Homeowners Insurance

As Summer Approaches, 17% of Americans Don’t Know How to Swim, While Almost 40% Wouldn't Feel Comfortable Saving a Struggling Swimmer

With summer starting next month, many Americans will look to cool down — especially with 72% of consumers having access to a pool. But despite it being a popular summertime activity, swimming can come with risks. According to the latest ValuePenguin survey, a good portion of consumers don’t feel prepared enough to handle a safety incident.

We asked more than 1,000 consumers about their swimming insecurities, experience with poolside incidents and safety training.

- Key findings

- Low-income families more at risk in swimming pools

- Nearly 4 in 10 consumers not comfortable with saving struggling swimmer

- Top safety-related incident: Slipping and falling

- Are pools worth it? Not everyone dreams of owning one

- Homeowner insurance tips for personal pool owners

- Methodology

Key findings

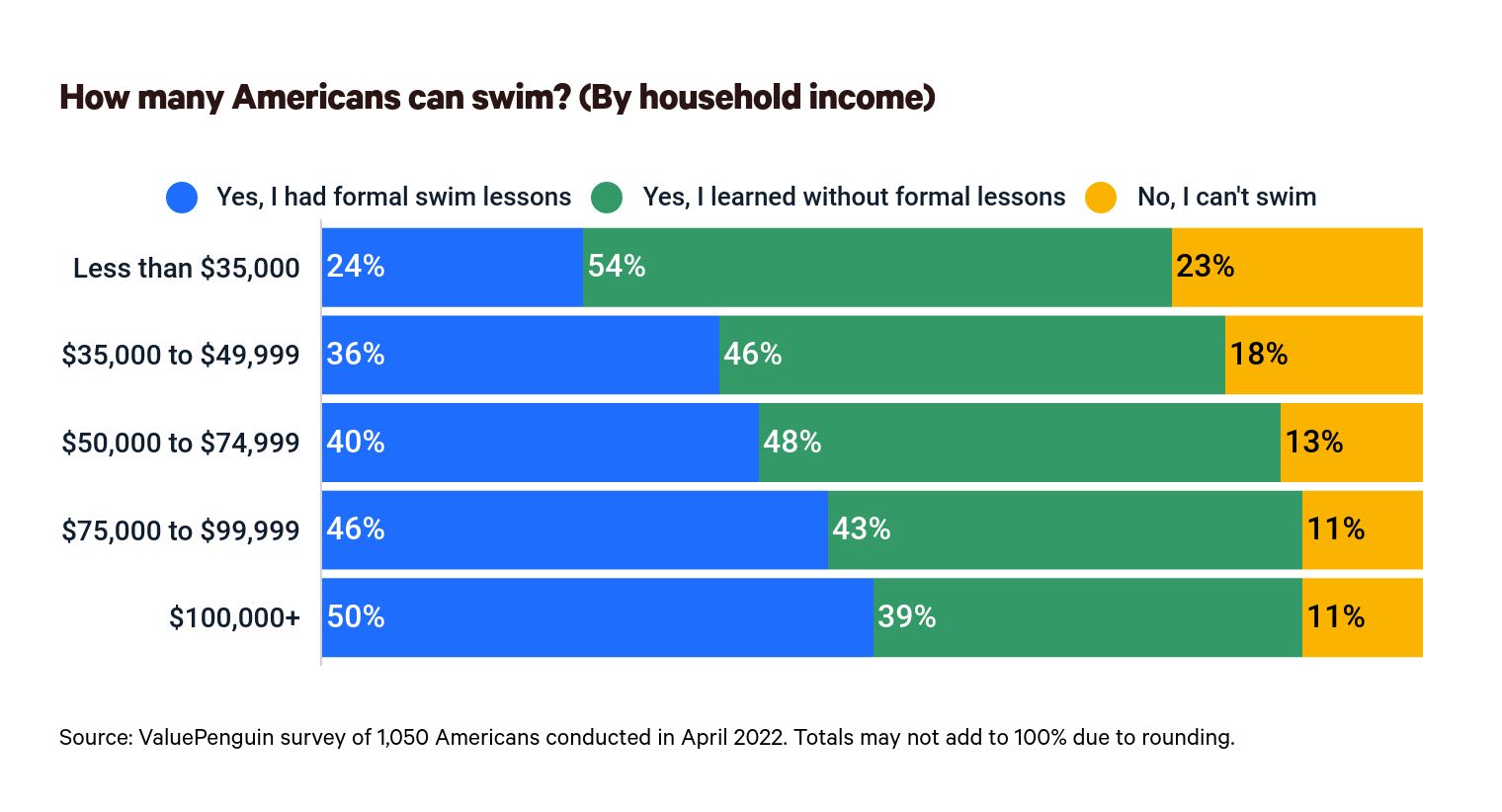

- 17% of Americans don’t know how to swim, with income a factor. The percentage of those who can’t swim is highest (23%) among those with household incomes below $35,000 and lowest (11%) among those with household incomes of $100,000 or more.

- Those who can’t swim would be among the 39% of consumers who say they wouldn’t be comfortable saving someone struggling in the water. That can be compounded by the nearly 60% of Americans who swim without a lifeguard present at the pool they most frequently use.

- Educationally, more teaching is necessary about drowning — especially what people commonly refer to as secondary/delayed or dry drowning. Only 41% of Americans are familiar with these concepts, which can happen after someone inhales water due to a near-drowning experience.

