Medicare vs. Private Health Insurance: Which Is Better?

Compare Medicare Plans in Your Area

Medicare offers great, cheap health care coverage if you qualify, but private insurance is better if you need to add a spouse or child to your policy.

If you qualify for both Medicare and private health insurance, understanding how each policy works may help you choose the best option for your needs.

Medicare vs. private insurance

Medicare may be best for those who qualify and are looking for low rates, but private health insurance can be more flexible.

Medicare is a health insurance program administered by the government or on behalf of the government, while private health insurance comes directly from a health insurance company.

But just because coverage comes from an insurance company doesn't make it private. Some Medicare benefits are sold by health insurance companies. It's also possible to have both types of coverage.

Medicare

Medicare is federally provided health insurance coverage.

Anyone 65 or older is eligible for Medicare, and younger people can qualify if they have an eligible disability. Coverage is broken down into four distinct parts:

Part A

Part B

Part C

Part D

Medicare Part A is also called hospital insurance and pays for the cost of inpatient care in hospitals, nursing facilities, hospice settings and more. Part A is part of Original Medicare and is managed by the federal government.

Part A

Medicare Part A is also called hospital insurance and pays for the cost of inpatient care in hospitals, nursing facilities, hospice settings and more. Part A is part of Original Medicare and is managed by the federal government.

Part B

The second half of Original Medicare is Medicare Part B, which pays for doctor visits and other outpatient services. Part B is also a government-run plan.

Part C

Medicare Part C, also called Medicare Advantage, bundles different Medicare parts into one plan. Medicare Advantage plans are sold by private insurance companies on behalf of the government.

Part D

Medicare Part D is prescription drug coverage and can be purchased as a stand-alone policy along with Parts A and B, or you can purchase prescription drug coverage as part of a Medicare Advantage plan. Like Part C, Part D is also sold by private companies.

You may also consider a Medicare Supplement policy, also called a Medigap policy, which supplements Original Medicare Parts A and B and can lower your out-of-pocket costs.

Private health insurance

Private health insurance includes coverage that you get through an employer as well as coverage that you buy on your own.

When an employer offers health insurance to its employees, the coverage is known as group insurance. You can also get private health insurance by purchasing a policy directly from an insurance company or on a marketplace website. You might consider individual health insurance if you don't have coverage through an employer and don't qualify for Medicare.

You don't have to be a certain age or have a disability to get private health insurance. Coverage is generally more expensive than government-sponsored plans, but you may also have more coverage options than with Medicare.

