Safeco Auto Insurance Review

Safeco boasts affordable rates and unique coverages, but beware of the lackluster customer service.

Find Cheap Auto Insurance Quotes in Your Area

Safeco boasts some of the cheapest rates available, particularly for younger drivers, in addition to offering a number of unique discounts and services.

But we found that Safeco has average customer service reviews. And you can't get quotes online, meaning you'll have to work directly with an agent to get coverage.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

Pros and cons

Pros

Cheap rates for young drivers

Offers classic car insurance

Low-mileage discount if you don't drive often

Cons

Can't get a quote online

Poor customer service

Safeco rates: Provides good value for most drivers

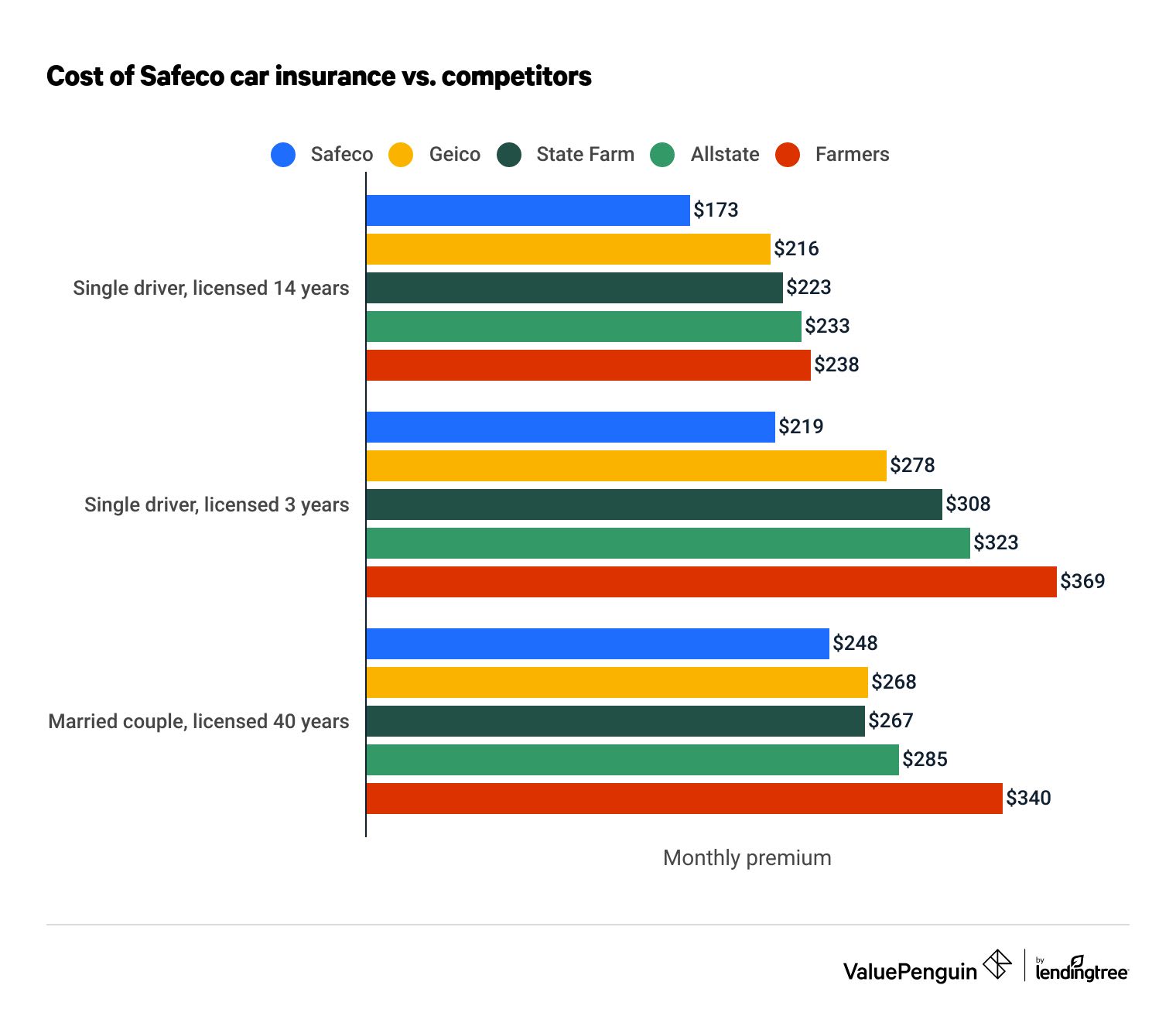

Safeco almost always offers the most affordable deal on auto insurance compared to State Farm and Geico. In fact, Safeco's rates are 22% less expensive than the average of four other major insurers.

