Health Insurance

74% of Americans Stressed About High Health Insurance Costs

‘Tis the season for holiday cheer and health insurance open enrollment. As Americans get underway for Thanksgiving and Christmas, many are making vital decisions about their health insurance coverage.

But costs are high, and Americans aren’t only feeling it in their holiday budgets. According to the latest ValuePenguin survey of nearly 1,550 U.S. consumers, the majority of insured Americans are worried about rising health insurance costs. What’s more, many think their premium is too expensive for its value.

Here’s what else we found.

On this page

- Key findings

- Insured Americans are concerned about rising health insurance costs

- 33% think their premium is too expensive

- 70% of Americans plan to stick to their current health plan next year

- If they didn’t have to pay their monthly premium, what would consumers do with the money?

- Pricey premiums: What to know, what to expect

- Methodology

Key findings

- 74% of insured Americans are worried about rising health insurance costs. Americans making between $75,000 and $99,999 (82%), baby boomers (80%), parents whose children are all 18 or older (77%) and women (77%) worry the most about rising health insurance costs.

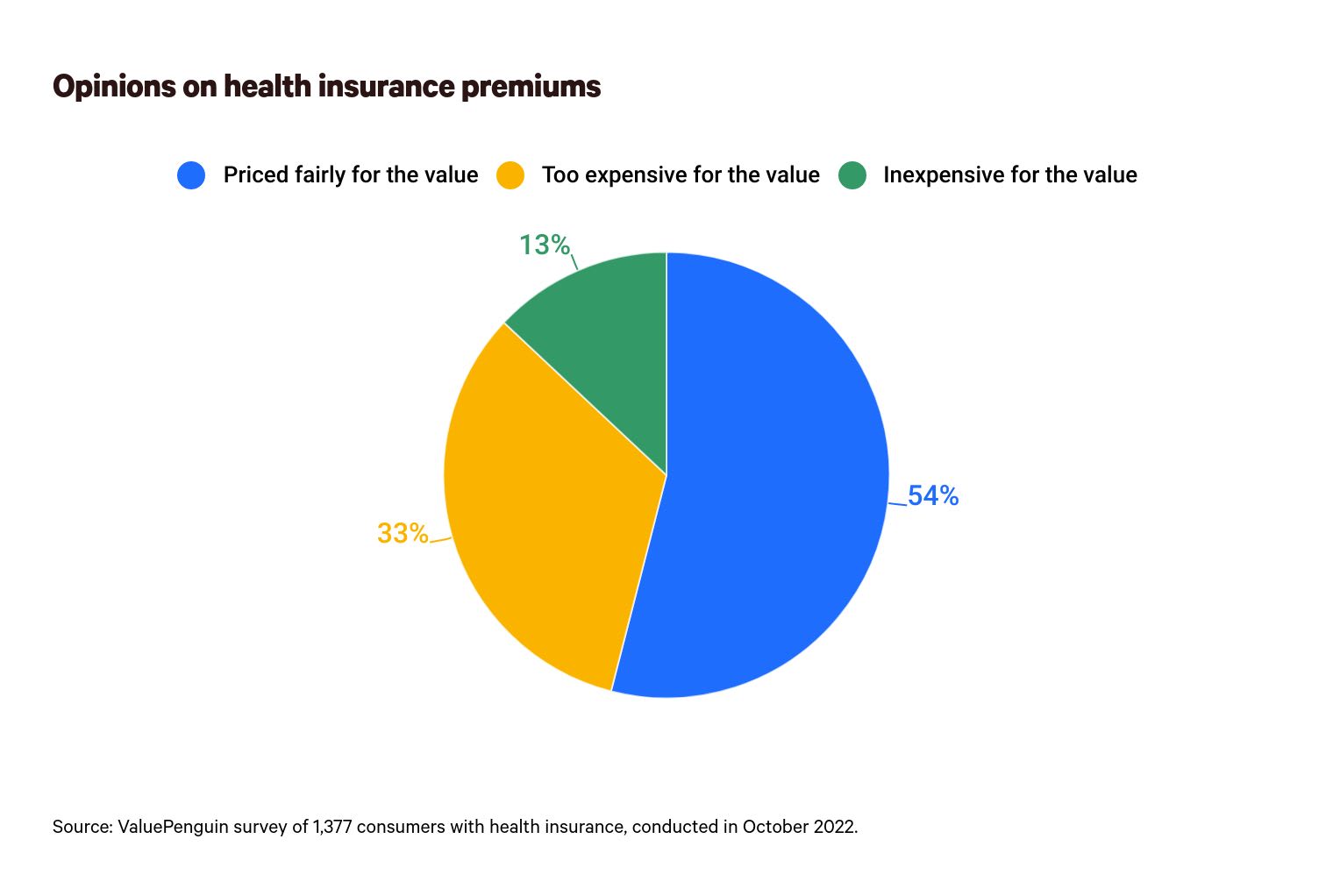

- 33% of Americans with health insurance think their premium is too expensive for the value. On average, insured Americans say a $364 increase in their monthly payment would make it unaffordable. By generation, millennials and Gen Xers (both 37%) are most likely to say their premiums are too high.