- Safety can prove key, too, as slipping and falling on the pool deck is the No. 1 safety-related incident at personal pools. Overall, 32% of pool owners say a safety-related incident has happened at their pool, but not all of them take the necessary precautions.

- More than 1 in 10 Americans who have a pool on their property say it’s not worth it. 13% of pool owners don’t think having a pool is worth the expense and/or liability. It’s not surprising, though, with consumers with pools spending nearly $1,500 a year to maintain them. And 50% of those who don’t have a swimming pool would never consider installing one, mainly due to property size.

Low-income families more at risk in swimming pools

About 1 in 5 (17%) Americans don’t know how to swim. Income may play a factor in a person’s ability to swim — among those with household incomes below $35,000, 23% say they’re unable to swim. Meanwhile, just 11% of consumers with household incomes of $100,000-plus report the same.

Despite having the longest time to learn, baby boomers (ages 57 to 76) tie Gen Zers (ages 18 to 25) as the generation most likely to not be able to swim, at 20%. Gen Xers (ages 42 to 56) are in slightly better shape at 18%, while millennials (26 to 41) are in the lead, with only 11% not knowing how to swim.

As for how a person learns to swim, there are more notable disparities between high-earners and low-earners. Only those with household incomes of $75,000-plus report a higher percentage of people with formal swimming lessons than informal training. Notably, half of the six-figure respondents who say they can swim took formal lessons.

Informal training becomes increasingly common as income levels decrease, peaking with 54% of consumers who make less than $35,000 saying they learned how to swim informally.

