Security First Home Insurance Review

Very competitive rates are marred by this insurer's poor customer service experience.

Find Cheap Homeowners Insurance Quotes in Your Area

Security First is a Florida-focused homeowners insurance company whose very affordable rates are tarnished by poor customer service. The company provides most of the policy coverage you'll need and has useful online tools.

Pros and cons

Pros

Very cheap rates

Good for managing your policy online

Cons

Poor customer service

Can't bundle with auto insurance

Security First home insurance: Our thoughts

Security First offers impressively affordable homeowners insurance coverage catered to the Florida market. But its great prices are marred by the fact that it has very poorly rated customer service. Reviews of the company's customer experience cite poor responsiveness and a lack of clarity from the company on policy coverage. Indicative of its poor reputation, Security First has among the worst customer complaint numbers of any of the major insurers in the state.

On the plus side, the company's policies provide home insurance coverage with some added bonuses, such as replacement cost coverage for damage to your home and belongings. The company is technologically sophisticated for a regional insurer, too. Its website has a useful quote calculator that can get you a price estimate within minutes, adding transparency to the buying process. Additionally, much of the claims process can be handled electronically through its mobile app. Security First also rates as a financially strong insurer: It received an "A" rating from Demotech, an agency that rates the financial stability of insurers and other companies.

Bottom line: The Security First homeowners insurance offering is impressively affordable, but its poor customer service reputation keeps us from recommending it wholeheartedly. If you're a home insurance shopper in Florida, Security First is the cheapest option but may not be the best.

