Homeowners Insurance

Oklahoma Is the Most Expensive State for Tiny Home Insurance

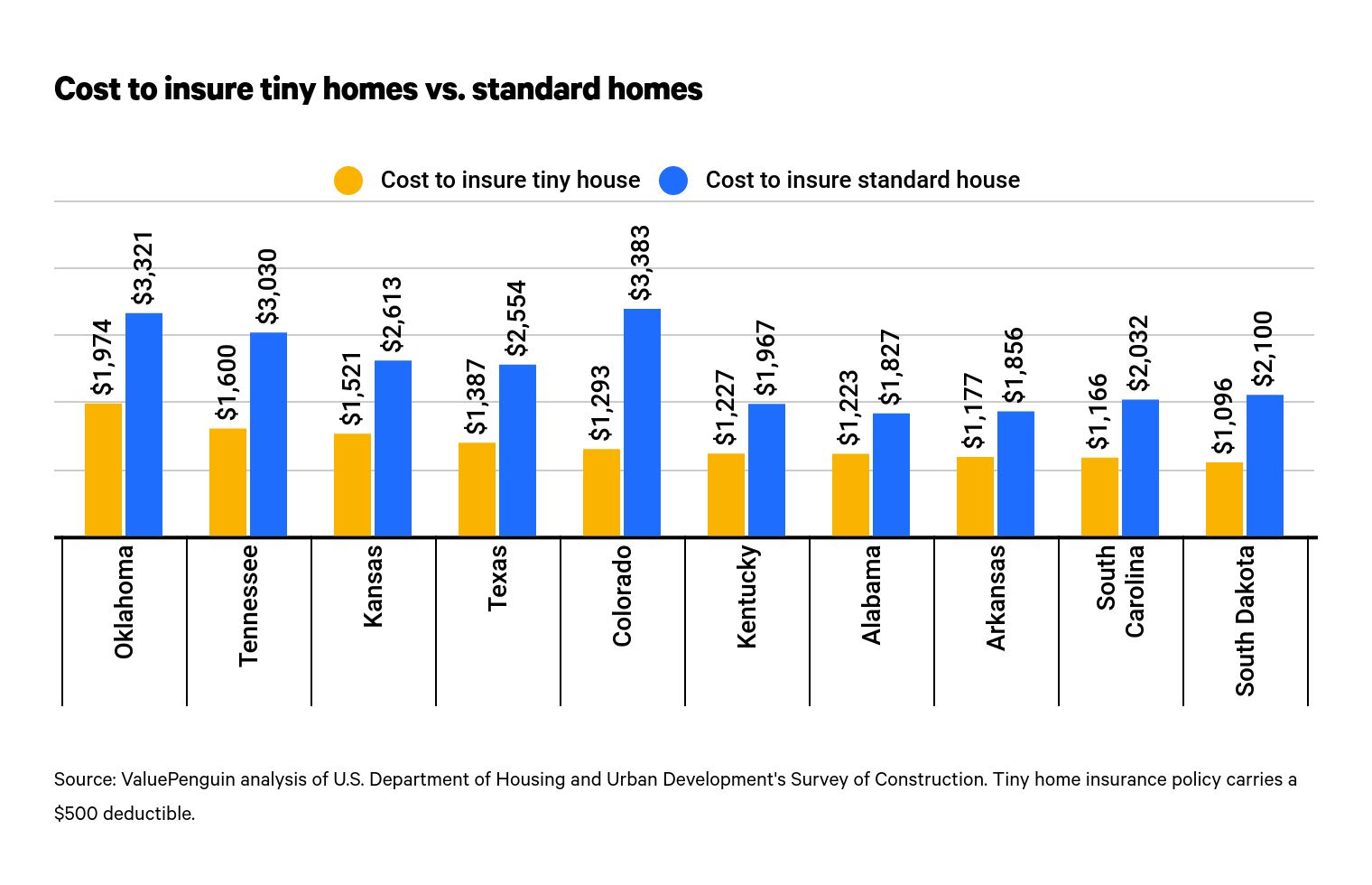

The movement toward minimalism could help homeowners save money if they are willing to downsize. ValuePenguin compared the cost of home insurance for a 2,100-square-foot home to the cost of insuring a tiny house that's more than five times smaller. While the price varies across the U.S., insuring a tiny house is cheaper than insurance for a standard home in every state and the District of Columbia.

The most expensive state to insure a tiny home in is Oklahoma, followed by others where costly natural disasters occur more frequently than in other parts of the country — Tennessee, Kansas, Texas and Colorado. Still, it costs 95% more to insure a 2,100-square-foot home in these five states than it costs to insure a tiny home. Across the U.S., the cost to insure large homes is 106% more expensive than the cost to insure tiny houses.

ValuePenguin analysts found that homeowners can offset the cost of insurance for tiny homes in disaster-prone areas by opting for a percentage-based deductible instead of one that's determined by a cash payment. By leveraging the lower value of their homes, homeowners can save an average of 9% a year on insurance compared to those whose policies use cash-based deductibles. This knowledge can prepare homeowners in the hottest markets for tiny homes, which can be in some of the most expensive states for tiny home insurance.