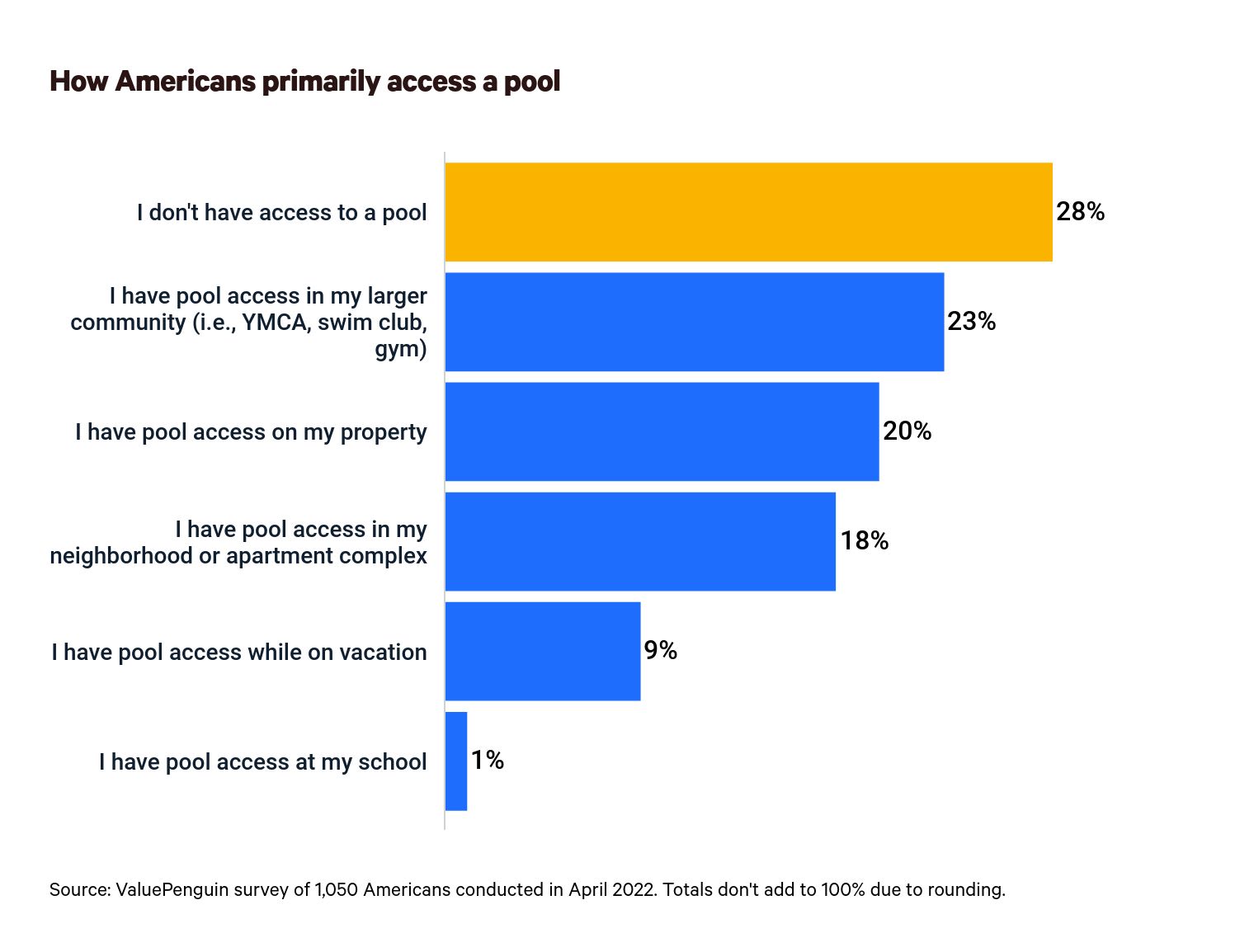

In terms of where they most often swim, 20% of Americans have access to a pool on their property. (We’ll focus more heavily on this group at times within this survey.)

Meanwhile, nearly 1 in 4 (23%) swim at a gym, YMCA, swim club or something similar in their community. And nearly 1 in 5 (18%) swim at a neighborhood pool — whether through a homeowners association or neighbor — or a shared pool at their apartment complex. Here’s a full look:

