Mobile Home Insurance: Do You Need It and What It Covers

Mobile home insurance covers the mobile home, your belongings and guests who are injured on your property.

Rates can range from several hundred to several thousand dollars per year, depending on where you live. If you have a mortgage or live in a mobile home park, you might be required to have a policy.

Find Cheap Mobile Home Insurance Quotes in Your Area

How much does mobile home insurance cost?

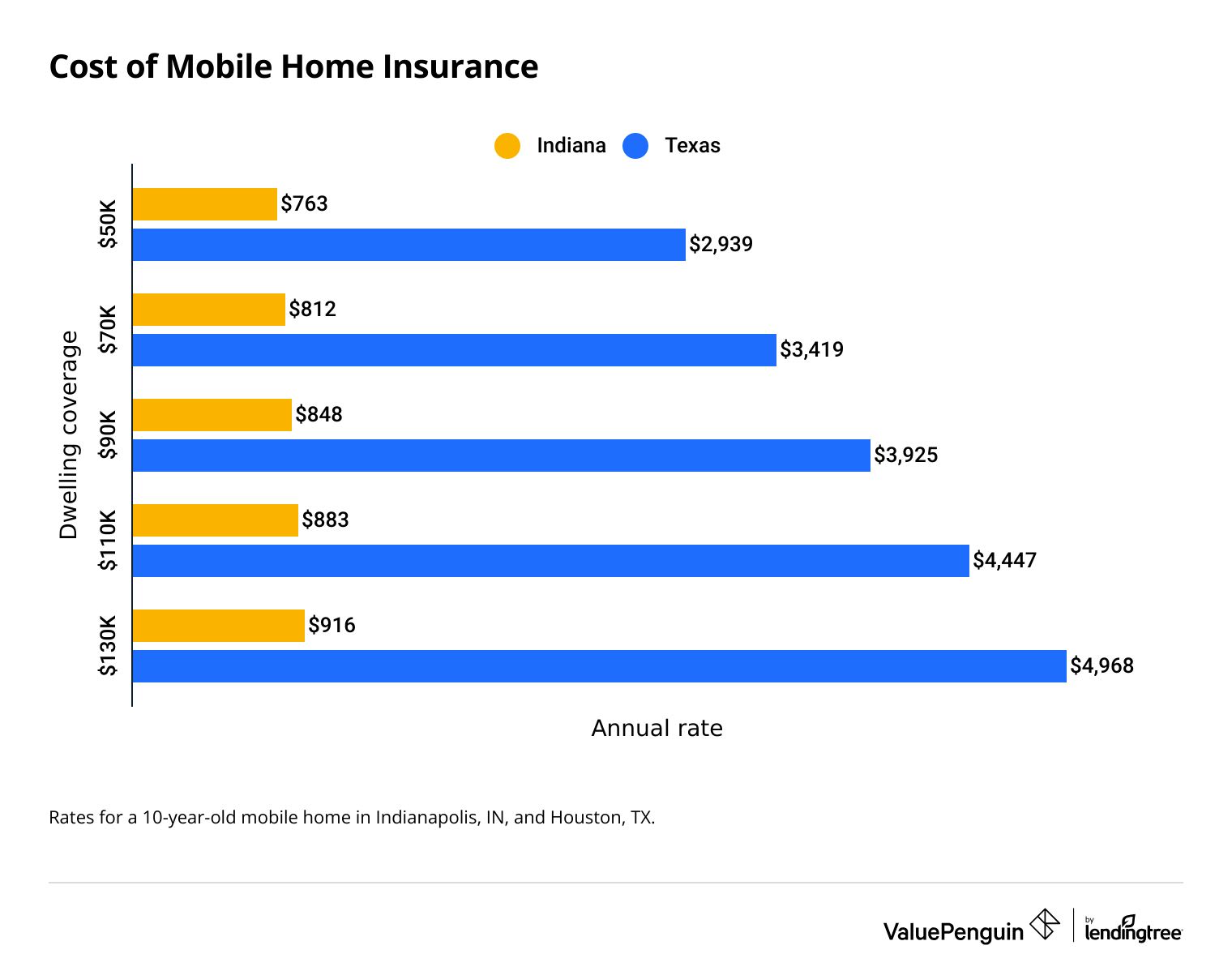

Mobile home insurance rates can range from under $1,000 per year to close to $5,000.

The cost you pay depends on where you live and the features of your home. For example, a $90,000 mobile home in Indianapolis costs about $848 per year to insure with Assurant through Geico. But the same mobile home in Houston costs almost five times that amount to insure.

That's because mobile homes are cheaper to insure in areas where damage is less common. Because Houston gets more severe weather than Indianapolis, mobile homes are more likely to be damaged, so insurance rates are higher.

Find Cheap Mobile Home Insurance Quotes in Your Area

Cost of mobile home insurance by coverage amount

Dwelling amount | Indiana cost | Texas cost |

|---|---|---|

| $50,000 | $763 | $2,939 |

| $60,000 | $788 | $3,192 |

| $70,000 | $812 | $3,419 |

| $80,000 | $832 | $3,672 |

| $90,000 | $848 | $3,925 |

Average annual costs for a 10-year-old mobile home in Indianapolis and Houston.

Rates also depend on the age of your mobile home and how much coverage you need.

The best way to find cheap mobile home insurance is to compare quotes. Many insurance companies don't give mobile home insurance quotes online. You will likely need to call companies directly or work with a local agent to get quotes from different companies.

What does mobile home insurance cover?

Mobile home insurance covers damage to your home and your personal property from events like fires, wind and water.

