Rider Motorcycle Insurance Review: Expansive Coverage With Limited Availability

Rider's basic policies include extras you'll usually pay more for, but rates are higher than average.

Find Cheap Motorcycle Insurance Quotes in Your Area

Rider Insurance is a solid choice for people shopping for motorcycle insurance in New Jersey and Pennsylvania — the only two states where service is available. Rider's coverage stands out because of a range of extras included with comprehensive and collision coverage. Rider also offers off-road vehicle and UTV insurance in addition to its motorcycle coverage.

Pros and cons

Pros

Lots of coverage extras

Multiple discounts

Cons

Expensive rates

Only available in New Jersey and Pennsylvania

Rider motorcycle insurance: Our thoughts

Rider's motorcycle insurance can be a good alternative to larger companies in both states where new policies are available, but prices are often high.

Rider motorcycle insurance is a good option to look into for people who live in the markets where it's available. In Pennsylvania it has rates around average, cheaper than Allstate and Geico, but more expensive than Progressive and Dairyland. Rider is the most expensive option we found in New Jersey. Additionally, many typical bikers will find motorcycle coverage that fits their needs with Rider Insurance — along with a few choices for upgrades.

Policies come with uninsured/underinsured motorist (UIM) and liability protections — both with adjustable limits. Additionally, the endorsements available through Rider motorcycle insurance are practical enough to warrant consideration from policyholders who want more than standard coverage. Rider motorcycle insurance offers roadside assistance and protection for accessories, along with comprehensive and collision coverages, as ways to upgrade a standard policy.

Unfortunately, Rider's availability is very limited. Although Rider used to sell motorcycle insurance in eight states across the eastern United States, the insurer now only accepts new policyholders in Pennsylvania and New Jersey. Rider's availability shrank in 2019 after the company was acquired by Plymouth Rock, a New England-based insurer.

Read: Our full review of Plymouth Rock

Cost of Rider motorcycle insurance quotes

Rider motorcycle insurance is more expensive than average in both Pennsylvania and New Jersey. It's about 7% and 24% more expensive than the statewide average cost of coverage, respectively. In New Jersey, Rider's typical rate is $200 more than average per year, while Rider's rate is $53 per year more expensive than average in Pennsylvania. However, there is some variance in New Jersey, where Rider rates vary by more than $700 per year.

Rider's online experience can be buggy, with somewhat common technical errors that prevent a user from getting a quote.

