Haven Life Insurance Review: Low Rates and Great Customer Service

Those who qualify for the online application will get competitive rates and a near-immediate decision.

Find Cheap Life Insurance Quotes in Your Area

Haven Life Insurance stopped accepting new life insurance applications on Jan. 12, 2024, and it will stop granting new policies altogether on March 31.

Haven Life is owned by MassMutual, so MassMutual is a good alternative that offers similar service, though it doesn't offer online applications. Existing Haven customers will have their policies managed by MassMutual.

For another life insurance company with an easy online application process, consider Ladder Insurance.

Haven Life is an online life insurance agency that offers term life insurance only. You can apply for coverage entirely online and get a near-immediate decision, as long as you're under the age of 45 and need less than $1 million in coverage. Haven Life accepts applicants with some common pre-existing chronic conditions, such as diabetes, though those who are healthy and young will get the most competitive quotes. Should you need to work with its team or ask questions, Haven Life's customer service is particularly well-rated.

Pros and cons

Pros

Fast approval for young, healthy people

Cheap rates

Great customer service

Cons

Doesn't sell more than $2 million in coverage

Not good for people with health issues

Not the best option for seniors

Haven Life Term Life Insurance

Haven Life's term life insurance is algorithmically underwritten. If you're under the age of 45, you need less than $1 million in coverage and the algorithm doesn't detect any concerns in your application, you can apply for coverage and get approval in less than an hour. In addition, the entire application process occurs online, unless a concern is detected and you're asked to take a medical exam.

Not all applicants will avoid the medical exam, and the algorithm will decline those with certain higher-risk pre-existing conditions, but this is still an incredible convenience since the process typically takes weeks with traditional insurers. Since the policy is fully underwritten, rates are much lower than you'd get with most no-exam life insurance policies.

If you are asked to take a medical exam, you may still be approved for temporary coverage, although this option isn't always available. Those who do get temporary coverage will have life insurance in place and will have their rates finalized after the exam (so long as their application is approved post-exam).

