Tower Hill Homeowners Insurance Review

Expertise in dealing with hurricanes makes this a strong choice for Florida residents.

Find Cheap Homeowners Insurance Quotes in Your Area

Tower Hill is a Florida-specific homeowners insurance company that offers very affordable prices. It has a wider range of insurance products than many other Florida insurers, including flood insurance and enhanced coverage options for high-value homes.

However, Tower Hill does not offer online buying, so it is difficult for insurance shoppers to purchase a policy without meeting with an insurance agent.

Pros and cons

Pros

Offers both home and flood insurance

Specialized coverage for high-value homes

Cons

Can't shop for insurance online

Unable to bundle home and auto insurance

Tower Hill home insurance: Our thoughts

Among home insurance companies that operate in Florida, Tower Hill is a strong option: Its affordable rates and good financial standing make it an appealing option for Florida homeowners. However, the company's limited online tools make the process of actually buying insurance coverage more challenging than with some of its competitors, which provide the ability to complete the purchase entirely online. People considering buying coverage from Tower Hill will almost always have to work with an agent or broker to get a quote or purchase a policy.

Tower Hill's coverage options are fairly broad, meaning insurance shoppers are likely to find the type of coverage they need from the company. In addition to typical home insurance offerings, like coverage for your home's structure and your possessions, the company has a variety of policies available that may supplement traditional (HO-3) home insurance. This includes flood insurance and higher available coverage levels for high-value homes, as well as specialized coverage for renters, landlords and owners of condominiums and mobile homes. The company, however, does not provide automobile insurance.

The price of insurance from Tower Hill was generally cheaper than competing Florida home insurance companies. Furthermore, the company received slightly better than average reviews for its customer service among Florida insurers. The most common issue cited in complaints was regarding the claims department, particularly unsatisfactory settlement amounts and claim denials.

Of particular significance to Florida homeowners is Tower Hill's ability to respond to hurricanes. As a Florida-specific insurer, Tower Hill has experience dealing with hurricane claims. For example, some customers noted that the company’s insurance agents or claims department reached out both before and after major storms to assist with claims. However, it is worth noting that financial rating service AM Best does have a degree of concern over whether continued large-scale disasters, like Hurricane Irma and Hurricane Florence in 2017 and 2018, may put Tower Hill in financial jeopardy.

Bottom line: Tower Hill is a solid, affordable choice for homeowners looking for a one-stop shop for homeowners and flood insurance. But buyers should be prepared to work alongside an insurance agent for a quote, as Tower Hill's online tools are lackluster.

Tower Hill home insurance coverage

Tower Hill offers all the most common coverages Florida residents would expect from a homeowners insurance company. It also offers several less-ubiquitous coverage options to protect your property, as well as flood coverage and extended limits for owners of high-value homes.

High-value home insurance

Tower Hill offers coverage that is geared specifically toward homes with high values and is typically available for homes worth between $750,000 and $5 million. Homes that fall into this category might be especially large, be in a desirable location or have a lot of amenities, such as a pool or private tennis court.

Tower Hill has two levels of high-end home insurance: Prime Plus and Spire. They generally offer similar coverages, though the ultra-premium Spire coverage includes more extras and add-ons.

Coverage levels for Tower Hill's high-value home policies will be higher than for a typical home in several respects. For example, Tower Hill's high-value policies include a few notable coverage options that substantially extend the limits available to typical homeowners:

Coverage | Maximum available limit | What it covers |

|---|---|---|

| Extended replacement cost | Up to 50% above your dwelling replacement cost | Pays for the cost to replace your home or property if it exceeds your coverage limit. Typically applies when costs are unexpectedly high, such as during labor shortages after a hurricane or other disaster. |

| Scheduled personal property | Up to 50% of contents or $1 million | Covers certain high-value items, like jewelry or cash, that are not covered under a regular home insurance policy. |

| Identity fraud expenses | $15,000 | Pays for expenses associated with identity theft, such as fraudulent credit card purchases. |

Flood insurance

Tower Hill offers two kinds of flood insurance to Florida homeowners: coverage through the federally backed National Flood Insurance Program (NFIP), as well as its own private flood insurance policy.

NFIP rates are set by the government and do not change from insurer to insurer. So if you're already considering purchasing home insurance from Tower Hill and want to buy NFIP flood coverage, there's no downside to going through Tower Hill — but there's no particular cost benefit, either.

Tower Hill's private flood insurance option is backed by Lloyd's and is available as either a stand-alone policy or an endorsement you can add to a Tower Hill homeowners policy. Private flood insurance companies calculate flood insurance premiums differently than the NFIP, so it's worth considering both private and NFIP flood insurance. The two most important benefits of a private flood insurance program are much higher available coverage limits (up to $5 million) and a much shorter waiting period. However, private flood insurers are allowed to deny you coverage based on flood risk, so you aren't guaranteed coverage.

