Progressive Insurance Review: Car, Home and More

Progressive auto insurance is fairly average. It has excellent motorcycle insurance, but homeowners and renters can typically find better coverage elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

Is Progressive insurance good?

Progressive's range of features and discounts make it a good company to consider for auto and motorcycle insurance.

On the other hand, Progressive's home and renters insurance coverage is lacking. Other companies tend to offer more coverage options and cheaper rates.

Overall, Progressive's customer service could be better. You'll likely experience a lot of back and forth before Progressive pays your claim.

Editor's rating breakdown | |

|---|---|

| Auto | |

| Home | |

| Renters | |

| Motorcycle | |

Pros and cons of Progressive insurance

Pros

Cheap rates after a DUI

Affordable renters insurance

Extra protection for your motorcycle

Cons

Mediocre customer service

Few home and renters coverage options

Progressive auto insurance reviews

Progressive's car insurance rates are average for most drivers.

It's typically very affordable if you have a DUI, but expensive for younger drivers.

However, there's nothing special about Progressive car insurance. Most people can find similar coverage and cheaper quotes elsewhere.

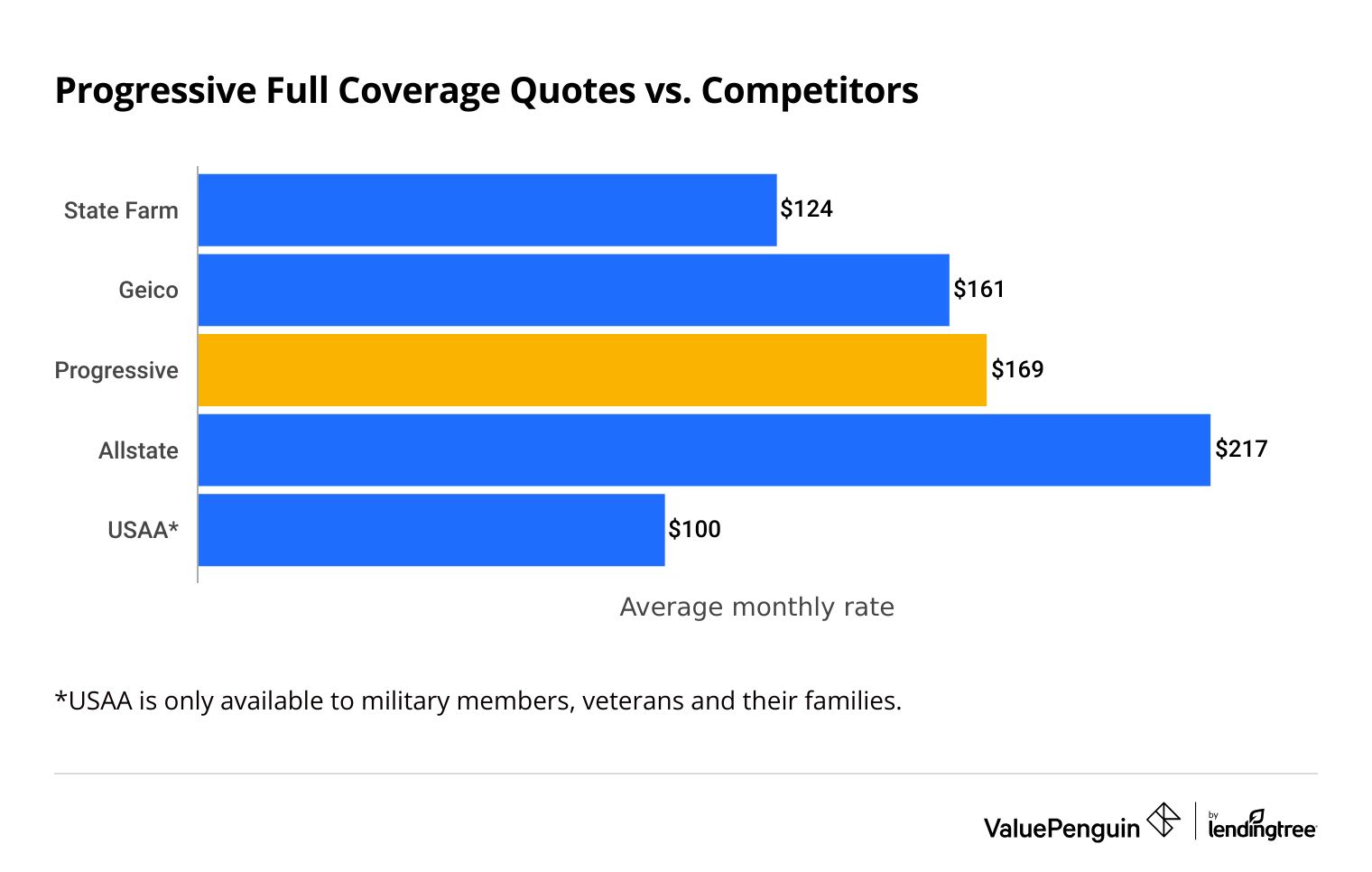

Progressive car insurance quotes

Car insurance quotes from Progressive are average for most drivers.

A full coverage policy from Progressive costs around $169 per month, which is $1 per month less than the national average. It's also $45 more expensive than the cheapest major insurance company, State Farm.

Find the Cheapest Car Insurance Quotes in Your Area

Minimum coverage car insurance from Progressive costs an average of $66 per month. That's $3 per month less than the national average. However, it's $16 more per month than the cheapest option, State Farm.

Compare Progressive car insurance quotes vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

*USAA is only available to military members, veterans and their families.

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $124 | ||

| American Family | $160 | ||

| Travelers | $160 | ||

| Geico | $161 | ||

| Progressive | $169 | ||

*USAA is only available to military members, veterans and their families.

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $50 | ||

| Geico | $61 | ||

| American Family | $61 | ||

| Progressive | $66 | ||

| Travelers | $70 | ||

*USAA is only available to military members, veterans and their families.

Progressive has affordable rates for drivers with a DUI. However, young drivers will find Progressive's rates to be high, and people with a speeding ticket or accident on their record can typically get cheaper insurance elsewhere.