Haven Life Term Life Insurance Quotes

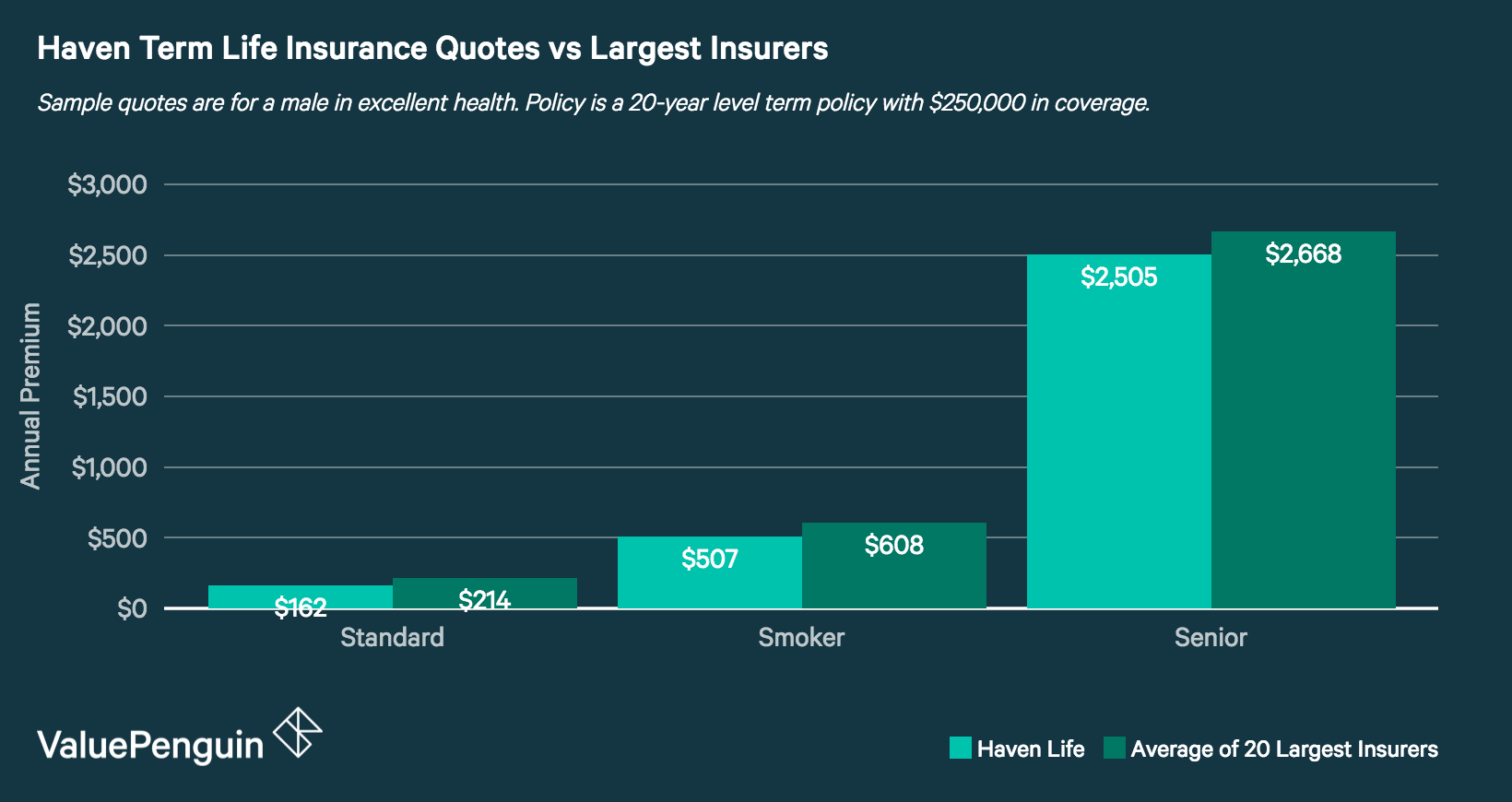

Haven Life's term life insurance rates aren't the lowest available, but they are consistently better than average when compared to those of the top insurers, even for smokers and seniors. In addition, because Haven Life's policies are fully underwritten, those who qualify for coverage without an exam will pay much lower rates than for the typical no-exam policy.