Key findings

- The most expensive state to insure a tiny home in is Oklahoma, followed by Tennessee, Kansas, Texas and Colorado. Insurance on a tiny house that's 400 square feet in Oklahoma costs 242% more than what it would take, on average, to insure one across the 50 states and the District of Columbia.

- Downsizing from a full-sized home to a tiny house could save homeowners 52% a year on the cost of insurance alone — and more depending on the state. Insurance for a full-sized house costs 68% more than insurance on a tiny home in Oklahoma, even though it's the most expensive state.

- The size of a tiny home may give policyholders more leverage when preparing for disasters. While tiny homes are more susceptible to catastrophic losses than a standard-size home, homeowners can use percentage-based deductibles instead of cash-based deductibles to pay an average of 9% less annually on insurance due to a tiny house's lower relative value.

- The market for tiny homes is hottest in Alabama. An analysis of sale-related search terms reveals that Alabama, Arkansas, Idaho, Oregon and Wyoming have the most people looking to buy tiny houses. Insurance in Alabama and Arkansas is among the most expensive in the country for tiny homes, though.

Even in the most expensive state to insure a tiny house — Oklahoma — it's still 68% more expensive to buy coverage for a standard-size home

The cost to insure a tiny house in Oklahoma is $1,974 a year. Compared to the average rate across the 50 states and the District of Columbia, tiny home insurance in Oklahoma is 242% more expensive. Insurance alone for a tiny home costs Oklahomans 4% of their household incomes.

Even in Oklahoma, the cost to insure a 2,100-square-foot home is 68% more expensive than it is to buy coverage for a tiny house.

This pattern holds in the other states where insuring tiny homes is most expensive. Following Oklahoma, Tennessee, Kansas, Texas and Colorado are the least affordable places to insure a 400-square-foot tiny home. Homeowners insurance premiums in these states are already expensive — the frequency of damage caused by natural disasters is a reason why. Still, taken together, it's 95% more expensive than average in these places to insure a more conventionally sized home than it is to insure a tiny home.

On average across the 50 states and the District of Columbia, it costs 106% more to insure a 2,100-square-foot home than it does to insure a tiny house. While insuring a 400-square-foot home takes up an average of 1% of the U.S. median household income, the average cost of home insurance for a 2,100-square-foot home is 3% of a household's median income. In nearly every state, downsizing can save consumers money.

Rank | State | Cost to insure tiny house ($500 deductible) | Percentage difference from conventionally sized home |

|---|---|---|---|

| 1 | Oklahoma | $1,974 | 68% |

| 2 | Tennessee | $1,600 | 89% |

| 3 | Kansas | $1,521 | 72% |

| 4 | Texas | $1,387 | 84% |

| 5 | Colorado | $1,293 | 162% |

| 6 | Kentucky | $1,227 | 60% |

| 7 | Alabama | $1,223 | 49% |

| 8 | Arkansas | $1,177 | 58% |

| 9 | South Carolina | $1,166 | 74% |

| 10 | South Dakota | $1,096 | 92% |

| 11 | Missouri | $1,076 | 89% |

| 12 | Montana | $1,034 | 139% |

Chart shows the percentage difference in the cost to insure a 2,100-square-foot home compared to the cost to insure a 400-square-foot tiny home.

Opting for percentage-based deductibles instead of cash-based deductibles allows tiny house policyholders to get more affordable coverage while keeping future expenses low

While the cost of insuring tiny homes is lower than the cost of coverage for conventionally sized houses, property owners may hesitate to downsize, especially in places where natural disasters happen more frequently than in other parts of the country. Because of their size, there's a greater chance tiny homes won't survive a natural disaster, such as a tornado or a severe storm, and that homeowners will suffer a complete loss.

In most cases, policyholders can set their own insurance deductibles — the cost paid when filing a claim before damage can be repaired. Higher deductibles mean lower premiums but necessitate higher levels of damage before the policy can be used to recover after a loss.

But ValuePenguin found that homeowners can leverage the size of their tiny houses to get more favorable insurance costs. Depending on the region, the median sale price per square foot ranges from $106 to $154, putting the value of a 400-square-foot home at $42,396 to $61,416 — according to an analysis of data on the price per square foot from the U.S. Department of Housing and Urban Development's Survey of Construction. (These prices and values have been rounded to the near dollar after calculations.)

A cash deductible of $500 takes up a larger percentage of the value of a tiny home than one that's five times larger. This means it's more advantageous to opt for a percentage-based deductible instead of one that's expressed as a flat dollar amount. A deductible of 2% on a $250,000 policy backing a larger home will come to $5,000, while a 2% deductible applied to a tiny home worth $42,396 to $61,416 translates to $848 to $1,228 depending on where one's tiny house is located — slightly more in terms of real dollars than a $500 deductible.