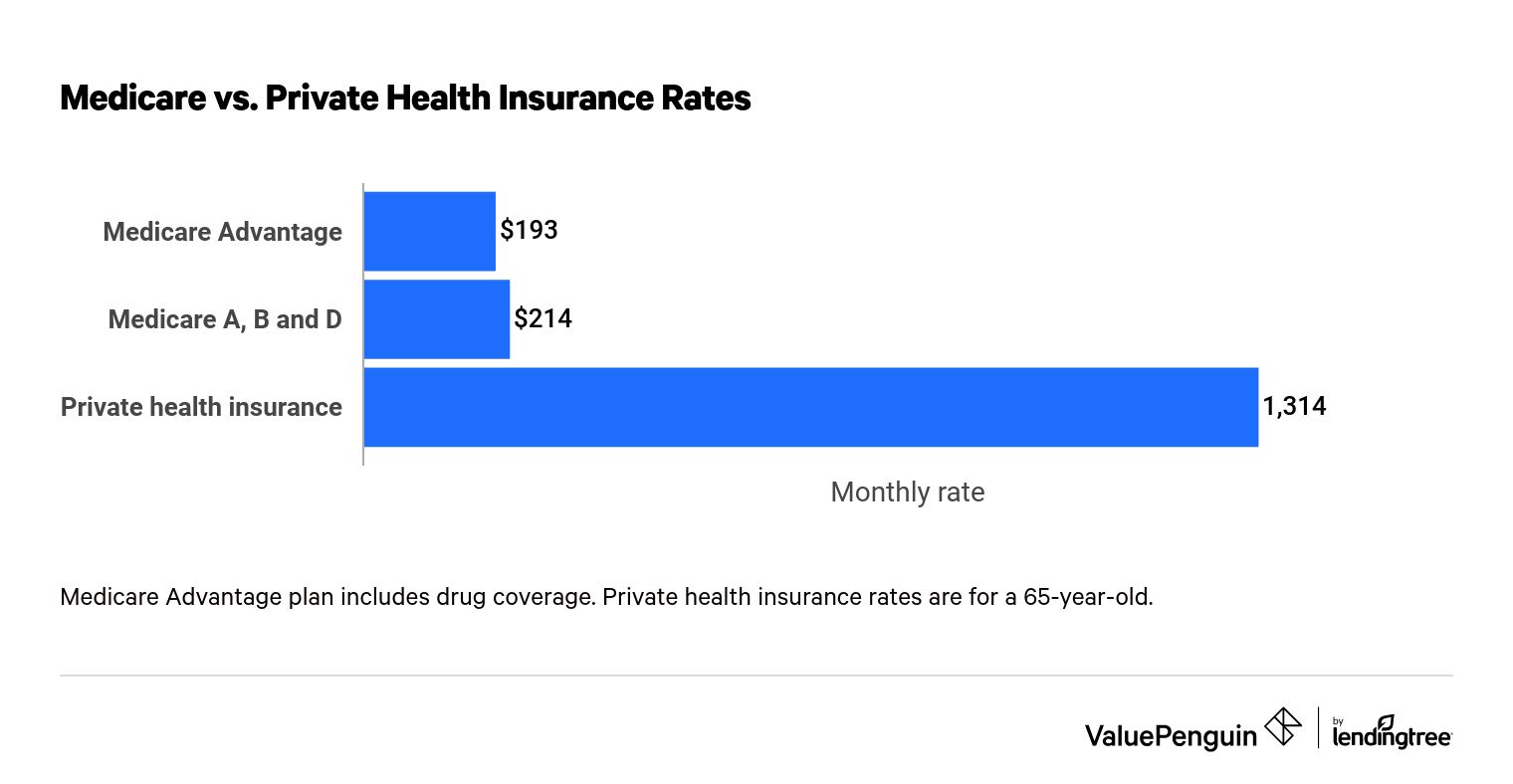

Medicare vs. private health insurance: Rates

Usually, private health insurance is more expensive than Medicare, but costs vary based on the coverage you choose.

The cost of Medicare will depend on how you purchase coverage. If you buy a Medicare Advantage plan with drug coverage, the average cost is $192.90 per month. Buying Parts A, B and D separately has a higher average total cost of $213.90 monthly.

Private health insurance costs an average of $1,314.00 per month for a 65-year-old on a Silver plan. However, health insurance costs vary based on your age, location and tobacco use, as well as how many people are on your policy, what company you choose, and what plan level or coverage options you choose. If you buy a plan from the federal marketplace or a state marketplace, you might qualify for income-based premium tax credits that could lower your premium, and if you have group insurance, your employer will likely offset part of your cost.

Pros and cons of private health insurance and Medicare

Medicare provides good coverage for those who qualify, but private health insurance is a better fit if you need to add someone to your policy.

Medicare pros and cons

Pros | Cons |

|---|---|

| Cheap rates | Only covers one person |

| Medicare Advantage plans can make policy management easier | No out-of-pocket max with Original Medicare |

| Medicare Advantage plans often offer vision and dental coverage | Drug coverage isn't automatic |

Private health insurance pros and cons

Pros | Cons |

|---|---|

| Can cover more than one person | Higher rates |

| Has an out-of-pocket maximum to help limit costs | May have high copays and coinsurance |

| Includes drug coverage | Usually have to buy separate vision and dental coverage |

Can you have private insurance and Medicare?

You can have private health insurance and Medicare at the same time.

If you're covered by Medicare as well as a private plan, whether it's group or individual, Medicare will work with your insurer to determine which plan pays first. For example, if you are 65 or older and covered by a group plan from an employer with more than 20 employees, your group insurance policy will usually pay first and Medicare will pay second.

