Nissan Insurance: The Cost to Insure Every Model

The average price to insure a 2022 Nissan is $2,636 per year. But some sporty models, like the GT-R, cost much more.

Compare Nissan Car Insurance Quotes

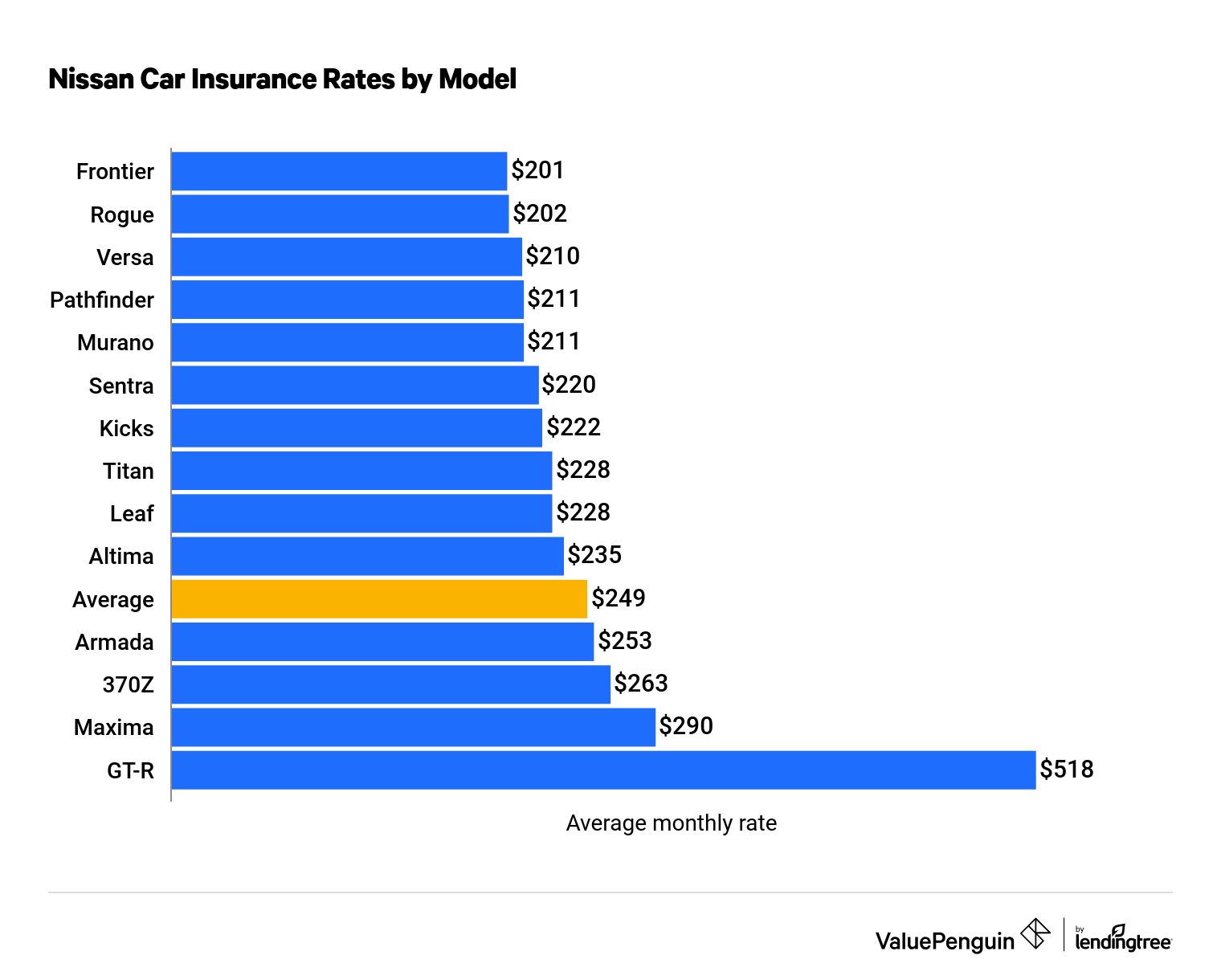

The Versa (subcompact sedan), Rogue (SUV) and Frontier (truck) are the cheapest Nissans to insure. The GT-R (sports car), Maxima (luxury sedan) and 370Z (sports car) are the most expensive.

