What is Full Coverage Car Insurance?

Full coverage combines liability, collision and comprehensive coverage plus sometimes add-ons like roadside assistance.

This means it will pay to repair your car and any damage you cause to other drivers.

Full coverage is a good choice if you have a car that's new or expensive, or if you want to avoid large mechanic bills after an accident. Plus, it's usually required if you have a car loan or lease.

Find Cheap Auto Insurance Quotes in Your Area

What does full-coverage car insurance include?

Full coverage includes:

- Property damage liability: Pays to repair cars you hit or damage you cause

- Bodily injury liability: Covers medical bills for the people you hurt

- Comprehensive and collision: Pays to repair to your car after any kind of accident

- Extras: Covers roadside assistance, rental car reimbursement, uninsured motorist, personal injury protection (PIP), or other add-ons you pay for.

How is full coverage different from liability-only coverage?

Full-coverage car insurance means you're covered for pretty much any damage that happens to your car, like if you crash into someone or a tree branch falls on your roof.

Full coverage | Minimum coverage | ||

|---|---|---|---|

| Property damage liability | |||

| Bodily injury liability | |||

| Comp. and collision | |||

| Extras |

A minimum-coverage policy, also called a liability-only policy, will only pay for the damages you cause to others. It won't pay to repair your car when you cause an accident. Extras like uninsured motorist coverage may be included in these basic policies if they're required in your state.

Comprehensive & collision: Full coverage for your car

Full-coverage insurance includes comprehensive and collision coverage, which pay for damage to your car. These types of insurance cover your car if you cause an accident or if it's damaged by something that's outside your control, such as the weather.

Comprehensive and collision are typically optional, and they can be expensive. But their biggest advantage is that you'll be protecting your own car so you can avoid unexpected repair bills.

Collision and comprehensive insurance are not required by any state, but they may be required if you lease or finance your car.

Collision insurance

Collision insurance will pay to repair any damage to your car from an accident, no matter who was at fault.

This means that the insurance company will repair or replace your car even if you cause an accident or if it's unclear who caused the accident.

The downside to collision insurance is that it is usually the most expensive part of car insurance — sometimes doubling the bill. For high-value or luxury cars, the price will be even higher.

You can reduce the price of your collision premium by choosing a high deductible. This means you'll pay less each month for insurance, but you'll pay more when you file a claim after an accident. Deductibles usually range from $50 up to $2,000.

Comprehensive coverage

Comprehensive coverage pays to repair your vehicle after events such as a branch falling on your car, vandalism or a baseball going through your windshield.

These events usually can't be avoided. Comprehensive coverage costs far less than collision, most likely because the average comprehensive claim is far smaller than a collision claim. You can also save on comprehensive coverage with a lower deductible.

Policy extras

Full-coverage policies can also include add-ons like roadside assistance or rental car reimbursement. Some companies won't offer certain add-ons unless you have full coverage.

Personal injury protection

Personal injury protection (PIP) insurance pays for your injuries, regardless of who was at fault.

That means if you or your passengers are hurt in a car accident, PIP will pay for the medical expenses. PIP tends to overlap often with your own health insurance and usually works as a useful complement and provides extra protection.

PIP costs only $15 per month, on average, making it a cheap component of full-coverage insurance.

In 12 states, you are required to carry personal injury protection (PIP). In the other 38 states, you can get optional coverage called medical payments coverage, or MedPay.

MedPay is essentially the same thing as PIP insurance, except that it is not mandatory in any state. MedPay can be useful in states with low PIP limits or where PIP is expensive.

Liability insurance: Included with full-coverage car insurance

Liability insurance covers damage you cause to another driver or their car. It is usually the only part of car insurance that you are required by law to carry.

Within liability, there are two main types of insurance.

- Bodily injury (BI) deals with injuries you cause to other people.

- Property damage (PD) covers damage to other cars or structures.

Neither coverage pays for damage to your vehicle. Liability coverage only pays for damage you cause others. Collision and comprehensive coverage pay for damage to your car.

For example, if you were injured after someone crashed into you, you would file a claim with their bodily injury insurance coverage. Their policy would pay for your health costs, not your policy.

A policy with these two coverages is the most basic type of car insurance you can have.

Each state has a minimum amount of liability coverage, which is often written in a three-number format, such as 25/50/25. The first two numbers refer to your bodily injury coverage. The first number is the limit of insurance you have for one person in an accident, while the second is the limit for the entire accident. The third number is the limit for your property damage liability coverage.

State minimums usually range from $10,000 to $50,000 worth of coverage. For example, in Pennsylvania, the minimum required coverage is 15/30/5. That's $15,000 in bodily injury liability per person and $30,000 in bodily injury liability per accident, plus $5,000 in property damage liability per accident.

