State of Auto Insurance in 2024

Car insurance rates are expected to increase by 12.6% across the U.S. in 2024, thanks to rising repair costs and frequent severe weather. That's an even bigger jump than 2023, when rates rose 11.2%. The average cost of full coverage car insurance across the U.S. going into 2024 is $1,984 per year, or about $165 per month.

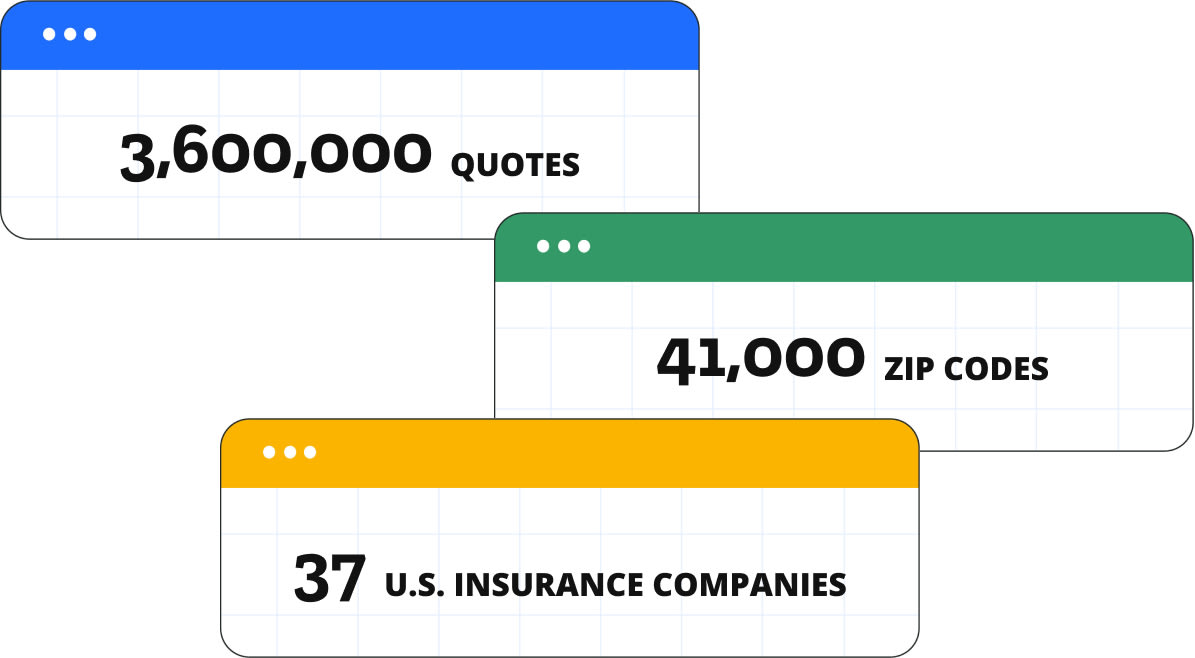

ValuePenguin used the Quadrant Information Services database to analyze millions of quotes for drivers across the U.S. Our experts also analyzed car insurance rate changes filed by top companies across the country to show the current and historical landscape of the auto insurance industry.

How much does car insurance cost in my state?

The average cost of full coverage car insurance for 2024 is $1,984 per year, or $165 per month.

Auto insurance rates in Michigan average $386 per month, the highest in the U.S. and 134% higher than the national average. This is largely because of the state's lofty Personal Injury Protection (PIP) coverage requirements.

Florida ($249 per month — 51% higher than the national average) and Nevada ($247 — 50% higher) are the second and third most expensive states for car insurance.

For cheap car insurance, prices in the states of Maine ($92 per month), New Hampshire ($96) and Idaho ($102) are the most affordable rates across the United States. Auto insurance in these states is 41% cheaper, on average, than the national average.

