How to Get the Best Health Insurance Without a Job

If you lose your job, a marketplace health plan is usually the cheapest choice.

Find Cheap Health Insurance in Your Area

You can also keep the coverage you get through work with COBRA, but this is typically expensive.

You may qualify for free government health insurance through Medicaid if you aren't getting more than about $1,800 per month in unemployment.

Other affordable options for getting health insurance when unemployed include joining a family member's health insurance and buying a short-term plan.

COBRA lets you keep your employer coverage after losing your job. Getting COBRA means you don’t have to worry about finding a new doctor while hunting for a job.

COBRA often costs more than other types of health insurance. Fortunately, you can usually find affordable alternatives, such as ACA marketplace plans and free government health insurance, called Medicaid.

Five ways to get health insurance without a job

Marketplace plans

- You can choose between plan tiers.

- You may get discounted rates depending on how much you make.

- You can get coverage immediately after losing your job through a special enrollment period.

- Companies can't deny coverage or charge you higher rates because of medical issues.

COBRA

- Often expensive

- Automatically eligible to continue your job-based insurance after you stop working.

Medicaid

- Low-income health insurance that's usually free.

- Good for families with children.

- Eligibility based on income and family size.

Family coverage

- Coverage depends on the plan.

- A good choice for spouses, dependents and students.

- You can enroll within 30 days of losing your workplace coverage.

Short-term coverage

- Offers quick coverage that can start immediately.

- Benefits aren't as good as traditional health insurance.

- Can sign up anytime, but companies can deny coverage or charge higher rates based on your health history.

Marketplace health plans: Best for cheap coverage

Marketplace plans offer quality coverage, and you may get discounted rates depending on your income. You can buy an Affordable Care Act (ACA) marketplace plan through HealthCare.gov or your state health exchange.

These websites make it easy to compare prices and coverage. Plus, once you put in your personal information, you can see how big of a discount you can get at a glance.

Affordable Care Act (ACA) marketplace health insurance is sometimes called Obamacare.

Find Cheap Health Insurance in Your Area

You can get coverage through the marketplace regardless of how much you earn. But you may get a discount, called a premium tax credit or subsidy, if you make less than about $63,000 per year (roughly $129,000 for a family of four).

Most people who get marketplace coverage are eligible for subsidies, and four out of five people can get a plan that costs less than $10 per month after subsidies.

After losing your job, you only have 60 days to enroll in marketplace coverage. If you apply early, you won't have the stress of sweating it out close to the deadline.

Otherwise, you have to wait until open enrollment (Nov. 1, 2025 to Jan. 15, 2026).

Marketplace health plans cover the same services you'd get through a workplace plan. By law, all marketplace plans have to cover 10 essential health services.

- Doctor visits

- Preventive and chronic disease care

- Emergency care

- Laboratory services

- Hospital care

- Pregnancy, maternity and newborn care

- Mental health and substance use services

- Prescription medications

- Rehabilitation care and devices

- Pediatric services

Find Cheap Health Insurance in Your Area

With ACA plans, you can choose from five different plan tiers. Keep in mind that you'll get access to the same services and types of care regardless of the tier you choose. The only difference between the plan tiers is how much you'll pay for your monthly rate versus the costs you're responsible for when you visit the doctor.

- Catastrophic plans have the cheapest monthly rates, but you'll have to pay a lot of money for health services before coverage starts, called a deductible. You can't get subsidies with a Catastrophic plan, and you can buy this plan tier only if you're under the age of 30 or you can prove you'd struggle to afford a better plan tier.

- Bronze plans have cheap rates, but high costs when you go to the doctor.

- Silver plans combine affordable rates and middle-of-the-road costs when you get medical care.

- Gold plans have high rates, but you won't pay much when you visit the hospital or get a prescription filled.

- Platinum plans have the most expensive monthly rates and very low deductibles and annual spending limits.

It's a good idea to choose a Silver health plan if you make less than about $39,000 per year because you may be eligible for extra discounts, called cost-sharing reductions (CSRs).