Liability coverage is usually about one-third of the total cost of full-coverage auto insurance. To double your coverage limits for bodily injury, it will probably cost less than an extra $100 per year. Property damage insurance is slightly more expensive than bodily injury but costs less to boost coverage.

Uninsured or underinsured motorist insurance

Uninsured motorist coverage is used when an uninsured driver causes an accident and damages your car or injures you.

In most cases, the other driver would have insurance, and you would file a claim through their company. If they are uninsured, you use your own uninsured motorist coverage instead.

- Uninsured motorist property damage (UMPD) pays to repair your car when the person who hit you doesn't have insurance.

- Uninsured motorist bodily injury (UMBI) will pay for your injuries if an uninsured person causes a car accident.

Underinsured coverage is used if the other driver does not have enough insurance. This would protect you in a situation where another driver causes $25,000 worth of damage to your car, but they only have $10,000 worth of property liability coverage. In this case, the other driver's insurance would pay up to its limit. Then you would use your underinsured motorist coverage to pay the rest of the damage costs.

In some states, you are required to carry some type of uninsured or underinsured motorist coverage. The amount you have is usually the same as your liability coverage.

The chance of getting in an accident with an uninsured driver is small. This makes uninsured/underinsured coverage one of the cheapest parts of "full coverage."

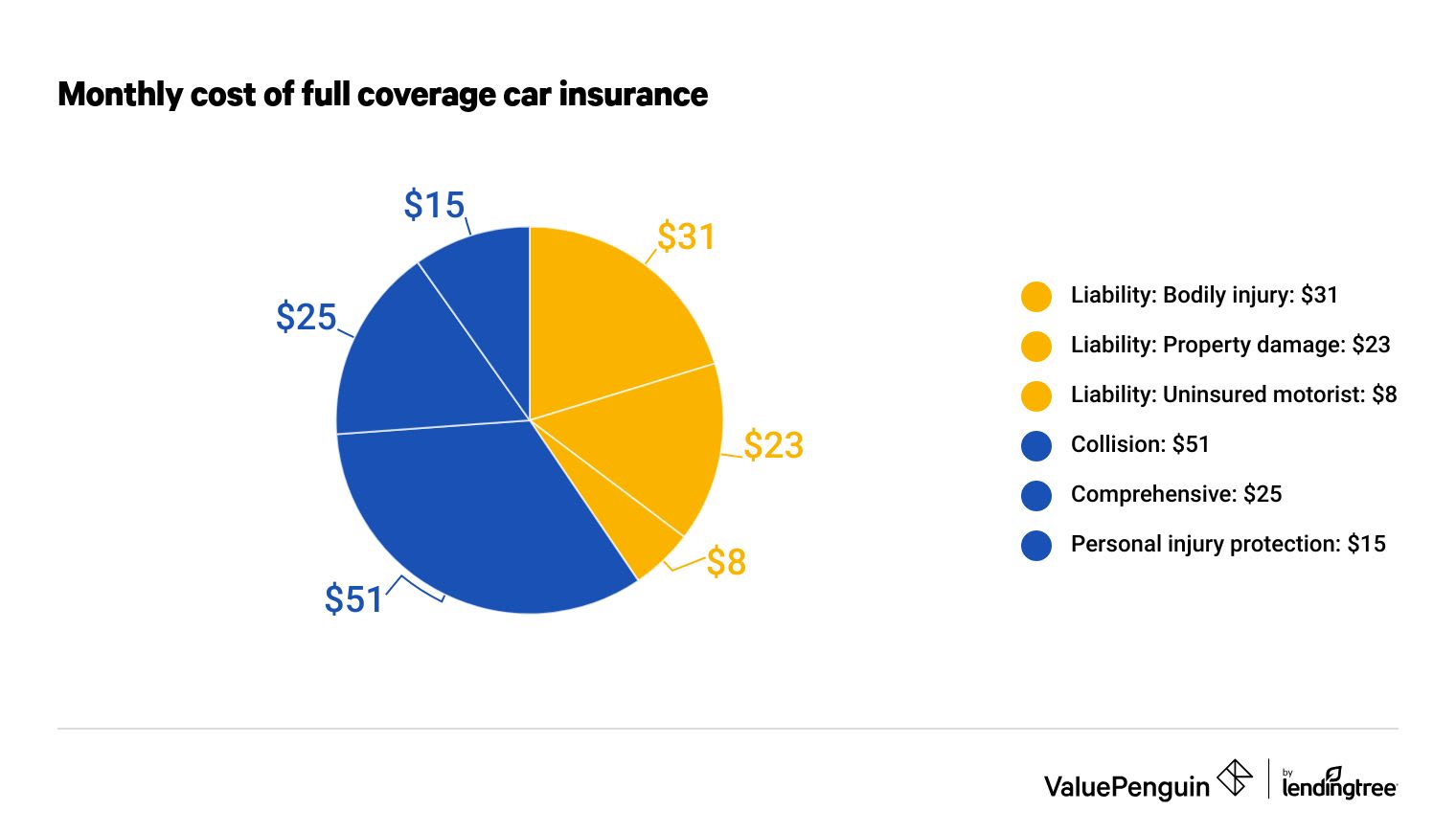

The total cost of full-coverage car insurance

A full-coverage policy is typically double or triple the cost of a minimum-coverage policy.