Your age will also impact your insurance rates, and younger drivers should expect to pay more for Nissan insurance. An 18-year-old driver will spend more than three times as much as a 30-year-old driver, even if the younger driver has a spotless record.

Compare Nissan insurance costs by model and insurance company:

Cost of Nissan insurance by model

The Nissan Frontier, the company's cheapest model of truck, is the cheapest Nissan model to insure, $2,414 per year for a 2022 edition. In contrast, the GT-R's average rate is $6,218 for a 2021 model.

Cost of Nissan car insurance by model

Model | Annual cost |

|---|---|

| Nissan 370Z (2020) | $3,153 |

| Nissan Altima | $2,825 |

| Nissan Armada | $3,033 |

| Nissan Frontier | $2,414 |

| Nissan GT-R (2021) | $6,218 |

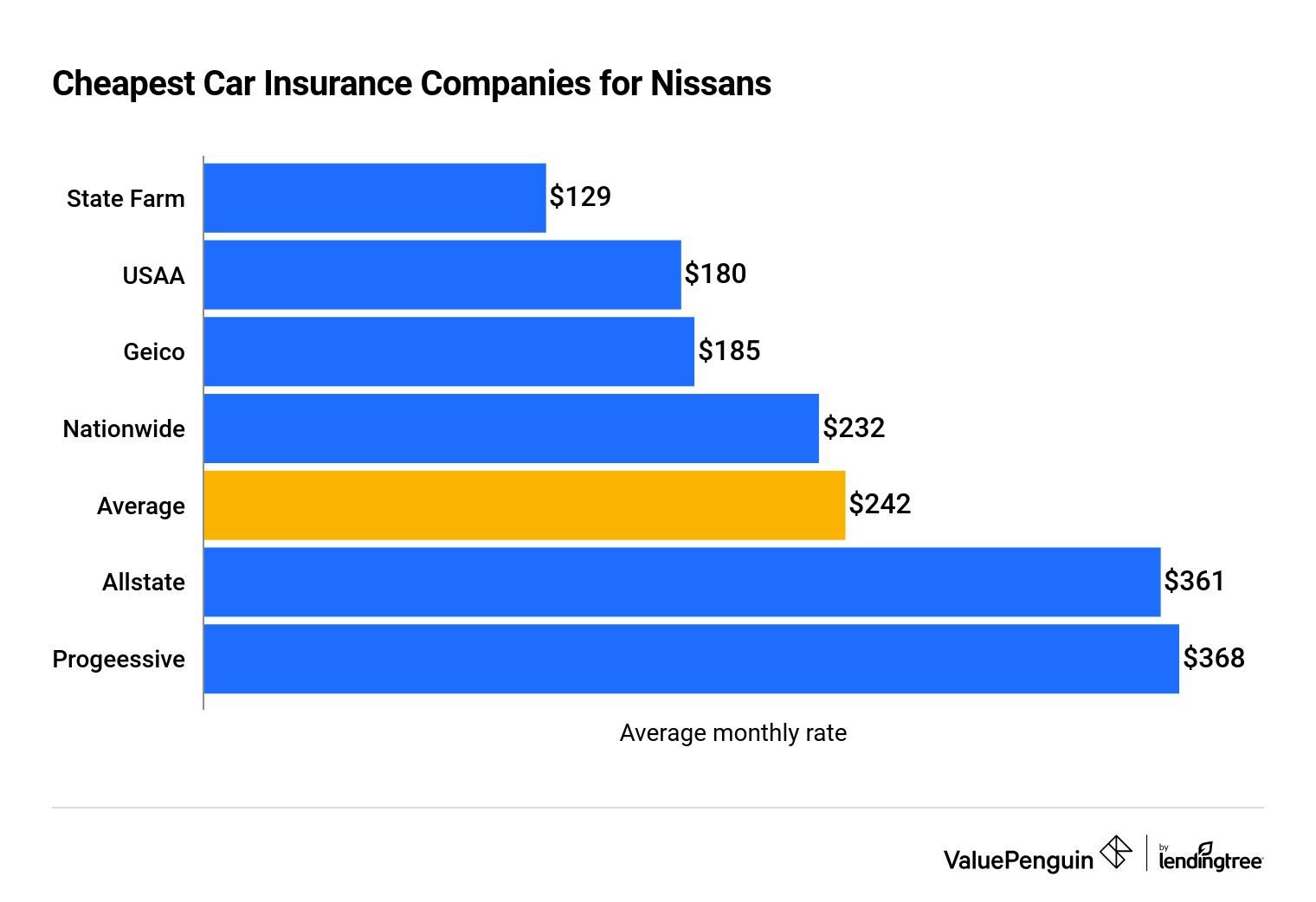

Nissan insurance by company

State Farm offers the most affordable car insurance for Nissan owners — $1,545 per year for full coverage on a 2021 model. That's 47% less than the average rate we found overall ($2,908), and 65% less than the most expensive insurer, Progressive ($4,419).

Cost of Nissan car insurance by company

Company | Monthly cost | Annual Cost | |

|---|---|---|---|

| State Farm | $129 | $1,545 | |

| USAA | $180 | $2,155 | |

| Geico | $185 | $2,215 | |

| Nationwide | $232 | $2,782 | |

| Allstate | $361 | $4,329 |

Quotes are based on a full-coverage policy for a 30-year-old man with a clean driving record who lives in Texas.

Compare Nissan Car Insurance Quotes

Nissan Altima

- Average annual rate: $2,825 ?

- 2022 MSRP: $24,900

Nissan's mid-tier sedan is slightly more expensive to insure than the average Nissan. But if you own an older Altima, you're likely to pay lower rates. A 2011 Altima costs just $1,868 per year to insure for our sample driver, which is 34% cheaper than coverage for a 2022 model.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,825 | $9,616 |

| 2021 | $2,721 | $9,235 |