Nearly 4 in 10 consumers not comfortable with saving struggling swimmer

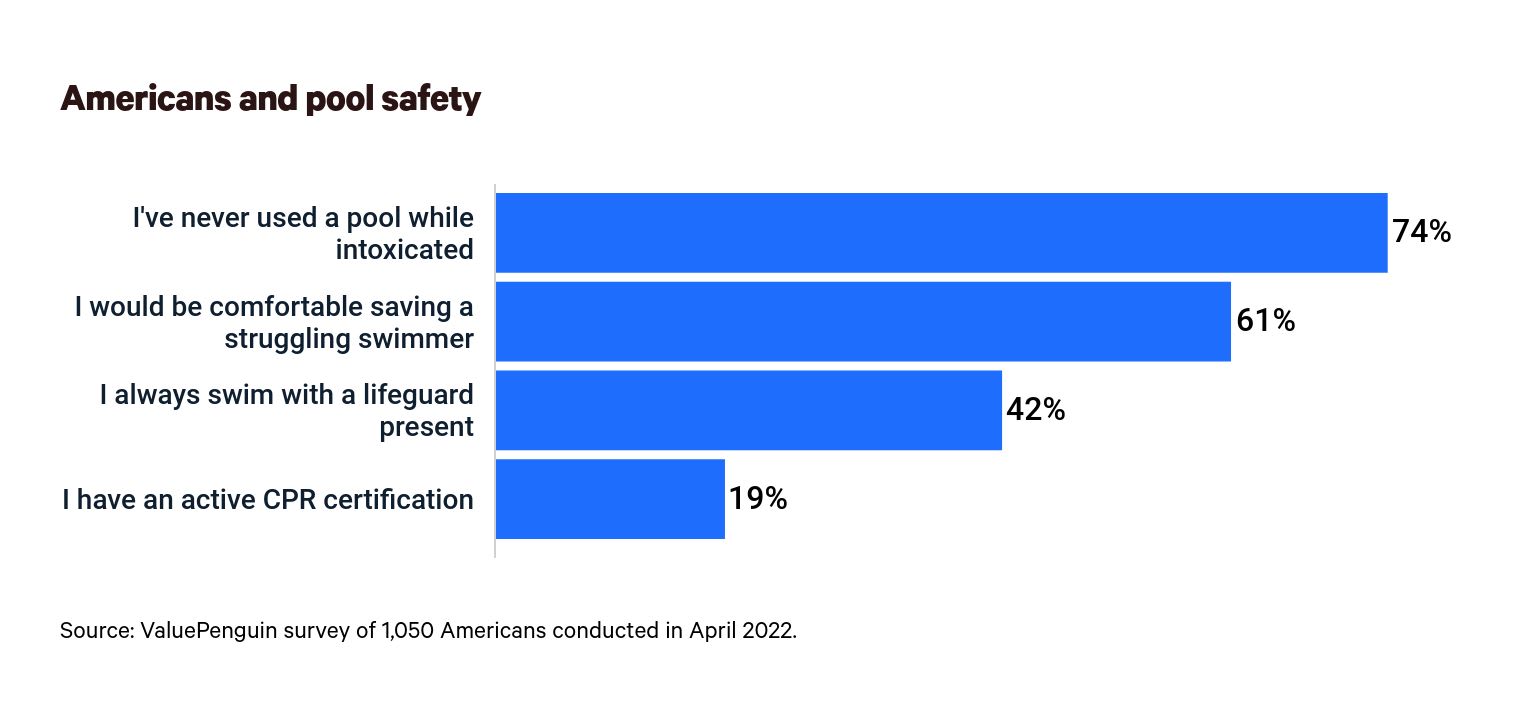

The U.S. averages 3,960 fatal unintentional drownings a year — or 11 a day — according to the Centers for Disease Control and Prevention (CDC), but most consumers aren’t comfortable intervening. In fact, just about 4 in 10 (39%) consumers say they wouldn’t be comfortable saving someone struggling to swim.

This data aligns with the first finding on not knowing how to swim: Baby boomer and Gen Z respondents report the lowest rates of comfort with saving a struggling summer.

A lack of education may play a role in this widespread discomfort, as 25% of Americans say they don’t know how to perform CPR. Just 38% of consumers are confident they could perform CPR, and an additional 38% are somewhat confident.

Overall, 19% of Americans have an active CPR certification.

This lack of proper safety training could be troublesome, with 58% of Americans reporting they swim without a lifeguard present at the pool they most frequently use. Owners with pools on their properties — where 20% of Americans primarily swim — are more likely to be confident performing CPR (60%) and feel comfortable saving a struggling swimmer (81%), but lax rules by some could pose alternative drowning risks.

Just 28% of pool owners say they prevent their guests from swimming alone. While this isn’t inherently dangerous, it could be under certain scenarios. And only 41% of pool owners prevent guests from swimming while intoxicated — a risk factor commonly associated with swimming injuries and death.

Alcohol use is involved in up to 70% of deaths associated with water recreation, according to the CDC. This latest ValuePenguin survey finds that 26% of consumers report going into the pool while intoxicated from drugs or alcohol.

Secondary and dry drowning: What to know

While proper safety training can help prevent injury or death in the water, surviving a near-drowning incident — or saving someone from it — doesn’t mean you’re in the clear yet.

A World Health Organization bulletin from 2005 states the phrases "secondary drowning" and "dry drowning" shouldn’t be used — and the Cleveland Clinic says they’re not true medical terms — but the outdated terms are still often referenced.

Children — who are most at risk of drowning, according to the CDC — are particularly susceptible, yet only 41% of Americans are familiar with secondary and dry drownings.