Rates after a DUI

$212/mo

$302/mo

National average full coverage policy after one DUI

Rates after a ticket

$217/mo

$202/mo

Rates for teens

$708/mo

$485/mo

National average full coverage policy for an 18-year-old driver

Rates after an accident

$252/mo

$244/mo

Progressive auto insurance coverage options

Progressive offers several coverage options you can add to your policy for an extra fee.

Progressive rental reimbursement pays for a rental vehicle after a covered accident. Progressive will typically pay between $40 and $60 per day for a rental car similar to yours.

Roadside assistance from Progressive pays for towing, a locksmith, gas and fluid delivery, flat tire changes and other emergency services if you're stuck on the side of the road.

Rideshare insurance is an essential add-on if you drive for a rideshare or delivery company like Uber or Lyft. It covers any gaps between your auto insurance coverage and the protection offered by the rideshare company.

Progressive offers rideshare insurance in 39 states and Washington, D.C.

Progressive gap insurance pays the difference between your balance on a loan or a lease and your car's value if it's totaled in an accident.

Progressive calls this coverage loan/lease payoff, and it's important if you have a new car. Your collision coverage will typically only cover the cost of your car up to its actual cash value. That means it factors in depreciation, wear and tear, which usually affects new cars the most.

Without gap insurance, your insurance payout for a new car will likely be less than what you owe on a loan or lease.

Progressive limits its gap insurance coverage to 25% over your vehicle's actual cash value. Not all companies have this limit.

Custom parts and equipment coverage from Progressive are a good idea if your car has after-market parts. This can include stereos, navigation systems, wheels, grilles and other custom parts you've added to your car.

Progressive custom parts coverage typically has a $5,000 limit.

Progressive deductible savings bank lowers your deductible by $50 for every six months you don't make a claim. Other car insurance companies call this a vanishing or diminishing deductible.

Progressive Mexico insurance protects people driving across the border. You'll need special insurance to drive legally in Mexico. This is the case whether you go there regularly for business or take a short vacation.

Progressive also offers all the standard auto insurance coverages you need to drive legally in your state. You can choose full coverage insurance with comprehensive and collision to protect your car against damage.

