Largest Title Insurance Companies

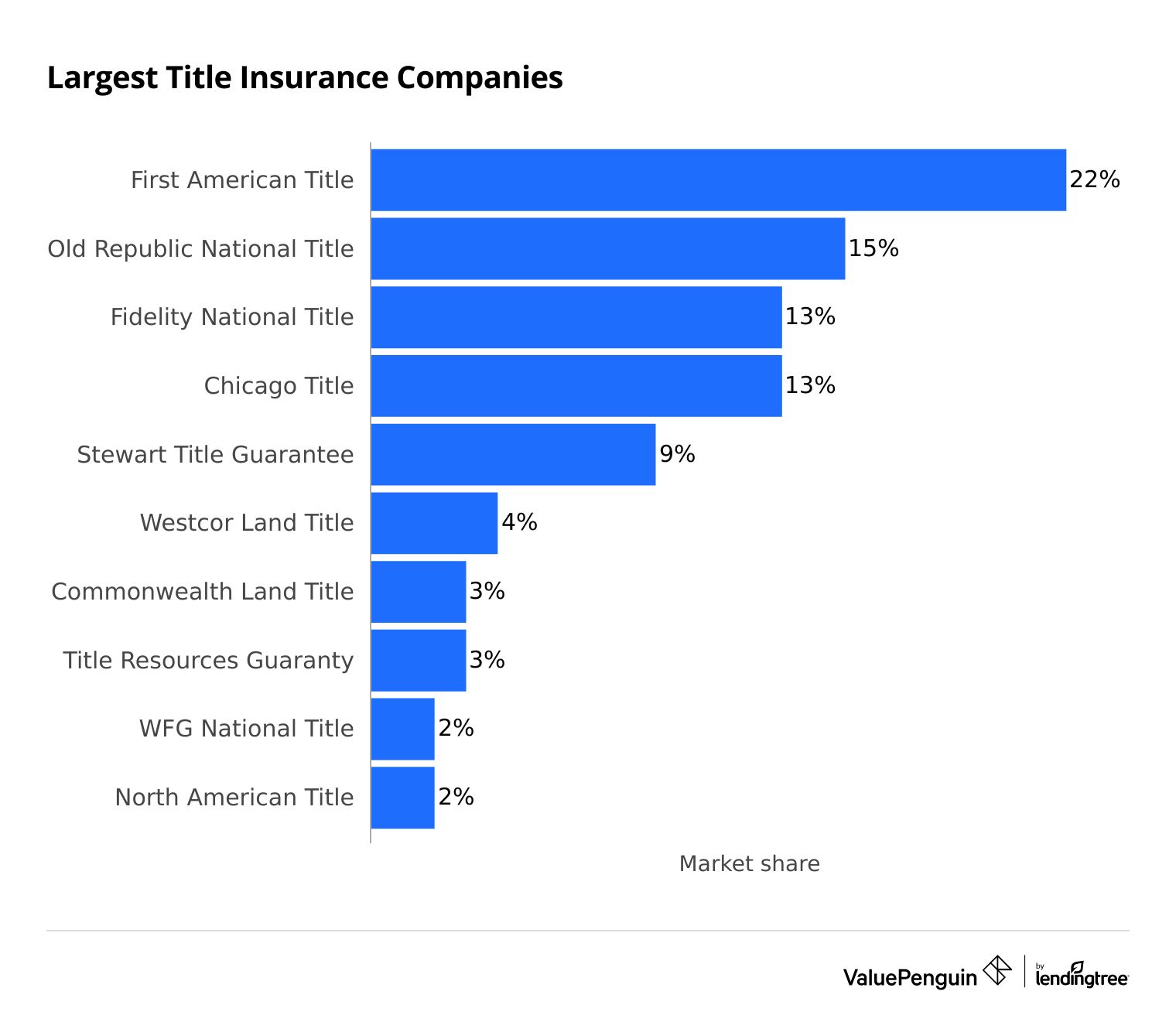

The largest title insurance company in the U.S. is First American Title, with $3.3 billion in premiums in 2023.

Title insurance statistics

- In 2023, the title insurance industry did over $16.5 billion in business.

- The three largest title insurance companies — First American Title, Old Republic National Title and Fidelity National Title — account for half of title insurance premiums in the U.S.

- The top 10 title companies account for 87% of the title insurance business in the U.S.

Largest title companies in the United States

First American Title is the largest title insurance company in the country.

First American Title Co. makes up 22% of the title insurance market. It had more than $3.3 billion in premiums in 2023, which is 45% more than the next-largest company.

Fidelity National Title Group is the largest title group. It owns Fidelity National Title Co., Chicago Title Insurance Co. and Commonwealth Land Title Insurance Co. Together, these companies have 30% of the title insurance market, with nearly $4.5 billion in business.

Title companies by market share

Company | Market share | Premiums (in millions) |

|---|---|---|

| First American Title | 22% | $3,329 |

| Old Republic National Title | 15% | $2,290 |

| Fidelity National Title | 13% | $2,018 |

| Chicago Title | 13% | $1,968 |

| Stewart Title Guarantee | 9% | $1,389 |

Where to buy title insurance

When choosing a title insurance company, you should consider the customer service reviews and price.

Of the 10 largest title companies, Old Republic National Title, Chicago Title, Title Resources Guaranty and North American Title have the fewest customer complaints, according to the National Association of Insurance Commissioners (NAIC). All 10 companies have high financial stability ratings. That means they should be able to pay claims, even in a difficult market.

You should also ask for referrals from your real estate agent, mortgage officer and closing attorney. They have experience working with title companies, and you may get a discount if they partner with a particular company.

Best title insurance companies

Old Republic National Title and Chicago Title are the best companies in the U.S.

Both have fewer complaints than other title companies of a similar size, according to the National Association of Insurance Commissioners (NAIC). Both companies also have the highest possible financial strength rating from Demotech. That means they should have enough funds to pay claims, even during difficult economic times.

Find Cheap Home Insurance Quotes Near You

Top-rated home title insurance companies

Company |

Complaints

|

|---|---|

| Old Republic National Title | Low |

| Chicago Title | Low |

| Title Resources Guaranty | Low |

| North American Title | Low |

| First American Title | Average |

All 10 of the largest property title insurance companies earned excellent financial strength ratings from Demotech.

Some title insurance companies also have financial strength ratings from AM Best:

- Old Republic National Title Insurance Company: A+

- First American Title: A

- Stewart Title Guaranty: A-

- Title Resources Guaranty: B++

Frequently asked questions

What is a title company?

A title company sells insurance policies that protect homeowners or lenders if there's anything wrong with the property title. When you buy a home or refinance your loan, title insurance covers the cost to correct your title rights if there are any issues. It also protects you if you lose your property due to a claim resulting from inaccurate title records.

What is the nation's largest title company?

The largest national title company is First American Title. It makes up 22% of the title insurance market in the U.S. Old Republic National Title and Fidelity National Title are the second- and third-largest companies at 15% and 13%, respectively.

What's the difference between an escrow company vs. a title company?

Title insurance companies issue policies that protect homeowners and lenders against inaccurate property title info. An escrow company holds funds in an account that it pays out later. When you're buying a home, the escrow company holds your earnest money deposit in an escrow account until you sign the closing paperwork.

Methodology

ValuePenguin sourced market share, direct written premium and financial strength information for the largest title insurance companies in the U.S. from S&P Global, a top provider of financial data, research and analytics.

Complaint levels are based on National Association of Insurance Commissioners (NAIC) complaint index data. Companies with low complaints have a complaint index below 0.75, while those with high complaint levels have a score above 1.25.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.