Largest Health Insurance Companies for 2024

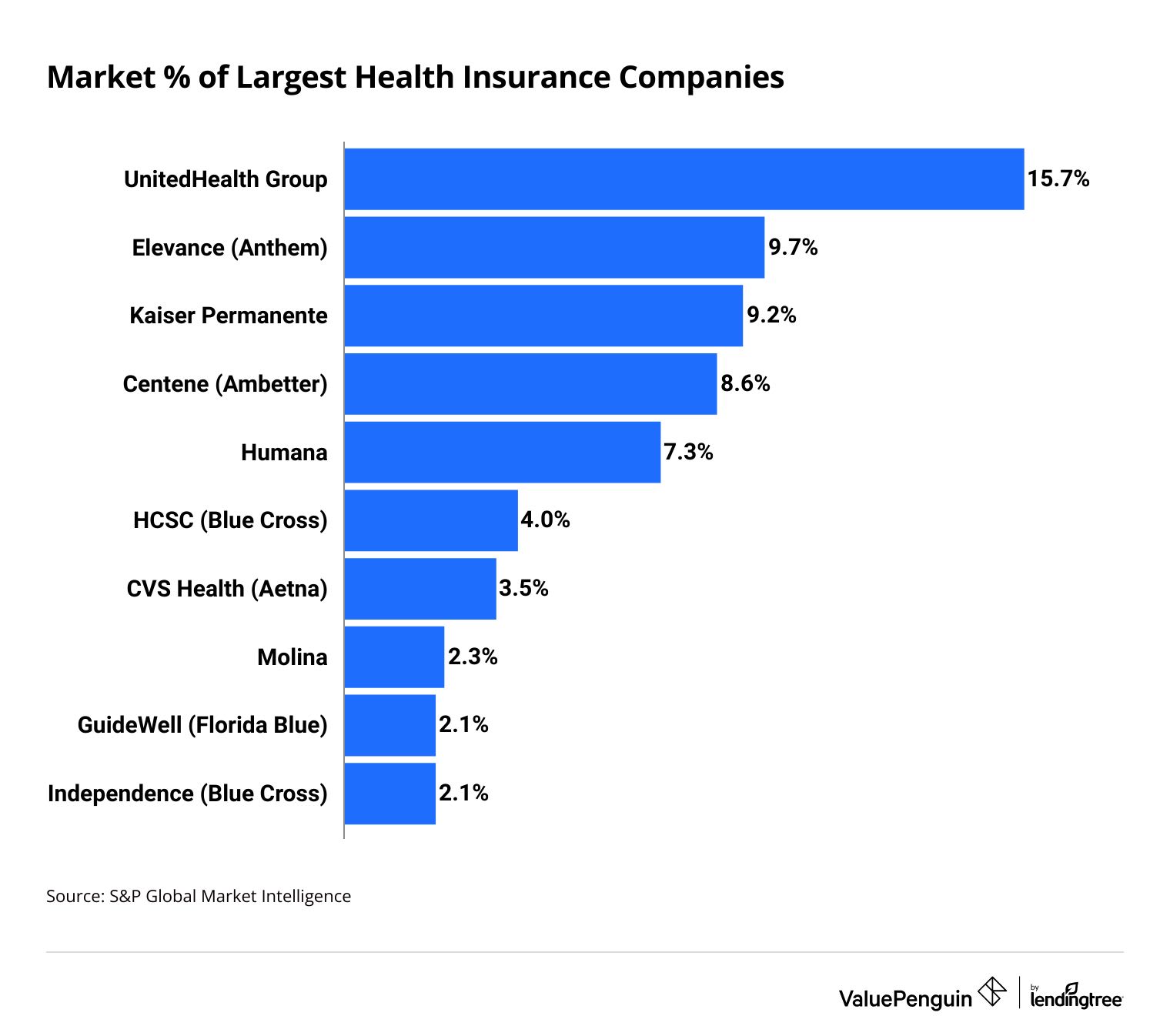

The five largest health insurance companies are UnitedHealth Group, Anthem, Kaiser Permanente, Ambetter and Humana.

Find Cheap Health Insurance Quotes in Your Area

5 largest health insurance companies

What are the biggest health insurance companies?

These five biggest health insurance companies make up half of the health insurance market.

Find Cheap Health Insurance in Your Area

List of largest health insurance companies by revenue

Company | Market share | Revenue (billions) | |

|---|---|---|---|

| UnitedHealth Group | 15.7% | $215B | |

| Elevance Health (Anthem) | 9.7% | $133B | |

| Kaiser Permanente | 9.2% | $126B | |

| Centene (Ambetter) | 8.6% | $116B | |

| Humana | 7.3% | $100B |

Top 5 largest health insurance companies

Each of the largest health insurance companies has millions of customers. You can enroll in a health insurance policy from one of the largest companies in many different ways.

For example, your employer’s benefit plan may offer health insurance, or you can buy a private insurance plan through the Affordable Care Act (ACA) marketplace, also called "Obamacare."

1. UnitedHealth Group

-

Editor rating

- Revenue: $215B

- Market share: 15.7%

- Enrollment: 4,849,762

UnitedHealthcare, part of UnitedHealth Group, is the largest health insurance company, based on revenue. UnitedHealthcare sells individual and family plans and group plans, which you get through an employer.

UnitedHealthcare also has a network of over 1.3 million doctors and health care professionals, with more than 6,700 hospitals. This means that if you have UnitedHealthcare, you will have many options for where you can get medical care.

