AARP Life Insurance Review: A Good Option for No Medical Exam Coverage

AARP is a good life insurance option for seniors with pre-existing conditions, but rates are high for healthy seniors.

Find Cheap Life Insurance Quotes in Your Area

AARP life insurance review

AARP’s life insurance program through New York Life offers coverage to seniors who have preexisting medical conditions or who would have difficulty getting life insurance elsewhere. None of AARP’s policies require a medical exam, so unless you have a serious medical condition, you are likely to find much cheaper rates for term and whole life insurance elsewhere.

If you are a senior specifically looking for no medical exam or guaranteed acceptance coverage, AARP does provide reasonable quotes for whole life insurance. However, your death benefit will be limited to $50,000 or less, so it's only useful for final expense coverage — you'll need to look elsewhere if your family needs extra financial protection.

Pros and cons

Pros

No medical exam

Offers coverage to people with preexisting conditions

Guaranteed acceptance whole life insurance

Cons

Expensive term life insurance

No death benefits over $50,000

AARP life insurance products

AARP and New York Life offer group term and whole life insurance policies for seniors, as well as whole life insurance coverage for minors. There are no medical exams, and you'll get coverage very quickly because all of the policies are either simplified issue or guaranteed acceptance. The downside to this is that insurers assume applicants are at higher risk and typically charge much higher rates.

AARP membership required

Only people who are members of the American Association of Retired Persons (AARP) can buy a life insurance policy from AARP. You have to be at least 50 to qualify, and membership can cost between $12 and $16 per year, depending on your method of payment. An AARP membership also includes eligibility to buy AARP auto insurance and other benefits like travel discounts, but not everyone will find these useful.

AARP level benefit term life insurance

Unless you have a serious preexisting condition and doubt your ability to pass a medical exam, AARP’s level benefit term life insurance through New York Life is not a good option for most people. The rates are incredibly high and increase over time. Unlike a typical "level term" policy, "level benefit" means the death benefit stays the same while rates rise, and coverage ends when you turn 80.

AARP offers term life insurance coverage for members between the ages of 50 and 74, and policies can be converted into a permanent life insurance policy at any point during coverage. Term life insurance death benefits only range from $10,000 to $150,000, meaning you may not be able to cover larger financial obligations, such as a mortgage. AARP’s term payouts are limited, in part, because the policies don’t require a medical exam.

AARP’s term life insurance policies from New York Life are one-year annually renewable policies. This means your rates will increase as you get older. Your initial price is determined by what five-year age bracket you fall into, and each time you enter a new age bracket, the rates increase.

For example, say you are a 55-year-old man and want $100,000 of coverage for 15 years. With New York Life and AARP’s program, you would pay three different prices over that 15-year period:

Age group | Monthly cost (nonsmoker) | Monthly cost (smoker) |

|---|---|---|

| 55-59 | $116 | $238 |

| 60-64 | $171 | $348 |

| 65-69 | $236 | $478 |

| Average | $174 | $355 |

Monthly rates in Texas

We found that getting an equivalent 15-year term life insurance policy from another insurer is much more affordable. Whether you’re in great health, just average or even a smoker, AARP term life insurance from New York Life is always the most expensive of the three options we analyzed.

Find Cheap Life Insurance Quotes in Your Area

While AARP’s term life insurance rates are incredibly high, they are in line with other insurers that offer coverage without a medical exam. However, you should still shop around and get multiple quotes. Depending on your age, height-to-weight ratio, tobacco use and health responses, no medical exam quotes for term life insurance can vary significantly.

Monthly rates for a 15-year term policy

Excellent health | Average health | Smoker | |

|---|---|---|---|

| MassMutual | $38 | $53 | $142 |

| New York Life | $44 | $57 | $139 |

| AARP | $174 | $174 | $355 |

Rates are for a $100,000, 15-year term life insurance policy for a 60-year-old.

AARP whole life insurance with no medical exam

Permanent life insurance policies, particularly those that have no medical exam, are almost always more expensive. Given this, we also would not recommend AARP simplified issue whole life insurance unless you have a preexisting condition that would prevent you from passing a medical exam. However, if you’re a senior and have had a medical condition for over two years that’s well managed, such as diabetes, the company's whole life insurance policy is a strong option.