Find Cheap Motorcycle Insurance Quotes in Your Area

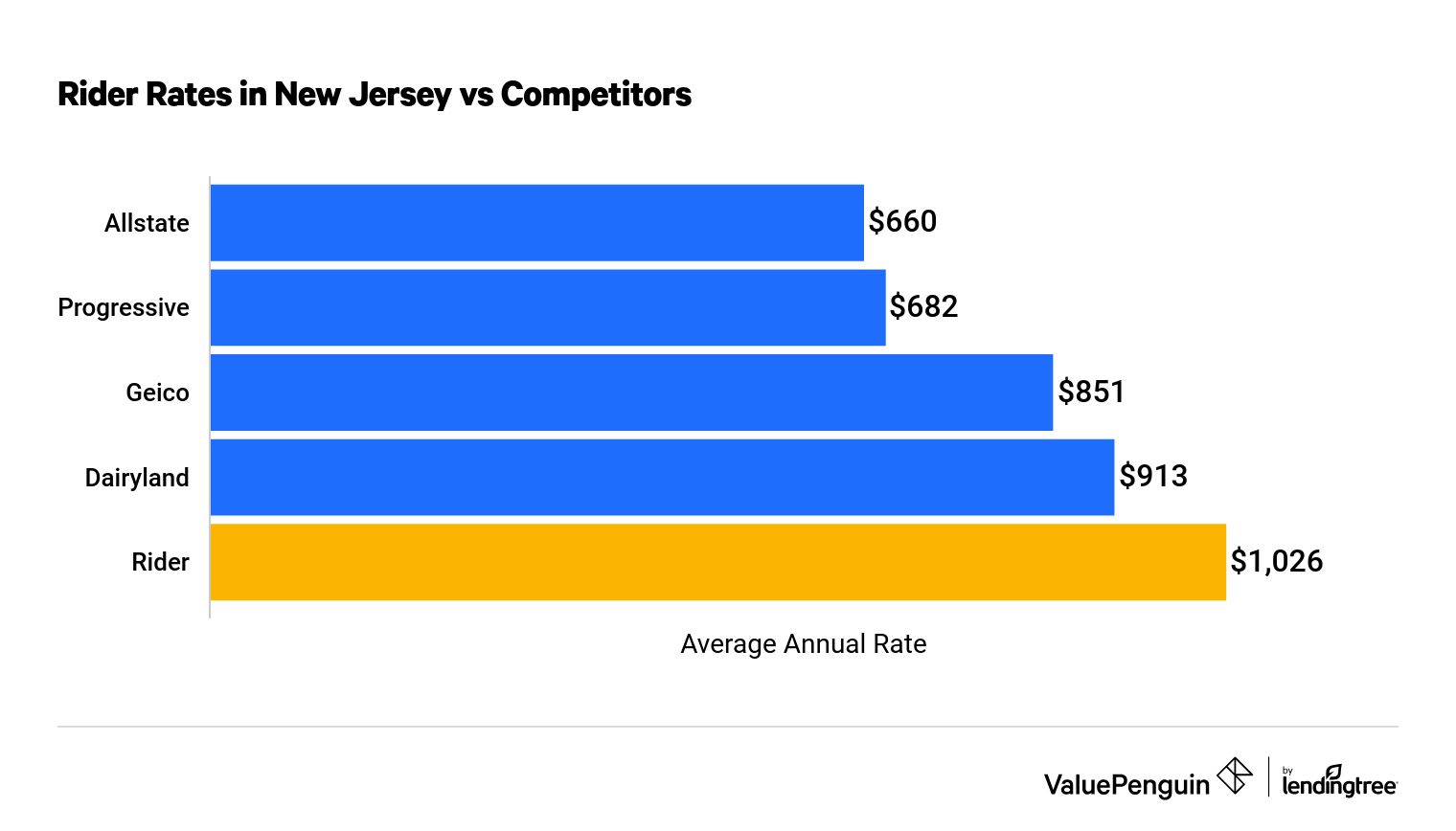

Rider motorcycle rates in New Jersey vs. competitors

Company | Cost in NJ |

|---|---|

| Allstate | $660 |

| Progressive | $682 |

| Geico | $851 |

| Dairyland | $913 |

| Rider | $1,026 |

Rider is 18% more expensive in New Jersey than in Pennsylvania. That's despite the states' average rates being nearly identical.

