Acuity Insurance Review

Solid customer service and coverage options likely won't make up for Acuity's expensive rates.

Find Cheap Auto Insurance Quotes in Your Area

Editor's Rating

Acuity has excellent customer service, a well-reviewed mobile app and coverages that meet most drivers' needs. However, rates are significantly higher than those offered by competitors, with some drivers paying double for the same coverage.

Pros and cons

Pros

User-friendly mobile app

Strong customer service

Cons

Expensive rates

Only available in 37 states

Our thoughts on Acuity

We do not think Acuity is a good choice for most drivers. Although the company has a strong customer service reputation and a solid list of add-on coverages, rates are significantly more expensive than those offered by competitors.

In fact, Acuity charged more than double what State Farm charged a 30-year-old driver with an at-fault accident on his record — for the same coverage. While the company offers a solid bundling discount, even drivers who get the full 20% off may get better rates from another insurer.

What states does Acuity write car insurance policies in?

Acuity is licensed to write property and casualty insurance policies in 37 states. States where Acuity is not available include:

- Arkansas

- California

- Connecticut

- Florida

- Hawaii

- Louisiana

- Maryland

- Massachusetts

- New Jersey

- New York

- North Carolina

- Rhode Island

- South Carolina

- District of Columbia

Cost of Acuity car insurance vs. competitors

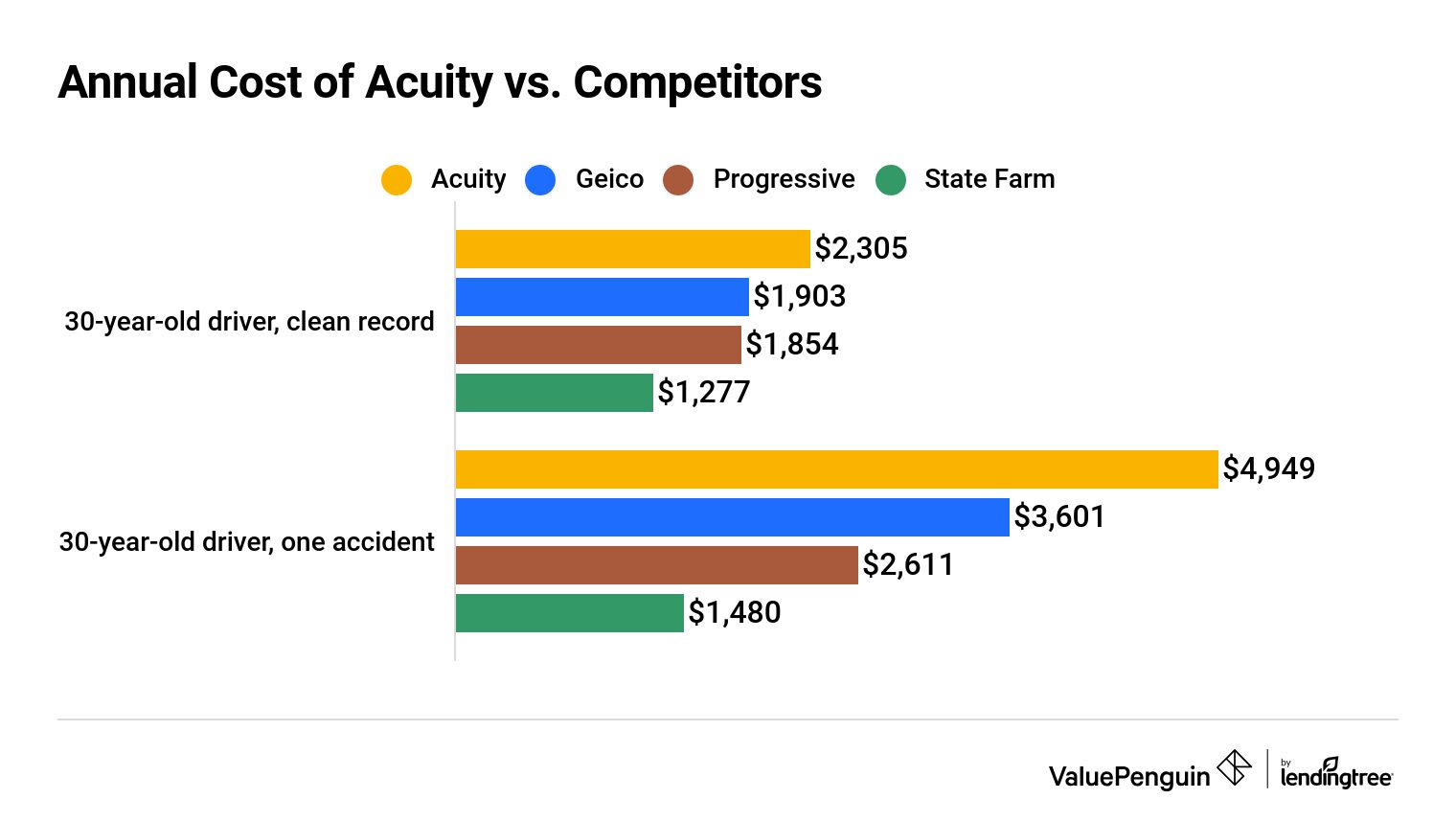

We would not recommend purchasing an auto insurance policy from Acuity if you're looking for cheap rates. Pricing for an annual policy from Acuity is significantly higher than the rates competitors offer. In fact, ValuePenguin found that State Farm, the cheapest insurer in our study, charged our sample driver 45% less than Acuity if he had a clean record, and 70% less if he had one accident on his record. That's $1,028 and $3,469 back in the driver's pocket, respectively.

