Banner Life Insurance Review: Great Quotes and Coverage for Term and Universal Policies

Low rates, easy underwriting and some useful coverage options make Banner Life a solid choice for term or universal life insurance.

Find Cheap Life Insurance Quotes in Your Area

Banner Life Insurance is a strong choice for term and universal life insurance coverage. Banner has well-rated customer service and great prices for term life, but its universal policies are on the expensive side. In addition, Banner’s life insurance policies have some built-in flexibility so you can choose what features you want to pay for.

For example, while most term life insurance policies offer a fixed death benefit for the term length, Banner’s term policy lets you stack multiple term insurance policies. This means you can pay a lower premium for the base coverage and only pay more when you need additional financial protection, like while putting a child through college.

Banner Life Insurance is a subsidiary of Legal and General America and issues its life insurance policies in every state besides New York, where the same policies are issued by William Penn Life Insurance.

Contents

Pros and cons

Pros

Cheap term life rates

Good if you have just one health issue

Option to temporarily increase coverage

Cons

Expensive for permanent insurance

Not a good option for serious health issues

Banner Life Insurance products

Banner Life offers term and universal life insurance policies, with a variety of coverage options available. Banner Life is an established insurance company with a strong financial strength rating that generally competes well on price, in part due to flexible underwriting.

Banner’s underwriting process is less strict than those of other insurers when it comes to having a single issue, such as smoking or having osteoporosis. Instead, they look at combinations of other health factors, meaning you’re less likely to be hit with a high premium if you’re very healthy overall with one medical condition or lifestyle concern.