| 2020 | $2,610 | $8,867 |

| 2019 | $2,593 | $8,825 |

| 2018 | $2,572 | $8,850 |

*Annual cost

Nissan GT-R

- Average annual rate: $6,218 ?

- 2021 MSRP: $113,540

The GT-R is Nissan's fastest and most expensive car, and it also costs the most to insure. You can expect to pay about 84% more to insure a GT-R than a 370Z, Nissan's other, less expensive, sports car.

Young drivers will pay even more for insurance on a 2021 GT-R. An 18-year-old driver will pay $21,005 per year to insure a GT-R. That's more than three times what a 30-year-old will spend.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2021 | $6,218 | $21,005 |

| 2020 | $5,792 | $19,169 |

| 2019 | $5,276 | $17,344 |

| 2018 | $5,493 | $18,442 |

| 2017 | $5,261 | $17,639 |

*2022 rates not available

Nissan Leaf

- Average annual rate: $2,741 ?

- 2022 MSRP: $27,800

The Leaf is Nissan's only all-electric car and it costs more than most other Nissans — it's the most expensive among Nissan's compact, electric vehicle offerings.

Electric cars often cost more to insure than vehicles with standard engines, partially because they cost more to repair. This can offset some of the fuel-savings that come with owning an electric car.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,741 | $9,811 |

| 2021 | $2,715 | $9,717 |

| 2020 | $2,593 | $9,256 |

| 2019 | $2,484 | $8,811 |

| 2018 | $2,482 | $8,954 |

*Annual cost

Nissan Maxima

- Average annual rate: $3,483 ?

- 2021 MSRP: $37,840

The Maxima is the most expensive Nissan sedan to insure. But some older Maximas can be far less expensive to cover: A 2011 Maxima costs $2,211 per year to insure, a difference of $1,272 per year compared to the 2021 model.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2021 | $3,483 | $11,978 |

| 2019 | $3,169 | $10,812 |

| 2018 | $3,102 | $10,589 |

| 2017 | $2,751 | $9,436 |

| 2016 | $2,717 | $9,271 |

Data for 2022, 2020, 2015 not available

Nissan Rogue

- Average annual rate: $2,423 ?

