Average Cost of Travel Insurance by Policy and Age

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Citi is an advertising partner.

The average cost of travel insurance in the U.S. is $148, but not all travel insurance policies are the same.

Some are much more comprehensive than others and, consequently, the range of costs between them can be wide. The cost of a comprehensive travel insurance policy is 56% more, on average, than a basic travel insurance policy. A policyholder’s age also has a significant impact on the cost of their travel insurance.

Average cost of travel insurance

We gathered travel insurance quotes for more than 50 different policies using a sample vacationer—a U.S. citizen living in the state of New York, going to the United Kingdom for one week in August. Some policies included in our study are more comprehensive than others, but the average across them is a good representation of what most travelers can expect to pay for such a trip. Considering all of the policies below, the average cost of travel insurance is $148.

Company | Average Premium |

|---|---|

| Average Quote | $148 |

| AIG Travel Guard Platinum | $216 |

| AIG Travel Guard Gold | $143 |

| AIG Travel Guard Silver | $122 |

| AIG Travel Guard Basic | $108 |

| April Choice | $89 |

| Allianz Basic | $109 |

| Allianz Classic | $141 |

| Allianz Classic Trip Plus | $191 |

| AXA USA Silver | $82 |

| AXA USA Gold | $142 |

| AXA USA Platinum | $172 |

Where someone is departing from, or traveling to, does not have as big an impact on rates as one might expect (unless they are traveling to an especially hazardous place). We experimented with departures from different states in the U.S. and when the final destination remained the United Kingdom, the cost of the travel insurance policy typically remained the same. The states of New York and New Jersey tended to have slightly higher premiums, but the difference was less than $10.

One way to increase the cost? Leaving from a country other than the United States. We maintained the final destination (the U.K.) and found that departing from most other countries other than the U.S. resulted in a significant increase in the average policy premium. It's hard to know what the reason behind that difference is—perhaps it is because the prices of the policies we were gathering quotes for were optimized for U.S. departures. Anything outside of the U.S. might simply be categorized as a different level of risk, regardless of where someone is departing from.

Average cost of basic vs. comprehensive travel insurance policies

We took a closer look at some relatively basic travel insurance policies and some of the least expensive ones offered by carriers. Not surprisingly, the average cost of the basic policies was lower than the average cost of the more comprehensive plans. The more a travel insurance policy covers, or the higher claim limits it has, the higher the mean premium.

Average cost of travel insurance coverage

Policyholders have quite a bit of control over the cost of travel insurance, because they can choose what coverage they need or want. For contrast, if a homeowner needs to insure their house, there aren’t many things they can do to affect the cost, beyond shopping around for the cheapest carrier. The basic or silver tiers generally have less medical coverage or lower limits to claim than higher gold or platinum tiers.