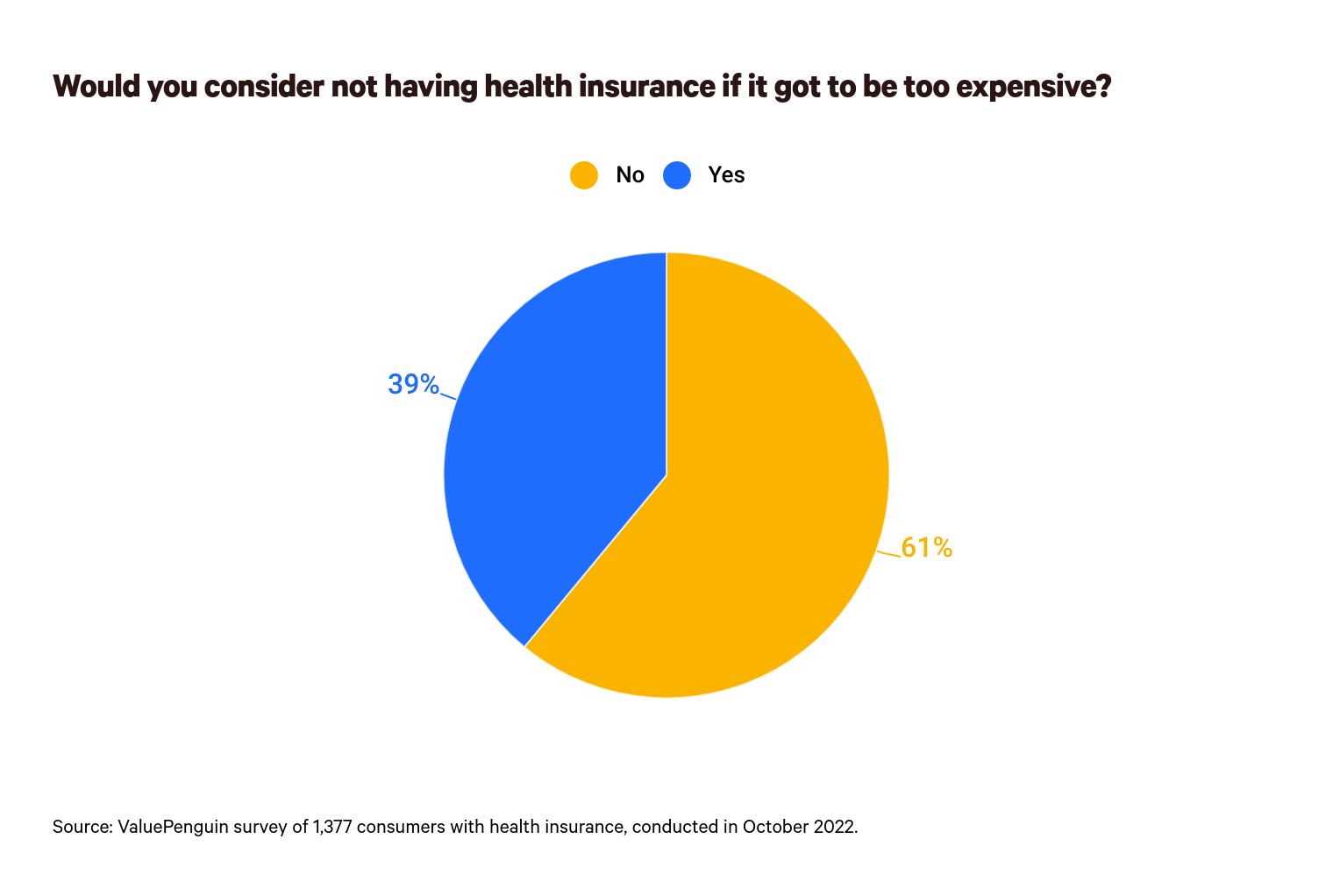

- 39% of insured Americans would consider dropping health insurance if it got too expensive. Millennials (52%) and Americans making less than $35,000 (51%) are most likely to say they’ll forgo health insurance if it gets too expensive.