- 2022 MSRP: $27,150

Average coverage for a new Rogue comes out to $202 per month. If you're looking to pay less for insurance on a Rogue, go for an older model — insuring a 2011 Rogue will lower your monthly rates by 29% compared to the 2022 model.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,423 | $8,238 |

| 2021 | $2,372 | $8,011 |

| 2020 | $2,317 | $7,785 |

| 2019 | $2,280 | $7,679 |

| 2018 | $2,246 | $7,666 |

*Annual cost. 2015 rates not available

Nissan 370Z

- Average annual rate: $3,153 ?

- 2020 MSRP: $30,090

An 18-year-old will pay much, much more than a 30-year-old to insure this car: The average price for an 18-year-old with a clean driving history is $10,536 — more than three times as expensive as coverage for the older driver.

The 370Z is the replacement for the older 350Z, which Nissan discontinued in 2009.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2020 | $3,153 | $10,536 |

| 2019 | $3,070 | $10,667 |

| 2018 | $3,011 | $10,504 |

| 2017 | $2,846 | $10,028 |

| 2016 | $2,760 | $9,719 |

*2021-2022 rates not available

Nissan Armada

- Average annual rate: $3,033 ?

- 2022 MSRP: $49,500

The Armada is Nissan's largest SUV and one of the most expensive vehicles the company sells. The vehicle's high cost and large size contribute to its being one the most expensive Nissans to insure: Of Nissan's currently available models, only four cost more for coverage.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $3,033 | $9,988 |

| 2021 | $2,890 | $9,497 |

| 2020 | $2,754 | $9,068 |

| 2019 | $2,694 | $8,895 |

| 2018 | $2,465 | $8,095 |

*Annual cost, 2016 data not available

Nissan Cube

- Average annual rate: $1,810 ?

- MSRP: This vehicle was discontinued after the 2014 model year

The Nissan Cube's small size and low cost made it a popular choice for young drivers. Unfortunately, as with most cars, the cost to insure the Cube for an 18-year-old is much higher than for older drivers: 18-year-olds will pay an average of $6,121 to cover the most recent model years of the Cube. That's more than three times as much as the average cost for a 30-year-old.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2014 | $1,810 | $6,121 |

| 2013 | $1,779 | $5,966 |

| 2012 | $1,729 | $5,813 |

| 2011 | $1,695 | $5,711 |

*Annual cost

Nissan Frontier

- Average annual rate: $2,414 ?

- 2022 MSRP: $28,690

The Frontier is the less expensive of Nissan's two pickup truck models to insure. The larger and more expensive Titan costs about 13% more for insurance coverage and has an MSRP that's about $10,000 higher.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,414 | $8,201 |

| 2021 | $2,308 | $7,862 |

| 2020 | $2,240 | $7,638 |

| 2019 | $2,093 | $7,146 |

| 2018 | $1,971 | $6,717 |

*Annual cost

Nissan Juke

- Average annual rate: $2,212 ?

- MSRP: Discontinued in 2018

The Juke was discontinued in 2018, and the last model of the Juke costs slightly less to insure than its replacement, the Kicks. The Juke is not particularly expensive to insure, in line with the average cost of a Nissan SUV from 2017.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2017 | $2,212 | $7,675 |

| 2016 | $2,104 | $7,323 |

| 2015 | $2,028 | $7,036 |

| 2014 | $1,960 | $6,738 |

| 2013 | $1,876 | $6,377 |

*Annual cost

Nissan Kicks

- Average annual rate: $2,659 ?

- 2022 MSRP: $19,990

The car was just introduced starting in the 2018 model year, and it is slightly more expensive to insure when compared to the average Nissan SUV. However, it still costs much less than more powerful vehicles like the Nissan 370Z.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,659 | $9,236 |

| 2021 | $2,557 | $8,851 |

| 2020 | $2,504 | $8,652 |

| 2019 | $2,420 | $8,399 |

| 2018 | $2,221 | $7,684 |

*Annual cost

Nissan Murano

- Average annual rate: $2,536 ?

- 2022 MSRP: $33,310

A Murano is cheaper to insure than the average Nissan. It has rates that are basically the same as the Pathfinder, Nissan's next-largest sport utility vehicle.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,536 | $8,531 |

| 2021 | $2,449 | $8,241 |

| 2020 | $2,386 | $8,006 |

| 2019 | $2,357 | $7,948 |

| 2018 | $2,167 | $7,205 |

*Annual cost

Nissan Pathfinder

- Average annual rate: $2,530 ?