Find Cheap Life Insurance Quotes in Your Area

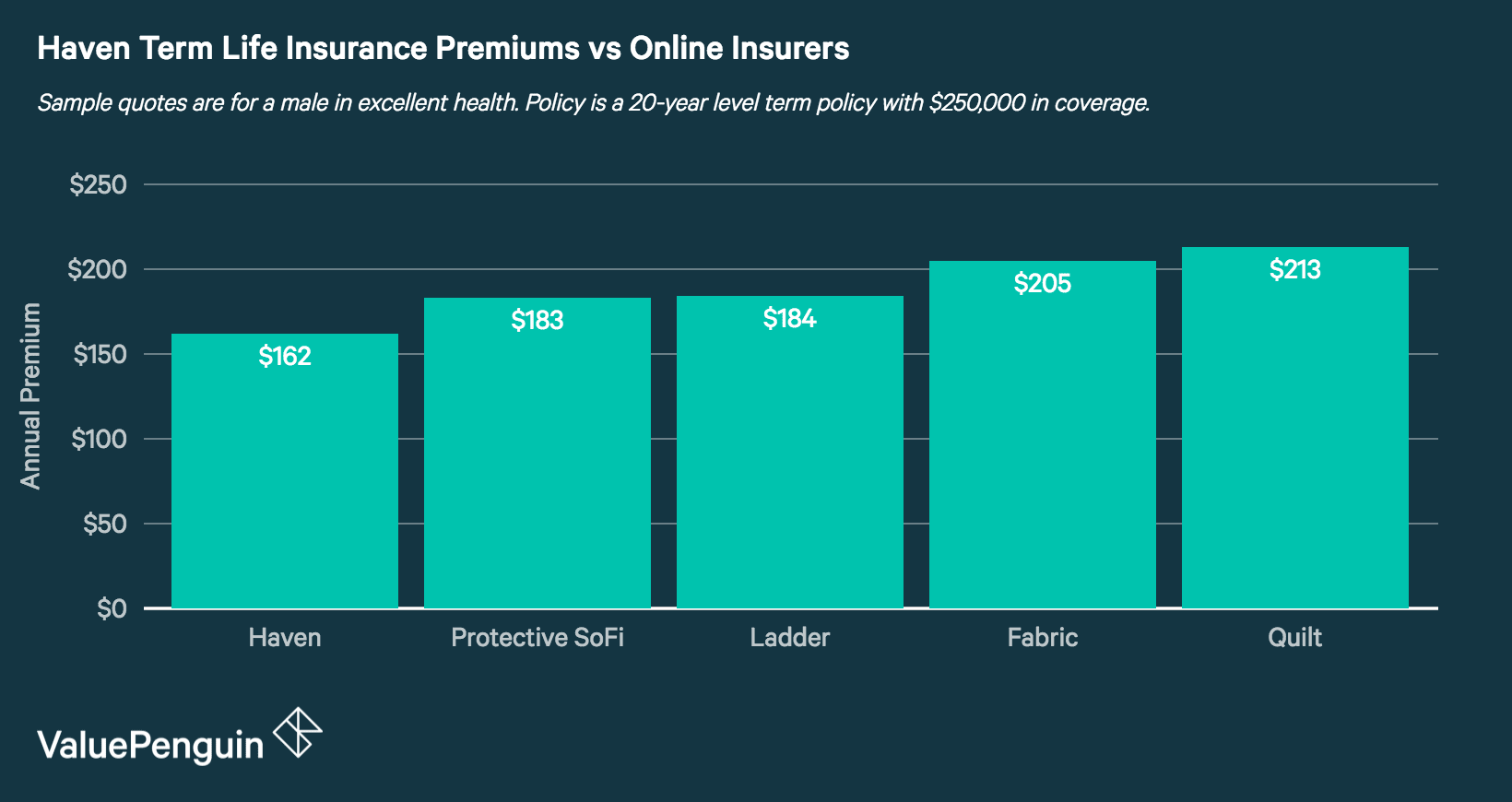

In comparison to other online life insurance companies, Haven Life has some of the lowest rates available. As you can see, similar online insurance companies are more costly.

Haven Life Coverage Options

Haven Life offers level term life insurance policies, meaning that your rates are consistent for the entire initial term of your coverage. The policies, which are underwritten by MassMutual, can be renewed annually after the initial term until age 65. If you choose to renew, rates will increase. You can get a policy for initial term lengths of:

- 10 years

- 15 years

- 20 years

- 30 years (if you're under the age of 50)

If you're under the age of 60, you can get a policy with up to $2 million in coverage. However, those over 60 are limited to just $1 million in coverage. You're also subject to the $1 million limit if you bought the policy entirely online.

As an online company, Haven Life allows you the option of managing some of your policy details online, without needing to call or complete paperwork. Through Haven Life's online portal, you can switch the policy owner, update payment info, decrease the policy's face value (if your financial obligations change), and change your beneficiaries.

Haven Life Coverage Restrictions

Haven Life's term policies can be purchased by those between the ages of 18 and 64 so long as the customer is a U.S. citizen (or resident with a visa or green card) and not active in the military or intending to enlist.

Since the company offers only term life insurance, there's no option to convert to a permanent life insurance policy should that be a better fit later, as you can with many insurers. In addition, Haven Life's insurance policies can't be used for business purposes, such as using them as key man insurance.

Haven Life Insurance Riders

Haven Life offers just two policy riders, or add-ons, which are available as a standard from nearly every life insurance company.

- Accidental Death Benefit. If you are diagnosed with a terminal illness, meaning you're expected to have less than 12 months to live, you can get a portion of your death benefit while still alive. This is a valuable benefit, as serious illnesses often come with a variety of medical bills and care costs. The rider is free and allows you to get the lesser of $250,000 or 75% of the death benefit. When receiving a portion of your death benefit early, the payout your beneficiaries get will be reduced by that amount.

- Waiver of Premium. Haven Life's waiver of premium rider helps you stay covered if you become disabled to the point of being unable to work and would have trouble affording your policy. If you become totally disabled before the age of 65, and the disability lasts at least six months, this rider continues your coverage while not requiring you to make payments. The only key restriction is that it's unavailable if you buy a policy after the age of 50.

A wide range of riders isn't indicative of a better policy, but if you are looking for a particular benefit, you won't find it through Haven Life. For example, some life insurance companies offer a child rider, which provides a payout if one of your children passes away. If you wanted this benefit as a part of your policy, as purchasing coverage separately can be more expensive, you would need to get your policy through a different insurance company.

Haven Life Insurance Reviews & Ratings

Haven Life is a young company, co-founded in 2015 by CEO Yaron Ben-Zvi, but it has outstanding reviews for customer service and competitive rates, making it one of the best life insurance companies available. In addition, those customers who qualify for coverage without a medical exam love the incredibly fast process and online interface.

The majority of the critiques are from those who are required to take a medical exam due to the algorithmic underwriting process. In some of these cases, rates increased slightly due to the results. Since Haven Life has only been around for a few years, info on how the company performs with claims is limited, but its parent company is very well-rated.

Haven Life's policies are underwritten by its parent company, MassMutual, which has not only a Superior (A++) financial strength rating from A.M. Best Rating Services, but also a 0.04 NAIC complaint ratio. A company's complaint ratio shows the number of complaints against it as compared to its size, with the national median being 1.00.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.