best policy possible.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,250 Americans, conducted Jan. 25-26, 2021. The survey was administered using a non-probability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021: Generation Z: 18 to 24 Millennial: 25 to 40 Generation X: 41 to 55 Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (defined as those 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.