Homeowners Insurance

Which States Are Most Likely to Suffer From Hurricanes?

ValuePenguin analyzed historic emergency data provided by the Federal Emergency Management Agency (FEMA) to assess the risks coastal property owners could face during hurricane season. We examined states along the Gulf and southern Atlantic coasts and discovered that hurricanes have caused $8 billion of damage since 2010.

This damage was focused in over 600 counties across eight states. Yet, in these counties, the number of property owners who could fully recover from a devastating storm surge is relatively low. In these counties, there are only four flood insurance policies for every 100 homes.

Flood damage isn't covered by homeowners insurance. This, coupled with the low percentage of insured Americans living in these counties, means that if the hurricane seasons during the next decade resemble those of the last, tens of thousands of families could be left without homes.

Key findings

- Hurricanes caused nearly $8 billion of damage to states along the Gulf and southern Atlantic from 2010 to 2019, resulting in 57 disaster declarations.

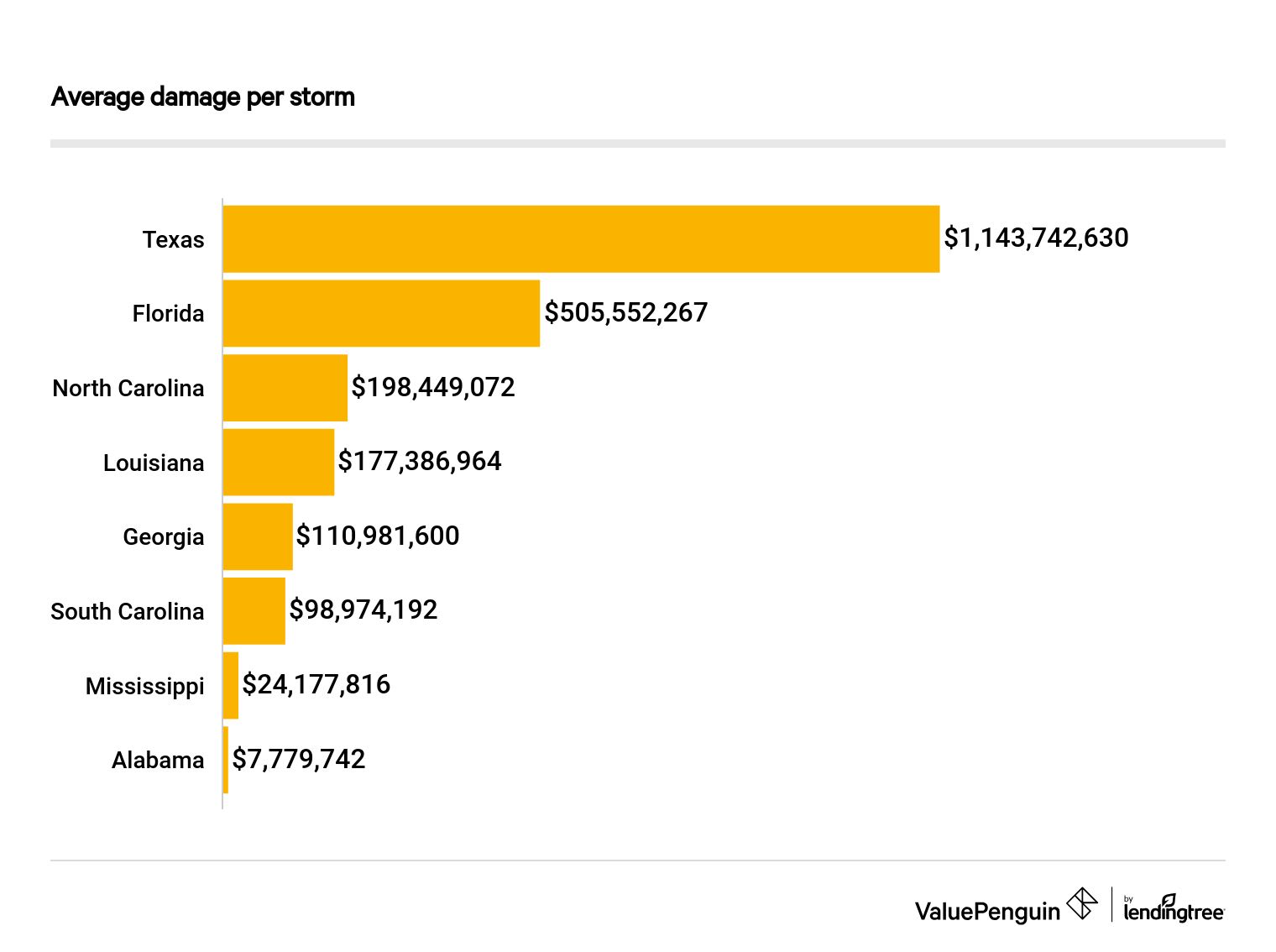

- Florida experienced the most expensive losses overall with $3.5 billion of damage, while Texas had the highest average damage per storm, with a typical loss exceeding $1 billion.