Does Progressive have accident forgiveness?

Progressive has a unique accident forgiveness program. It breaks accidents into two categories:

- Progressive includes small accident forgiveness for most new customers. Progressive considers an accident small if the claim is less than $500.

- Progressive includes large accident forgiveness for customers who have had insurance with the company for more than five years. It only applies to drivers without a claim in five years or more. Large accident forgiveness will keep your rates the same even if the claim is more than $500.

Some drivers can also buy accident forgiveness from Progressive when they get a policy.

Progressive's accident forgiveness program can be very helpful if you cause a crash. Without accident forgiveness, full coverage rates from Progressive go up by 49% after an at-fault accident. That's an average increase of $83 per month.

Progressive auto insurance discounts

Progressive offers lots of discounts to drivers. Many of Progressive's discounts are easy to get, like a discount for getting a quote or buying your policy online.

Save around 7% when you get a quote online and then buy on the phone.

Save around 9% when you sign your insurance documents online.

Get a discount of around 12% when you insure multiple cars with Progressive.

Get a discount based on how long you've been with your previous insurance company.

Save around 5% when you bundle more than one policy with Progressive.

Get a discount of around 10% if you own a home, even if you don't have home insurance from Progressive.

Get a discount when you get policy documents and bills via email.

Earn a discount when you pay your entire bill upfront or sign up for automatic payments.

Progressive also has three helpful discounts to lower the cost of car insurance for young drivers.

- Teen driver discount: Add a child under 18-year-old to your policy.

- Good student discount: Save around 10% if you have a student on your policy with a "B" average or better.

- Distant student discount: Get a discount if you have a child on your policy who is away at college and doesn't have a car at school.

Progressive Snapshot discount

Progressive Snapshot is a program that helps good drivers save money by tracking their driving habits using a device or mobile app and rewarding safe driving behavior.

If you sign up when you buy a new Progressive policy, you'll get a discount of around $25. Drivers who show safe habits over six months will get a discount. Progressive says drivers save an average of $146 per year with Snapshot.

However, your rate can also go up if you have unsafe habits, like hard braking or driving late at night. Progressive says that two out of every ten drivers end up with a higher rate rather than a discount.

Progressive car and motorcycle insurance reviews and ratings

Progressive auto insurance has mixed customer service reviews.

The company gets 22% fewer customer complaints than similar companies, according to the National Association of Insurance Commissioners (NAIC). Most complaints are about Progressive insurance claims taking longer than customers expect.

In addition, J.D. Power ranked Progressive 19th out of 25 top insurance companies on its claims satisfaction survey. That indicates Progressive customers aren't typically happy with Progressive's customer service after an accident.

On a positive note, Progressive has an A+ financial strength rating from AM Best. That means Progressive should be able to pay out customer claims, even in tough economic times.