Car insurance costs by state

State | Avg monthly rate | % from average |

|---|---|---|

| Michigan | $386 | 134% |

| Florida | $249 | 51% |

| Nevada | $247 | 50% |

| Louisiana | $227 | 38% |

| Arizona | $224 | 36% |

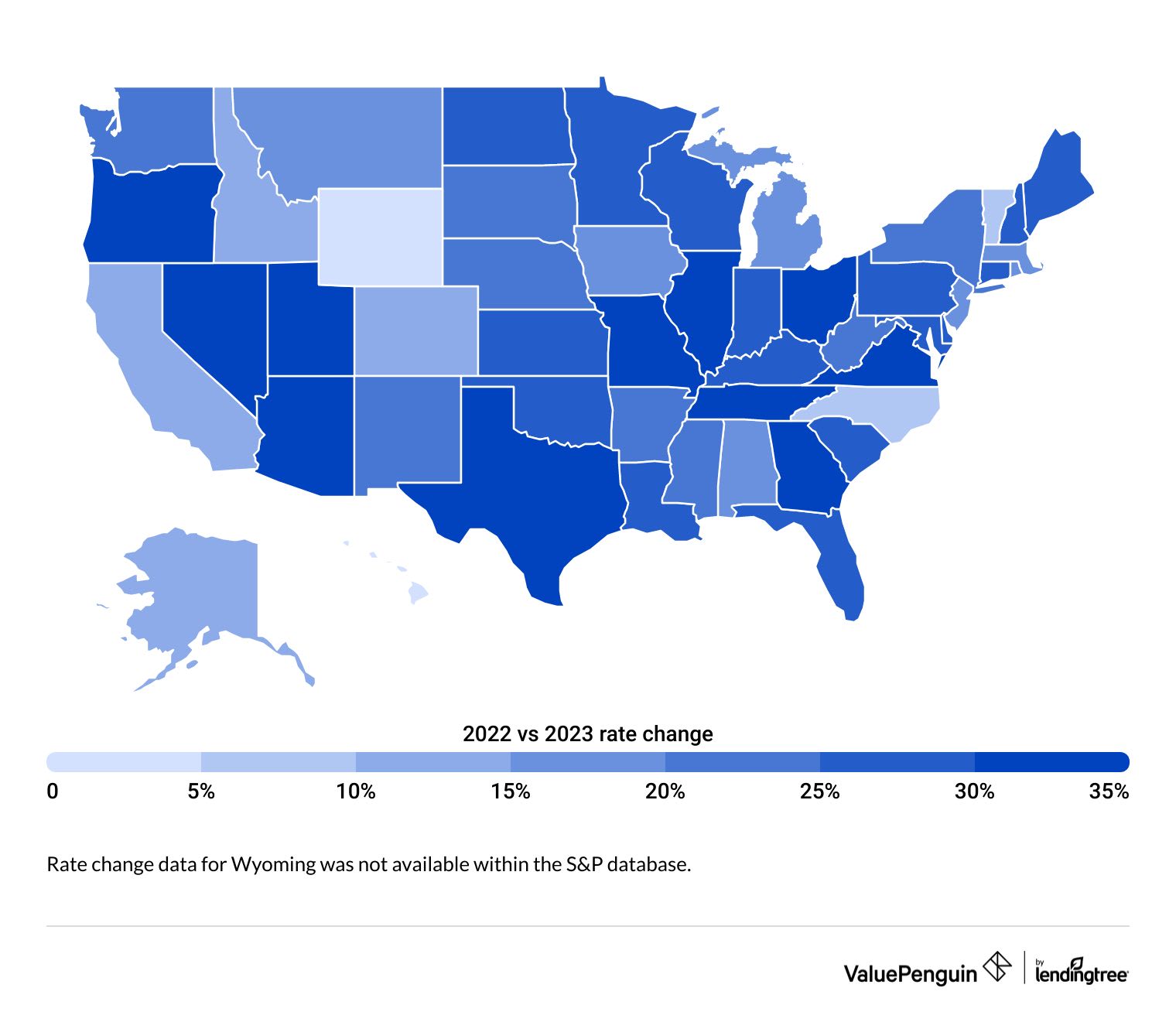

Average car insurance rate changes by state

Car insurance costs are expected to increase by 13% across the US in 2024.