Mobile home insurance coverage is similar to a regular homeowners insurance policy. Many common events are covered, but not everything. For example, if a storm damages your roof and water leaks inside, both the roof and the water damage would be covered. But mobile home insurance doesn't cover flood or earthquake damage.

You can usually get more coverage with add-ons, also called endorsements or floaters. Common add-ons include coverage for expensive jewelry and identity theft.

Each mobile home policy has several parts. Each part gives you different coverage.

Dwelling coverage: This helps pay to repair or rebuild the structure of your mobile home if it's damaged. Dwelling coverage includes the structure of your mobile home and anything attached, like stairs or a porch.

Other structures: This coverage, also called adjacent structure coverage, is for structures that aren't attached to your home, like sheds and garages. Things like fire, windstorms, vandalism and theft are covered, just like with the mobile home itself.

Personal property: Your stuff is covered on your mobile home insurance too. This includes your furniture, clothing, electronics and household tools. If you have expensive things like fine jewelry or collectibles, you should insure them separately with an add-on to make sure you have enough coverage.

Liability and medical payments: These two coverages pay the medical bills if someone is hurt at your mobile home. Medical payments coverage pays even if you're not at fault, and liability coverage kicks in if you're found responsible for the injury. Liability also pays for damage to someone's belongings if you're at fault.

Additional living expense: If your mobile home is damaged and you can't live in it, this coverage pays for you to live somewhere else. It could pay for a rental home or apartment, for example. It can also pay for things like food and laundry.

Best mobile home insurance companies

Assurant and Foremost are the best mobile home insurance companies.

But mobile home quotes can be hard to get online. It's a good idea to contact a local insurance agent to get a quote. An independent agent can also get quotes from several companies to help you find the best coverage and the best price.

Why it's great

Assurant is great if you want to get a mobile home insurance quote online. Several major insurance companies — including Geico, Progressive and Liberty Mutual — use Assurant for their mobile home coverage.

Why it's great

Foremost has a ton of options for extra coverage, like replacement cost, coverage for trees and shrubs, and home business coverage. It also insures older mobile homes. Since older homes have a higher risk for damage, getting quotes can be tough. Foremost is a good option.

Find Cheap Mobile Home Insurance Quotes in Your Area

Do you need mobile home insurance?

If you have a mortgage or loan on your mobile home, you have to have insurance.

Mobile home parks might also require a policy with a certain amount of liability coverage.

There's no law that says you have to have mobile home insurance if your mortgage is paid off and if your park doesn't require it. But getting a mobile home policy is usually a good idea. A new mobile home costs roughly $130,000 in the U.S. That's a big investment, and insurance helps you rebuild if it's damaged.

Mobile vs. manufactured vs. modular homes

Mobile and manufactured homes are essentially the same thing. "Mobile home" refers to a home built before June 15, 1976. After that date, the same type of home was called a "manufactured home."

Mobile and manufactured homes are completely built in factories and then shipped to a building site. They don't usually have permanent foundations. Because they're shipped whole, they only come in a few standard shapes and sizes. Usually, they're rectangular.

Modular homes are different. These homes are built in pieces, which are shipped to building sites. Because they aren't shipped whole, they can be any size or shape. They also usually have a permanent foundation, like a slab or a basement. Once a modular home is built, it's hard to tell the difference between it and a home that was built completely on the building site.

Mobile or manufactured homes | Modular homes |

|---|---|

| Delivered to the property in one piece | Delivered to the property in multiple pieces |

| Typically built on a metal frame | Built on a slab, crawl space or basement |

| Usually boxy and rectangular | Can be any size or shape |

If you're not sure what kind of home you have, look for a small metal plate with a label number. This is the Department of Housing and Urban Development (HUD) tag, and it's usually on the outside of your home. Homes with this tag are mobile or manufactured homes.

Insurance for older mobile homes

Getting insurance for an older mobile home can often be difficult. Before June 15, 1976, mobile homes weren't regulated, so there were no building standards. Essentially, older mobile homes might not be built to modern safety standards.

If you have a mobile home that was built before June 15, 1976, contact an independent insurance agent. An independent agent knows the insurance market in your area and can help you get quotes. They can also suggest the best coverage and help you find discounts to lower your rate.

Frequently asked questions

How much is mobile home insurance?

Mobile home insurance costs vary from a few hundred dollars a year to several thousand. It depends on where you live, your home itself and how much coverage you need.

Why is it harder to insure a manufactured home?

Mobile and manufactured homes are more likely to be damaged than traditional homes. For example, mobile homes often aren't attached to a permanent foundation, which makes it more likely that strong winds can damage or even blow them over. Not all insurance companies will write policies for mobile homes because of the higher risk of damage.

What makes a mobile home uninsurable?

There isn't a single definition of what makes a mobile home uninsurable. But there are things that can make it harder to find insurance. If your mobile home was built before 1976, if it has outdated wiring or plumbing, or if you have filed more than one claim in the past, you might have trouble finding a policy. Working with a local agent can help.

Methodology

ValuePenguin collected sample quotes from Assurant, through Geico, for a 2014 mobile home in Indianapolis and Houston. The home was 16 feet wide and 67 feet long, located in a mobile home park, tied down and skirted. It was also used as a primary residence. The quotes used these coverage limits:

Coverage | Limit |

|---|---|

| Dwelling coverage | $50,000 to $130,000 |

| Adjacent structure | $3,500 |

| Personal property | $20,000 |

| Personal liability | $100,000 |

| Deductible | $1,000 |

Rates should be used for comparative purposes only. Your rates will be based on your unique situation.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.