You can buy policies individual and family plans from UnitedHealthcare in 26 states. UnitedHealthcare is headquartered in Minnetonka, MN.

2. Elevance (Anthem)

-

Editor rating

- Revenue: $133B

- Market share: 9.7%

- Enrollment: 5,344,108

Anthem, which is part of Elevance Health, is the second-largest medical insurance provider by revenue and has over 5 million health insurance members. The company offers insurance to large and small businesses, individuals and families.

The company currently only sells plans in 14 states.

Anthem is part of the Blue Cross Blue Shield Association, which, in total, covers all 50 states. This can give you some benefits like nationwide access to medical care through the BlueCard program, which lets you use your coverage easily when you're traveling. The Blue Cross Blue Shield provider network is the largest in the country and includes about 90% of doctors and hospitals.

3. Kaiser Permanente

-

Editor rating

- Revenue: $126B

- Market share: 9.2%

- Enrollment: 8,815,885

Kaiser Permanente is the third-largest provider of health insurance in the U.S. by revenue, but the largest by enrollment for group and individual health insurance. Much of its membership comes from group health insurance plans from employers. The company also sells low-cost plans across a variety of coverage types including individual health insurance, Medicare Advantage and Medicaid.

Kaiser Permanente only sells policies in eight states and Washington, D.C., but it's very popular where it's available. The insurance company's focus is on low-cost HMO plans that require you to use one of Kaiser's medical centers to get health care.

4. Centene (Ambetter)

-

Editor rating

- Revenue: $116B

- Market share: 8.6%

- Enrollment: 5,173,502

Centene is a large health insurance company, and most of its health insurance plans come from Ambetter. As a company, Centene is the fourth-largest major medical insurance company in the United States by revenue. It sells the most individual health insurance plans of any company, with 3,969,040 members in 2023.

Ambetter is one of Centene's main individual health insurance companies. But Ambetter doesn't sell Medicare Advantage or Medicare Part D plans. Instead, Wellcare is the main Centene subsidiary selling these policies.

Centene was started in 1984 as a provider of Medicaid plans, and today, it's the largest provider of managed care Medicaid plans — where a health insurance company oversees Medicaid benefits — in the country.

5. Humana

-

Editor rating

- Revenue: $100B

- Market share: 7.3%

- Enrollment: 417,212

Humana is the fifth-largest health insurance company by revenue. The company was founded in 1961 and originally sold long-term care insurance before expanding into selling health insurance policies.

Humana focuses on employer health insurance plans, dental and vision insurance. It also sells Medicare plans including Medicare Advantage, Medigap and Medicare Part D plans. Humana has not offered new individual ACA health insurance since January 2018.

Major health insurance companies by state

Blue Cross Blue Shield is the largest health insurance company in most states by membership. That includes affiliates like Elevance (Anthem), Highmark and CareFirst.

State | Company |

|---|---|

| Alabama | Blue Cross Blue Shield of Alabama |

| Alaska | Premera Blue Cross |

| Arizona | Prosano |

| Arkansas | Arkansas BlueCross BlueShield |

| California | Kaiser Permanente |

Largest health insurance companies by enrollment

Kaiser Permanente is the largest health insurance company in the country by enrollment.

The company has nearly 9 million members with either an individual or group health insurance plan. Even though Kaiser's plans are only sold in eight states and Washington, D.C., it has high enrollment in the states where it is available.

But Kaiser Permanente doesn't have the highest revenue because it sells cheap health insurance plans. Anthem has the second-largest membership, followed by UnitedHealthcare.

Company | 2023 enrollment | |

|---|---|---|

| Kaiser Permanente | 8.8 million | |

| Elevance Health (Anthem) | 5.3 million | |

| Centene (Ambetter) | 5.2 million | |

| UnitedHealth Group | 4.8 million | |

| HCSC (Blue Cross) | 4.8 million |

Individual and employer health insurance plans

Blue Cross Blue Shield (BCBS) is a big health insurance company, but it's actually a collection of different individual companies. Of the 10 health insurance companies with the most members, six are part of BCBS. If all BCBS companies were combined, they would have the largest health insurance enrollment in the U.S.

Frequently asked questions

What are the five largest health insurance companies?

The five largest health insurance companies by revenue are UnitedHealth Group, Anthem, Kaiser Permanente, Centene (mostly Ambetter) and Humana. They make up about half of the total market share in the health insurance industry. UnitedHealthcare has the highest revenue, earning $215 billion.

Who is the #1 provider of health insurance in the U.S.?

Kaiser Permanente has the most health insurance plans of any company in the U.S., with 8.8 million members. About 7 million Kaiser Permanente members have group health insurance plans that are sold through an employer. You can only get Kaiser Permanente in eight states, but it's one of the best health insurance companies where it's available.

Should you choose a large health insurance company when buying a plan?

Getting coverage from a big company can be helpful. The biggest health insurance companies usually have a large network of doctors and medical providers, which gives you options for where you get your medical care. But poor customer service is a common complaint about big insurance companies, and there are several smaller companies that have better customer satisfaction.

Methodology

Data on market share, revenue and enrollment is from S&P Capital IQ, pulled in June 2024 based on the most recent annual data available — for the calendar year of 2023. Enrollment data includes group and individual health insurance plans, but not Medicare or Medicaid. National enrollment and California enrollment are reported separately but have been combined.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.