The average rate increase across all states is 13% in 2024 — up even more from 2023, when the typical price hike was 11%, according to the latest data.

Insurance prices in Nevada will leap by 28% in 2024 — the largest increase in the nation. Washington state will see the second-biggest increase, at 18%.

Inflation has cooled in the second half of 2023, but prices for car insurance continue to increase by record amounts.

Every state is expected to see a rate increase of at least 5% this year, except for Colorado, Hawaii, Idaho, and North Carolina.

Other states with substantial increases this year include Arizona (17%), Connecticut (17%), Louisiana (16%) and Georgia (16%).

The average cost of car insurance has increased 29% overall since 2018, with a 25% jump in the last 2 years.

Insurance rate changes by state

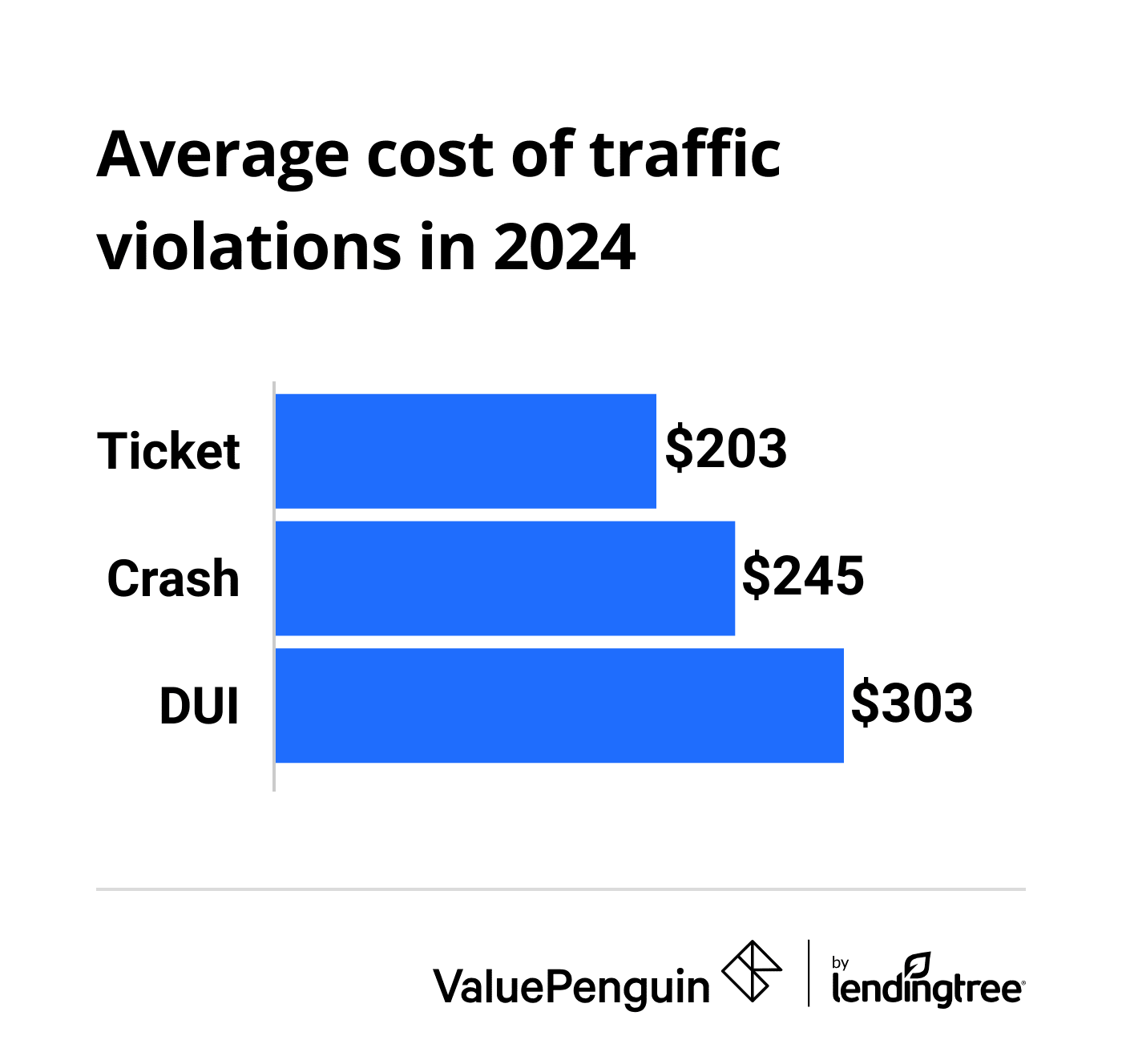

How much does a traffic violation increase car insurance costs?

Drivers with a traffic violation or accident could see an average car insurance rate increase of 52% in 2024.

North Carolina drivers see the largest average increase (134%) in full coverage auto insurance after a ticket, accident or DUI.

In contrast, Pennsylvania auto insurance companies tend to be the most forgiving to drivers with an imperfect driving record, with rates only increasing by 31% on average.

A DUI will have the biggest impact on rates among common incidents, with an average rate increase of 84% nationwide.

Car insurance costs after a ticket, accident or DUI

State | Rate hike | Ticket | Crash | DUI |

|---|---|---|---|---|

| North Carolina | 134% | $150 | $182 | $434 |

| California | 107% | $228 | $313 | $428 |

| Hawaii | 92% | $160 | $188 | $442 |

| New Jersey | 78% | $251 | $305 | $339 |

| Connecticut | 71% | $229 | $316 | $461 |

| Kentucky | 63% | $250 | $301 | $384 |

Young drivers report high price premiums

Gen Z drivers report the highest rates of difficulty paying for car insurance. In a recent LendingTree survey, 59% of those ages 18 to 26 reported having trouble paying for car insurance in the last year.

That's no surprise, as the youngest drivers almost always pay the most for car insurance. Younger drivers can expect to pay 188% more for car insurance in 2024 than their older peers. Their lack of driving experience means that they're more likely to file claims than older drivers.

The one bright spot? Insurance companies are more forgiving of driving incidents, like a speeding ticket or at-fault crash, for younger drivers. An 18-year-old will face an increase of 35% after an at-fault crash, while a 30-year-old will see their rate jump 49%.