As their names suggest, these respiratory conditions typically occur after a near-drowning incident. Dry drowning occurs after a person inhales water. Although water never gets into the lungs, the muscles in the airway spasm and block airflow. Meanwhile, secondary drowning occurs when the water reaches the lungs, subsequently causing them to fill with fluid — known as pulmonary edema.

Regardless of how the terms should be referenced, proper education is crucial to prevent severe injury or death. While life-threatening, dry and secondary drownings are usually treatable if you get medical care immediately.

Top safety-related incident: Slipping and falling

Slipping and falling on the pool deck is the No. 1 safety-related incident at personal pools (14%), followed by someone falling into the pool (11%). That’s followed by:

- Someone struggling to swim (8%)

- A child wandering in unattended (7%)

- Catching someone using the pool without permission (5%)

- Someone hitting their head (5%)

Overall, 32% of pool owners say a safety-related incident has happened at their pool.

Homeowners insurance may not cover you if someone is injured at your pool, but it might cover legal costs if a slip-and-fall claim is brought against you.

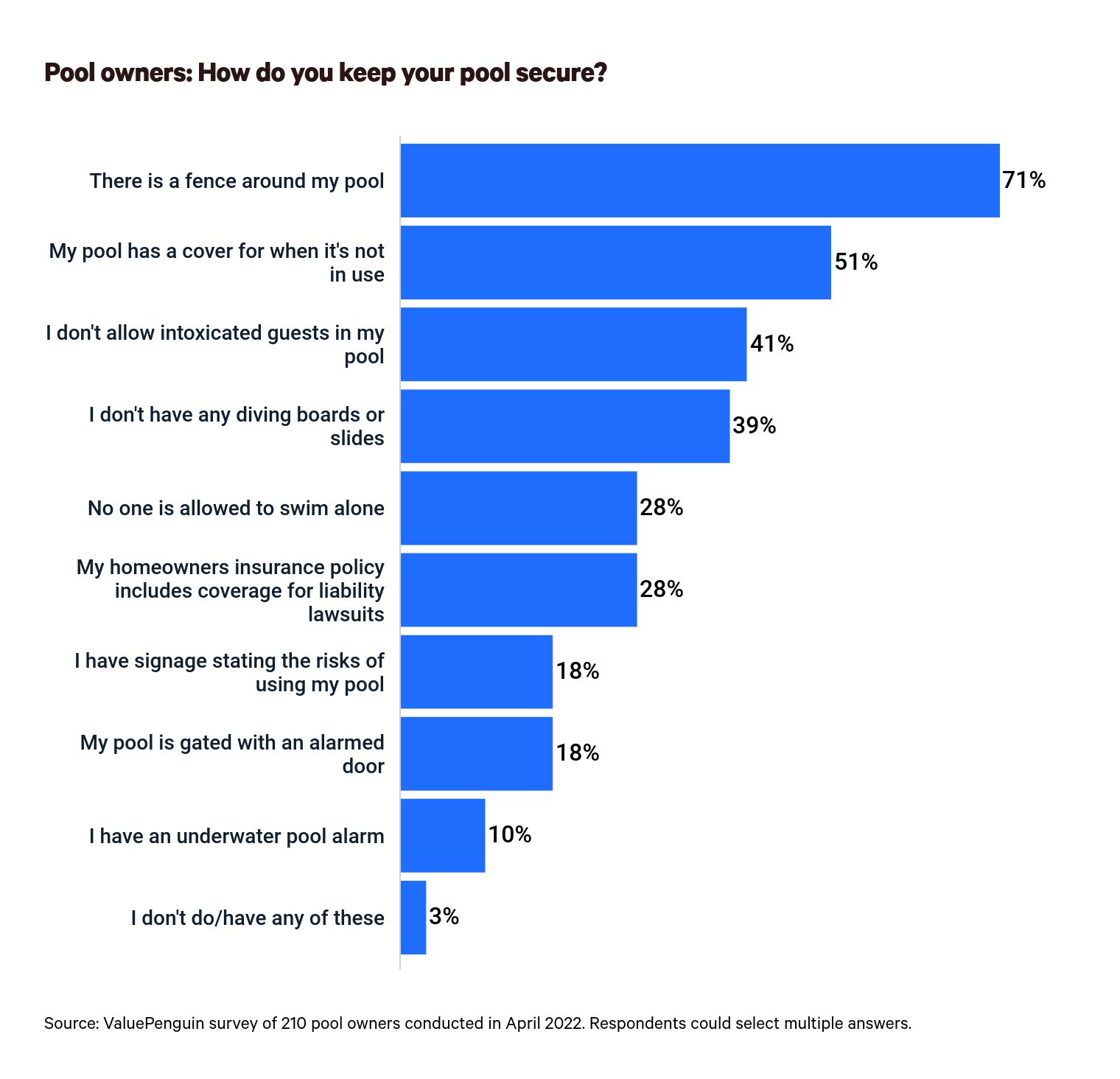

Despite these safety-related incidents, not all pool owners take the necessary precautions. Most pool owners have a fence around their pool (71%) and/or a pool cover (51%), but few have alarmed gate doors (18%) or underwater pool alarms (10%).

Divya Sangameshwar, ValuePenguin home insurance expert, says the No. 1 safety measure more homeowners should consider is implementing alarm systems at their pools.

"These alarms will notify homeowners if someone is trying to access their pool unauthorized, or if a child or pet fell into the pool, and allow them to render aid in a timely manner," Sangameshwar says.

In the event of an injury, 28% of pool owners say they’re covered against liability lawsuits by their homeowners insurance policy. But many pool owners may not be fully protected — some insurance companies won’t cover certain liabilities.

"It’s important to identify these potential liabilities and make necessary improvements to your pool," Sangameshwar says, particularly before your summer pool parties are in full swing.

Are pools worth it? Not everyone dreams of owning one

Understandably, 13% of pool owners think having a pool isn’t worth the expense or liability.

Because of the liability risks associated with swimming, pool owners face slightly higher insurance rates than their pool-free neighbors, though a 2021 study from ValuePenguin found the difference isn’t substantial. Pool owners often need extra liability insurance, which will cover them for medical bills and lawsuits.