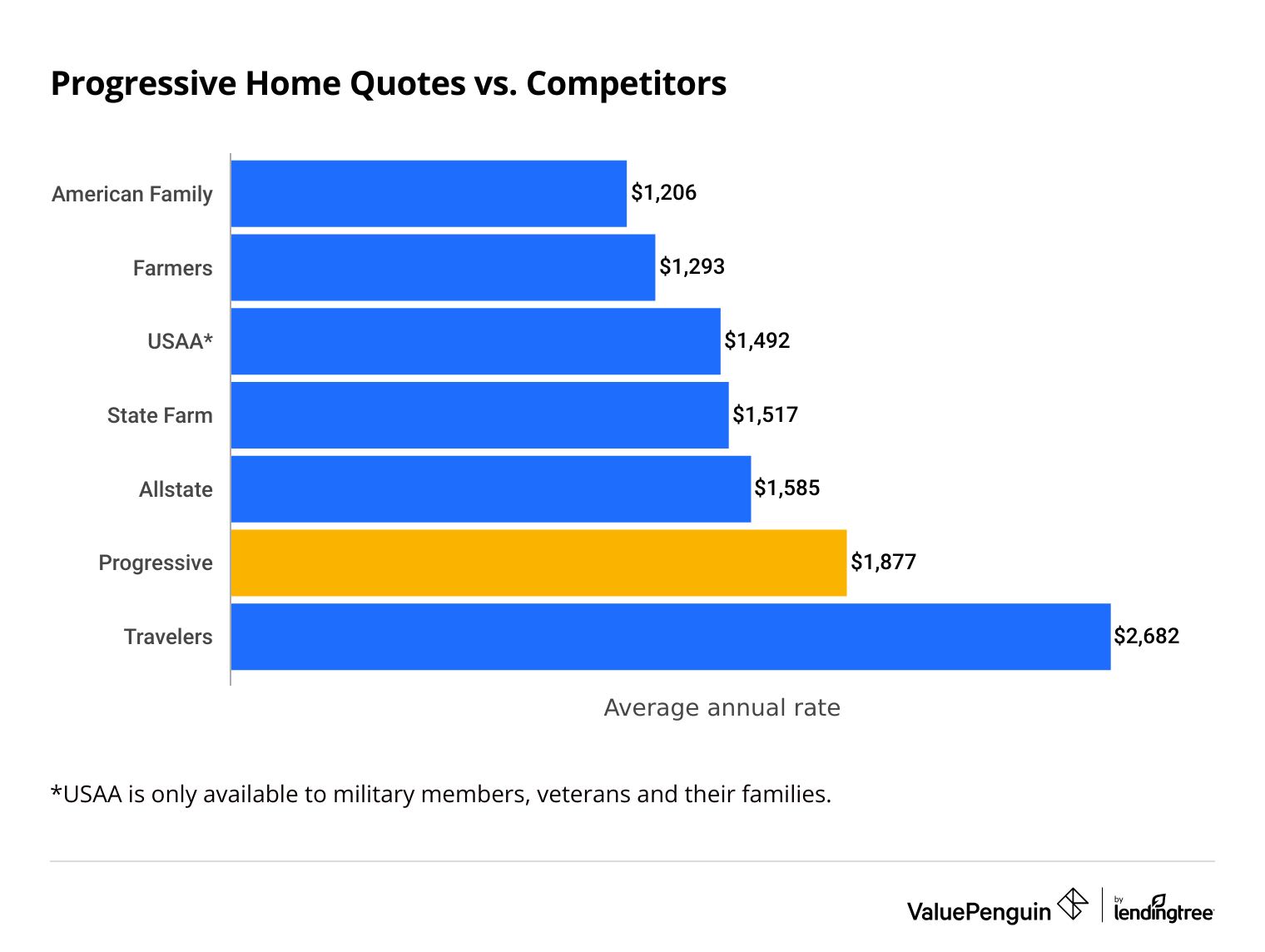

Progressive home insurance reviews

Progressive's home insurance rates are average, and most major insurance companies offer better service.

In addition, Progressive only offers a few ways to increase the protection for your home and belongings.

Progressive homeowners insurance quotes

Progressive home insurance costs around $1,877 per year, which is 6% more expensive than average.

Find Cheap Homeowners Insurance Quotes in Your Area

You can typically find cheaper rates from other national insurance companies, including American Family, Farmers and State Farm. Home insurance from the cheapest major company, American Family, costs $671 per year less than Progressive.

Compare Progressive home insurance quotes vs. competitors

Company | Annual rate | ||

|---|---|---|---|

| American Family | $1,206 | ||

| Farmers | $1,293 | ||

| USAA* | $1,492 | ||

| State Farm | $1,517 | ||

| Allstate | $1,585 | ||

| Nationwide | $1,624 | ||

| Progressive | $1,877 | ||

*USAA is only available to military members, veterans and their families.

Progressive's online quote tool makes it difficult to compare its rates for specific coverage levels. That's because it doesn't allow you to customize your policy limits.

Before Progressive gives you a quote, it asks if you'd prefer to spend less or get more coverage. This is the only way to customize your quote.

You have to speak to an agent to make any changes to the quote. That includes changing your liability and medical payments coverage limits or deductible.

Progressive home insurance coverage

Progressive doesn't offer many ways to customize your coverage.

It only offers a few coverage add-ons: water backup protection and personal injury liability.

- Water backup protection helps pay for damage caused by backed-up pipes or sewers or a broken sump pump.

- Personal injury liability covers lawsuits involving slander or libel, wrongful eviction and false arrest.