AARP’s no medical exam whole life insurance is a kind of "final expense insurance" (also called burial insurance), as the amount of coverage available is usually just enough to cover end-of-life expenses. AARP’s whole life insurance policy offers $5,000 to $50,000 as a death benefit and is available if you’re between the ages of 50 and 80. While this is certainly enough to cover a funeral and minor debts, it is likely not a large enough death benefit to cover your mortgage or other large expenses. So if you have large outstanding debts, you should consider other insurers.

As with other whole life insurance policies, AARP’s whole life coverage builds cash value over time. This amount can be borrowed against if, for example, you have an emergency medical expense. However, AARP’s whole life insurance policy is unusual in that monthly payments end when you turn 95. Few people live to be 95, but giving people the chance to stop making payments and continue to have coverage isn’t common among whole life insurance companies.

In addition, AARP’s whole life insurance comes with two features that offer financial assistance if you become disabled or ill:

- Waiver of premium: If you need to move into a nursing home due to a covered illness or disability, you only have to make monthly payments for six months (or until you turn 80, whichever is sooner).

- Accelerated death benefit: If you’re diagnosed with a terminal illness and the doctor believes you have less than 12 months to live, you can access up to 50% of the policy’s death benefit while still alive.

AARP guaranteed acceptance whole life insurance

AARP and New York Life also offer guaranteed acceptance whole life insurance, though this option isn’t available in New Jersey or Washington. A guaranteed acceptance whole life policy means that you will pay the same rate for as long as you hold the policy, without an end date. And eventually you'll stop making payments altogether — though this happens after you've paid much more than the coverage amount.

AARP’s guaranteed acceptance policy, like many policies available at competing insurers, has a very small maximum coverage amount: $25,000. That may be enough to cover funeral expenses or a small debt, but it won't make a big impact if someone relies on your income or will inherit your debts.

In addition, if you pass away from natural causes during the first two years of coverage, your beneficiary won’t get the full death benefit. Instead, they will get 110% of the value of what you have paid up until that point — and deaths due to suicide will void coverage entirely. Waiting periods are common for guaranteed acceptance coverage, as insurers want to avoid large payments in case terminally ill patients sign up.

Otherwise, this plan is similar to AARP's other whole life policy, in that:

- It’s available if you’re between the ages of 50 and 80

- You no longer have to make payments once you turn 95, and coverage remains in force

- There’s no medical exam

- If you become terminally ill, you can get up to 50% of the death benefit while still alive

While AARP’s guaranteed acceptance coverage offers rates that are about equal to its competition, if you aren’t already a member, you shouldn’t join AARP to get access to this product. Competitor quotes are on par with or cheaper than those from AARP but don’t require any sort of membership.