In addition to the potential for increased insurance rates, pool owners spend an average of almost $1,500 a year maintaining their pools. If a pool isn’t properly maintained, owners may face additional costly repairs from cracks or leaks, which insurance may not cover.

"A leaking pool can do significant damage, like flooding your basement, or even damage your home’s foundation," Sangameshwar says. "Repairing damage to your home’s foundation is one of the most expensive repairs a homeowner could encounter, especially since homeowners insurance doesn’t cover damage from gradual leaks."

Homeowner insurance tips for personal pool owners

When considering your homeowners insurance, giving your pool’s coverage very little thought can be easy. However, as the pool covers come off, understanding the extent of coverage you have can help protect you against potential liabilities and unexpected costs. To get the most out of your policy, Sangameshwar offers these essential tips:

- The type of pool you have makes a difference. Homeowners insurance companies treat in-ground and above-ground pools differently. "In-ground pools are considered part of your dwelling and should be included in your policy’s dwelling coverage," Sangameshwar says. "Above-ground pools are classified as personal property — like bicycles — so if you have one, make sure you have enough personal property coverage to protect your above-ground pool against damages."

- Insurance companies won’t cover your pool if you don’t meet their requirements for safety measures. However, these precautions alone aren’t enough. "You also need to check if you have enough personal liability coverage in your homeowners insurance policy to protect you financially if a guest or visitor were to sue you after getting hurt near or at your pool," Sangameshwar says.

- There are no preventive measures that homeowners should consider unnecessary. While home insurance companies may not require all the safety measures outlined in the survey, it’s best to err on the side of caution to keep your family and friends safe around your pool.

- Consider opting for more coverage. If your net worth exceeds the level of liability coverage offered, Sangameshwar says to consider getting more liability coverage or even an umbrella policy. "A plaintiff can come after your assets to compensate for the damages not covered by your policy," Sangameshwar says. By opting for more coverage, homeowners may be better protected from substantial financial losses.

- Shop for a new policy. If all else fails, compare homeowners insurance rates to find coverage within your budget.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,050 U.S. consumers, fielded April 15-20, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76

While the survey also included consumers from the silent generation (those 77 and older), the sample size was too small to include findings related to that group in the generational breakdowns.