- Alabama garnered $31 million of aid from FEMA in the last decade, the lowest among states we surveyed.

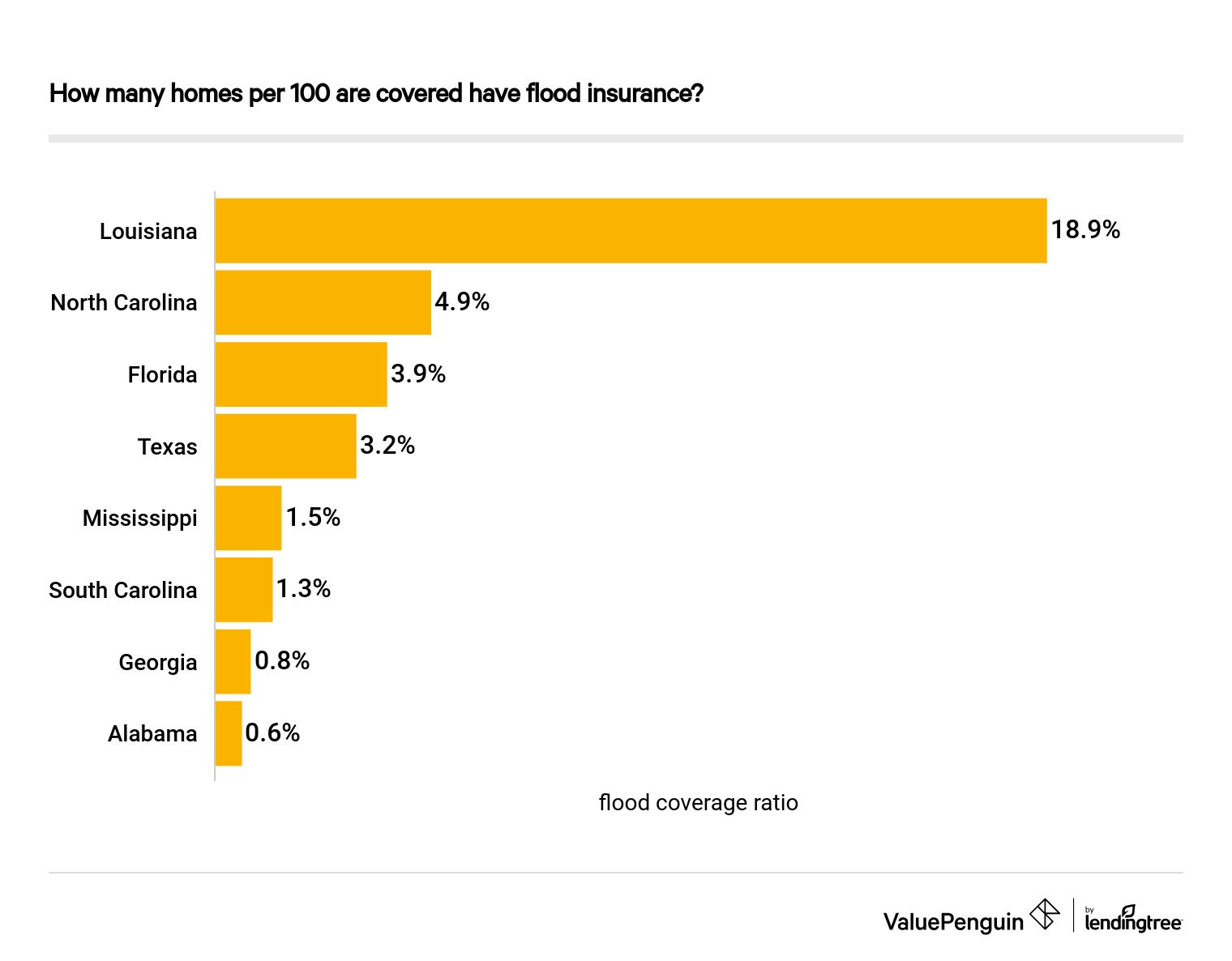

- Across the 628 counties that experienced hurricane emergencies, less than 4% of homes have flood insurance.