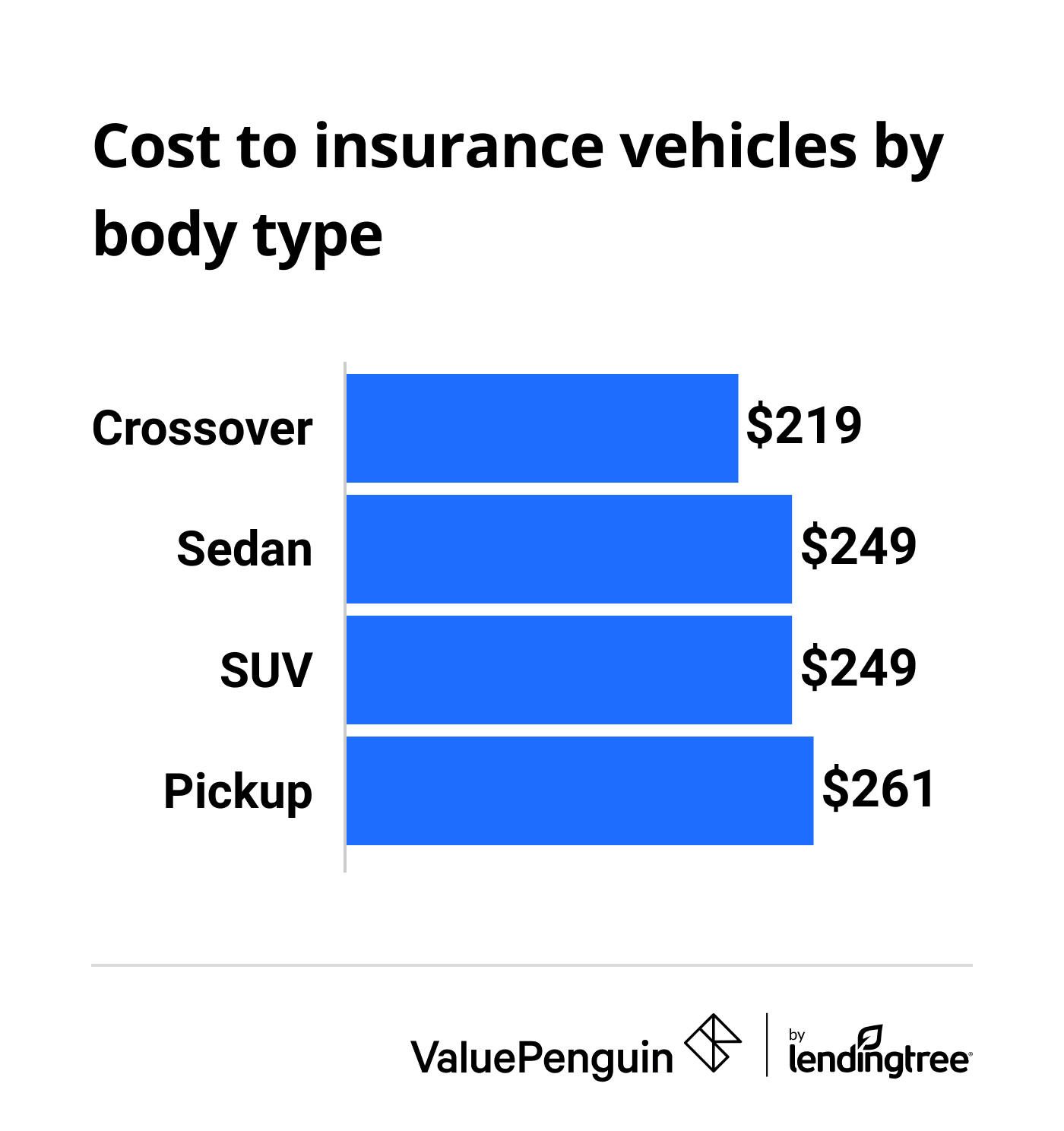

Cost of car insurance for the most popular new cars

The Honda CR-V and Ford F-150 are the two most affordable popular cars to insure.

A CR-V is just $219 per month, $131 less than the Tesla Model Y — the most expensive top car to insure.

Among top-selling vehicles in the U.S., the cheapest new cars to insure tend to be crossover SUVs and sedans, while pickups and larger SUVs cost more. Smaller sedans and midsize SUVs, like the Honda CR-V and Nissan Rogue, are often cheaper to repair or replace than larger cars, so their insurance costs are typically cheaper.

Cost of car insurance for top-selling cars

Car model | Monthly rate |

|---|---|

| Chevrolet Silverado | $265 |

| Ford F-Series | $230 |

| GMC Sierra | $273 |

| Honda CR-V | $219 |

| Jeep Grand Cherokee | $251 |

Electric cars are growing in popularity — and getting cheaper to insure.

Teslas continue to be the most expensive car models on the market to insure — the Model X, 3 and Y were the three most expensive EVs to insure among top options.

Overall, non-Tesla EVs are 31% cheaper to insure than Teslas.

Cost of car insurance for popular EVs

EV model | Monthly rate |

|---|---|

| Volkswagen ID.4 | $223 |

| Chevrolet Bolt EV/EUV | $242 |

| Kia EV6 | $260 |

| Hyundai Ioniq5 | $260 |

| Ford Mustang Mach-E | $288 |

2024 car insurance trends

Expect higher car insurance rates in 2024. Insurers have continued raising rates because of an increase in car repair costs and claims.

For insurance companies, one of the biggest causes for increased costs was natural disasters — these included severe hail in Texas, Colorado and Missouri, plus major windstorms in states like Georgia and Alabama.

And while inflation slowed in 2023, cars continue to be more expensive to repair or replace. The used car market exploded after the pandemic when new car production slowed down, which in turn drove up the prices for parts — increasing repair costs.