Find Cheap Motorcycle Insurance Quotes in Your Area

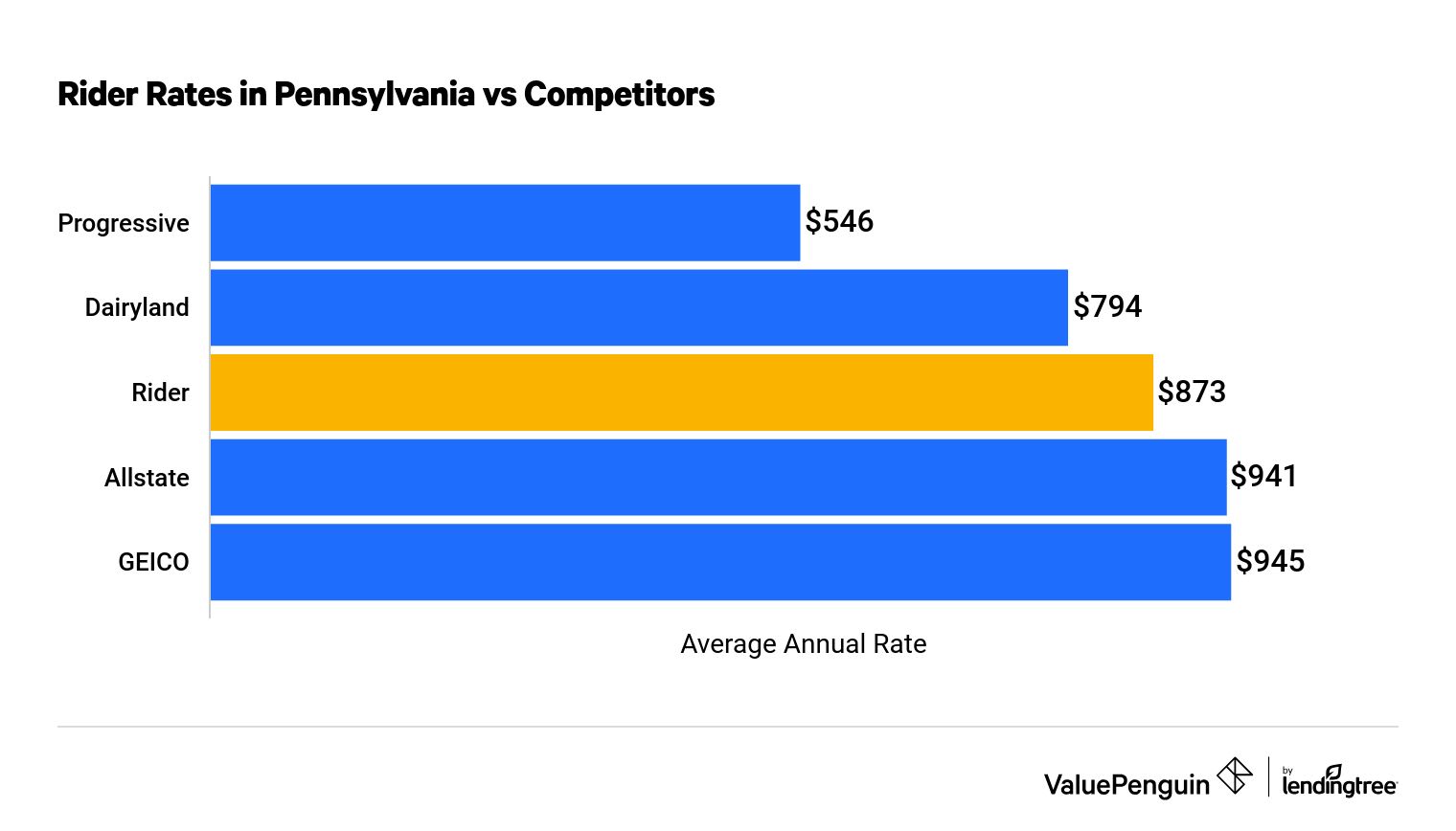

Rider motorcycle rates in Pennsylvania vs. competitors

Company | Cost in PA |

|---|---|

| Progressive | $546 |

| Dairyland | $794 |

| Rider | $873 |

| Allstate | $941 |

| Geico | $945 |

The average cost of Rider's motorcycle insurance in both of its markets is $950 per year. This makes Rider more expensive than the national average cost of coverage, $721 per year.

Insurance discounts at Rider

Rider Insurance offers 15 discounts that can help lower your annual costs.

All of those discounts are available in both Pennsylvania and New Jersey. Previously, the company had widely differing options depending on which state you lived in.

- Transfer: Transfer from another insurer with no more than 180 days in between policies

- Homeowner: Own a home

- Advanced shopper: Request a policy before your current policy has to go into effect, and save more the earlier you get your quote

- Claims-free: Have a record with no losses in the prior five years

- Rider experience: Have three years of experience riding a motorcycle

- Anti-lock brake: Operate a bike with anti-lock brakes

- Anti-theft: Applies to comprehensive coverage policies for vehicles with anti-theft devices

- Safety course: Complete a safety course and receive this discount for three years

- Safety course instructor: Complete an instructor safety course

- Companion package discount: Bundle your motorcycle insurance with Plymouth Rock home, personal auto or commercial auto insurance

- Group affinity discount/Riding group discount: Be a member of an approved affinity group or riding group

- Military discount: Have served in the military

- eDocuments discount: Receive your policy documents electronically

- Pay-in-full discount: Pay the full cost of your policy up front

Coverages offered by Rider motorcycle insurance

Rider has more coverage options than a typical small provider. In addition to its bodily injury and property damage liability coverage, Rider Insurance also offers a range of upgrades in both states for people who want extra coverage.

Your basic policy with Rider automatically includes the company's Get Home Safe program, which will reimburse you for one cab ride per year of up to $50 if you don't feel safe riding. The company will also pay for the full replacement cost of certain motorcycles if they are considered a total loss after an accident.

If a customer purchases comprehensive and collision coverage, Rider will add an impressive suite of extras:

Coverage | Coverage options |

|---|---|

| Accessory and custom parts | $8,000 included with purchase of comprehensive and collision coverage |

| Trailer coverage | Extends comprehensive coverage to your trailer |

| Trip interruption | Up to $600 reimbursement for meals and lodging after an accident |

| Helmet, apparel | Up to $500 in coverage for your helmet, and $500 more for other safety apparel |

Rider also offers an option called Rider Assurance Plus, which adds a few additional coverage perks:

- Roadside assistance: 24-hour assistance that includes 35 miles of towing, mechanical or electrical breakdown assistance and lockout service

- Carried property coverage: Up to $1,000 to repair or replace personal property damaged in an accident

Customer feedback for Rider motorcycle insurance

Customer feedback for Rider is generally positive. According to data from the National Association of Insurance Commissioners (NAIC), Rider received only two service complaints across 2020 and 2021.

Although it receives few complaints, Rider's NAIC complaint index is affected more by a single complaint than larger insurers. For this reason, Rider Insurance has a 4.02 complaint index — which means the insurer receives about four times more complaints than its market share would lead one to expect. Even so, we don't believe that Rider's customer service is of poor quality given the low total number of complaints historically.

Rider Insurance received an A- from AM Best, a credit-rating agency that assesses financial strength in the insurance industry. That indicates a strong ability to meet financial obligations. Rider is a subsidiary of Plymouth Rock Assurance.

Methodology

To evaluate Rider Insurance, we collected motorcycle insurance quotes in New Jersey and Pennsylvania. We compared these rates with prices we compiled from other insurers in the two states. We collected rates for the following companies:

- Geico

- Progressive

- Dairyland

- Allstate

We collected rates for a sample rider: a 45-year-old married male motorcyclist insuring a 2022 Harley-Davidson FLHX Street Glide. Our rider had more than 20 years of experience riding motorcycles. All of these factors can influence rates. Additionally, your premiums depend on your personal insurance history, your driving record and the amount of coverage you purchase. The rates you receive are likely to vary.

The sample rider's policy includes:

- Bodily injury liability coverage: $100,000 per person/$300,000 per accident

- Property damage liability coverage: $50,000 per accident

- Collision coverage: Included/$500 deductible

- Comprehensive coverage: Included/$500 deductible

- All other coverages: Not included

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.