Cost-sharing reductions help cover the costs you're responsible for paying when you visit the doctor, including your deductible, copays and coinsurance.

How to get marketplace health coverage with no job

Start by shopping on HealthCare.gov when you're unemployed and need health insurance.

This website will tell you if you qualify for discounts on marketplace plans. You'll also find out if you can get free government health insurance, called Medicaid.

Each state has different rules about who qualifies and how to sign up. But starting from HealthCare.gov will help you get to where you need to go.

COBRA health insurance: Best for keeping your existing coverage

With COBRA, you can keep the same coverage you had while working, but your monthly costs will increase significantly.

Find Cheap Health Insurance in Your Area

COBRA, short for the Consolidated Omnibus Budget Reconciliation Act, is a program that lets you continue the health insurance you had through a job even after you stop working.

COBRA is expensive because you'll be paying the full price of the plan rather than splitting the costs with your employer. For example, a worker pays $119 per month on average for health insurance, and their workplace covers the remaining $627. If that worker goes on COBRA, they will now have to pay the full $746 per month.

Usually, COBRA doesn't make sense because of its high costs. But it may be a good choice if you don't mind paying extra to keep your current doctor, or if you're already getting medical care and you've met your plan's deductible. . Keep in mind that you may be able to find a marketplace plan that has your doctor in-network.

You'll usually have 60 days to sign up for COBRA after losing coverage through an employer. And typically, you can keep COBRA for at least 18 months. There are no contracts, and you can cancel at any time.

Medicaid: Best free health insurance for people without a job

Medicaid is a type of free government health insurance for people who earn a low income.

In 2025, you can make up to $1,800 per month (about $3,700 per month for a family of four) in most states and get Medicaid.

Coverage usually begins immediately after you qualify, and most states determine eligibility in real time, so you'll know right away if you qualify.

Signing up for Medicaid doesn't have to be intimidating. There are resources to help you figure out if you're eligible. Even if you can't get Medicaid, you may still get information about other free or low cost health resources.

Get started by searching for your state on Medicaid.gov.

Medicaid eligibility typically depends on monthly income, so the sharp drop in earnings after losing a job could make you more likely to qualify.

It's important to remember that the government looks at unemployment income when determining Medicaid eligibility. To get a rough idea of how much unemployment you can expect to get, check if your state offers an unemployment calculator tool.

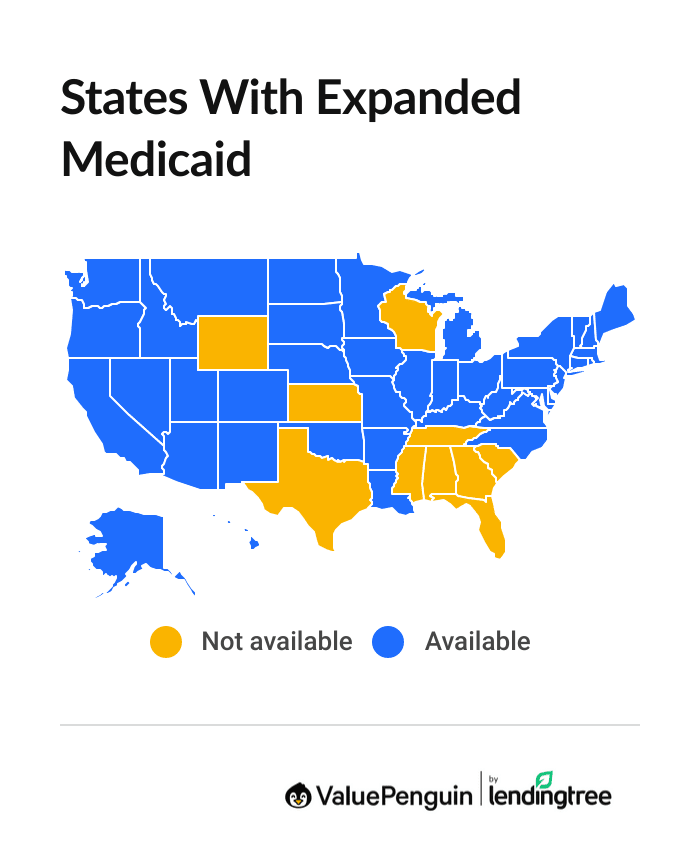

In the 10 states without expanded Medicaid, you can get Medicaid only if you make a low income and meet another qualifying condition, such as being pregnant, disabled or over the age of 65.