Progressive doesn't offer other typical coverage options like identity theft protection or extra coverage for valuable items.

But, its homeowners insurance provides standard protection for your home's structure and your personal property.

Progressive home insurance discounts

Progressive's homeowners insurance discounts will be different depending on your location and which partners operate in your area. Along with bundling auto and home insurance, you may be able to save money by:

- Installing alarms in your home

- Buying a home

- Buying a newly constructed home

- Paying your annual bill upfront

- Getting a quote 10 days before your new policy starts

- Getting your policy documents by email

Progressive home and renters insurance reviews and ratings

Progressive home insurance customers may have a difficult time making claims with the company.

It gets 21% more customer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). Many customers complain that the claims process needs to be shorter. Progressive customers also mentioned low settlement offers. That means you could pay more to fix your home or replace your things after an emergency.

In addition, J.D. Power ranked Progressive 19th out of 22 of the largest home insurance companies on its customer satisfaction survey. And it earned last place on the J.D. Power renters insurance customer satisfaction survey. That means Progressive customers aren't thrilled with the service they get from the company overall.

However, Progressive earned an A+ or Superior financial strength rating from AM Best. So homeowners don't need to worry about their ability to pay claims.

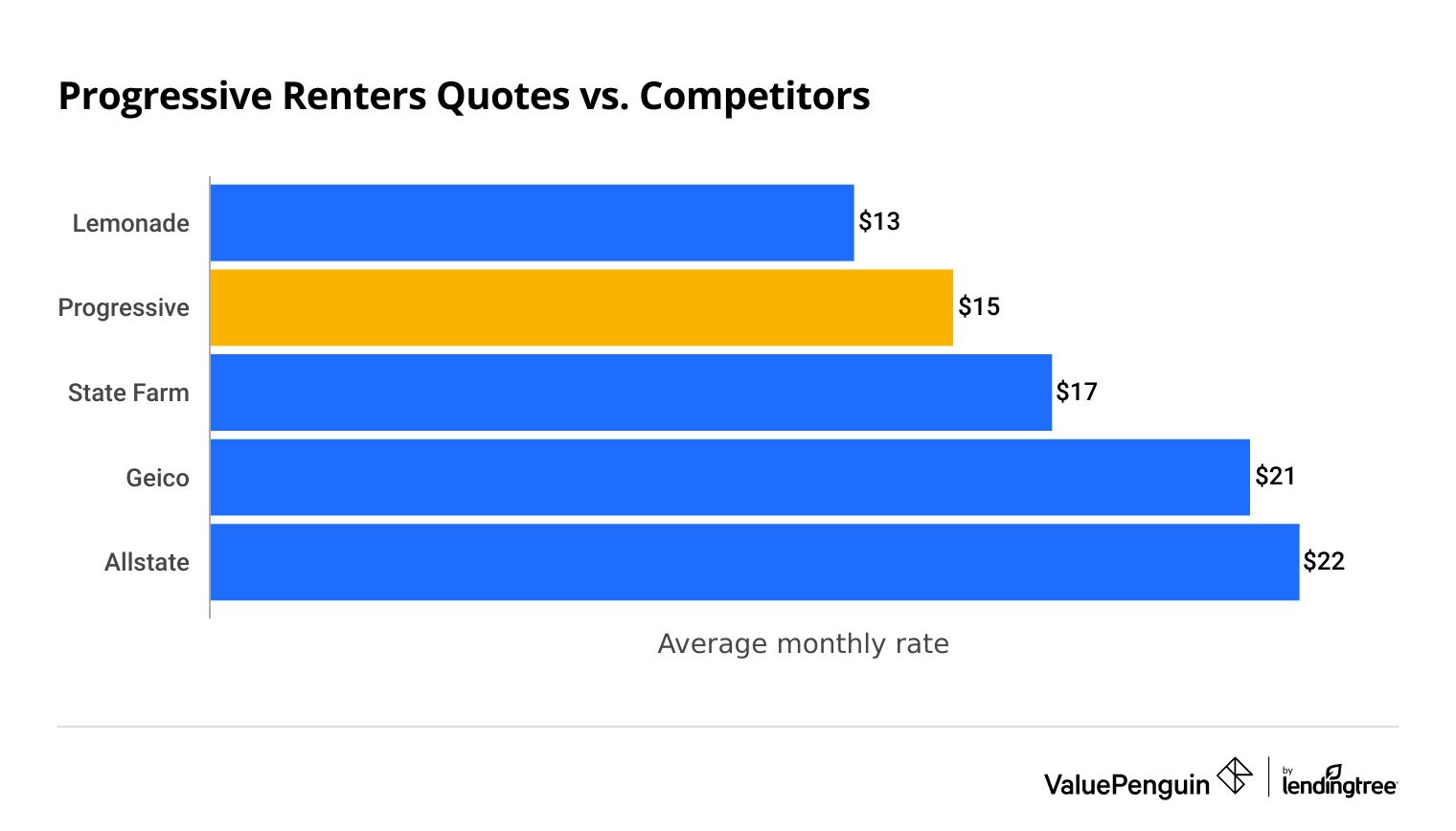

Progressive renters insurance review

Progressive has cheap renters insurance rates. However, there aren't many ways to customize your policy.