Banner term life insurance

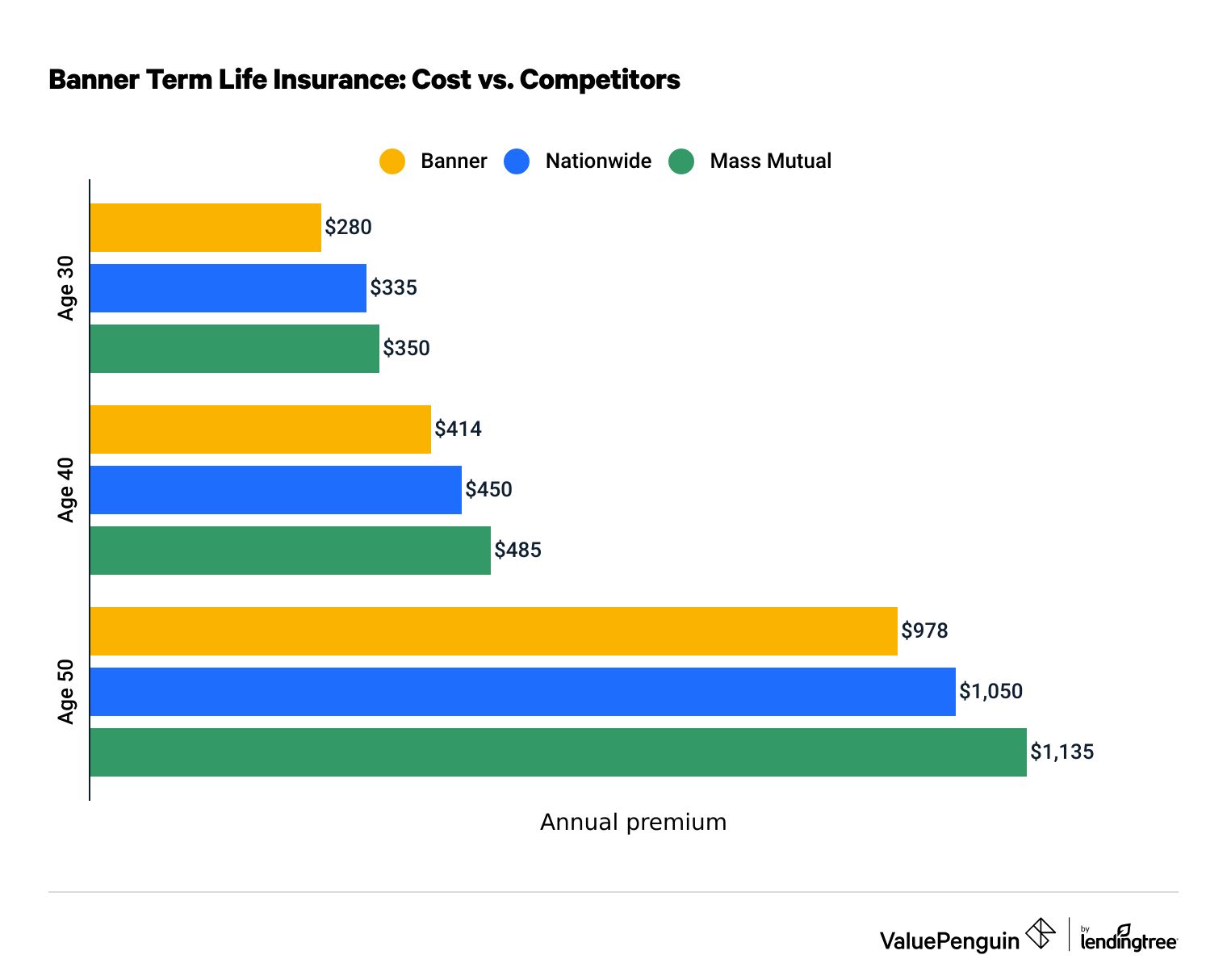

Banner's term life insurance policies offer flexible coverage with lower rates than many competitors. We found that its prices were about 9% cheaper than competing companies, depending on your age. A 20-year policy for a healthy 30-year-old costs $280 per year, while a 50-year-old will pay $978 per year.

Find Cheap Life Insurance Quotes in Your Area

Banner Term Life Insurance prices

Age | Banner | Mass Mutual | Nationwide |

|---|---|---|---|

| 30 | $280 | $350 | $335 |

| 40 | $414 | $485 | $450 |

| 50 | $978 | $1,135 | $1,050 |

Banner’s term life insurance death benefits range from $100,000 to $10 million. Depending on your age, you can get a term policy for:

Term Length | Age Availability |

|---|---|

| 10 years | 20-75 |

| 15 years | 20–75 |

| 20 years | 20–70 (non–smoker), 20–65 (smoker) |

| 25 years | 20–60 (non–smoker), 20–55 (smoker) |

| 30 years | 20–55 (non–smoker), 20–50 (smoker) |

| 35 years | 20–50 (non-smoker), 20–45 (smoker) |

| 40 years | 20–45 (non-smoker), 20–40 (smoker) |

In addition, Banner’s term policies can be "laddered" using a term rider. This means you can increase your coverage during certain periods of time during which your needs are higher.

For example, you could purchase a 30-year term policy for $250,000 then add on 10-year term coverage for $150,000 to cover your child’s education until they graduate from college.

This means you don’t have to pay higher rates over the entire term of the policy if you only need more coverage for a shorter period of time. In addition, it adds flexibility as it can be hard to predict what financial obligations you may have in 10 or 15 years.

Banner Life doesn’t offer a traditional no-medical exam term life insurance policy and their full underwriting process can take several weeks. However, they do offer an accelerated underwriting program to certain customers, which is the same price and coverage as their standard policy. There's no defined set of health criteria to qualify, but generally healthier people are more likely to qualify. Essentially, if you complete an application and phone interview with no issues, you may qualify for coverage within a few hours without a medical exam or blood test.

In addition, if you’re undecided between term and permanent coverage, any of Banner’s term policies can be converted to a universal policy so long as you’re below age 70.

Banner Life universal life insurance

Banner Life's universal life insurance policy is called Life Step UL, and is available if you’re between the ages of 20 and 85. It's more expensive than competing policies from other life insurance companies, but offers a guaranteed interest rate of 2% — which is typical for this type of policy.