Insurer | Single driver, licensed 14 years | Single driver, licensed 3 years | Married couple, licensed 40 years |

|---|---|---|---|

| Safeco | $173 | $219 | $248 |

| Geico | $216 | $278 | $268 |

| State Farm | $223 | $308 | $267 |

| Allstate | $233 | $323 | $285 |

| Farmers | $238 | $369 | $340 |

Source: California Department of Insurance

Find the Cheapest Auto Insurance Quotes in Your Area

Safeco coverage options

In addition to standard car insurance coverages, Safeco offers policyholders several unique policy add-ons.

New vehicle replacement

If your new car is totaled or stolen before you put 15,000 miles on it, Safeco will pay to replace it.

Rental reimbursement

Safeco offers coverage of rental cars used when you get into an accident.

Safeco classic car insurance

Safeco offers coverage for classic cars and offers low-mileage discounts to drivers who drive less than 5,000 miles a year in their classic car.

Loan and lease coverage

In some states, Safeco offers auto loan/lease coverage, also known as gap insurance. This coverage helps drivers who have financed or leased their car to cover the rest of their car payments should their car get totaled or stolen.

Safeco claims valet service

Not only does Safeco cover rental cars after you get into a covered accident, but if your car is still operational, a Safeco valet driver will deliver a rental vehicle, drive your car to an authorized repair shop and return your repaired car. The valet service can deliver a rental vehicle to different locations, not limited to your home or office. You must have rental reimbursement coverage to use valet services.

Safeco RightTrack

Safeco RightTrack is a free telematics program that tracks your driving using a mobile app, and everyone who takes part qualifies for a discount between 5% and 30%. (The exception to this is New York state drivers, who use a plug-in device for monitoring.) Safeco RightTrack monitors behaviors like hard braking, acceleration, nighttime driving and total miles driven. After 90 days of monitoring, Safeco will evaluate the savings it can offer you based on your driving habits.

As with the Liberty Mutual version of RightTrack, Safeco policyholders can enroll more than one vehicle. Residents of most states are eligible, with the exception of the following:

- Alaska

- California

- Delaware

- District of Columbia

- Hawaii

- North Carolina

Roadside assistance

Safeco includes towing, tire changes, battery service, fuel and fluids replenishment and car unlocking if you lock your keys in your car. Roadside assistance is available 24/7.

Other features

Safeco also offers the standard coverages you'd expect to see from any major auto insurer, including:

- Medical payments

- Property damage liability

- Bodily injury liability

- Collision

- Comprehensive

- Glass coverage

Discounts offered by Safeco

On top of its affordable rates, Safeco offers a few appealing discounts that may reduce your rates even more. One uncommon discount option is the claims-free cash back program. For every six months that you avoid making an at-fault claim, Safeco will mail you a small refund: a check worth 2.5% of your insurance policy premium.

If you have collision coverage, Safeco's diminishing deductible will reduce the amount of your collision deductible each policy period you go without making a collision claim, down to a minimum of $500.

Safeco discounts

- Bundle your auto insurance with other Safeco policies

- Maintain a clean driving record and Safeco will lower your deductible in increments, up to $500

- Take an accident prevention course (if you meet the required age that varies by state)

- Insure multiple cars with Safeco

- Make Safeco aware if your car has anti-lock brakes

- Own a home

Safeco also offers a low-mileage discount program. If you're older than 25 and drive your car less than 8,000 miles each year, you could get up to 20% off your auto insurance. This could be a solid option for those who work from home or those who frequently use public transit.

Another big perk of buying insurance from Safeco is its accident forgiveness program. If you have been a Safeco customer for several years and you have not been in an at-fault accident, your first accident will be waived and will not impact your rates. However, this bonus is not available in some states, including California.

With Safeco, you can also get the standard discounts that you would expect from a large auto insurance company.

Safeco Insurance complaints, reviews and financial strength ratings

Safeco's customer service reputation is lacking. J.D. Power's 2022 Auto Claims Satisfaction Study found that Safeco customer satisfaction with claims was slightly lower than average, rating the company 16th out of 22 insurers.

