Personal Finance

What Is the Pink Tax? (And Are You Paying It?)

For all the gender equality strides that have been made, it’s still difficult to be a woman in 2019. Women still only make 80.5 cents for every dollar men make, according to the Institute for Women’s Policy Research. There were only 24 women heading up companies on the Fortune 500 list in 2018. And half of the companies on the Russell 3000 index have one or no women directors on their boards.

While having fewer opportunities to rise through the ranks of corporate America and earning less than their male counterparts, women, it seems, generally pay more for a variety of consumer goods.

"By the time a woman turns 30, she’s been robbed of $40,562 just for being a woman," says Sherry Baker, president of product development and marketing at European Wax Center, which launched the campaign #AxThePinkTax. "Every year, a woman spends more than a man for products, including T-shirts, personal care items and services, because of inflated pricing."

What is the pink tax?

Baker is referring to the practice of charging more for products marketed toward women — which are frequently pink — than the same products sold to men. This includes female-specific products that would be considered medical necessities, such as tampons. "The pink tax impacts each and every woman in the U.S., forcing us to pay more for basic necessities, for the mere fact of being a woman," says Baker.

History of the pink tax

The pink tax isn’t new; in fact, it’s been around for decades — since the U.S. drafted the sales tax system between the 1930s and the 1960s. "It was a very different world at a time when legislators were figuring out which products to tax and which to exempt," says Laura Strausfeld, co-founder of PeriodEquity.org. "It was a world in which it was single-income families with men working and women staying at home."

In other words, in the old days, these expenses were borne by a household. Today, they’re often borne by women alone. "This notion of the pink tax arises from the advances women have made in the workforce and bearing individually the cost of being a woman in the world," Strausfeld says.

There are other explanations for why the pink tax exists. One such reason is that tariffs on clothing imports for women are higher. Another chalks it up to the fact that product design for women’s consumer goods is often more elaborate — marketing pink women’s razors, for instance — which runs up costs for a company that then passes those costs down to the consumer.

How much does the pink tax cost women?

Estimates of how much women pay in pink taxes vary. In 1994, California ran a gender-pricing study and estimated that women paid roughly an extra $1,350 every year for personal care services, such as haircuts and dry cleaning, which is $2,135 in today’s dollars.