Progressive renters insurance quotes

Progressive offers affordable renters insurance rates, at around $15 per month. That's 14% cheaper than average.

Find Cheap Renters Insurance Quotes in Your Area

The only company that offers renters insurance rates cheaper than Progressive is Lemonade. At $13 per month, coverage from Lemonade costs around $2 less than Progressive.

Compare Progressive renters insurance rates vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| Lemonade | $13 | ||

| Progressive | $15 | ||

| State Farm | $17 | ||

| Geico | $21 | ||

| Allstate | $22 | ||

Progressive renters insurance coverage

Progressive only offers a few ways to upgrade your protection.

For a little more money, renters can get water backup coverage, which pays for damage to your stuff if your home floods due to backed-up pipes or sewers. You can also buy personal injury liability protection, which pays for lawsuits for wrongful eviction, false arrest, slander or libel.

Progressive doesn't allow renters to upgrade to replacement cost coverage or add identity theft protection. Both of these options are common with other renters insurance companies.

A standard renters policy from Progressive includes typical coverage like:

- Personal property protection

- Personal liability insurance

- Medical payments to guests

- Loss of use coverage

Progressive renters insurance discounts

Progressive offers renters a few standard discounts.

You can save by:

- Bundling renters and auto insurance from Progressive

- Getting a quote three days before your new policy starts

- Paying your annual bill upfront

- Getting your policy documents via email

Renters who live in a gated community with a security guard or remote or keyed entry can also earn a discount from Progressive.