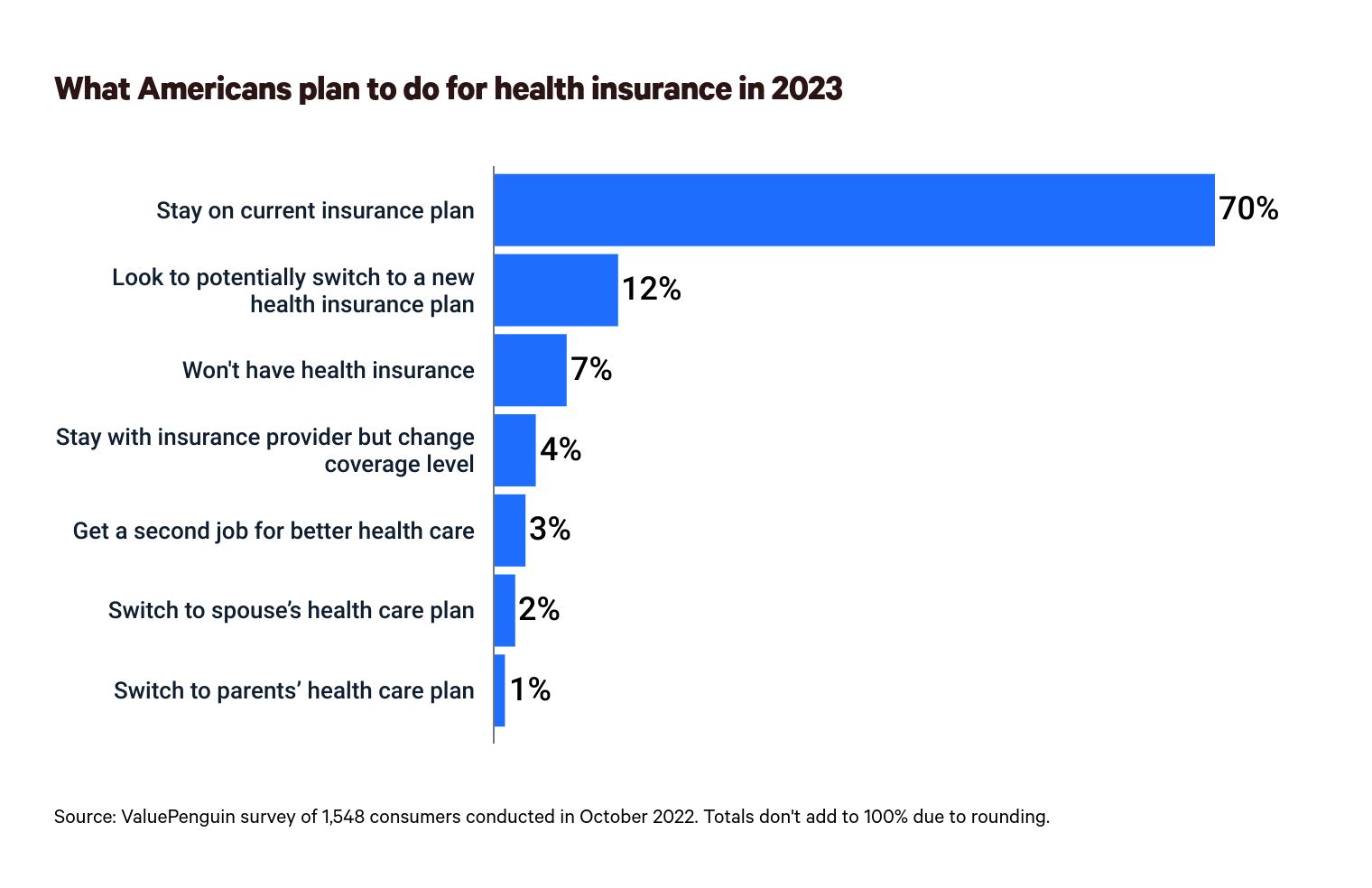

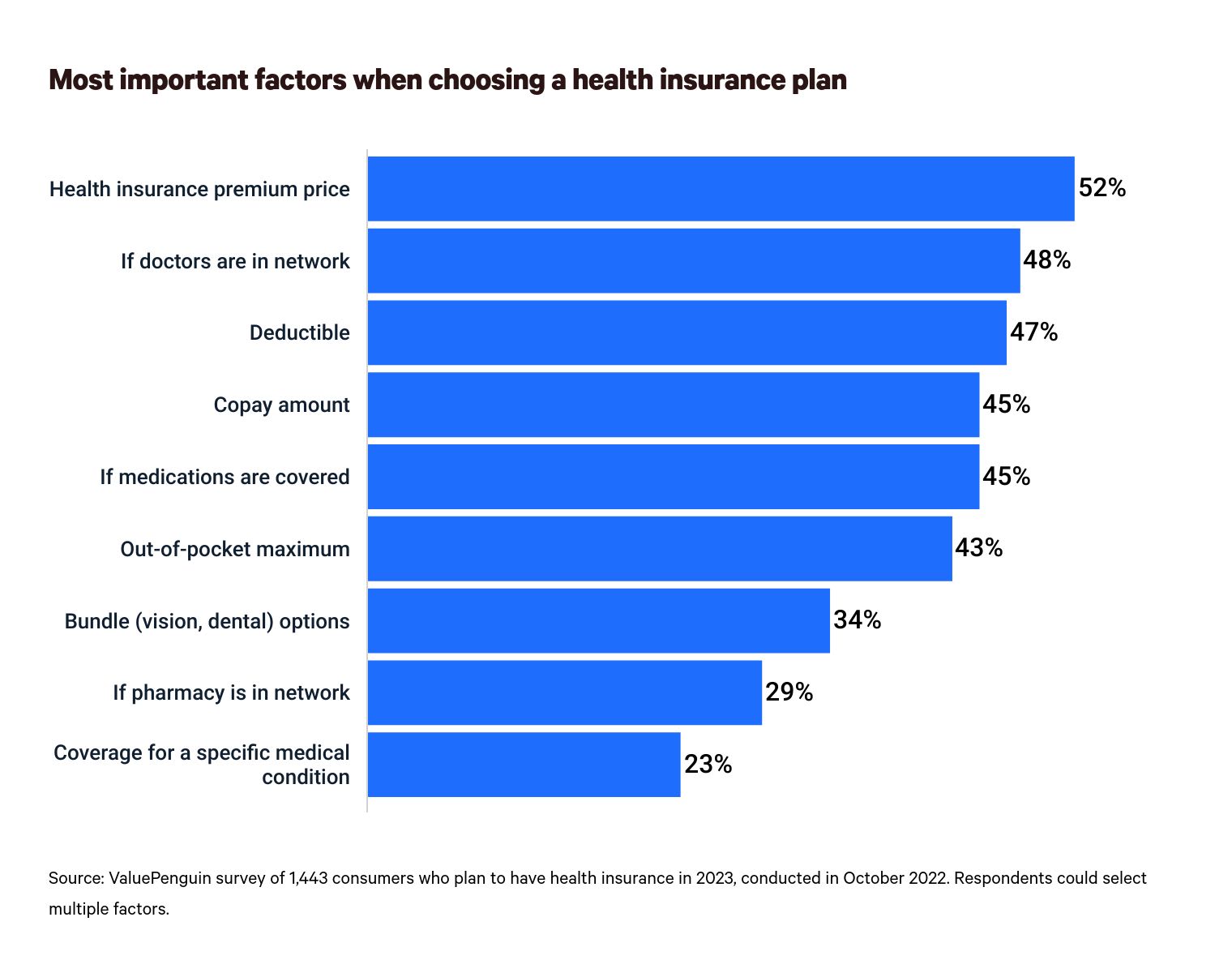

- Looking ahead to next year, the majority of Americans (70%) will stay on their current plan. 23% say they’ll look to make changes or switch to another plan, while 7% will go without health insurance in 2023. Those who’ll be insured in 2023 say premiums (52%), in-network doctors (48%) and deductibles (47%) are the most important factors they consider when selecting a health insurance plan.

