Mutual Of Omaha Insurance Review: Cost and Coverage

Term and permanent insurance options with an emphasis on providing one of the cheapest guaranteed whole life insurance products in the industry.

Find Cheap Life Insurance Quotes in Your Area

Mutual of Omaha is an above-average life insurance provider that offers a wide variety of policies but specializes in guaranteed whole life. Mutual of Omaha has average rates for term life insurance but excels at providing one of the cheapest guaranteed whole life insurance plans in the industry. This policy allows the company to cater well to individuals who may have health problems or have had issues with getting approved for life insurance in the past.

Although Mutual of Omaha has great financial strength, the company does have some negative reviews for processing claims and complaints.

Pros and cons

Pros

Cheap guaranteed whole life insurance

Options to convert term to permanent coverage

Good term insurance options

Cons

Expensive term life insurance rates

Claims process can be slow

Mutual of Omaha products

Mutual of Omaha is a mutual insurance and financial services company. Furthermore, it is the parent company of United of Omaha, through which it offers life insurance products and services.

United of Omaha policy offerings include term, guaranteed whole and universal life insurance. The company's best offering is the guaranteed whole life policy, which has some of the cheapest rates available in the industry. All of these policies come with typical life insurance riders including:

- Chronic illness

- Terminal illness

- Waiver of premium

- Accidental death

Term life insurance

United of Omaha offers two different term life insurance policies: Term Life Express and Term Life Answers. Both products provide life insurance coverage for a set period of time but are more expensive when compared to similar products from other life insurers.

Term life insurance through United of Omaha is guaranteed level, which means premiums will not increase during the life of the policy. Furthermore, both of these term life insurance products can be purchased for applicants between the ages of 18 and 65 years old and have term length options of 10, 15, 20 or 30 years. The plans differ in the amount of coverage you can purchase as well as the underwriting requirements.

The Term Life Answers product is a standard term life insurance policy with a minimum death benefit of $100,000 and a maximum of $65 million.The policies typically have underwriting requirements that involve you filling out an application as well as taking a medical exam.