Historic weather damage

Despite the relatively quiet hurricane season in the fall, 2023 had substantial severe weather that drove up repair costs. Hail is an especially big factor, since it happens suddenly and affects hundreds or thousands of cars in one area. The cost to repair body damage can easily eclipse the cost of the car.

Further, severe storms and hurricanes cause a rise in car insurance claims from cars that are flooded, damaged or destroyed. As the U.S. faces more extreme weather over time, car insurance rates will increase to match a higher risk of damage, especially in coastal areas.

More EV sales

Electric vehicle sales have increased almost 50% in 2023 as prices have fallen. What's more, insurance prices for EVs have begun to fall too, getting closer to that of gas-powered cars, especially as legacy car makers' EVs catch up to Tesla's cars.

In 2024, EVs will cost around 23% more to insure than a new gas-powered car. Look for vehicle-specific insurance discounts, like electric car and safety feature discounts. And drivers can save by opting for EVs from brands like Toyota or Honda, which are about $110 cheaper per month than options from Tesla or Rivian.

Car thefts continue

Car theft rates have continued to increase since 2022, with a 2% increase in the first half of 2023. Kia and Hyundai models have been particularly targeted due to a vulnerability that makes them easy to steal. In some cities, thefts of Kia and Hyundai vehicles have made up more than half of car thefts in 2023 overall.

In addition, catalytic converter thefts have decreased since 2022 but are still a major issue, with an increase in thefts of over 700% compared to 2019.

You can keep your vehicle and insurance rates safe if you:

- Store your car in a secure garage when possible

- Secure your catalytic converter to your car, especially if your car is a hybrid or has high ground clearance

- Check with your manufacturer for recalls and security updates that may reduce theft

How can I save money on auto insurance in 2024?

68% of auto insurance owners shopped around to find the best rate — and those who did saved an average of $398 a year on their premiums, according to a recent ValuePenguin survey.

SHOP AROUND

Comparing quotes from several companies is the most important part of searching for car insurance.

Quotes can vary by hundreds of dollars across companies, even for the same driver.

ADJUST YOUR COVERAGE

Switching from full to minimum coverage is a great way to save on your car insurance if you don't have a car loan or an expensive car. Removing optional coverage like roadside assistance can bring down your bill, too.

FIND CAR INSURANCE DISCOUNTS

Insurance companies offer many discounts to help you lower your rates. In the wake of increased remote work, many companies offer discounts or lower rates for driving less. Pay-per-mile car insurance can reduce rates even more for low-mileage drivers.

IMPROVE YOUR CREDIT SCORE

Insurance companies in most states evaluate your credit as a factor for insurance rates. The difference between a good and poor credit score can change premiums by 80%, as people with poor credit may be more likely to file car insurance claims.

About this report

ValuePenguin has a mission to empower people with information and resources to help them make smarter financial decisions. Car insurance can be a difficult and time-consuming topic to understand. This report attempts to unmask some of the critical issues.

In crafting our analysis, we reviewed more than 3.6 million quotes for different drivers, adjusting for various factors that affect auto insurance premiums. We gathered rates from 37 top insurance companies across the country since rates can vary widely by company.

Methodology

Auto insurance rate change data was compiled using RateWatch from S&P Global, which uses annual information from the National Association of Insurance Commissioners (NAIC).

Quotes are for a 30-year-old man who drives a 2015 Honda Civic EX with good credit and a clean driving record, unless otherwise noted. Quotes include the largest companies in each state from all available ZIP codes. Rates for popular car models are from every ZIP code in Illinois.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only, as your quotes may differ.

Quotes are annual costs for full coverage unless otherwise stated. Minimum coverage corresponds to the minimum amounts required by the states. Full coverage quotes include liability coverage plus collision and comprehensive coverage.

Coverage Type | Coverage limits |

|---|---|

| Bodily liability | $50,000 per person/ $100,000 per accident |

| Property damage | $25,000 per accident |

| Uninsured / underinsured motorist BI | $50,000 per person/ $100,000 per accident |

| Comprehensive & collision | $500 deductible |

| Personal injury protection | Minimum when required by state |

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.