Ultimately, by opting for a percentage-based deductible, homeowners of tiny houses can pay slightly more after damage for a discount on premiums. ValuePenguin determined that committing to a 2% deductible instead of a $500 deductible results in an annual discount of 9% across the country, with the most substantial savings amounting to 19% in North Carolina. And as policyholders increase their deductibles past 2%, their rates will decrease further in most cases.

Rank | State | Cost to insure tiny house ($500 deductible) | Cost with 2% deductible | Deductible discount |

|---|---|---|---|---|

| 1 | North Carolina | $958 | $776 | 19% |

| 2 | New Jersey | $448 | $371 | 17% |

| 3 | Massachusetts | $685 | $570 | 17% |

| 4 | Kansas | $1,521 | $1,295 | 15% |

| 5 | Florida | $827 | $713 | 14% |

| 6 | Wyoming | $750 | $648 | 14% |

| 7 | Vermont | $409 | $354 | 14% |

| 8 | Maine | $490 | $424 | 13% |

| 9 | Montana | $1,034 | $900 | 13% |

| 10 | Minnesota | $1,002 | $878 | 12% |

| 11 | Arizona | $688 | $604 | 12% |

| 12 | Connecticut | $607 | $534 | 12% |

States are sorted by discount, from highest to lowest.

The strategy of utilizing percentage-based deductibles is less effective in states where the cost of tiny home insurance with a $500 deductible is closer to the cost of a policy where the deductible is expressed as a percentage. In Nebraska, there’s virtually no difference in choosing a deductible of 2%, though, again, consumers who opt for even larger deductibles — 3%, 5% or higher — are more likely to receive a larger premium reduction.

Some of the most expensive states for tiny house insurance are also where demand is the highest

ValuePenguin checked Google Trends search volume for terms related to the sale of tiny houses to evaluate changing geographic demand for tiny homes among consumers. A high number of searches from August 2020 to July 2021 in Alabama indicates that many residents are interested in buying a tiny home.

Alabama and Arkansas, the state with the second-largest search volume, are among the 10 most expensive places to buy insurance for tiny homes. This is, in part, because of the high number of tornadoes that can occur in both states, as well as the cost of damage they have caused historically. Across Alabama and Arkansas, it typically costs about $1,200 to insure a home with a policy carrying a $500 deductible — 68% more expensive than the national average. These states, where rates and demand are both high, are the best places to prioritize lowering the cost of insurance with discounts.

The demand for tiny houses in Oklahoma is tied for the sixth-highest in the country, though it's the most expensive place to buy tiny home insurance.

Outside of Alabama and Arkansas, the other states where high demand combines with expensive insurance prices are:

- Oklahoma (tied for sixth for demand and first for insurance cost)

- South Carolina (tied for sixth for demand and ninth for cost)

- Tennessee (ninth for demand and second for cost)

- Colorado (tied for 15th for demand and fifth for cost)

- Kentucky (tied for 15th for demand and sixth for cost)

- Texas (17th for demand and fourth for cost)

While discounts are valuable for residents of these eight states (including Alabama and Arkansas), the average premium reduction following a higher deductible election (2% deductible) is only 7% — lower than average.

Rank | State | Average cost of insurance ($500) | Deductible discount |

|---|---|---|---|

| 1 | Alabama | $1,223 | 5% |

| 2 | Arkansas | $1,177 | 6% |

| 3 | Idaho | $514 | 10% |

| 4 | Oregon | $564 | 9% |

| 5 | Wyoming | $750 | 14% |

| 6 | South Carolina | $1,166 | 8% |

| 6 | Oklahoma | $1,974 | 9% |

| 8 | Montana | $1,034 | 13% |

| 9 | Tennessee | $1,600 | 4% |

| 10 | Louisiana | $751 | 6% |

| 11 | Washington | $439 | 9% |

| 12 | North Carolina | $958 | 19% |

States are ordered by popularity of search terms related to tiny homes for sale.

Aside from considering a higher deductible, owners of tiny homes or those looking to downsize from a conventionally sized home to a smaller version might consider looking for discount opportunities with their auto insurance providers. If a property owner plans to transport their tiny home around the country, they’ll need insurance coverage for RVs to protect their home from damage. By bundling RV insurance with their auto insurance, owners of tiny homes can get significantly more affordable rates on coverage.

Methodology

ValuePenguin determined the U.S. median household income using the 2015-19 five-year average income data from the U.S. Census Bureau's American Community Survey. Using regional median sale data on price per square foot from the U.S. Department of Housing and Urban Development's 2020 Survey of Construction, researchers estimated the value of a 400-square-foot house — the largest area a structure deemed a "tiny house" may possess, according to the 2020 International Residential Code.

The rates for tiny houses are compared to the cost of home insurance for a 2,100-square-foot property. Researchers' analysis used 2021 insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, as your quotes may be different.

Lastly, to evaluate search patterns, ValuePenguin used Google Trends data related to the terms "tiny homes for sale" and "tiny houses for sale." From August 2020 to July 2021, 135,000 and 110,000 people searched these terms, respectively. Researchers calculated the average frequency with which each state searched for these terms to construct an index for the interest in tiny homes for sale.