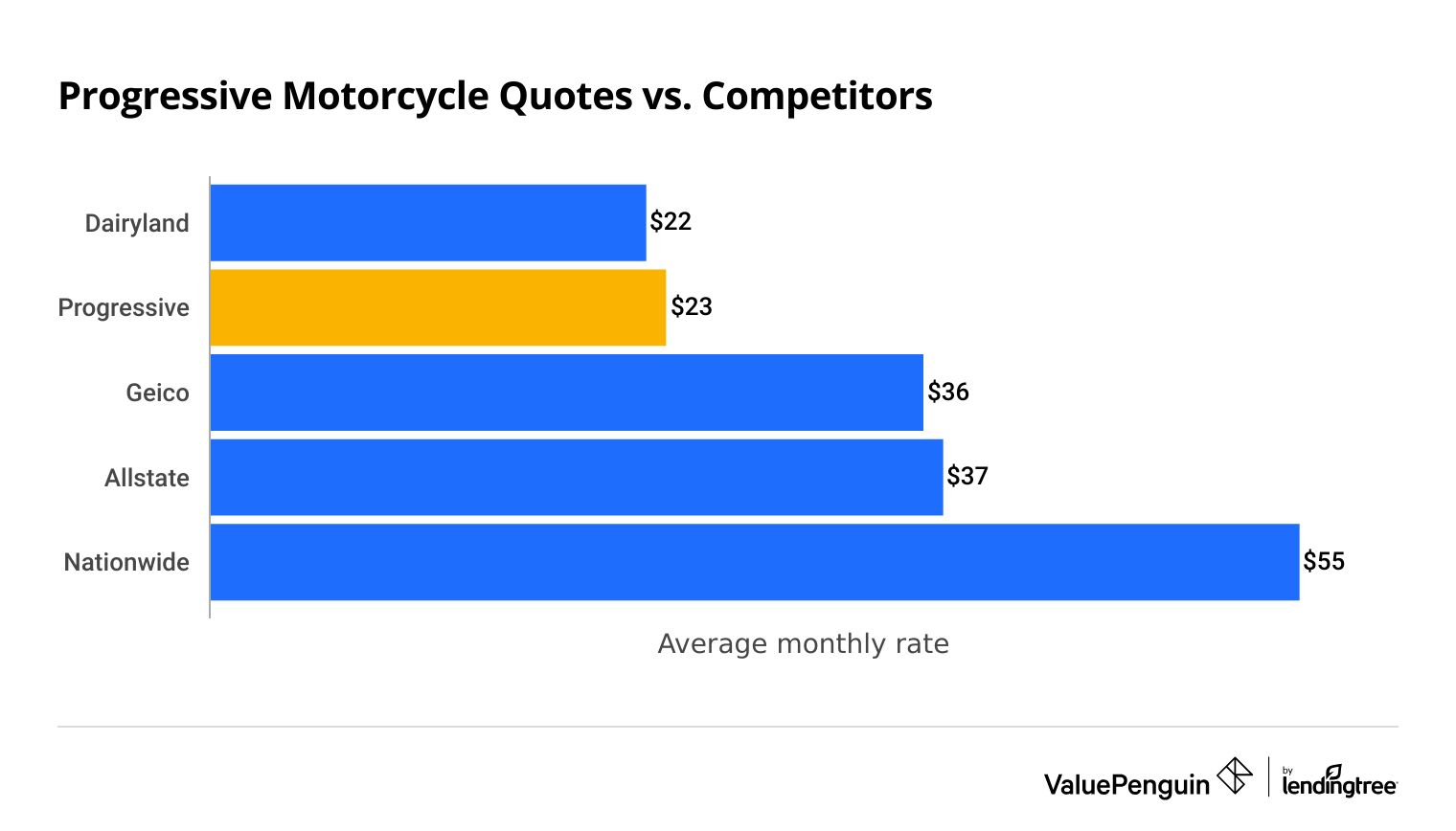

Progressive motorcycle insurance reviews

Progressive motorcycle insurance is an excellent option for many riders.

Its standard policy is affordable and comes with extra coverage. Progressive also offers lots of ways to upgrade your motorcycle insurance coverage. That makes it a great choice for people with custom bikes.

Progressive motorcycle insurance quotes

Progressive motorcycle insurance costs about $23 per month for a full coverage policy. That's 32% less than the national average cost.

Find Cheap Motorcycle Insurance Quotes in Your Area

Dairyland charges $1 less per month than Progressive for motorcycle insurance. But full coverage insurance from Progressive comes with extra coverage that makes it worth the extra cost for many riders.

Compare Progressive motorcycle insurance quotes vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $23 | ||

| Harley-Davidson | $24 | ||

| Geico | $36 | ||

| Allstate | $37 | ||

Progressive motorcycle insurance coverage

Progressive is one of the best motorcycle insurance companies for riders who need extra coverage.

Progressive's motorcycle insurance comes with the basic coverages you'd expect, along with extra features.

For example, a standard Progressive policy also includes full replacement cost. Progressive will pay to fix your bike with brand-new parts after an accident, regardless of any wear and tear beforehand.

If you buy a full coverage policy with comprehensive and collision coverage, you'll also get:

- $3,000 of protection for custom parts and accessories, like a custom saddle or CB radio

- Original manufacturer parts (OEM) coverage will fix your motorcycle with parts from the original manufacturer after an accident, as opposed to using aftermarket parts.

You can also customize your policy by adding extra protection.

Total loss coverage will replace your bike with a brand new model if it's totaled in an accident. This coverage is only available for a bike less than one model year old.

Roadside assistance and trip interruption will pay to tow your bike if it breaks down on the side of the road.

If you're on a road trip, this coverage will also pay up to $500 for your hotel, meals and transportation while your bike is in the repair shop.