-

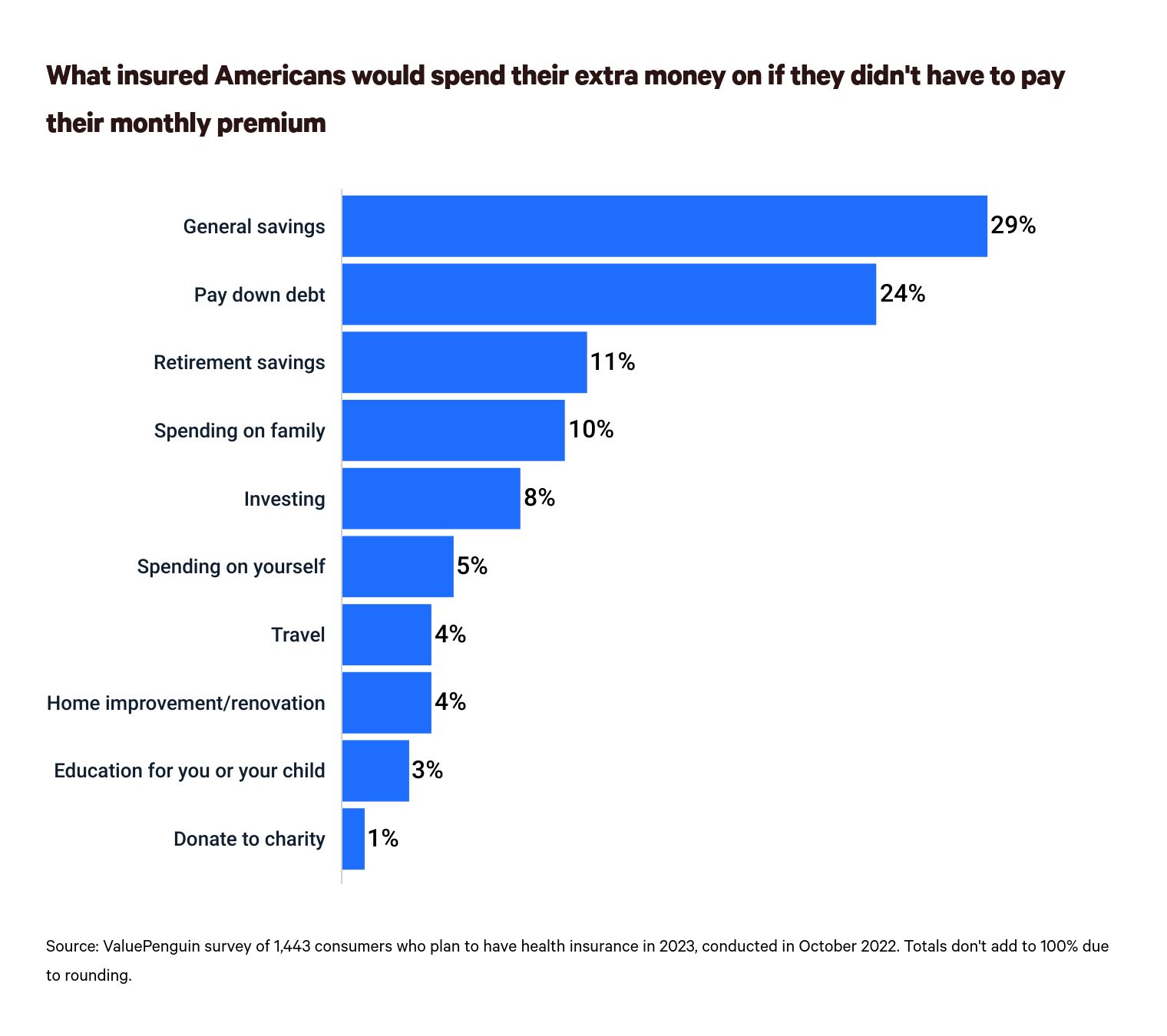

Hypothetically, those who expect to be insured in 2023 would save or pay down debt if they didn’t have to pay their health insurance premiums each month. 29% say they’d use the extra cash to pad their general savings, 24% say they’d pay down debt (whether credit card, mortgage, student loans or something else), 11% say they’d put the money into their retirement savings and 8% say they’d invest the extra cash.

Insured Americans are concerned about rising health insurance costs

Open enrollment is when consumers can enroll in a health insurance plan or make changes without a qualifying event. (The open enrollment period for the health insurance marketplace started on Nov. 1, 2022, and ends on Jan. 15, 2023. Meanwhile, private employers can choose their open enrollment period.)

This year, Americans are concerned about the costs. In fact, nearly three-quarters (74%) of insured Americans are worried about rising health insurance costs.

Insured Americans making between $75,000 and $99,999 annually are the most worried about rising costs, at 82%. That’s followed by baby boomers ages 57 to 76 (80%), parents whose children are all 18 or older (77%) and women (77%). Meanwhile, those making less than $35,000 (67%), Gen Zers ages 18 to 25 (68%), those who’ve never been married (70%) and men (71%) are the least likely to say they’re concerned.

According to ValuePenguin health insurance expert Divya Sangameshwar, many are right to be concerned. A Kaiser Family Foundation (KFF) analysis from July found that health insurers have proposed a median increase of 10% to premiums in 13 states and the District of Columbia. For employer-sponsored health insurance plans, employer costs are expected to rise by 6.5%, according to an analysis from professional services firm Aon — a hike that’ll likely impact premium costs.

Meanwhile, premiums for a silver marketplace plan with moderate premiums and care costs will rise by 4% for a 27-year-old, according to the Centers for Medicare and Medicaid Services. This is the first increase after four years of declines for this plan, according to an analysis by the publication Health Affairs. Changes to Medicare premiums vary, with some plans seeing decreases as high as 3% and others seeing increases as high as 5%.