Term life customers at Banner can also convert their policy to universal when their term is up, or after at least five years of coverage — with no additional medical exam.

Policy Details | Life Step UL |

|---|---|

| Minimum Coverage | $50,000 |

| Guaranteed Cash Value Interest Rate | 2% annually |

| Surrender Charges | None after 9 years |

| Policy Loan Interest Rate | 7.4% (3.8% in NY through William Penn) |

| Changes to Death Benefit | Can decrease death benefit, but not below $50,000 |

| Term Conversion | Can convert a term policy to Life Step UL if it has been in place at least five years |

What is universal life insurance?

Universal life insurance is a form of permanent coverage. The policy stays in-force so long as you continue to pay premiums and it builds a cash value. The policy’s cash value is the amount of money you would receive if you surrendered. It can be borrowed against or withdrawn. With universal life policies, the cash value grows according to the performance of the insurer’s portfolio, but there’s also a guaranteed minimum annual return.

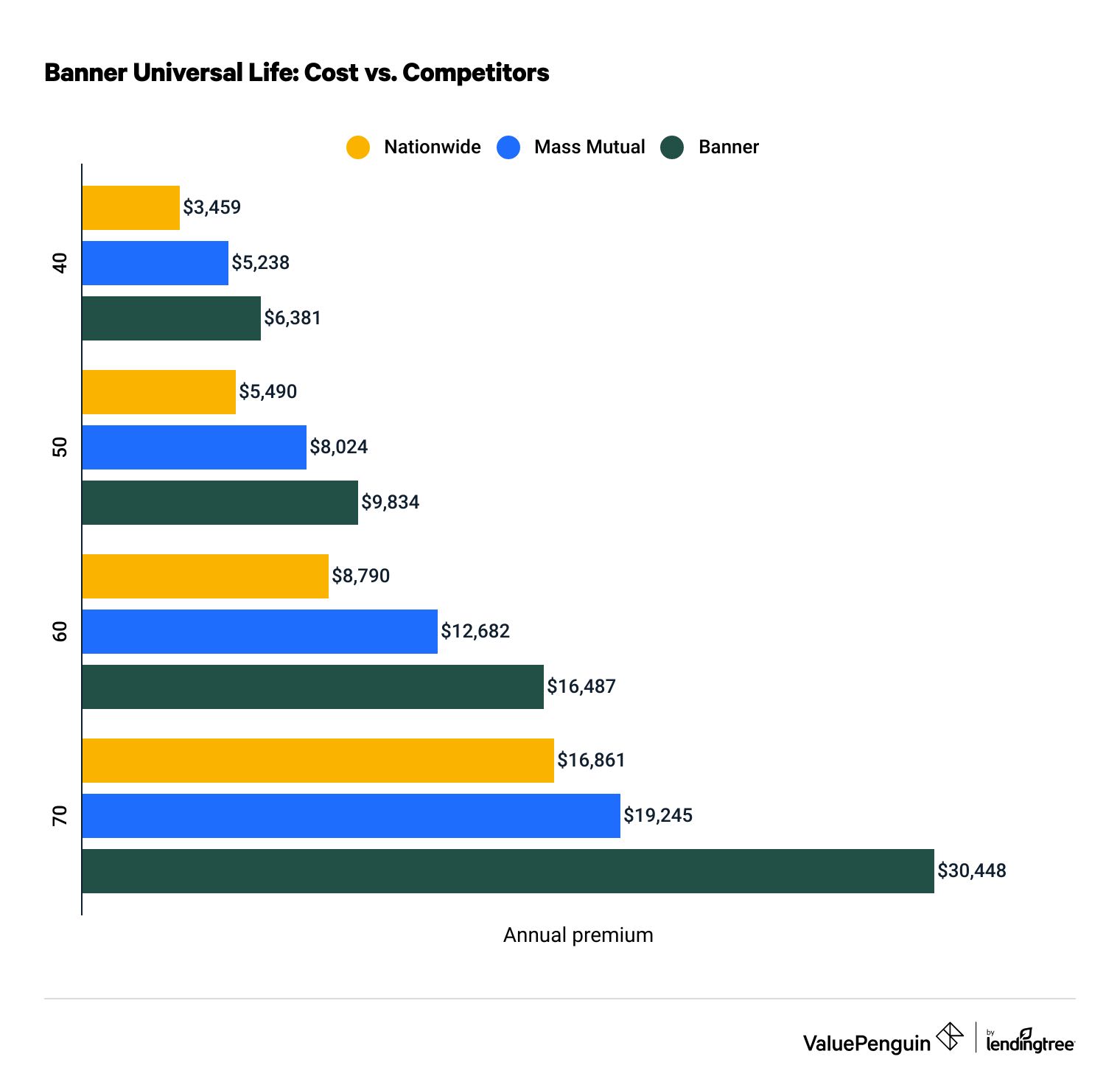

Life Step UL is more expensive than competing companies, especially for older customers. Its rates were 30% higher than average overall, and 37% more for a 70-year-old.

Banner universal life rates

Age | Banner | MassMutual | Nationwide |

|---|---|---|---|

| 40 | $6,381 | $5,238 | $3,459 |

| 50 | $9,834 | $8,024 | $5,490 |

| 60 | $16,487 | $12,682 | $8,790 |

| 70 | $30,448 | $19,245 | $16,861 |

Banner Life Insurance riders

Life insurance riders are policy add-ons offered by insurers to let you adjust your coverage or edit standard features of a policy. Banner Life offers four riders which are available for their term and universal life insurance policies.

- Waiver of Premium: With this rider, If you demonstrate that you have become totally disabled for at least 6 months, you can stop making payments and your policy will remain in force so long as you’re disabled. The only limitation is that the disability has to occur before you turn 65.

- Accelerated Death Benefit - If you are diagnosed with a terminal illness, you can receive a portion of the death benefit while you’re still alive. This reduces the strain on your family as it can help to cover hospital bills, treatment and other expenses. The maximum amount of money you can receive early is $500,000 or 75% of the policy’s full death benefit — whichever is less. This is included on all policies for free.