Carried contents coverage will replace any personal belongings damaged in an accident, like your phone or camping gear.

Extra accessories and custom parts coverage protects aftermarket upgrades to your bike up to $30,000.

Disappearing deductible lowers your deductible by 25% for each policy period that you remain claim-free.

Enhanced injury protection pays up to $250 per week for two years if you're hurt on your bike and can't work. It will also pay your family $25,000 if you're in a fatal crash.

Progressive motorcycle insurance discounts

Progressive offers more motorcycle insurance discounts than most other companies.

Most Progressive discounts are pretty easy to get, like discounts for:

- Switching from another insurance company

- Getting a quote one day before your policy's start date

- Carrying a valid motorcycle license or endorsement

- Avoiding accidents for three years or longer

- Paying for your policy in full, on time or with automatic payments

- Having a Harley Owners Group (HOG) or USAA membership

- Buying auto, home, renters, boat or RV insurance from Progressive

- Taking a motorcycle safety course

In addition, riders who are 45 years old with more than three years of riding experience can get a Safe and Steady Rider discount. This discount is only available if you haven't had any accidents or tickets in the last three years.

About Progressive

Founded in 1937, Progressive is the second-largest auto insurance company in the U.S.. It's also the 10th-largest home insurance company in the country.

In addition to auto, home, renters and motorcycle insurance, Progressive offers a range of other kinds of insurance.

Contact Progressive

There are multiple ways for customers to contact Progressive.

To get a quote, report a claim and ask questions about your policy, you can:

- Call the general Progressive customer service phone number at 888-671-4405

- Use the Progressive live chat feature on the company website

- Send an email through the Progressive website

You can also manage your policy using the Progressive app or logging into its online portal. Either option allows you to file a claim, contact roadside assistance, view your policy documents and access your insurance card.

Frequently asked questions

How much is Progressive car insurance?

Full coverage insurance from Progressive costs around $169 per month, which is fairly average. Minimum liability from Progressive costs 4% less than the national average at $66 per month.

Is Progressive home insurance good?

Progressive home insurance isn't a good choice for most people. Its home insurance prices are higher than average, and it has a reputation for poor customer service.

Progressive may be a good choice if you don't need much coverage and want to bundle your home and auto policies.

Is Progressive auto insurance good?

Progressive auto insurance is a good choice for drivers looking for a large national company. However, you can probably find better rates and a more reliable customer service experience with State Farm, Geico or American Family.

How good is Progressive at paying claims?

Progressive reviews indicate customers aren't typically happy with its claims process. J.D. Power ranked Progressive 19th out of 25 companies on its auto claims satisfaction survey. Progressive also earned below-average scores on J.D. Power's home and renters customer satisfaction surveys. That means Progressive may take longer to pay out claims than other companies, and you could spend more on repairs.

Methodology

Auto insurance

To compare Progressive's auto insurance prices, ValuePenguin collected rates from ZIP codes across all 50 states in the U.S. Rates are for a 30-year-old single man with a good credit score and clean driving record who owns a 2015 Honda Civic EX.

Full coverage and DUI quotes are for a policy with higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection or medical payments coverage: State requirement

- Comprehensive and collision deductibles: $500

Home insurance

To compare Progressive's homeowners insurance quotes, ValuePenguin collected rates for every ZIP code across 6 states . Rates are for the median home age and value for each state. For example, the median home in California was built in 1975 and valued at $505,000. Our experts used median home values to estimate the rebuild cost in each state.

Renters insurance

To compare Progressive's renters insurance quotes, ValuePenguin gathered rates from the five largest cities in California. Rates are for a 25-year-old man who lives alone with no history of insurance claims.

Quotes include:

- Personal property coverage: $30,000

- Liability coverage: $100,000

- Medical payments coverage: $5,000

- Deductible: $500

Motorcycle insurance

To compare Progressive's motorcycle insurance rates, ValuePenguin gathered thousands of quotes from all 50 states and seven major companies. Quotes are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage policy, including higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

ValuePenguin uses Quadrant Information Services to collect auto and home insurance rates. These rates were publicly sourced from insurance company filings; you should use them only for comparative purposes. Your quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.