Reviewer | National average | Safeco rating |

|---|---|---|

| J.D. Power | 873 out of 1,000 (higher is better) | 865 (ranked 16th out of 22) |

| NAIC complaint index | 1.00 (lower is better) | 0.94 |

| AM Best | N/A | A |

The National Association of Insurance Commissioners (NAIC) gave Safeco a complaint index rating of 0.94, slightly below the national average rating of 1.00. This suggests Safeco customers are about as likely to be satisfied with Safeco as they are with an average insurer.

While Safeco may have average customer satisfaction ratings, it does have solid financial strength and can pay out customer claims. AM Best gave the company an "A" financial strength rating, which means that it has an "excellent" ability to pay out claims.

Mobile app

Safeco also has a mobile app that allows you to view and manage your policy, make a claim and pay your bill. The app has positive ratings overall, with a 4.8 out of 5 from iPhone users and 4.2 out of 5 from Android users.

Other Safeco Insurance products

In addition to auto insurance, Safeco offers a number of other products to protect different aspects of your life.

- Homeowners insurance

- Renters insurance

- RV insurance

- Pet insurance

- Boat insurance

- Earthquake coverage

- Umbrella policy

- Motorcycle insurance

Safeco does not offer life insurance, so shoppers interested in this coverage will need to look elsewhere.

Shoppers interested in Safeco home insurance should note that service line coverage is available as an optional add-on. The maximum limit is $12,000, with a $500 deductible. If, however, you experience a major loss that impacts not just your service line, but other covered aspects of your home, you will only need to pay the home deductible, and the other deductibles will be waived.

Safeco home insurance includes the standard coverages you would see from most major insurers, including dwelling, personal property and loss of use.

Who owns Safeco Insurance?

Safeco Insurance is owned by Liberty Mutual, one of the 10 largest insurance companies in America. Safeco operates out of a number of different locations, with different Safeco subsidiaries spread across the country. These include:

- Safeco Insurance Co. of America

- Safeco Insurance Co. of Illinois

- Safeco Insurance Co. of Indiana

- Safeco Insurance Co. of Oregon

- Safeco Lloyds Insurance Co.

- Safeco National Insurance Co.

- Safeco Surplus Lines

Safeco also has other subsidiaries that do not take its name, such as New Hampshire's Excelsior Insurance Co. and Hawkeye-Security Insurance Co. in Wisconsin.

Filing an auto insurance claim with Safeco

To file an insurance claim with Safeco, you can call the claims phone number, which is 800-332-3226, to reach the 24/7 claims center, or you can file your claim online. After filing your claim, you can track it online through your Safeco account. For roadside assistance, call 877-762-3101. When you file a claim, make sure to have this information ready:

- Time and place of the accident

- A recollection of the accident

- Details about other vehicles involved

- A description of the damage incurred by your vehicle

- Contact information for everyone involved and any witnesses

- Any injuries incurred by either party

- Police report number and the name of the responding police department (if any)

Safeco has a large network of independent agents across the country, thanks in part to the company becoming a subsidiary of Liberty Mutual in 2008. Thus, Safeco’s customers get the benefit of the company’s extensive reach.

Frequently asked questions

Is Safeco a good insurance company?

In general, yes. Safeco has great prices and some impressive coverage options, but customers weren't always happy with the service they received.

What is Safeco's AM Best rating?

Safeco has an "A" rating from AM Best, meaning it has an "excellent" financial ability to pay out claims. This is the third-best score available, behind A+ and A++.

Is Safeco part of Liberty Mutual?

Yes. Liberty Mutual purchased Safeco in 2008.

Is Safeco cheaper than Geico?

Yes, Safeco tends to be cheaper than Geico for car insurance. However, every driver's price will be different, so the only way to be sure which is cheaper for you is to get quotes.

Methodology

Rate data comes from the California Department of Insurance. All quotes include comprehensive and collision coverage, plus $100,000/$300,000/$50,000 limits for liability protection. The married drivers quoted have been licensed for more than 40 years and drive 7,600 miles per year in their Toyota Prius and Toyota Camry.

The single driver who has been licensed for 14 years drives 10,000 miles per year in a Honda Accord, as does the single driver who has been licensed for one to four years. All of the sample drivers live in La Mesa, a suburb of San Diego, and none of them have any incidents on their driving records.

ValuePenguin's star ratings are based on consumer complaints filed with the NAIC, J.D. Power ratings, coverage options and price.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.