- Louisiana is the most prepared for future storms, with an insured rate of about 19% in previously affected counties.

In the last decade, hurricanes inflicted nearly $8 billion to states along the Gulf and southern Atlantic, with Florida sustaining the most economic damage

We examined FEMA disaster data from eight states: Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina and Texas. There were 57 disaster declarations made by FEMA from 2010 to 2019 in these states, which resulted in $7.9 billion of public assistance aid.

This type of aid is used by FEMA to fund emergency responses to damaged communities. FEMA allots money, after local requests are made, to repair and replace buildings and infrastructure and protect public health. The work that these funds enable can be immediate and long term.

Of these states, Florida was most affected by storms. Emergencies that stemmed from hurricanes caused more than $3.5 billion to the Sunshine State, with an average per-storm loss of $505 million. Of the 57 disaster declarations made in the last decade, Florida was issued 14 — more than any other state.

Despite the frequency of hurricanes that struck Florida during this time, Texas actually had the highest average amount of damage per disaster: $1.1 billion. This was thanks, in large part, to Hurricane Harvey in 2017, which damaged a substantial number of homes built below FEMA's elevation requirements.

Alabama suffered the least damage from hurricanes on average and overall, but its losses were still high. FEMA granted the state $31 million of public assistance in all. Additionally, each disaster did about $8 million in damage, on average.

South Carolina, Louisiana and Mississippi experienced the highest frequencies of major disaster declarations. Each storm that hit these states resulted in an escalated federal response. Differing from a standard declaration, this designation expands the aid states can receive from FEMA. The total damage to each of these states, respectively, was $395 million, $354 million and $48 million.

In the last decade, 628 counties were declared disaster zones for damage resulting from hurricanes, and the majority of counties experienced more than one emergency

To measure how hurricanes affected local communities, we gathered data on the counties in each state that were affected by at least one FEMA-designated emergency during the last decade. This allowed us to understand which parts of affected states were most likely to experience repeated storms.

North Carolina's Dare, Brunswick and Hyde counties each experienced 10 separate FEMA emergencies on account of hurricanes — the most of any one county.

Over the course of the last decade, counties were typically affected by more than one storm. Specifically, South Carolina experienced the most declarations per county of any state we surveyed. Counties in the paths of last decade's hurricanes were likely to experience more than six storm-based emergencies, on average. Conversely, if a county in Texas or Mississippi was hit by a storm, it was unlikely to undergo a second emergency.

Following South Carolina, counties in Florida and Georgia were the most likely to be affected by multiple storms. Floridians who experienced one storm were likely to experience a total of five, while Georgians might experience between three and four emergencies.

Despite the chance of multiple hurricanes, a high percentage aren't protected against future storms: On average, the insured rate in counties that were affected by hurricanes falls under 4%

Unlike a regular homeowners insurance policy, which is required by a mortgage lender, flood insurance isn't always mandatory. But protections against floods aren't granted by regular home insurance.

In Brunswick County, North Carolina, which underwent 10 FEMA emergencies, there is fewer than one flood insurance policy for every 100 homes. If Brunswick experiences another storm in the next decade, only a fraction of its residents would be able to recoup the value of their destroyed property.

In our analysis, we found that there were a few counties with more than 100,000 homeowners living on a 100-year floodplain — land where there's a 1% chance of being inundated by a flood. These counties are: Miami-Dade, Fla; Harris, Texas; Lee, Fla.; Pinellas, Fla.; Broughhard, Fla. and Hillsborough, Fla. Even though these counties have experienced about four hurricane emergencies on average in the last 10 years, less than 11% of their homes are insured against floods.

However, it's much more likely that the insured rate of all property owners is lower in a given county. Counties in Georgia and Alabama are the least prepared for more storms in the next decade. In these states, the rate of flood insurance in counties that were affected by storms is less than 1%.

Hyde County, North Carolina has an insured rate of over 93%, making it the most covered among other counties where disaster declarations were issued in the 2010s. Additionally, Louisiana is the most prepared state to weather hurricanes, as the ratio of flood insurance policies is almost 19% statewide.

Methodology

We examined storm damage in eight Gulf and Atlantic states: Alabama, Louisiana, Florida, Georgia, Mississippi, the Carolinas and Texas using FEMA's Historical Disaster Damage database. We found the number of disasters that were declared by FEMa since 2010 statewide and by county, then checked the public assistance totals that each state received.

Using NYU's Furman Center floodplain research, we obtained the number of homes in these counties, then used FEMA's flood policy data to find out the ratio of flood insurance policies.