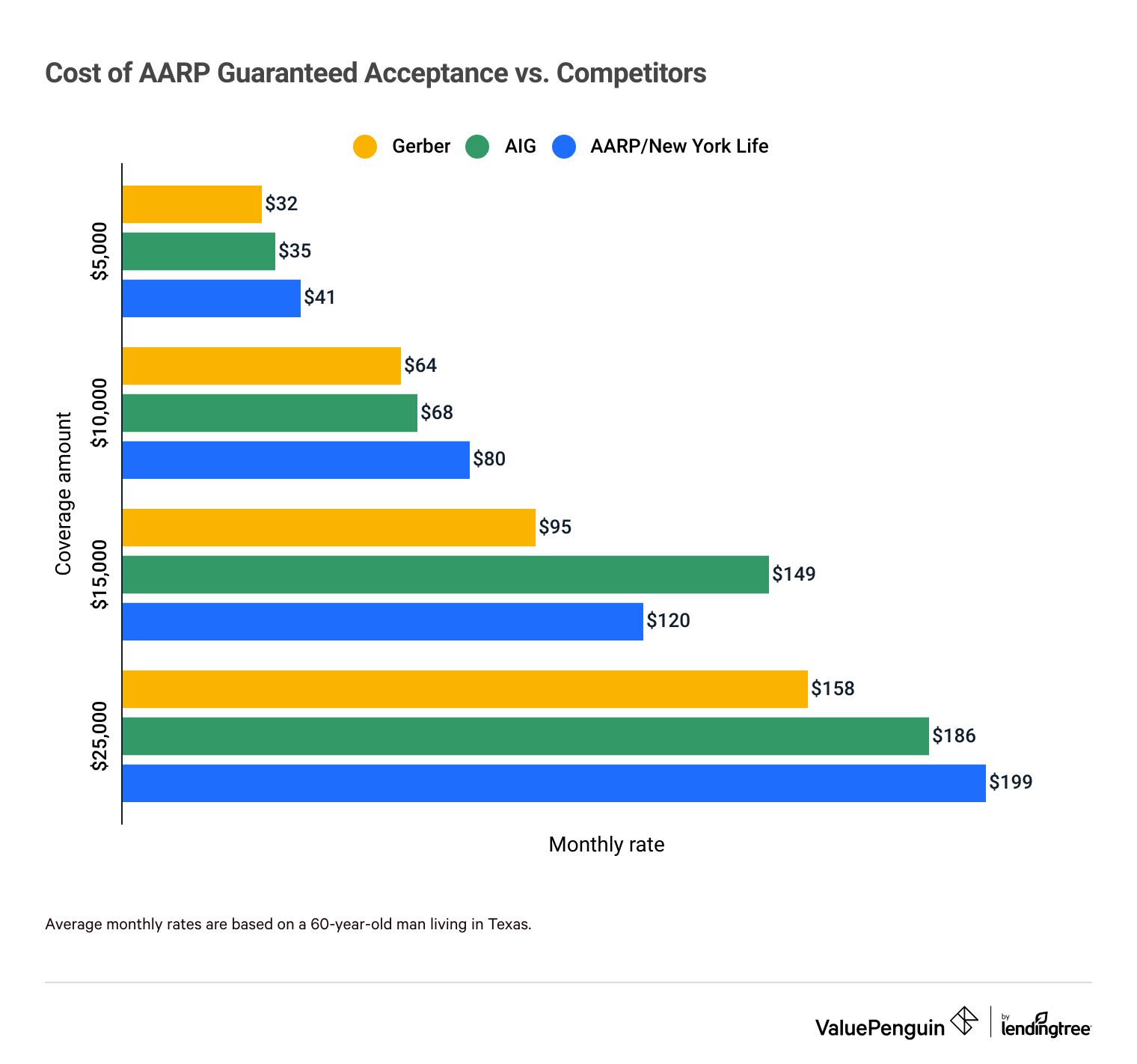

AARP guaranteed acceptance policy rates

Coverage amount | AARP/New York Life | AIG | Gerber |

|---|---|---|---|

| $5,000 | $41 | $35 | $32 |

| $10,000 | $80 | $68 | $64 |

| $15,000 | $120 | $149 | $95 |

| $25,000 | $199 | $186 | $158 |

AARP rates not including required AARP membership fee

AARP life insurance reviews and complaints

AARP’s life insurance policies are underwritten and managed by New York Life, one of the largest and most dependable life insurance companies in the U.S. It has an A++ (Superior) financial strength rating for life insurance companies from AM Best and gets very few complaints according to the National Association of Insurance Commissioners, with just 27% as many complaints as a typical life insurance company of its size.

Customer service at New York Life is rated slightly above average by J.D. Power (10th out of 22), suggesting good, but not industry-leading, customer care.

New York Life’s program with AARP gets a lot of critical reviews with regard to claims handling — especially for claims that happen during the first two years after a policy is opened.

Tip: To reduce issues, carefully read all application questions from AARP and New York Life and answer them honestly. You should also give your beneficiaries access to a copy of the policy and all payment records. Finally, let your beneficiaries know that they’ll be better served directly contacting AARP if they have issues during the claims process with New York Life.

Methodology

To compare the cost of AARP/New York Life insurance with competitors, ValuePenguin gathered sample rates for term and guaranteed acceptance whole life policies from AARP/New York Life, as well as top competitors in each category. We considered rates for seniors of a variety of ages and health levels, including those who smoke and those who don't.

To evaluate the service from AARP/New York Life, ValuePenguin analyzed online customer reviews and official complaint statistics. We also considered AM Best's financial strength rating, which describes the company's overall financial health and ability to pay claims.

We gathered rates from insurer websites, as well as through Compulife, a software subscription. AARP rates do not include the cost of an AARP membership.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.