- 2022 MSRP: $34,640

The Pathfinder costs about the same amount to insure compared to its slightly smaller sibling, the Murano. However, drivers looking to save money on Pathfinder insurance rates may want to look at an older model: Covering a 2011 Pathfinder will reduce your insurance cost by $820 per year, when compared to a 2022 model with the same amount of coverage.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,530 | $8,484 |

| 2021 | $2,462 | $8,241 |

| 2020 | $2,394 | $7,981 |

| 2019 | $2,324 | $7,772 |

| 2018 | $2,228 | $7,588 |

*Annual cost

Nissan Quest

- Average annual rate: $1,995 ?

- MSRP: Discontinued in 2017

Nissan's minivan was discontinued in 2017 but is nevertheless one of the most affordable Nissans to insure: The 2016 Quest is 16% cheaper than other 2016 Nissans on our list.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2016 | $1,995 | $6,713 |

| 2015 | $1,937 | $6,455 |

| 2014 | $1,836 | $6,122 |

| 2013 | $1,775 | $5,856 |

| 2012 | $1,729 | $5,670 |

*Annual cost

Nissan Sentra

- Average annual rate: $2,640 ?

- 2022 MSRP: $19,810

Among Nissan sedans, the cost of insuring a Sentra is second cheapest; it's less expensive to insure than the larger Altima and Maxima but more expensive than the smaller Versa.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,640 | $9,208 |

| 2021 | $2,551 | $8,877 |

| 2020 | $2,431 | $8,425 |

| 2019 | $2,380 | $8,254 |

| 2018 | $2,336 | $8,239 |

*Annual cost

Nissan Titan

- Average annual rate: $2,731 ?

- 2022 MSRP: $38,810

Coverage for the Titan is $317 per year more expensive than coverage for Nissan's other pickup, the Frontier. The cost to insure a Titan is just slightly above the overall average for a Nissan.

Like most models, younger drivers will likely pay a lot more to insure a Titan. An 18-year-old will pay more than three times what a 30-year-old would to insure this vehicle: $9,186 per year, on average.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,731 | $9,186 |

| 2021 | $2,614 | $8,721 |

| 2020 | $2,589 | $8,692 |

| 2019 | $2,486 | $8,296 |

| 2018 | $2,406 | $8,062 |

*Annual cost. 2016 data not available

Nissan Versa

- Average annual rate: $2,515 ?

- 2022 MSRP: $15,380

The Versa is Nissan's smallest and least costly car to buy, so drivers looking to save money on a car and insurance may want to consider the Versa.

Teens and young drivers considering a Versa will likely have to pay more, unfortunately. The typical price an 18-year-old can expect to pay is $8,683, well over three times the price to insure a Versa for an older driver.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 | $2,515 | $8,683 |

| 2021 | $2,460 | $8,476 |

| 2020 | $2,307 | $7,929 |

| 2019 | $2,226 | $7,696 |

| 2018 | $2,233 | $7,855 |

*Annual cost

Nissan Xterra

- Average annual rate: $1,827 ?

- MSRP: Discontinued in 2016

The Xterra was discontinued after the 2016 model year, but it is one of the most affordable Nissans to insure, and the 2015 Xterra has the lowest cost for coverage of any 2015 Nissan model. The Frontier — the pickup truck upon which the Xterra was based — costs slightly more, $16 per year, to insure for a 2015 model.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2015 | $1,827 | $6,095 |

| 2014 | $1,764 | $5,850 |

| 2013 | $1,694 | $5,599 |

| 2012 | $1,692 | $5,654 |

| 2011 | $1,615 | $5,324 |

*Annual cost

Methodology

We surveyed rates from six major national insurance providers: Allstate, Geico, Nationwide, Progressive, State Farm and USAA. We used two sample drivers in Texas, one aged 18 and one aged 30. The profiles were otherwise identical: The drivers were both male, licensed at 16 years old and have no recent tickets or at-fault accidents.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

MSRP data was gathered directly from Nissan.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.