Find Cheap Auto Insurance Quotes

Annual cost of Acuity auto insurance vs. competitors

Insurer | Annual cost, clean record | Annual cost, one accident |

|---|---|---|

| State Farm | $1,277 | $1,480 |

| Progressive | $1,854 | $2,611 |

| Geico | $1,903 | $3,601 |

| Acuity | $2,305 | $4,949 |

Acuity also raised rates for an incident more sharply than the other insurers in our study. Rates increased by 115% after an at-fault accident — far more than Geico (89%), Progressive (41%) and State Farm (16%). Compare quotes from several other insurers before buying a policy.

What discounts does Acuity offer?

Acuity offers a multi-policy discount of up to 20% to policyholders who bundle their car insurance with another product, such as boat or homeowners insurance. That's competitive with the bundle discounts offered by major national insurers.

Policyholders who bundle their home and auto coverages are also eligible for other benefits. Acuity allows these customers to have one high coverage limit and one deductible, which lowers your out-of-pocket expense.

Replacement cost coverage for your home and personal property is also included when you bundle your home and auto insurance. And if you don't own a home, you can bundle other types of insurance — such as renters or boat — with your auto insurance to get a discount as well.

Other discounts offered by Acuity include:

- Multi-car

- Good student

- Graduate student

- Incident-free

- Accident prevention course

- Safety features installed in car, such as automatic braking and rear cameras

Coverages from Acuity

The coverages Acuity offers probably meet the needs of most drivers. The company particularly stands out for its personal auto enhancement endorsement, which bundles several useful extra coverages into one package. Many other insurers sell these coverages piecemeal rather than offering them together in one package.

Coverages included in the personal auto enhancement package include:

- Replacement of lost, stolen or damaged keys or lock

- Replacement of personal property in your car that has been damaged in an accident

- Travel expenses if an accident leaves you stranded

- Veterinary expenses if your pet is injured in an accident

- Replacement of airbag if it discharges for a reason other than an accident

- Accidental death and total disability (only in some states)

In addition to this package, Acuity offers a number of add-on coverages that you frequently see from major insurers. These additional coverages include:

Coverage | Explanation |

|---|---|

| Vehicle replacement | Replaces your car if it is totaled in a covered accident. If your car is an older model, you'll receive 25% more than the car's current value. |

| Full safety glass | Waives the comprehensive deductible if your car's windshield or windows require repair or replacement. |

| Uninsured motorists property damage | Covers repairs to your car if you get into an accident with an uninsured driver. |

| Towing and labor | Covers towing and 24/7 roadside assistance, which includes services such as tire changes, jump starts, gas delivery, locksmith service and winching. |

| Auto loan/lease | Also known as gap coverage, this covers the difference between what you owe on your car loan and what your car is worth after it's been totaled. |

| Temporary transportation expenses | Covers the costs of your transportation, such as a rental, rideshare or cab, while your car receives covered repairs. |

Acuity offers a unique add-on incentive that increases medical payments coverage limits if the injured individual was wearing a seatbelt during the accident.

Acuity also offers drivers the standard coverages all auto insurers sell. These include:

Acuity customer service reviews

If strong customer support is a top priority for you, Acuity is a solid choice. Data from the National Association of Insurance Commissioners (NAIC) shows that Acuity receives about a third fewer complaints than would normally be expected for an insurer of its size. Its NAIC Complaint Index is 0.66, lower than the average 1.0.

Reviewer | Maximum score | Acuity’s score |

|---|---|---|

| NAIC | 1.0 is average; lower is better | 0.66 |

| A.M. Best | A+ (Superior) | A+ (Superior) |

| Apple Store | 5.0 | 4.7 |

| Google Play | 5.0 | 4.6 |

Acuity also received an A+ Financial Strength Rating from A.M. Best, which means that the company has a "superior" ability to pay out insurance claims. Policyholders can be confident that Acuity can meet its financial obligations.

Acuity also provides an excellent mobile user experience. Both Apple and Android users left strong reviews of the Acuity insurance app. Apple users gave it a 4.7 out of 5 and Android users gave it a 4.6 out of 5. Functionalities available in the Acuity app include:

- Bill pay

- Reporting claims

- Storing insurance documents

- Finding an agent

- Locating an auto repair shop

Claims, customer service and roadside assistance from Acuity

Acuity differs from other insurance companies in that policyholders can pay their bill, file claims or contact customer service all at the same phone number: (800) 242-7666. Payment and claims can also be made online or via the Acuity mobile app.

However, Acuity has a separate telephone number dedicated specifically to roadside assistance. The number is (866) 732-1466.

Other Acuity insurance products

In addition to auto insurance, Acuity offers other personal and commercial insurance options. Here are the types of personal insurance you can buy from Acuity:

- Homeowners

- Renters

- Condo

- Motorcycle

- Boat and yacht

- ATV

- RV and camper

- Personal watercraft

- Snowmobile

- Identity theft and cyber protection

- Umbrella

Acuity does not offer life or health insurance, so shoppers seeking these coverages will need to consider another company.

About Acuity Insurance

Acuity, A Mutual Insurance Company, is a subsidiary of the Acuity Group, which sells property and casualty insurance. A private company, it is owned by President and CEO Benjamin Michael Salzmann. Acuity insurance headquarters are located at 2800 South Taylor Drive in Sheboygan, Wisconsin.

Methodology

ValuePenguin analyzed thousands of quotes from across the state of Colorado. Our two sample drivers are both 30-year-old men who drive a 2015 Honda Civic EX and have average credit scores. One has an at-fault accident on his record; the other does not.

We gave our driver the following coverages:

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin used rate data from Quadrant Information Services for this study. Rate data is publicly sourced from insurer filings. Use these quotes for comparative purposes only, as your own quotes will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.