An additional advantage of buying home insurance and flood insurance from the same company is a simplified claim process. There is likely to be less confusion or debate about whether a claim is covered under your home or flood insurance if both policies are purchased from the same insurer.

Additional coverage options available from Tower Hill

Tower Hill also offers several additional, less commonly selected coverages that homeowners can add to their policy if they so choose. These coverages go beyond typical home insurance to pay for extra expenses you might incur from a covered peril.

- Ordinance/law coverage: Pays for additional home rebuilding costs to bring a home up to code when repairs are needed. For example, if your home is damaged by wind and it's discovered that the house needs additional upgrades to meet new fire safety standards, this coverage would pay for the extra costs.

- Landscaping: Compensates you for damage to your home's landscaping, including lawns.

- Debris removal: Pays for extra costs of removing debris after a storm or other disaster, even if your dwelling limit has been exhausted.

- Loss assessment: If you're a member of a homeowners or neighborhood association, loss assessment pays for any assessments the association charges you for, so long as the cause of the assessment is a covered peril.

Standard insurance coverages available from Tower Hill

Tower Hill's standard coverages protect the structure of your home; other structures on your property, such as a detached garage or shed; and your personal property, like furniture, clothing and appliances. The insurer also provides liability coverage, which protects you financially in case someone sues you for financial damages. This might be because they were injured on your property, for example.

- Dwelling coverage/Coverage A: Covers the dwelling and structure of your home, including interior and exterior walls, windows, doors and the roof.

- Other structures/Coverage B: Covers other structures on your property, like a detached garage, shed or pool house.

- Personal property/Coverage C: Covers the personal property you own that is in your house, such as furniture and electronics.

- Additional living expenses/Coverage D: Pays for extra living costs, like a hotel room or temporary rental, if you have to leave your home due to a covered cause.

- Liability coverage: If someone makes a liability claim against you, such as if they are injured on your property, liability coverage will cover the expense, as well as associated legal costs.

Tower Hill shopping experience

Shopping for a homeowners insurance policy from Tower Hill can be challenging, as shoppers have a limited set of options when shopping online. The Tower Hill website contains fairly little information about available coverage options, so the only way to determine whether the company's offerings meet your needs is to contact a representative or meet with an insurance agent.

The Tower Hill website does have a "quick quote" function, allowing Florida homeowners to provide their address and a few basic details about their property in order to get an approximate home insurance quote. However, we found that the tool did not work consistently. We were usually unable to actually get a quote from the tool and were instead directed to a company insurance agent. There is no option to purchase insurance online from Tower Hill.

However, the company's website is not totally without functionality. Tower Hill customers are able to log in online in order to make premium payments and claims, though the company also has a 24/7 claims hotline.