Find Cheap Health Insurance in Your Area

If you live in a state that doesn't have expanded Medicaid, it's a good idea to check your state's Medicaid requirements to see if you qualify.

States Without Expanded Medicaid

- Alabama

- Florida

- Georgia

- Kansas

- Mississippi

- South Carolina

- Tennessee

- Texas

- Wisconsin

- Wyoming

Join a family member's plan: Best if available

If you don't have a job, you may be able to get health insurance through a parent if you're 26 or younger, a spouse, a domestic partner or another family member. This coverage tends to cost less than COBRA or a full price marketplace plan because part of the cost is covered by your family member's employer.

On average, it costs an extra $236 per month to add a second adult to an employer health insurance plan.

Your actual costs will depend on factors including the plan tier, where you live and the size of the employer contribution. Usually, you can also get vision or dental coverage through your family member, although you may need to pay an extra monthly cost for this coverage.

When can you get coverage?

You automatically get a special 30-day window to buy health insurance if you lose your workplace coverage.

All employers have to offer this special enrollment period.

Short-term health insurance: Best for bridging small coverage gaps

A short-term health insurance plan is a good solution if you need immediate health coverage for just a month or two and you can't get a marketplace plan with subsidies, Medicaid or coverage through a family member.

The affordability of short-term health insurance plans is a major advantage. Plans cost an average of $224 per month. That's cheaper than the full price of an ACA marketplace plan.

But short-term coverage often costs more than a marketplace plan if you're eligible for subsidies based on your income.

Benefits and coverage

Short-term health insurance can be a helpful fix if you're between plans, but it usually offers less coverage than regular health insurance. Understanding the pros and cons to short-term coverage can help you decide whether it makes sense for you.

Short-term plans don't have to cover the same services as an ACA marketplace plan, such as maternity care, mental health or prescription drugs. Plus, short-term plans rarely limit how much you'll pay in a single year. In fact, short-term health insurance often comes with an annual or lifetime spending limit.

Plans can begin right away, so this is a quick way to get coverage. But there is usually a health screening before you can enroll, and companies can deny coverage because of your age or medical conditions such as diabetes, cancer or heart disease. And even if you're able to get a policy with a preexisting condition, short-term insurance may not cover medical treatments for that condition.