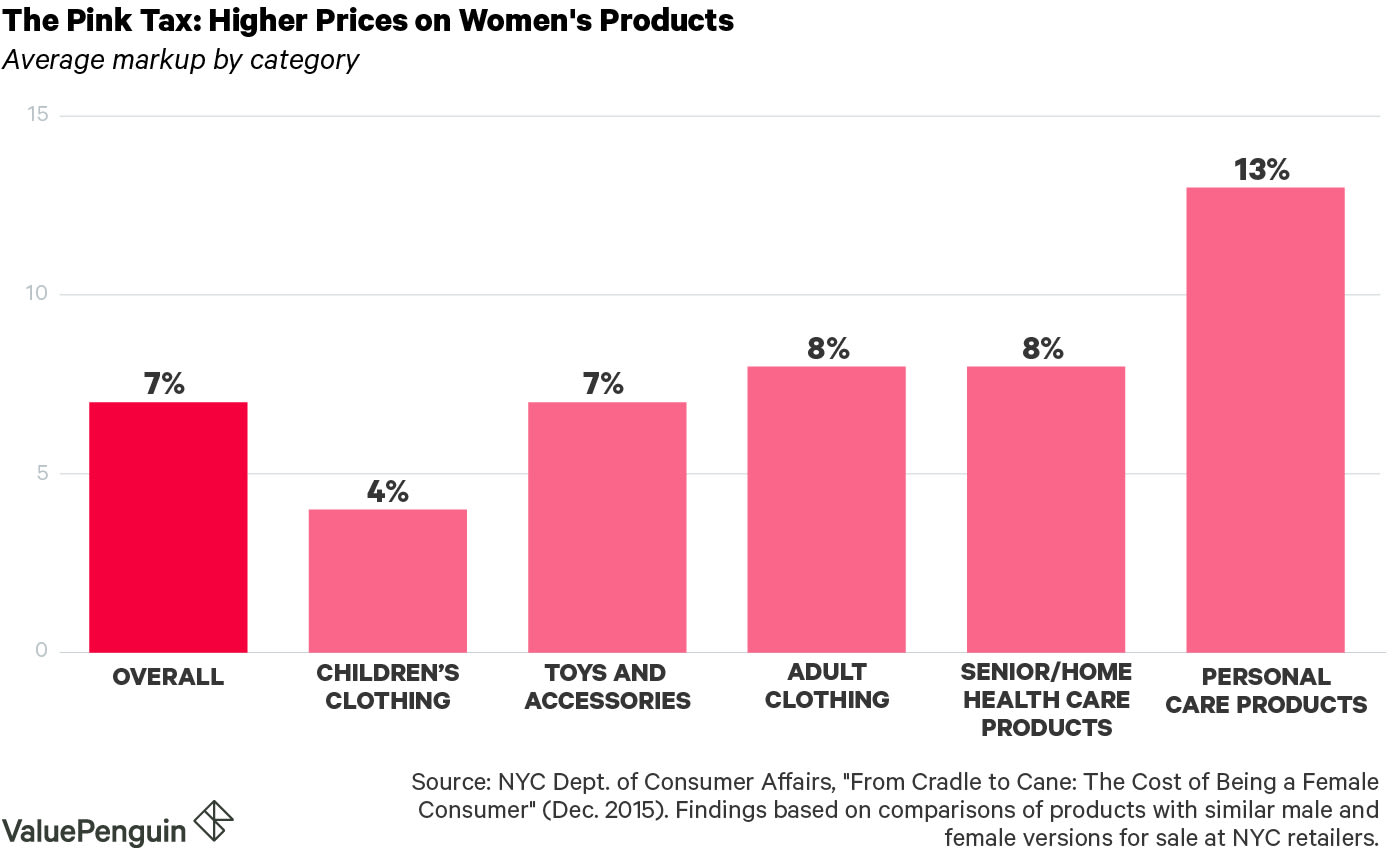

In 2015, the New York City Department of Consumer Affairs did its own study, concluding that women and girls pay about 7% more, on average, for consumer goods than men and boys do. That breakdown looks like this:

In fact, products for women cost more in 30 out of 35 categories covered by the study. The report’s takeaway: "In every industry, products for female consumers were more likely to cost more."

While studies haven’t estimated the long-term cost of the pink tax, it’s clear that women will generally pay thousands more than men for services and products over a lifetime.

Items that get the pink tax markup

Women frequently pay more for products that are marketed specifically to women, but they also pay more for services than men do. Some pink tax examples include:

- Tampons: While other medically necessary products, such as prescription drugs and neck braces, are exempt from state sales tax, 36 states still tax women’s menstrual products. It’s called the "tampon tax."

- Personal care products: Shampoo and conditioner, razors, lotion, deodorant, body wash and shaving cream all fall under this category. Gillette, for instance, took heat over the fact that its women’s razors cost more than those for men.

- Dry cleaning: It costs more to dry clean women’s clothes than men’s.

- Toys: Even for gender-neutral toys like bikes, scooters, backpacks, helmets and arts and crafts items, those marketed to girls cost more.

- Clothes: Both women’s and girls’ clothing see a higher markup than those for boys and men.

- Mortgages: Mortgages cost more for sole female borrowers, in part because they have weaker credit overall. But other studies show women default less on mortgages than men, even controlling for credit differences, all of which says single female borrowers are paying more than they should.

- Haircuts: Women pay more for a haircut than men, even when their hair is the same length.

- Senior/home health care products: Supports and braces, canes, compression socks, adult incontinence products and digestive health products cost more for senior women than senior men.

How to fight the pink tax

There are a few ways to fight back against this practice. The first is to turn your shopping dollars toward companies that are taking a stand against the pink tax. Boxed, for instance, has reduced the pricing on its women’s products so they’re the same price as the men’s. Billie, a subscription shaving company, claims to offer pricing that’s comparable to men’s razor subscriptions. Even Burger King has staged its own campaign against pink pricing.

Aside from supporting companies with gender-neutral pricing, you can choose not to buy products marketed specifically to women. But if you want your state to ban the pink tax altogether, get in touch with your state representatives. "Voice your outrage about it," Strausfeld says. "The more people who call their state representatives, the more support these people have to put forward bills to remove the tax." Find your government representatives here.