If you have an individual plan from the federal marketplace or a state marketplace already in place when you qualify for Medicare, you can keep both plans, although you'll lose any premium tax credits you have on the marketplace plan. However, if you already have Medicare, it's illegal for someone to knowingly sell you a marketplace plan.

Frequently asked questions

Is private insurance better than Medicare?

No, private insurance isn't necessarily better than Medicare, just different. Private health insurance is usually more expensive than Medicare and offers roughly the same benefits, which means Medicare may be a better option if you qualify. Private health insurance does offer a greater degree of flexibility if you want to have a spouse or dependent children on your policy.

Is Medicare good insurance?

Medicare can be good insurance. For example, Medicare may be a good option if low-cost coverage is your biggest concern, but you won't be able to add a spouse or dependent children to a Medicare policy like you can with private coverage. If you need to include someone else on your health insurance plan, Medicare won't be the right fit for you.

Can I have Medicare and employer coverage at the same time?

Yes, you can have both Medicare and health insurance from an employer at the same time. Generally, the policy from your employer will pay first and Medicare will be secondary, but there are cases where Medicare would pay first. For example, if you are 65 or older and your employer has over 20 employees, your group plan will probably pay first on your medical and hospital bills. If your employer has fewer than 20 employees, Medicare may pay first. You may find scenarios where neither coverage will pay, like if you get care outside of your employer plan's provider network.

Methodology

Medicare cost data is from Medicare.gov and the Centers for Medicare & Medicaid Services (CMS). Medicare Advantage costs are based on average 2023 rates that include prescription drug coverage. Special needs plans, Part-B-only plans, sanctioned plans, PACE plans, prepayment plans (HCPPs), Medicare savings account (MSA) plans, Medicare-Medicaid plans and employer-sponsored plans were excluded from the analysis. The average cost of Medicare Part D is based on stand-alone prescription drug plans and excludes employer-sponsored and sanctioned plans.

The average cost of health insurance was compiled from public use files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website, as well as state-run marketplaces for states that do not use the federal marketplace. Included in our analysis were the plans and providers for which county-level data was included in the CMS Crosswalk file; plans and providers that were excluded from this data set were not part of our study. The average cost of health insurance was calculated from Silver plans for 65-year-olds, based on the age curve variations published by CMS.

ValuePenguin.com is owned and operated by LendingTree, LLC ("LendingTree"). All rights reserved.

Invitations for application for insurance may be made through QW Insurance Solutions, LLC ("QWIS"), a separate subsidiary of QuoteWizard, LLC ("QuoteWizard"), a LendingTree subsidiary, or through its designated agents, only where licensed and appointed. QWIS is a non-government licensed health insurance agency and is not affiliated with or endorsed by any government agency. Find licensing information for QWIS.

Callers will be directed to a licensed and certified representative of Medicare Supplement insurance and/or Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations. Calls will be routed to a licensed insurance agent who can provide you with further information about the insurance plans offered by one or more nationally recognized insurance companies. Each of the organizations they represent has a Medicare contract. Enrollment in any plan depends on contract renewal.

Availability of benefits and plans varies by carrier and location and may be limited to certain times of the year, unless you qualify for a Special Enrollment Period. We do not offer every plan available in your area. Currently we represent 73 organizations that offer 5,110 products in your area. Contact Medicare.gov or 1-800-MEDICARE, or your local State Health Insurance Program (SHIP), to get information on all of your options.

These numbers provided are not specific to your area, but rather represent the number of organizations and the number of products available on a national basis. We will connect you with licensed insurance agents who can provide information about the number of organizations they represent and the number of products they offer in your service area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

Medicare has neither reviewed nor endorsed the information contained on this website.

Medicare supplement insurance is available to people age 65 or older enrolled in Medicare Parts A and B, and in some states to those under age 65 eligible for Medicare due to disability or end stage renal disease.

Medicare Advantage and Part D plans and benefits are offered by these carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Baylor Scott & White Health Plan, Simply, UnitedHealthcare, Wellcare and WellPoint.

MULTIPLAN_QW.VP.WEB_C

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.