Cost of medical insurance when you're unemployed

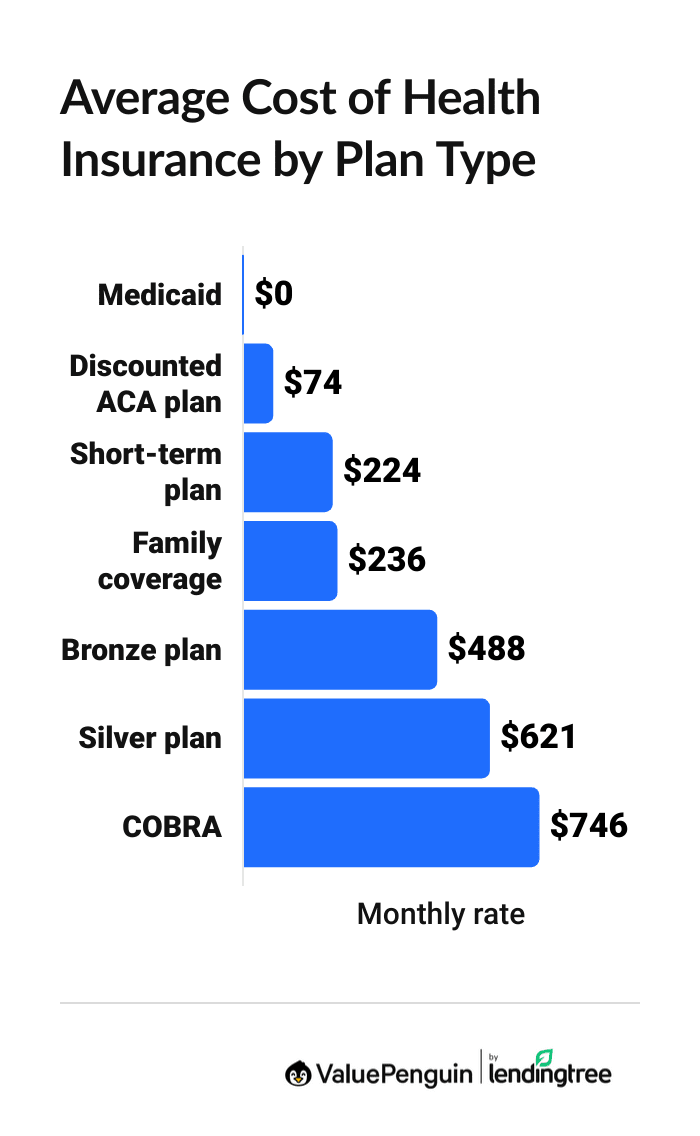

The cost of health insurance when you're unemployed depends on the type of coverage you get and your income.

You may qualify for free government health insurance if you make less than $1,800 per month ($3,697 per month for a family of four) and you live in a state with expanded Medicaid. Depending on your income, you may have access to ACA marketplace plans that cost less than $100 per month.

Adding yourself to a family member's plan or buying short-term coverage typically costs a couple hundred dollars per month. More expensive health insurance options for those without a job include full cost marketplace plans and COBRA.

How much does health insurance cost without a job?

Plan | Average monthly cost |

|---|---|

| Medicaid | $0 |

| Discounted ACA plan | $74 |

| Short-term plan | $224 |

| Family coverage (add-on) | $236 |

| Bronze plan | $488 |

| Silver plan | $621 |

| COBRA | $746 |

Marketplace plans are for a 40-year-old.

Find Cheap Health Insurance in Your Area

Frequently asked questions

Can you get health insurance without a job?

Yes, you can get health insurance without a job by enrolling in Medicaid, signing up for a marketplace plan or continuing your current coverage through COBRA. Other health insurance options for the unemployed include joining a family member's health insurance or getting a short-term health plan.

Is there free health insurance for the unemployed?

You may qualify for free government health insurance, called Medicaid, if you earn less than $1,800 per month ($3,697 per month for a family of four) and you live in a state with expanded Medicaid.

How much does health insurance cost without a job?

The cost of health insurance without a job depends on the type of coverage you choose and your income. Marketplace health coverage costs an average of $74 per month if you're eligible for discounts, called subsidies.

Adding yourself to a family member's plan costs an average of $236 per month, and COBRA is $746 per month, on average.

Are you eligible for COBRA if you quit?

Yes, you can get COBRA if you quit. According to the Department of Labor, COBRA is available if your employment ends for any reason other than gross misconduct, such as theft or harassment. You can also get COBRA if your employer reduces your hours, so that you're no longer eligible for workplace coverage.

What's the best cheap health insurance if you're jobless?

The best health insurance if you're unemployed is Medicaid, a type of free or low-cost government insurance. If you don't qualify for Medicaid, consider a plan through the ACA health insurance marketplace, since you may be eligible for government subsidies that can significantly lower your monthly rate.

Methodology and sources

ValuePenguin used the CMS public use files (PUFs) to find average health insurance rates. Plans and insurance companies for which county-level data was included in the CMS Crosswalk file were used in our reporting. Those excluded from these files were not included in our analysis. Rates are for a 40-year-old with a Silver plan, unless otherwise noted.

Rate information for employer health plans and COBRA came from the Kaiser Family Foundation (KFF).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.