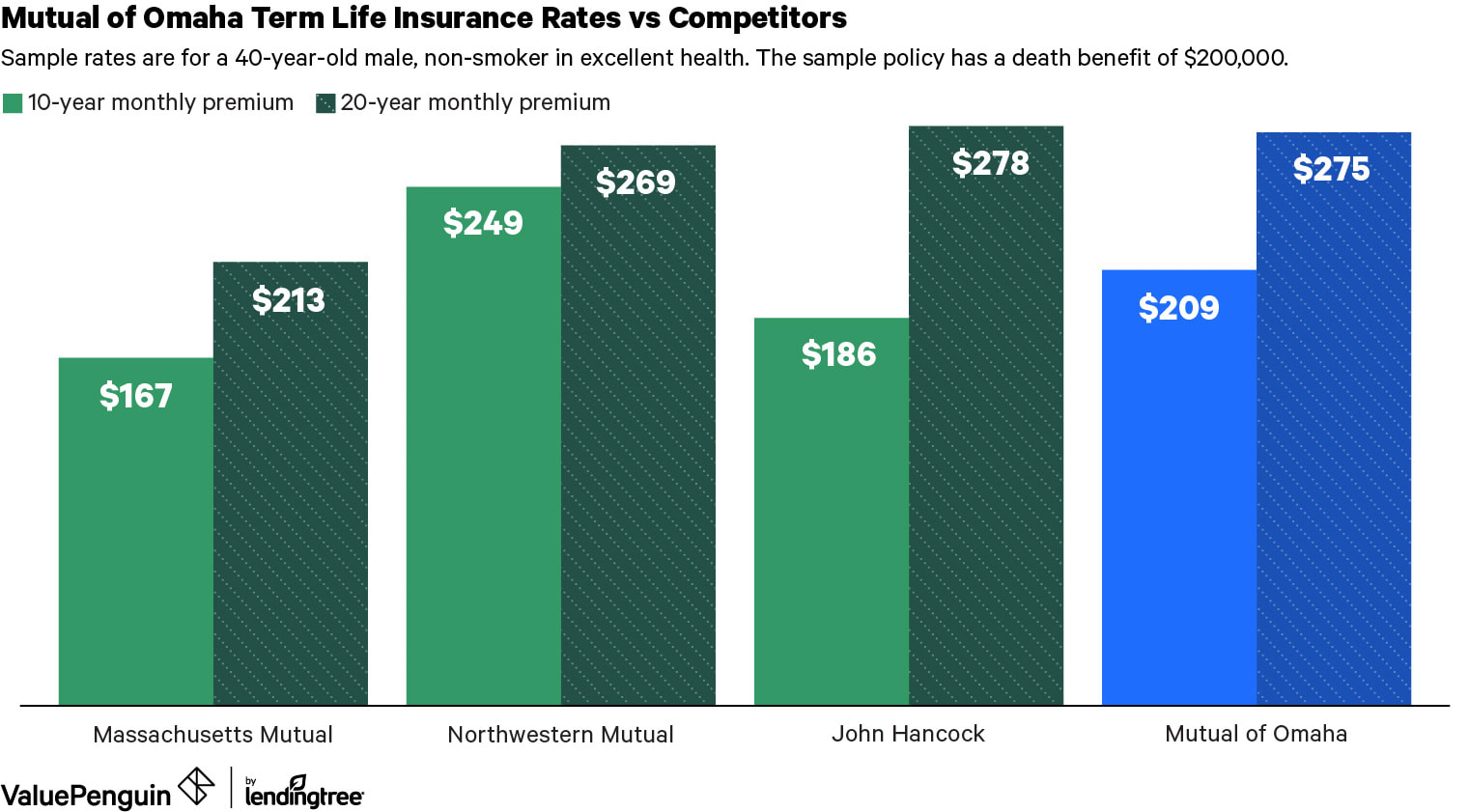

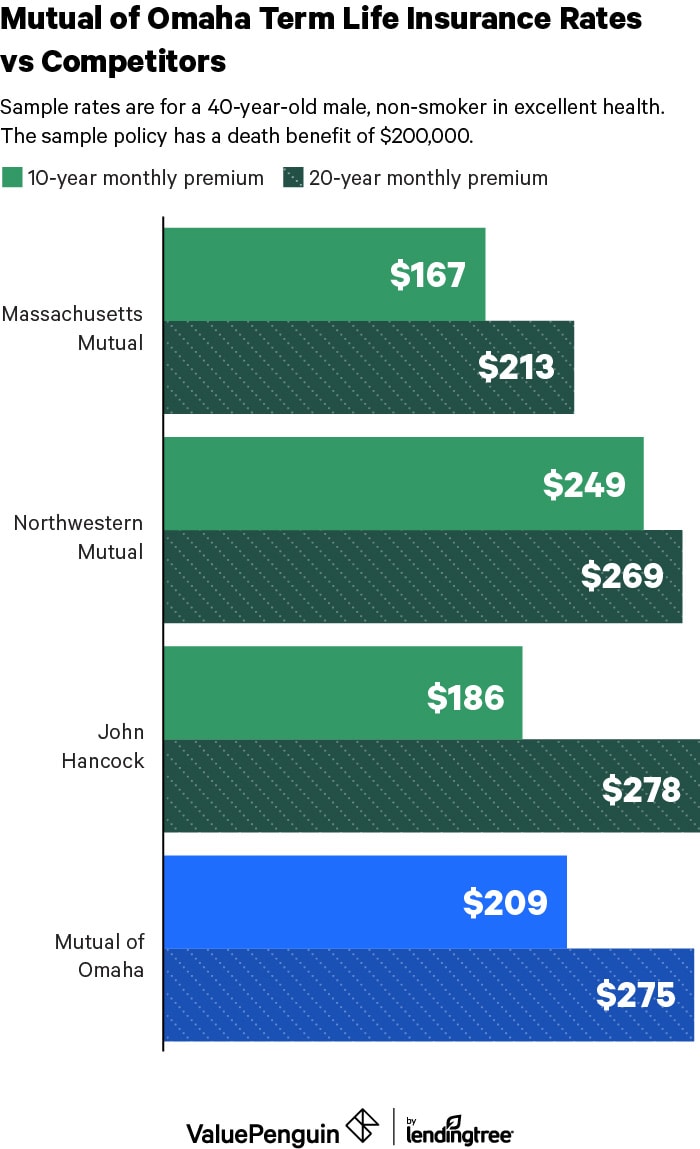

Life insurance rates are slightly more expensive for the Term Life Answers policy from United of Omaha compared to policies from other insurers. As you can see below, both John Hancock and Massachusetts Mutual offer cheaper 10-year term life insurance when compared to United of Omaha.

Find Cheap Life Insurance in Your Area

The Term Life Express product is a simplified issue term life insurance policy. This means it will not require you to take a full medical exam to be issued the plan. However, you would need to participate in a phone interview, which would include basic health and life questions like your health, weight, tobacco use, health history, lifestyle and occupation.

Since no medical exam is conducted, the maximum size of the death benefit that can be purchased is considerably smaller and premiums are typically more expensive when compared to the Term Life Answers plan. Coverage amounts for the Term Life Express policy range from $25,000 to $300,000.

All of United of Omaha's term life insurance plans offer the ability to convert the policy to a permanent life insurance policy. However, if you currently have the Term Life Express product, you can only convert it to United of Omaha's guaranteed whole life plan.

Before choosing term life insurance, you should evaluate when exactly you are able to convert the policy, since there are some restrictions. United of Omaha only allows the conversion if you have had your term policy for more than two years, which prevents immediately changing your term policy to permanent. Additionally, you can only convert to permanent life insurance if you are under the age of 70 years old.

Guaranteed whole life insurance

United of Omaha offers guaranteed whole life insurance, which is designed to provide lifelong coverage while not requiring a medical exam. The whole life plan offers premiums that are guaranteed not to increase and can be purchased by individuals between the ages of 45 and 85 years old. Additionally, policy death benefits range from $2,000 to $25,000.