For example, in Texas, it costs about $62 per month for a liability policy that covers bodily injury, property damage and uninsured motorist coverage.

Full coverage costs an extra $91 per month for collision, comprehensive and PIP, for a total cost of $153 per month.

Find Cheap Auto Insurance Quotes in Your Area

Monthly cost of full coverage vs. a liability policy

Coverage type | Full coverage | Liability only |

|---|---|---|

| Liability: Bodily injury (BI) | $31 | $31 |

| Liability: Property damage (PD) | $23 | $23 |

| Liability: Uninsured motorist | $8 | $8 |

| Collision | $51 | |

| Comprehensive | $25 | |

| Personal injury protection (PIP) | $15 | |

| Total | $153 | $62 |

Where you live is a key factor in how much more you'll pay for full coverage versus minimum coverage. This is because of state laws, the chance of getting into an accident and other regional factors.

Full coverage and minimum liability rate increase by state

State | Full coverage | Min. coverage | Difference |

|---|---|---|---|

| California | $146 | $50 | 192% more |

| Georgia | $125 | $52 | 140% more |

| Indiana | $106 | $40 | 165% more |

| Massachusetts | $178 | $61 | 192% more |

| Michigan | $399 | $196 | 104% more |

| New York | $149 | $77 | 94% more |

Why you should get full coverage

Full-coverage car insurance protects your car in case you cause an accident. This gives you more coverage than a liability policy.

- Costs if you cause an accident: In 2021, the average collision claim was $5,010. So if you didn't have full coverage, you would need to pay about $5,000 to fix your car. That's a large and unexpected repair bill. Your total costs could be even higher if you miss work because you can't get there.

- Requirements from leasing or financing companies: Full-coverage car insurance may be required as part of your car loan or lease terms.

- Risks of depending on other drivers' insurance: Filing through another person's insurer means there is a higher chance the full claim isn't approved. Filing through another insurer also means needing to prove who the "at-fault" driver is. This can be difficult to determine and sometimes depends on the state you are in.

When you shouldn't get full coverage

If your car is more than 10 years old or worth less than $5,000, it may be time to drop full coverage.

The rule of thumb is that when your car's value drops to four to six times the annual cost of comprehensive and collision coverage, it's usually a better deal to drop full coverage and pay for any damage yourself.

However, it depends on your financial situation. Those who don't have a savings cushion may prefer knowing they have more coverage and knowing that the insurance company will pay for any kind of covered damage.

How to get affordable full-coverage car insurance

Full coverage is expensive, but there are several things you can do to save.

- Increase your deductible for collision and comprehensive: Increasing your deductible from $500 to $1,000 will save you about $100 per year.

- Look for discounts: Insurance companies offer discounts for things like being a safe driver, being a good student or taking a driver's education course. Taking advantage of these can save you 20% on your yearly bill.

- Compare insurance companies: Quote comparison shopping can save you thousands every year on your car insurance bill.

Frequently asked questions

What is full-coverage insurance?

Full-coverage car insurance means your policy has comprehensive and collision coverage, as well as liability coverage. With this type of policy, the insurance company will pay for damage you cause to your car and damage to other cars and people.

What does full-coverage car insurance cover?

A full-coverage policy will cover damage you cause to other cars and other people's injuries. It also pays to repair your car if you cause an accident or it's damaged by weather, theft or other events. The policy might also include personal injury protection or uninsured motorist coverage.

How much does full-coverage insurance cost?

Full-coverage car insurance costs $148 per month, based on the U.S. average. The best full coverage car insurance is from State Farm. It costs an average of $99 per month while also having good customer satisfaction.

Methodology

Car insurance costs are based on a 30-year-old man with good credit who drives a 2015 Honda Civic EX. Averages are based on thousands of insurance quotes from ZIP codes across Texas for the largest insurance companies. The sample full-coverage policy has comprehensive and collision coverage, in addition to liability coverage.

Coverage type | Limits |

|---|---|

| Bodily injury liability | $50,000 per person; $100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured or underinsured motorist bodily injury | $50,000 per person; $100,000 per accident |

| Comprehensive and collision | $500 deductible |

Rates for state comparisons are based on national data for the average cost of insurance.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.