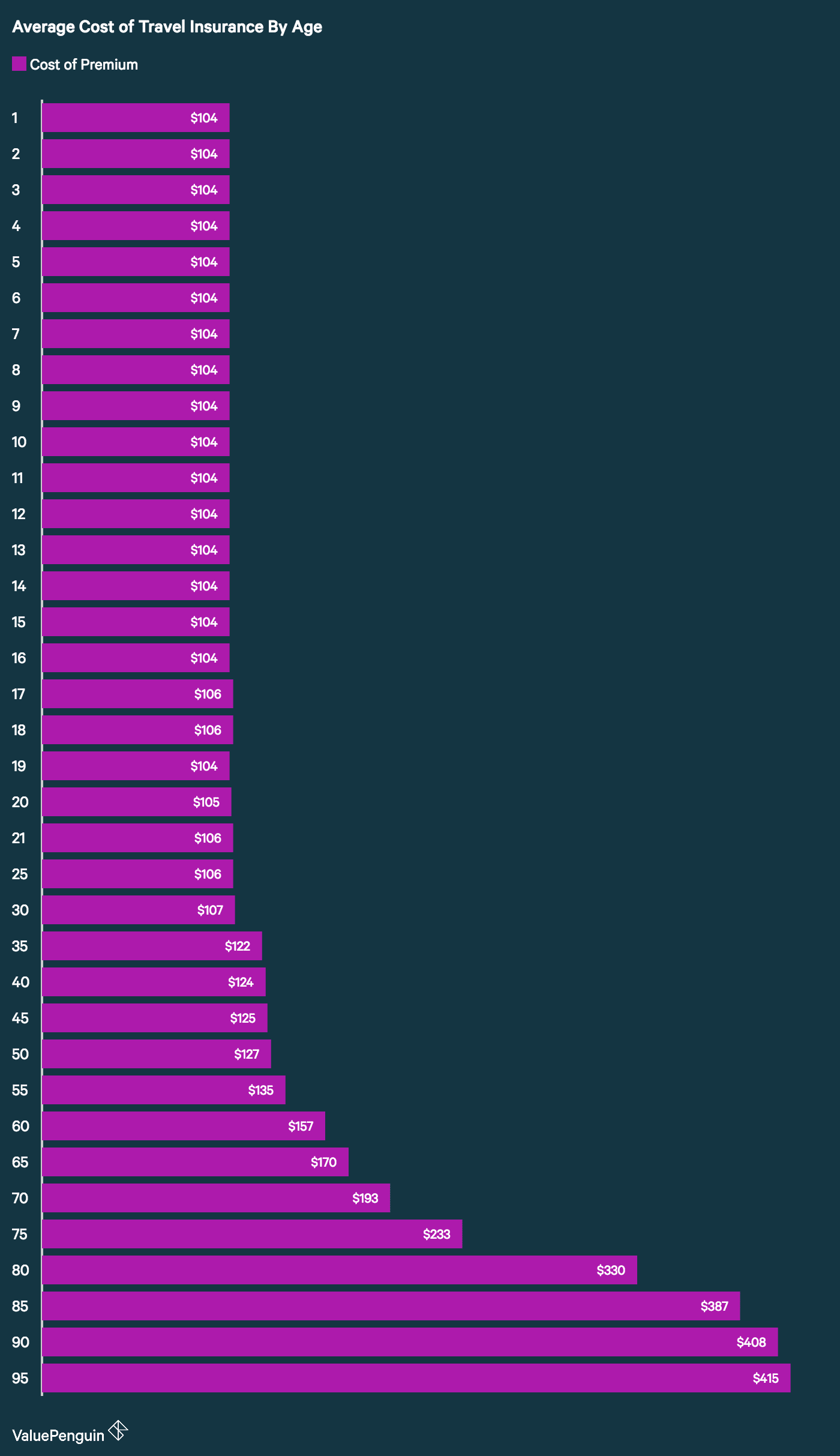

Average travel insurance cost by age

In addition to the types of coverage and the claim limits, a person’s age has a substantial impact on the cost of travel insurance. No matter the type of policy someone buys, the price increases dramatically the older they are. Our analysis below showed that premiums remained relatively flat for travelers age 1 through 30, but then the cost begins to climb. The most drastic increases occur between ages 60 and 80. We attempted to gather quotes for travelers as old as 100, 105 and 110, but no companies offered quotes for our sample traveler of those ages.

Age | Cost of Premium |

|---|---|

| 1 | $104 |

| 2 | $104 |

| 3 | $104 |

| 4 | $104 |

| 5 | $104 |

| 6 | $104 |

| 7 | $104 |

| 8 | $104 |

| 9 | $104 |

| 10 | $104 |

| 11 | $104 |

| 12 | $104 |

Factors that impact the cost of travel insurance

The factors that determine the cost of travel insurance vary depending on the insurer and policy you choose. For instance, some travel insurance companies don't take your destination into consideration when setting rates, while others do. The following are some of the most commonly used inputs in determining travel insurance rates:

- Trip cost and policy limits: When choosing a travel insurance policy's limits, it's important to take into account all the costs of your trip, from flights to booked activities. The total trip cost and your policy sublimits will be one of the greatest factors impacting your travel insurance rates, since these determine the maximum payout in the event of a claim.

- Types of coverage: A travel insurance policy can be very narrow or broad, so it's important to consider the risks involved in your trip and choose the appropriate combination of coverages. As you increase the situations in which you're covered, such as adding hazardous sports coverage, or reasons you might be reimbursed, the cost of a policy will increase.

- Deductible: Choosing a higher deductible policy will lower travel insurance rates, since you'll pay a larger amount out of pocket in the case you file a claim.

- Age and number of travelers: Older travelers, particularly those over the age of 50, are considered more likely to file a claim, since they have a higher risk of becoming ill or getting injured.

- Length of trip: Longer trips often come with more expensive travel insurance rates, since there are more opportunities to sustain a loss.

- Destinations: If you travel to regions with higher health care costs, this can increase the price of travel insurance. Additionally, some locations will be more expensive to organize emergency transportation from, so you may need a policy with higher limits to account for this.

- Health of travelers: If you have pre-existing conditions, you'll typically either be charged a higher rate for a policy that would cover issues that arise for problems related to those conditions, or you'll have coverage exclusions.

Travel insurance spending trends

In 2018, U.S. citizens traveled internationally 93 million times, according to the National Travel and Tourism Office. Millions purchased some form of travel insurance and a recent analysis from AAA indicated 38% of Americans are likely to for future trips abroad.

Americans spent more than $3.8 billion on all types of travel protection in 2018—a 41% increase over the past two years—according to a survey of the travel insurance market by the U.S. Travel Insurance Association. The same survey, which includes the most recent available data, also showed approximately 65.8 million travelers were covered by more than 46.3 million travel insurance plans.

Methodology

To assess the cost of travel insurance in the U.S., we first researched and established a sample traveler to gather quotes for a U.S. citizen living in the state of New York, going to the United Kingdom for one week in August, with an estimated trip cost of $2,500. We then collected more than 2,000 travel insurance quotes for 52 different policies offered by dozens of companies.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

How We Calculate Rewards: ValuePenguin calculates the value of rewards by estimating the dollar value of any points, miles or bonuses earned using the card less any associated annual fees. These estimates here are ValuePenguin's alone, not those of the card issuer, and have not been reviewed, approved or otherwise endorsed by the credit card issuer.

Example of how we calculate the rewards rates: When redeemed for travel through Ultimate Rewards, Chase Sapphire Preferred points are worth $0.0125 each. The card awards 2 points on travel and dining and 1 point on everything else. Therefore, we say the card has a 2.5% rewards rate on dining and travel (2 x $0.0125) and a 1.25% rewards rate on everything else (1 x $0.0125).