Americans’ health care coverage varies across the board. Specifically:

- 39% have a health insurance plan through their or a spouse’s employer

- 34% have Medicare or Medicaid

- 10% have health insurance through the HealthCare.gov marketplace

- 5% have insurance through their parents’ family plan

- 1% are on a COBRA plan.

Nearly 1 in 10 (8%) don’t have insurance, while 3% cite "other."

33% think their premium is too expensive

It’s not just future costs that concern consumers. Many already think health insurance is too expensive already. Of those with health insurance, 33% believe their premium is too expensive. That’s particularly true for millennials ages 26 to 41 and Gen Xers ages 42 to 56 (37% for both).

Beyond the generational look, six-figure earners are the most likely to say their premiums aren’t worth the value. Among insured Americans making $100,000 or more, 42% find their premiums too expensive, compared with just 24% of insured Americans making less than $35,000.

Most Americans are fine with the prices they’re paying, though. Overall, 67% think their insurance premiums are fairly priced or inexpensive, leading with consumers making less than $35,000 (76%), Gen Zers (74%) and divorced consumers (74%).

But how much are consumers paying? Currently, 69% of all insured Americans spend less than $500 a month on health insurance. More than half (53%) spend less than $250 a month on health insurance, with divorced Americans (73%), those who earn less than $35,000 (71%) and baby boomers (70%) the most likely to do so.

Few insured Americans are on the costlier side. Just 15% spend $500 or more a month on health insurance — 1% of which spend at least $1,500 monthly. Meanwhile, 16% don’t know how much they spend on health insurance.

Regardless of what they’re paying now and whether they think it’s worth the cost, consumers have their limits. When it comes to how much more they’d be willing to shell out, they’d draw the line at an increase of $364, on average — though more on that below.

Insured consumers are willing to draw a line

With potential price hikes looming, 39% of insured Americans say they’d consider giving up health insurance if it got too expensive. Millennials (52%) and Americans making less than $35,000 (51%) are the most likely groups to consider giving up health insurance if it gets too expensive.

Notably, 17% of Americans who say they’ll drop their health insurance coverage if it gets too expensive also admit that they don’t know how much their premiums cost.

But what’s considered too expensive? On average, insured Americans say a $364 increase in their monthly payment would make it unaffordable. For those who’d consider dropping their health insurance if it became too expensive, however, an increase of $318, on average, would be enough for them to drop their health insurance coverage.

Still, that isn’t the group with the lowest threshold. That dollar amount is significantly lower among Americans making less than $35,000 a year ($233) and divorced Americans ($291).

70% of Americans plan to stick to their current health plan next year

Despite looming price hikes in certain scenarios, 70% of Americans say they plan to stick to their current plan next year. Meanwhile, nearly a quarter (23%) say they’ll make changes or switch to another plan, while 7% will go without health insurance in 2023.

While the majority don’t plan on making changes to their plans, Sangameshwar cautions against sticking with a provider out of convenience.

"Having a ‘set and forget it’ mindset isn’t the best approach," she says. "Your premiums may have increased, your coverage may have changed (such as the doctors available in your network) and your health care needs might have changed. Make it a practice to evaluate your coverage annually, compare plans and make an informed decision."

Of those looking to change their health insurance, 63% want to switch to a cheaper plan. Meanwhile, 4% of Americans plan to stay with their insurer but change their coverage, while 3% of consumers plan to take a second job to get better health insurance in 2023. (Think about this one for a second.)

Nearly 3 in 4 (72%) Americans who’ll be insured in 2023 say they compare health care plans before choosing one. That percentage is highest among millennials (77%) and consumers who make $35,000 to $49,999 a year (76%).

When it comes to what consumers prioritize when picking a plan, those who’ll be insured in 2023 are most likely to say premiums (52%) are one of the most important factors they consider. Following that, insured Americans are most likely to consider in-network doctors (48%) and deductibles (47%). Meanwhile, Americans are least likely to consider if they’ll be covered for a specific medical condition (23%) or if their pharmacy is in network (29%).