Tower Hill homeowners insurance price comparison

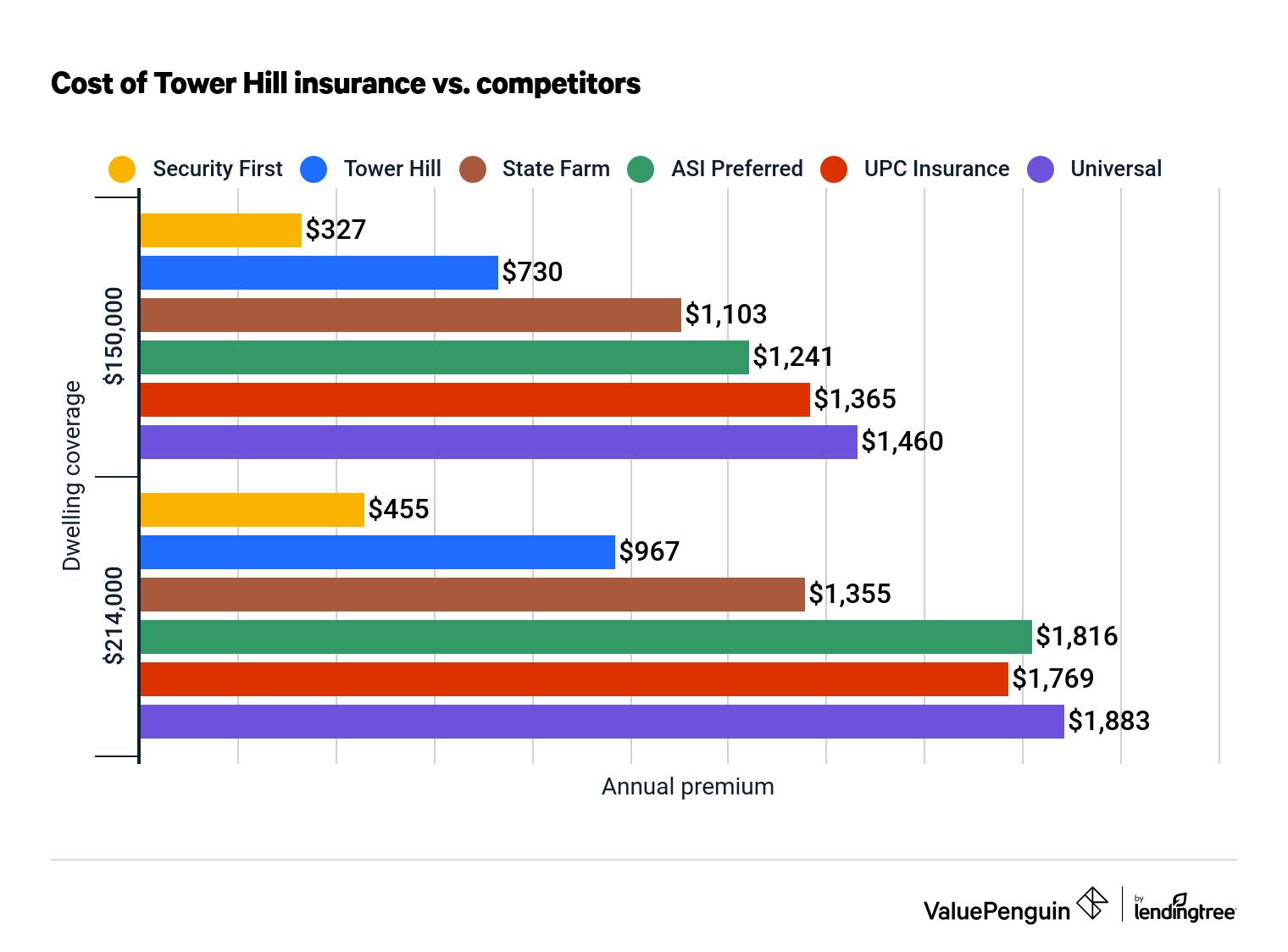

We did a detailed price analysis of Tower Hill and its competitors and found Tower Hill's prices to be about even with the prices of its peers, coming in below average overall. We gathered quotes from Tower Hill and five other top home insurance companies that operate in Florida in order to understand how it compares. Our findings showed that Tower Hill's average annual rate for home insurance was $967, or about 30% cheaper than the overall average of $1,374.

Find Cheap Homeowners Insurance Quotes in Your Area

Tower Hill home insurance rates by dwelling coverage

Dwelling coverage limit | $150,000 | $214,000 | $350,000 |

|---|---|---|---|

| Security First | $327 | $455 | $727 |

| Tower Hill | $730 | $967 | $1,495 |

| State Farm | $1,103 | $1,355 | $2,085 |

| ASI Preferred | $1,241 | $1,816 | $2,723 |

| UPC Insurance | $1,365 | $1,769 | $3,028 |

| Universal | $1,460 | $1,883 | $3,268 |

While it offered competitive premiums overall, Tower Hill did not provide the absolute lowest price for any of our three sample properties. Home insurance shoppers who prioritize a low price may want to check with multiple insurers for the best rates.

Tower Hill customer service reviews and ratings

Tower Hill has mixed reviews when it comes to customer service and financial stability, though it fared about average among Florida insurance companies. On a national level, Tower Hill does not perform well: The company had a very weak complaint ratio of 6.47 from the National Association of Insurance Commissioners (NAIC) in 2019, meaning it received more than six times as many complaints as other companies of its size nationwide.

However, Tower Hill received a far more favorable score from the Florida Office of Insurance Regulation (FLOIR). When compared to other Florida home insurance companies, it received a score of 0.94 in 2019. This suggests that it had a fairly typical number of complaints for insurance companies of its size that operate in Florida.

In addition, Tower Hill has mediocre financial ratings. It received a B++ rating from AM Best, suggesting that the company has a good ability to pay out insurance claims. But Tower Hill's longevity as a Florida-specific insurer suggests that it is prepared to respond to hurricanes and other disasters common in Florida.

Tower Hill customer service and complaint scores

Agency | Score |

|---|---|

| NAIC complaint index (2020) | 0.14 |

| NAIC complaint index (2019) | 6.47 |

| FLOIR complaint index (2019) | 0.94 |

| AM Best | B++ |

| Demotech | A |

For NAIC and FLOIR complaint scores, a lower number indicates fewer complaints. 2020 complaint index may be an outlier due to COVID-19.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.