Security First home insurance quote comparison

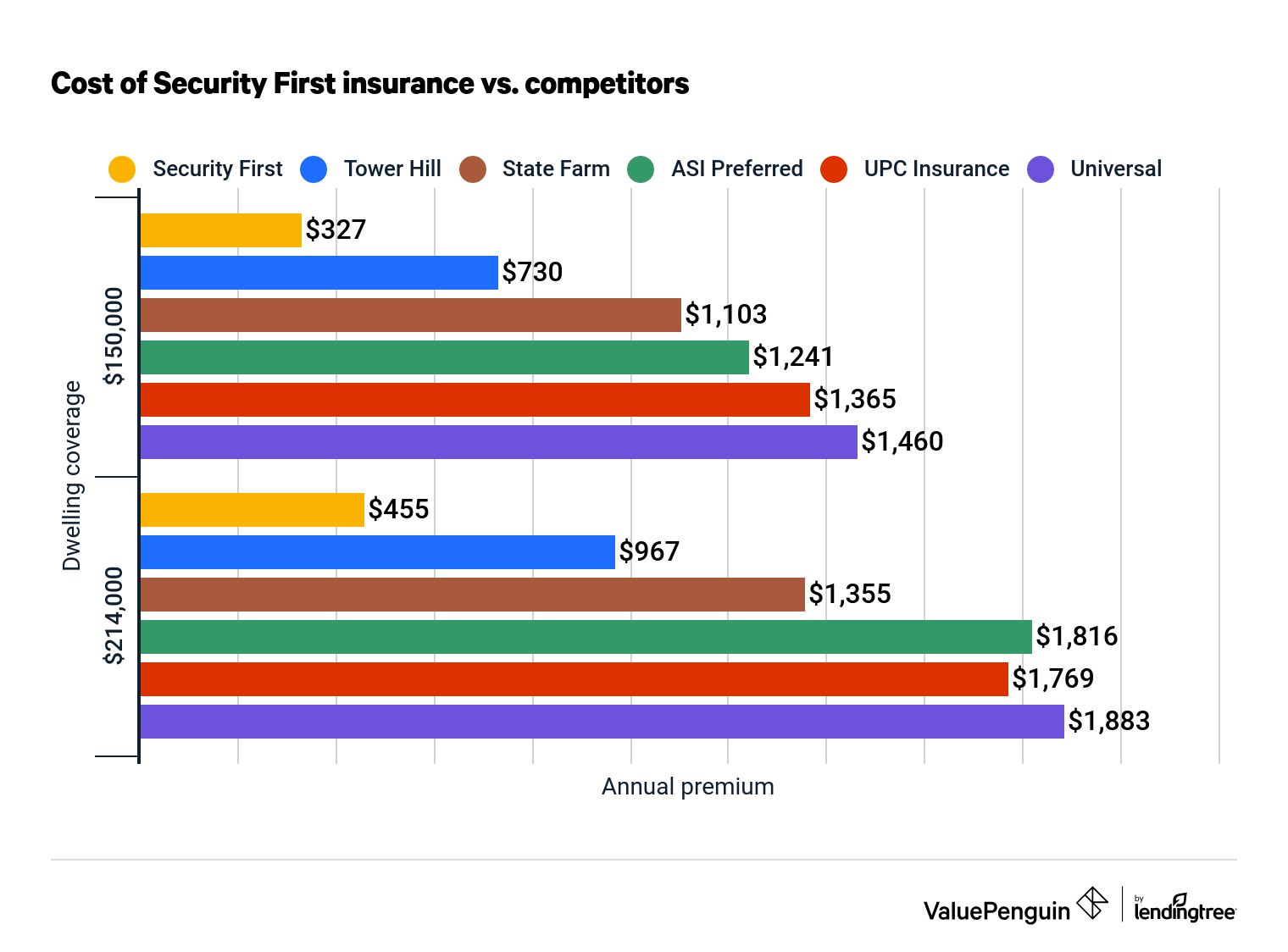

Security First rates are exceptionally affordable when measured against top Florida homeowners insurers. Security First annual premiums were consistently the lowest we found in the state.

For example, Security First offered our sample homeowner a policy including $214,000 of dwelling coverage for just $455 per year. That's 67% cheaper than the average price we found and less than half as much as the next-cheapest option, Tower Hill.

However, remember that insurance rates will differ for every home based on storm risk, your own claim history and other factors, so the only way to find your best price is to get a quote yourself.

Find Cheap Homeowners Insurance Quotes in Your Area

Security First home insurance rates vs. competitors

Dwelling coverage limit | $150,000 | $214,000 | $350,000 |

|---|---|---|---|

| Security First | $327 | $455 | $727 |

| Tower Hill | $730 | $967 | $1,495 |

| State Farm | $1,103 | $1,355 | $2,085 |

| ASI Preferred | $1,241 | $1,816 | $2,723 |

| UPC Insurance | $1,365 | $1,769 | $3,028 |

| Universal | $1,460 | $1,883 | $3,268 |

One benefit of looking into a Security First policy is that you can get an instant quote on its website and find prices for yourself. By entering details about your house — for example, location, square footage and wind-resistant features — you can obtain a rough estimate of your Security First annual premium. The calculator can even be used to estimate how your premium will change with different deductibles. You should be aware that the calculator doesn't represent a guaranteed premium, and the company will email you with follow-up questions before providing a finalized rate.

Security First home insurance: Policy coverage

The Security First homeowners insurance policy offers fairly typical coverage for home insurance. As the table below illustrates, its policies generally cover the same items as other homeowners insurance offerings: your dwelling and other structures, personal belongings, additional living expenses and liability costs. If you have a high-value home, you should note that coverage for the structure of your home under Security First has a maximum limit of $1 million.

One standout feature in the Security First offering is the inclusion of replacement cost coverage for both the structure of your home and your personal belongings. Replacement cost coverage means that you will be reimbursed for damage to your home and belongings at their current prices, ignoring wear and tear. Offering this type of coverage for personal belongings is especially rare, and it means Security First provides ample coverage — up to the limits of your policy — if your home contents are destroyed in a covered peril.