Sangameshwar says this indicates that many Americans go about their health care correctly.

"While cost may be a top priority, it isn’t the only criteria being used to select coverage," she says. "Any decision made about health insurance needs to weigh the balance between several factors. For example, if you’re young and very healthy, you won’t need to splurge for the Lamborghini of health insurance policies, but you should have some form of health insurance that’ll allow you to see the doctor you’ve been seeing before."

Start by assessing your needs, Sangameshwar says. Once you have a good understanding, you should be able to identify the plan where your health care providers are in network, your medications are covered and your deductible and out-of-pocket maximum are affordable.

If they didn’t have to pay their monthly premium, what would consumers do with the money?

With health insurance costs expected to take up more of consumers’ already tight budgets, it’s worth wondering what insured Americans in 2023 would do with the extra cash if they didn’t have to pay their monthly premiums.

Most say they’d put the costs toward their financial health. In fact, 29% say they’d use the extra cash to pad their general savings, with baby boomers (35%), people without children (34%) and divorced consumers (33%) the most likely to say so. Following that, 24% of insured Americans in 2023 say they’d use the money to pay down debt, whether credit card, mortgage, student loans or something else. That figure is particularly high among women (30%), consumers making between $50,000 and $74,999 (29%) and consumers making less than $35,000 (28%).

Among other financially savvy decisions consumers would make, 11% say they’d put the money into their retirement savings and 8% say they’d invest that extra cash in the stock market. Just 15% say they’d spend the money — whether on themselves or their family — and an even smaller percentage (4%) say they’d use the cash to travel.

Pricey premiums: What to know, what to expect

As consumers make critical health care insurance decisions, it’s worth noting that 2023 will bring many changes beyond premium hikes. Most notably, Sangameshwar says early 2023 may bring the end of the COVID-19 emergency health declaration in the U.S.

If the COVID-19 public health emergency ends in mid-January as is expected, up to 15 million Americans will be disenrolled from Medicaid and the Children’s Health Insurance Program, according to the U.S. Department of Health and Human Services (HHS) estimates. If these Americans want to be insured, they'll have to get private health insurance — which is generally much more expensive.

Sangameshwar says trimming the cost of your health insurance without sacrificing a lot of coverage is a challenge. Here are a few tips to keep in mind:

- Shop around. "When it comes to health care plans, compare multiple plans before settling on one," she says. "From health maintenance organizations (HMOs) to preferred provider organizations (PPOs), the one that works for you based on your own needs is the one you want. If the plans are hard to understand, work with an insurance broker to understand what each plan entails and how it can serve your specific health care needs."

- Browse off-exchange options. "The government-run health insurance exchange in your state will show you the plans eligible for purchase with a government subsidy in your area," Sangameshwar says. "But if you want to make sure you’ve seen all your options, be sure to work with an insurance broker or call insurers to find out about other plans that may not be listed on the government exchanges."

- Choose a high-deductible health plan (HDHP). If you’re relatively healthy and don’t expect lots of doctor visits in a year, you can increase your deductible in exchange for a lower premium. It’s a common option that can save a lot of money. In fact, a ValuePenguin study on HDHPs found that 52.9% of American private-sector workers were enrolled in one in 2020. "However, keep in mind that choosing a high-deductible plan can be risky — after all, if something catastrophic happens, you could be hit with huge out-of-pocket costs," Sangameshwar says. "If you opt for a high deductible health plan, make sure you get one with a health savings account (HSA) or flexible spending account (FSA) to help with unexpected medical expenses."

- Enroll in a wellness incentive. If you’re getting health insurance through your employer, Sangameshwar recommends asking about wellness incentives. Some organizations offer lower premiums to employees who participate in wellness challenges or check off certain tasks for preventive health, such as getting an annual physical or joining a fitness program.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,548 U.S. consumers ages 18 to 76 from Oct. 5-6, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76