As shown in the table below, United of Omaha has some of the cheapest rates available, especially for applicants between the ages of 50 and 60 years old. That is why we recommend this company for the best guaranteed whole life insurance.

Sample monthly premiums for guaranteed whole life at United of Omaha

Company | Age 50 | Age 60 | Age 70 |

|---|---|---|---|

| United of Omaha | $36 | $55 | $89 |

| Gerber | $38 | $57 | $88 |

| AIG | $52 | $63 | $93 |

Sample monthly premiums are for a male living in California purchasing $10,000 of coverage.

Guaranteed whole life tends to be much more expensive and offer smaller life insurance coverage. This is due to the policy being issued on a guaranteed basis without the need for a medical exam. Since the insurance provider does not have as much information about the risks you pose, they are forced to charge more for the product. However, this product can be a great option if you do not have great health and were previously denied other life insurance products for this reason.

Universal life insurance

United of Omaha currently has four different universal life insurance policy offerings:

- AccumUL

- Guaranteed Universal Life

- Life Protection Advantage

- Income Advantage

AccumUL

The AccumUL product through United of Omaha is their standard universal life insurance plan. This is a permanent life insurance policy, which guarantees the cash value account will grow at a minimum of 2% annually. Cash value is an account within your life insurance policy that is separate from the death benefit. As you pay premiums into the policy, a portion of that payment will go toward the cost of the insurance — such as administrative fees — and the other portion will be placed into the cash value account.

In this case, the AccumUL plan cash value is guaranteed to grow by at least 2% every year, which is a higher rate when compared to the guaranteed universal life policy. However, this will be dependent on what you invest in the cash value account.

Guaranteed universal life insurance

Guaranteed universal life insurance is a universal policy that will not lapse if the cash value is zero. Typically, a permanent life insurance policy could lapse if the cash value were to go below zero, in which case the policy would be terminated.

For example, with some permanent life insurance, you can use the cash value to pay for the policy premiums. If you are not careful in this situation, the cash value could deplete very quickly, go negative and eventually lapse. For this reason, this universal life insurance policy focuses more on providing a stable, guaranteed death benefit and less about cash accumulation.

Indexed universal life insurance

Indexed universal life insurance can be purchased through United of Omaha's Life Protection Advantage and Income Advantage policies. Both plans have permanent death benefit coverage, meaning the policy will last your entire life. Furthermore, both have a cash value account similar to the AccumUL plan, but these policies have an interest rate that is tied to the performance of a market index.

The two indexed universal plans only differ in that the Income Advantage policy emphasizes cash value growth potential while guaranteeing no negative risk. Since these plans are tied to the performance of a market index like the S&P 500, there can be negative cash value growth for other indexed universal life insurance plans.

Children's whole life insurance

United of Omaha has a child whole life insurance plan, which has simplified underwriting and is available for children between the ages of 14 days and 17 years old. These are small life insurance policies — with coverage between $5,000 and $50,000 — which are meant to provide financial protection if the child becomes seriously ill and passes away unexpectedly.

As you can see below, Mutual of Omaha offers one of the cheapest rates available for these types of plans.

Company | Monthly premium |

|---|---|

| United of Omaha | $24 |

| Protective | $41 |

| Gerber Grow Up | $44 |

Sample monthly premiums are for a male, 10-year-old child in Connecticut purchasing $50,000 in coverage.

Financial ratings and customer reviews

United of Omaha and its parent Mutual of Omaha are great choices for the best guaranteed life insurance available. Additionally, the company is well above average in terms of its financial strength ratings. Its A+ (superior) A.M. Best rating indicates that United of Omaha has the financial ability to pay claims. Furthermore, Mutual of Omaha has received a J.D Power customer satisfaction index score of 792, which ranks them fifth out of the 23 insurance providers in the study.

However, their National Association of Insurance Commissioners (NAIC) complaint index score of 1.06 is high and indicates that United of Omaha receives more complaints on average when compared to the amount of business it writes. Additionally, there are some negative reviews that focus on claims that were not paid in a timely manner or not paid at all.

Frequently asked questions

Is Mutual of Omaha a good life insurance option?

Mutual of Omaha is an above-average life insurance company that offers a wide variety of life insurance products. While the company does specialize in whole life insurance, you should avoid its term life insurance plans, as these policies can be more expensive when compared to term plans from other life insurers.

Why would I get life insurance?

You should consider purchasing a life insurance product if you currently have people that rely on your income. Life insurance is a way to protect your loved ones from financial hardships if you were to pass away unexpectedly. For this reason, life insurance is a crucial part of having a complete financial plan.

What is the difference between term and whole life insurance?

Whole life insurance is a type of life insurance policy that has a smaller death benefit but has a coverage period that spans your entire life. On the other hand, term policies only provide coverage for a specific number of years. If you were to pass away during that time period, the death benefit of the policy would be paid to your beneficiary.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.