- Child Rider: This allows you to add coverage for your children, an option that’s typically meant to protect parents from burial costs if the child passes away in an accident. Coverage is available for $5,000 (costs $27.50 per year) or $10,000 (costs $55.00 per year). The rider ends when the child turns 25, or when you turn 65 — whichever is first.

- Term rider: You can add a temporary term life rider to boost or "stack" your policy temporarily. You have the option to add a term rider to a universal life policy, or boost your underlying term policy with another if you have higher financial needs — such as children in college.

Banner Life Insurance customer reviews and complaints

The Banner Life Insurance Company has very positive reviews from its customers, and tends to receive fewer complaints than competing companies. The company receives a low number of complaints, 57% less than an average company its size.

Banner Life’s reputation is based upon a smooth signup process and competitive prices, and these features are reflected in their positive reviews. It also received an A+, or Superior, financial strength rating for the best life insurance companies from A.M. Best. This means the company is very likely to be able to pay out claims regardless of demand or economic conditions.

However, Banner Life does receive some negative reviews, indicating challenges interacting with the customer service team. These crop up primarily when a clerical error was made or a client tries to surrender a policy. Therefore, while it’s always a good practice, with Banner Life you will want to get confirmation of any policy actions you take, even small edits such as changing a name or updating your mailing address.

Methodology

To compare Banner Life Insurance with its competitors, ValuePenguin gathered sample quotes for term and universal life policies from Compulife. Sample rates are for a man in good health who lives in Minnesota, with a $500,000 death benefit on all policies.

To evaluate the service from Banner, ValuePenguin considered online customer reviews from around the web and complaint data from the National Association of Insurance Commissioners. We also considered A.M. Best's Financial Strength Rating, which describes the company's overall financial health and ability to pay claims.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.