Security First home insurance coverages

Coverage | How it works | Range of limits |

|---|---|---|

| The structure of your home (Coverage A) | Covers damage to the structure of your home for a covered loss at replacement cost | $200,000 to $1 million |

| Other structures | Covers damage to other structures on the premises, like a garage or shed | 2% to 70% of Coverage A |

| Personal belongings | Covers damage or theft of the contents of your home at replacement cost | 0% to 75% of Coverage A |

| Additional living expenses | Covers the costs of staying elsewhere if your home is temporarily uninhabitable, such as room and board | 10% of Coverage A |

| Personal liability coverage | Protects you and your family from lawsuits for bodily injury or property damage to others | $100,000 to $500,000 |

| Medical payments | Covers medical costs in the event guests are injured on your property | $1,000 to $5,000 |

Security First Insurance also offers a variety of optional coverages that can be added to your homeowners insurance policy for an additional cost. For instance, if you're a Florida resident wary of the dangers of water backup or a sump pump failure, you can purchase an endorsement to cover this event in your policy. Optional add-ons such as these can be quite cheap: Buying water backup or sump pump coverage up to a limit of $5,000 could add as little as $20 to your annual premium.

You should also be aware of exclusions to coverage and additional costs in your policy related to hurricanes. Many of these exclusions and costs are common across Florida insurers, and Security First is no exception. One example is a separate hurricane deductible, which is set as a percentage of total policy coverage. For instance, let's say you select a policy covering the structure of your home up to $500,000 with a 2% hurricane deductible. If a hurricane strikes, you will have to pay $10,000 out of pocket before Security First begins covering the damage. And certain unattached structures, such as fences and sheds, may be excluded from coverage in the event of a hurricane.

High-value home coverage

For high-value homes with rebuild costs of up to $2 million, Security First also offers its "Premier" HO-5 package. This includes increased Coverage C (personal property) limits, equipment breakdown coverage and a variety of other extra protections that are either excluded entirely from a regular policy or only available via an add-on to a regular policy.

Supplementary flood coverage

Flood insurance isn't part of standard homeowners insurance, but Security First policyholders can purchase flood insurance through its partner, Wright Flood. This may create a slight hassle for customers, as they'll have to work with a separate company rather than Security First when filing a claim. But it does allow you to streamline your flood and homeowners insurance purchases.

Security First customer service reviews and ratings

Based on customer reviews and complaints, Security First Insurance Co. rates particularly poorly in regards to customer service. Customer reviews are overwhelmingly negative, citing breakdowns in communication in the claims process and a lack of clarity in the finer details of policy coverage. Security First also has an exceedingly poor complaint ratio as calculated by the National Association of Insurance Commissioners (NAIC). Compared to a national median of 1.00, Security First scored a 12.52 in 2019, which is unusually high, even compared to other Florida companies.

The Florida Office of Insurance Regulation (FLOIR) also calculated a score comparing Security First to other Florida insurers, and it was still well above average, with 2.25 times as many complaints as you'd expect given its size.

Conversely, Security First receives good ratings from a financial perspective, so it may provide peace of mind if you're concerned about your insurer's financial health. Demotech, a firm that evaluates the financial stability of regional insurers, gave Security First an A rating for financial strength, meaning the company is very likely to stay in business, even given the extreme weather patterns in Florida.

Security First insurance ratings

Agency | Score |

|---|---|

| NAIC complaint index (2020) | 0.27 |

| NAIC complaint index (2019) | 12.52 |

| FLOIR complaint index (2019) | 2.25 |

| AM Best | Not rated |

| Demotech | A |

For NAIC and FLOIR complaint scores, a lower number indicates fewer complaints. 2020 complaint index may be an outlier due to COVID-19.

Filing a claim with Security First

Although customers have criticized the effectiveness and transparency of the claims process, Security First does offer several ways to file claims, track your coverage and make payments. The insurer has a 24/7 claims team, and you can reach the company by dialing its phone number; accessing its online portal, My Security First, using your customer login; or downloading its mobile app, Security First Mobile.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

We evaluated Security First at three different levels of dwelling coverage: $150,000, $214,000 and $350,000. Each policy included personal property limits at 50% of the dwelling limit and other structures coverage at 10%.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.